Peru is a key destination for foreign investors in Latin America, offering a dynamic market and economic potential. However, there may come a time when a business needs to cease operations. Whether due to strategic restructuring, market challenges, or compliance needs, properly dissolving and liquidating a company in Peru is critical. This 2025 guide explains each required step, legal obligation, and practical tips to close a company cleanly and compliantly.

Key takeaways on how to liquidate a company in Peru

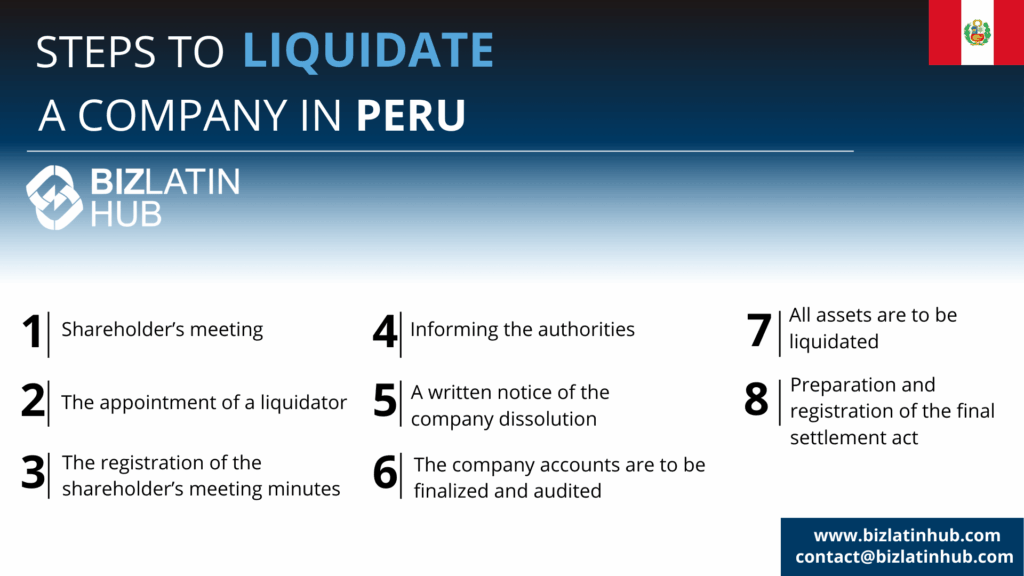

| 8 steps to liquidate a company in Peru | Shareholder’s meeting The appointment of a liquidator The registration of the shareholder’s meeting minutes Informing the authorities A written notice of the company dissolution The company accounts are to be finalized and audited All assets are to be liquidated Preparation and registration of the final settlement act |

| What timeframe is needed to liquidate a company in Peru? | Approximately, there is a maximum term of 4-6 months for the process of dissolution, liquidation, and extinction of the company. |

| What are the reasons to liquidate a company in Peru? | Reasons include: The company completes its corporate purpose Continued inactivity Creditors approve an agreement of bankruptcy Lack of plurality of shareholders Judicial resolution by the Supreme Court The agreement was approved by the shareholders Any other cause established in the corporate by-laws |

| What causes involuntary liquidation in Peru? | This can be triggered by not complying with legal responsibilities under the law such as those listed above. |

What is the process of liquidation in Peru?

Liquidating a company in Peru involves three main stages: dissolution, liquidation proceedings, and extinction. Below is a breakdown based on client experience and legal obligations.

Step 1 – Shareholder’s Meeting

Call a General Shareholders’ Meeting to vote and approve the company’s dissolution. This is a mandatory step to begin the process. In practice, ensure the meeting is documented with formal minutes signed by all participants.

Step 2 – Appointment of a Liquidator

A liquidator must be appointed to handle the process. Based on our client experience, it’s recommended to choose someone with accounting or legal background and ensure their appointment is registered at SUNARP.

Tip: If you already work with a trusted legal representative, it may be efficient to appoint them as liquidator to avoid delays.

Step 3 – Registration of the Shareholder’s Meeting Minutes

The minutes from the dissolution meeting must be formally registered with the Public Registry (SUNARP). This is often where delays occur, so it’s best to pre-check all company documents for consistency.

Recommendation: Have your legal advisor double-check the corporate records beforehand to ensure the shareholder structure and prior filings match SUNARP’s expectations.

Step 4 – Informing the Authorities

Notify SUNAT (Peru’s tax authority) and other relevant entities that the company is entering liquidation. It is recommended to reconcile all pending taxes beforehand to avoid blocking the closure.

Step 5 – Written Notice of Dissolution

The company must publish a public notice in two widely circulated newspapers for three consecutive days. Keep digital and hard copies of all newspaper publications, as these may be requested by the authorities.

Step 6 – Finalize and Audit Company Accounts

The company must prepare final financial statements and close all bank accounts. A certified public accountant should audit these. Discrepancies often delay liquidation—review all accounting entries in advance.

Tip: Have your accounting team prepare a reconciliation report in advance for review by your auditor.

Step 7 – Liquidation of Assets

Sell or transfer company assets. Prioritize clearing debts with proceeds. Document all asset transfers and creditor payments with signed receipts and contracts.

Step 8 – Final Settlement Act Registration

The liquidator must prepare and file a final settlement act detailing assets, liabilities, and distributions. Once approved by shareholders and submitted to SUNARP and SUNAT, the company is officially extinguished.

Total estimated duration: 4–6 months, assuming full compliance. Disorganized accounts or tax issues are the most common causes of delay.

Why dissolve a company in Peru?

There are several circumstances which could influence a company’s decision to dissolve in Peru:

- The term set out in the company by-laws for its operational life expires.

- The company completes its corporate purpose, doesn’t fulfill it for a prolonged period, or cannot possibly fulfill it at all.

- Continued inactivity in the General Shareholders Meeting.

- Total incurred losses that reduce the value of net assets to less than one-third of the company’s paid-in capital, (unless this capital is increased or reduced).

- Creditors approve an agreement of bankruptcy or insolvency, following due legal procedures.

- Lack of plurality of shareholders for more than 6 months.

- Judicial resolution by the Supreme Court.

- The agreement was approved by the shareholders.

- Any other cause established in the corporate by-laws or in a shareholders’ agreement duly registered before the company.

FAQs for liquidating a company in Peru

Based on our extensive experience these are the common questions we receive from clients about liquidating an entity in Peru.

1. What is the process of liquidation in Peru?

The liquidation process involves the following principal activities:

- The conduct of a shareholder’s meeting in which the shareholders approve the company`s dissolution.

- The appointment of a liquidator who will be legally responsible for the liquidation process; this person may be the company’s legal representative or a third party designated to act in this role.

- The registration of the shareholder’s meeting minutes with the responsible local authority.

- The national tax authority (“SUNAT”) and “Public Registers (“SUNARP”) must be informed formally of such a decision.

- A written notice of the company dissolution must be published in the local media as formal notification to external parties.

- The company accounts are to be finalized and audited (with any outstanding issues resolved)

- All assets are to be liquidated.

- Preparation and registration of the final settlement act.

2. How long does it take to liquidate a company in Peru?

Approximately, there is a maximum term of 4-6 months for the process of dissolution, liquidation, and extinction of the company.

3. What are the reasons to liquidate a company in Peru?

There are several circumstances which could influence a company’s decision to dissolve in Peru:

- The term set out in the company by-laws for its operational life expires.

- The company completes its corporate purpose, doesn’t fulfill it for a prolonged period, or cannot possibly fulfill it at all.

- Continued inactivity in the General Shareholders Meeting.

- Total incurred losses that reduce the value of net assets to less than one-third of the company’s paid-in capital, (unless this capital is increased or reduced).

- Creditors approve an agreement of bankruptcy or insolvency, following due legal procedures.

- Lack of plurality of shareholders for more than 6 months.

- Judicial resolution by the Supreme Court.

- The agreement was approved by the shareholders.

- Any other cause established in the corporate by-laws or in a shareholders’ agreement duly registered before the company.

4. Can you be forced to liquidate a company in Peru?

Yes, under certain circumstances. In Belize, companies must regularly renew their operating licenses to do business in the country. The Belizean state can liquidate the organization if the business is unable to pay for the re-establishment of its operating license one year after its expiration date.

If the company chooses not to, or is unable to, renew its license and continue operations, it will be erased from the business register by the administrative experts in Belize. This liquidation procedure will only be performed after the end of the calendar year.

Liquidate your company in Peru with support from local legal experts

Properly closing a business in Peru requires more than just a resolution—it involves accurate filings, public notices, financial reconciliation, and formal deregistration across multiple agencies.

At Biz Latin Hub, our bilingual legal and financial professionals in Peru offer comprehensive support to ensure your liquidation process runs smoothly. We manage every stage—from shareholder approval to registry closure—ensuring compliance with Peruvian law.

To get started with your liquidation:

- Contact us to schedule a consultation.

- We evaluate your company’s compliance status.

- You receive a checklist of documents and a step-by-step plan.

- Upon your confirmation, our team executes the liquidation process on your behalf.

Contact our Peru team today to initiate a compliant, efficient business exit.

Learn more about our team and expert authors.