It is essential to know the steps to liquidate a company in New Zealand if business operations are not playing out as planned in these challenging economic times. Sometimes, the most beneficial action to take is to close company operations to avoid accumulating further expenses. This makes liquidation a viable option for executives when reorganization or further capital injections are not feasible after company formation in New Zealand.

Key Takeaways:

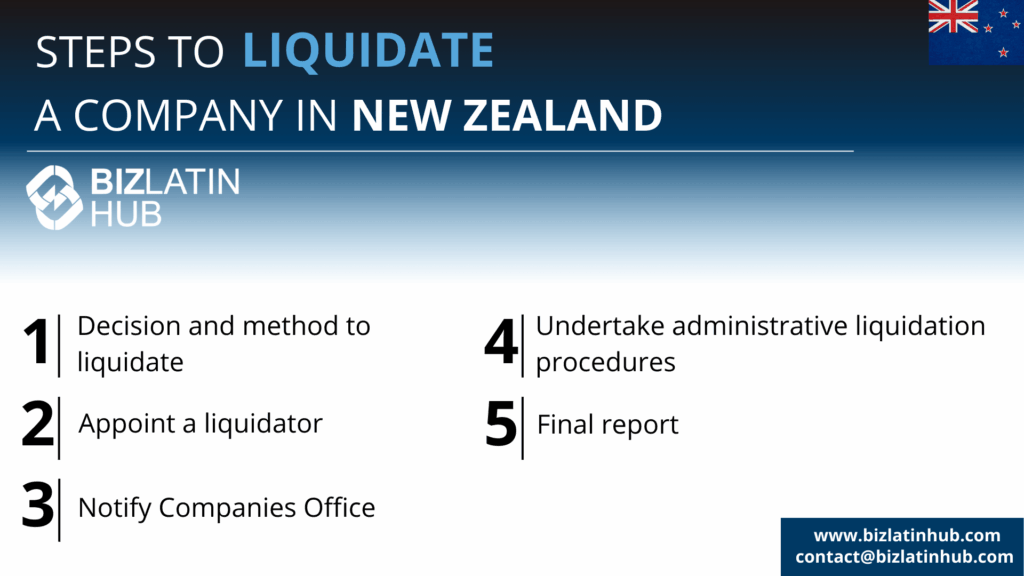

| Steps to liquidate a company in New Zealand | 1. Decision and method to liquidate 2. Shareholder resolution 3. Appoint a liquidator 4. Notify Companies Office 5. Undertake administrative liquidation procedures 6. Final report |

| Time generally needed | It should take approximately a year to liquidate a company in New Zealand, if everything is in order. |

| Reasons to liquidate a company in New Zealand | These vary, but the key point is to stay compliant and in good standing with the authorities. |

| Involuntary liquidation | This can be triggered by not complying with legal responsibilities under the law. |

| What are the main duties of a liquidator? | The appointed liquidator is responsible for managing the company’s unsecured assets, and must freeze them. They must then sell these assets to repay debts owed to creditors and shareholders. |

| Do the shareholders have responsibilities? | A special resolution of the shareholders is required to start the process. |

The 6-Step Process for a Solvent Liquidation

These are the six basic steps you need to go through when you liquidate a company in New Zealand:

Expert Tip: Choosing a Qualified Liquidator

From our experience, while New Zealand law does not require a liquidator for a solvent liquidation to hold a specific license, it is highly advisable to appoint a professional. The liquidator assumes full control of the company and has significant legal responsibilities.

We recommend appointing a member of a professional body, such as a Chartered Accountant or a lawyer specializing in insolvency. Using a professional ensures the process is handled efficiently, all statutory duties are met correctly, and the directors are protected from potential liability arising from an improperly managed liquidation.

Step 1: The Board Proposes Liquidation

The company’s board of directors meets and resolves that the company should be put into liquidation and calls a meeting of shareholders. A business can go into liquidation through several methods:

- Voluntary liquidation

- Solvent liquidation

- Court-ordered liquidation

- Receivership.

The liquidation takes immediate effect. The business must close, and its listing is removed from the Companies Office Register.

Step 2: Shareholders Pass a Special Resolution

At the shareholders’ meeting, a special resolution requiring a 75% majority vote is passed to initiate the liquidation.

Step 3: Appoint a Liquidator

The shareholders appoint one or more liquidators to manage the winding-up of the company.

A liquidator can be appointed by court order, shareholder meeting, or by resolution of a company’s creditors at a ‘watershed meeting’. These meetings are for creditors to decide upon the future of the business.

The appointed liquidator is responsible for managing the company’s unsecured assets, and must freeze them. They must then sell these assets to repay debts owed to creditors and shareholders.

The liquidator must also review the company’s financial situation and identify the issue(s) leading to its liquidation. If necessary, the liquidator must investigate offences made by the company or director(s).

The liquidator may need to hold a creditors’ meeting in order to:

- Gather information about the company

- Allow creditors to raise and discuss issues related to the company’s liquidation

- Identify any additional assets.

The liquidator may communicate with shareholders, current and former employees, accountants, auditors, and other parties involved in establishing or managing the company.

Finally, the liquidator must produce regular reports regarding the activities and outcomes of the liquidation for creditors and shareholders, and file these reports with the Companies Office.

Replacing a liquidator

Note that companies may replace a liquidator, if necessary, through a creditor’s meeting.

Step 4: Give Public Notice of the Liquidation

The liquidator must notify the Companies Office of the liquidation, and advertise it publicly. This is to notify third parties of the ‘winding up’ and intent to liquidate the company in New Zealand. This advertisement is published in the New Zealand Gazette.

After this public notice, the company must wait 20 working days to allow any objections to the removal of the company filed.

The liquidator must file a notice of their appointment with the Companies Office and advertise it in the New Zealand Gazette and a local newspaper.

Step 5: The Liquidator Winds Up the Company

The liquidator takes control, realizes the company’s assets, pays all creditors, and prepares final financial reports.

Once the company has given sufficient notice of its intent to liquidate, it can begin formal liquidation procedures. This is carried out by the liquidator, and includes:

- closing the business,

- selling any relevant company assets

- communicating with and receiving claims from creditors

- preparing and sending regular reports to creditors and other relevant parties

- investigating discrepancies, possible offences or irregular transactions

- making necessary payments to creditors (dividends).

Step 6: Final Report and Removal from the Register

The liquidator files their final report with the Companies Office. Once the Registrar is satisfied that the process is complete, the company is removed from the Companies Register and is formally dissolved.

When liquidating a company in New Zealand, the liquidator must prepare a final report and file it with the government. This final report should include a brief description of the activities and outcomes of the liquidation.

The Role of the Companies Office

The New Zealand Companies Office is the government agency that manages the register of all companies. The appointment of the liquidator and other key notices must be filed with the Companies Office. The final step of the process is requesting that the Registrar of Companies remove the company from the register.

The role of a Director during liquidation in New Zealand

Directors are required to complete a Statement of Affairs, which must include:

- A description of the company’s history

- Details of the cause of the company’s failure

- Trading details

- Any legal claims by or against the company

- All company assets and company liabilities

- All shareholder information

Business directors are required to help the liquidator locating its business records and assets. Furthermore, they help to answer all the questions about the firm and its way of doing business.

Under New Zealand law, it is illegal for a director to destroy, hide or remove property, records or other company documents. Consequences for doing so can be fines and imprisonment.

FAQs for liquidating an entity in New Zealand

Based on our extensive experience these are the common questions we receive from clients about liquidating an entity in New Zealand.

1. What is the process of liquidation in New Zealand?

- 1. Decision and method to liquidate

- 2. Appoint a liquidator

- 3. Notify Companies Office

- 4. Undertake administrative liquidation procedures

- 5. Final report

2. How long does it take to liquidate a company in New Zealand?

The liquidation process will normally take between 10 and 14 months, assuming the entity is in good standing and no rectification work is required.

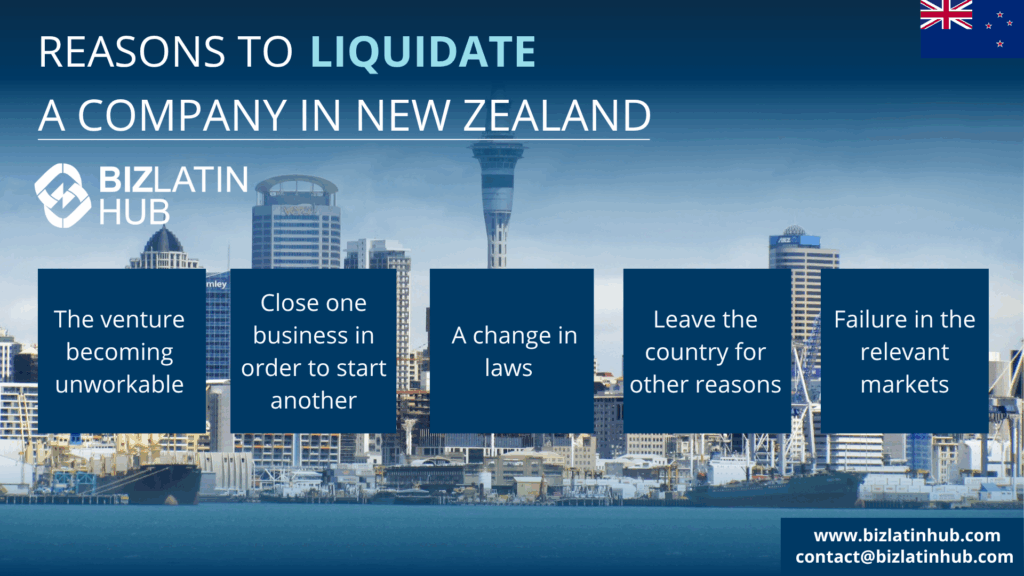

3. What are the reasons to liquidate a company in New Zealand?

There are a number of reasons you may do so, such as the venture becoming unworkable, a change in laws or simple failure in the relevant markets. You may wish to close one business in order to start another or you may want to leave the country for other reasons. For whatever reason you eventually decide to liquidate a company in New Zealand, it is best to do so in accordance with the law.

4. Can you be forced to liquidate a company in New Zealand?

Yes, under certain circumstances.

5. What happens to the company’s tax status?

The liquidator is responsible for filing a final tax return with the Inland Revenue Department (IRD) and settling all outstanding tax liabilities before the company is dissolved.

6. What is the difference between liquidation and “striking off”?

Liquidation is a formal process to wind up a company’s affairs, whether solvent or insolvent. “Striking off” or removal is a simpler process where the Registrar removes a company from the register because it has ceased trading and has no assets or liabilities. A formal liquidation is required for a company with a more complex financial history.

7. What does a liquidator do?

The liquidator takes custody of all company assets, settles all claims from creditors, and distributes any surplus assets to the shareholders. They must also file regular reports with the Companies Office.

8. What is a “special resolution”?

A special resolution is a formal decision passed by a majority of at least 75% of the company’s shareholders who are entitled to vote on the matter.

Liquidate your company in New Zealand with Biz Latin Hub

When your business plan is not working out as you expected, or if current commercial conditions make it too dfficult to cntinue operating, then liquidation may be the best choice for you.

Liquidating a business is an extensive legal procedure, which can be very complex. Therefore, it is essential to use a knowledgeable lawyer in New Zealand who can guide you through voluntary or court liquidation procedures, as well as offering advice on the next steps to exit the market.

At Biz Latin Hub, our team of multilingual local lawyers and professionals have vast experience with liquidation procedures and building comprehensive market exit strategies in New Zealand. We support you with tailor-made business solutions in regard to legal services, hiring and recruitment, payroll management, visa procedures, accounting and taxation, due diligence, and others.

Reach out to our team of local experts for advice and comprehensive support to liquidate your business in New Zealand. Contact us now at contact@bizlatinhub.com to get personalized assistance for your business management.

Learn more about our team and expert authors.