Lately, foreign investors have been looking to set up business in Paraguay as it has been working on recovering its economic growth and cutting superficial government spending to improve its quality and move toward more efficient administration. Though there are many good reasons to do business in the country, projects may don’t go as planned and business owners may decide to liquidate a company in Paraguay as a final decision.

Key Takeaways:

| What are the main steps in the company liquidation process? | Step 1: Pass a Shareholder Resolution Step 2: Register the Dissolution and Appoint a Liquidator Step 3: Publish Public Notices Step 4: Settle All Liabilities and Prepare Final Accounts Step 5: Final Shareholder Approval and Cancellation |

| What is the role of a liquidator? | They take control of the company’s assets, ensure all employees and creditors are paid, deal with the tax authorities, and prepare the final financial statements for the liquidation. |

| What reasons are there to liquidate a company in Paraguay? | These vary, but usually are due to a problem in achieving the purpose of the business or financial difficulties. |

| Requirements for involuntary liquidation in Paraguay | This can be triggered by not complying with legal responsibilities under the law, especially in regard to not paying creditors |

| Do the shareholders have a role? | A formal resolution by the shareholders is the first step. |

The 5-Step Process for Dissolving a Company

Companies must go through a dissolution process before undertaking the liquidation procedure in Paraguay. Likewise, the company’s liquidation and cessation of its commercial activities must be communicated to:

- The Public Registry of Commerce and Treasury Advocacy.

- Company Registration and Inspection Directorate (Dirección de Registro y Fiscalización de Sociedades).

To liquidate a company in Paraguay, the company must be formalized through Public Deed before a public notary and be registered in the Public Registry of Commerce (Dirección General de los Registros Públicos). The liquidation also needs to be communicated to the Treasury Advocacy (Abogacía del Tesoro).

Expert Tip: The Duration of the Liquidator’s Role

From our experience, a key point for shareholders to understand is that the company’s normal administrators (directors and managers) lose their authority the moment the dissolution is registered. From that point on, the appointed liquidator is the sole legal representative of the company.

This role continues until the final cancellation is complete, a process that can take a significant amount of time, often more than a year, due to the requirement for a final tax audit. It is crucial to appoint a trusted and professional liquidator, as they will have full control over the company’s remaining affairs for an extended period.

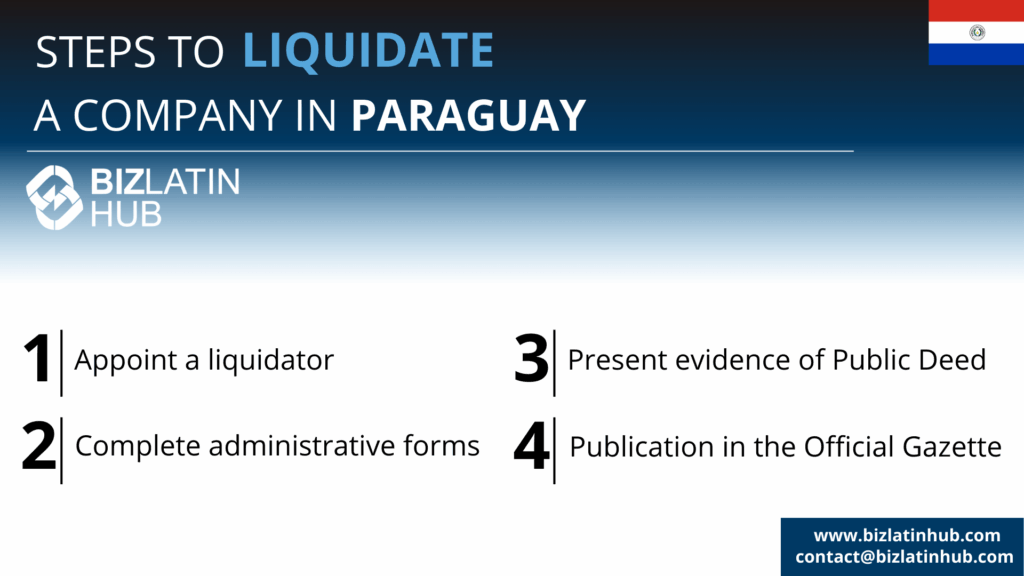

In summary, the following are the necessary steps to liquidate a Company in Paraguay:

Step 1: Pass a Shareholder Resolution

The shareholders meet and formally agree to dissolve the company and place it into liquidation.

Step 2: Register the Dissolution and Appoint a Liquidator

The shareholder resolution is documented in a public deed, which also names the appointed liquidator. This deed is then registered with the Public Registry of Commerce.

Step 3: Publish Public Notices

A notice of the company’s dissolution is published in a newspaper to inform the public and creditors.

Step 4: Settle All Liabilities and Prepare Final Accounts

The liquidator takes control of the company, pays all debts, and prepares a final balance sheet and a report on the distribution of assets.

Step 5: Final Shareholder Approval and Cancellation

The final accounts are presented to the shareholders for approval. Once approved, the final documents are registered, and the company’s registration is formally cancelled.

Reasons for company liquidation

Liquidation arises from different circumstances indicated in the company’s bylaws and in the Paraguayan Civil Code, its laws, regulatory presidential decrees and ministerial resolutions. Different articles of the Paraguayan Civil Code highlights the following key reasons to liquidate a company in Paraguay:

Art.1003. The company is extinguished

- due to the expiration of the term, or due to the fulfillment of the condition to which its existence was subordinated; in both cases, even if the business that was intended is not concluded;

- for the realization of the social purpose;

- due to the physical or legal impossibility of achieving a said end, either due to the complete loss of capital, of a part of it that prevents achieving it; or by bankruptcy;

- by unanimous agreement of the partners;

- if it were two people, due to the death of one of them; and

- for the other causes foreseen in the social contract.

Art.1004. The company may be dissolved at the request of any of the partners

- by death, resignation or removal of the administrator named in the social contract, or the partner put up by your industry, or by a participant whose personal service is necessary to continue the business turn;

- for the breach of the provision of one of the partners; and

- when it is of unlimited term.

Art.1005. Judicial decision to liquidate

In the judicial dissolution of the company, the sentence will take effect retroactive to the day it had placed the generating cause.

Several government authorities are involved in the liquidation process. The Public Registry of Commerce is where the dissolution is formally recorded. The Undersecretariat of State for Taxation (SET) must provide a final tax clearance, and the company must also settle its accounts with the Social Security Institute (IPS).

SUACE: Unified System for Opening or Liquidation of Companies

SUACE (Sistema Unificado de Apertura y Cierre de Empresas) created a bylaw (Bylaw No. 4,986/2013) as a single window for the opening, formalization and/or closing of physical and legal companies. It simplifies, streamlines and makes transparent the process of opening new business ventures.

It is an institutional scheme to strengthen the business climate in Paraguay. This bylaw contributes to the increasing number of foreign and national entrepreneurs interested in investing, producing and/or trading in the country.

Art.1006 and 1007: liquidation of assets

Once a company is dissolved, its assets will be liquidated. The society will subsist to the extent that the liquidation requires it, to conclude the pending matters, to initiate the new operations that she demands, and to administer, preserve and realize the social patrimony.

The obligations and responsibility of the liquidators are regulated by the provisions established with respect to the administrators, provided that nothing else has been provided.

Art.1008 and 1009: liquidator responsibilities

The administrators must deliver to the liquidators the assets and social documents and present the management account for the period following the last accounting. The liquidators must take charge of the assets and social documents, and draw up and sign together with the administrators, the inventory that results in the active and passive status of the equity.

The liquidators must perform the necessary acts for the liquidation, and if the partners have not provided otherwise, they can sell the social assets and make transactions and commitments.

Art.1010. ensuring payments to creditors

The liquidators cannot distribute among the partners, not even partially, the social assets, as long as the creditors of the company have not been paid.

If the available funds are insufficient to pay the social debts, the liquidators can ask the partners for the sums still due on the respective quotas, and if necessary, the necessary sums, within the limits of the respective responsibility and in proportion to each other’s part in the losses. In the same proportion, the debt of the insolvent partner is distributed among the partners.

Art. 1011: contributions to partners

To proceed to the partition of the assets, the losses and the gains will be divided according to what has been agreed. If only the share of each partner in the profits has been agreed, the corresponding in the losses will be the same. In the absence of any convention, the respective contribution will determine the part of each one, and that of the industrial partner must be determined equally by the judge.

Final arrangements

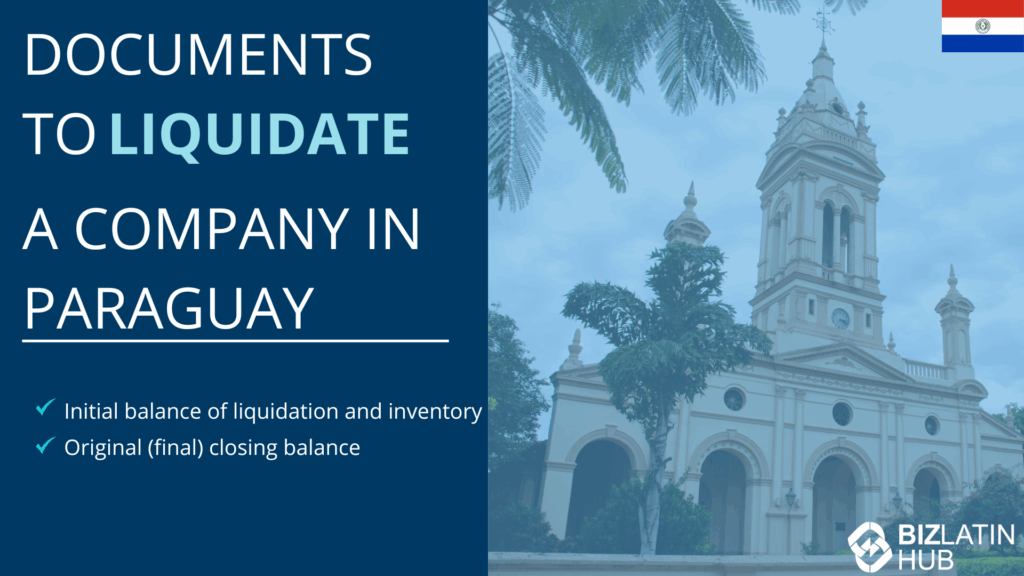

To finalize a liquidation process in Paraguay, the company must prepare the following documents:

- Original balance of liquidation and inventory.

- Original closing balance (final).

Note: to completely liquidate a company in Paraguay, you must communicate the agreement to the Mayor Offices, Ministry of Labour (MTESS or Ministerio de Trabajo Empleo y Seguridad Social), National Pension and Health Plan (IPS – Instituto de Previsión de Social), the Municipality and other entities that still consider the company as active.

Considerations when liquidating in Paraguay

Some considerations the company must take into account when liquidating a company are:

- The company keeps its legal status, but it stops normal activities.

- The corporate purpose is modified to realize the assets and settlement of any of its liabilities.

- When the liquidation process starts, the General Manager ceases activity and the legal representation of the company. At this point, the liquidator(s) takes charge of the company.

- The company must add the expression “In Liquidation” to its company’s name.

The aim of this process is the corresponding distribution of the social assets resulting from liquidation among the shareholders. The distribution occurs after all pending operations are successfully completed.

FAQs for liquidating an entity in Paraguay

Based on our extensive experience these are the common questions we receive from clients about liquidating an entity in Paraguay.

1. What is the process of liquidation in Paraguay?

In summary, the following are the necessary steps to liquidate a Company in Paraguay:

- Appoint a liquidator

- Complete the administrative form from SUACE and SET (Sub Secretaría de Estado de Tributación)

- Present evidence of Public Deed to the Public Registry.

- Publication in the Official Gazette.

2. How long does it take to liquidate a company in Belize?

The process will normally take between eight and 14 months, assuming the entity is in good standing and no rectification work is required.

3. What are the reasons to liquidate a company in Paraguay?

There are a number of reasons you may do so, such as the venture becoming unworkable, a change in laws or simple failure in the relevant markets. You may wish to close one business in order to start another or you may want to leave the country for other reasons. For whatever reason you eventually decide to liquidate a company in Paraguay, it is best to do so in accordance with the law.

4. Can you be forced to liquidate a company in Paraguay?

Yes, under certain circumstances. This most commonly happens when a company cannot pay creditors, leading them to petition the courts for forced liquidation in order to recoup their losses.

5. What is the first step in a voluntary liquidation?

The first step is for the shareholders to hold an extraordinary meeting and pass a formal resolution to dissolve the company.

6. What does the liquidator do?

The liquidator manages the entire winding-up process. They take control of the company’s assets, ensure all employees and creditors are paid, deal with the tax authorities, and prepare the final financial statements for the liquidation.

7. Why are public notices required?

A notice of the company’s dissolution must be published in a major newspaper to inform the public and any potential creditors of the company’s status, giving them a chance to present claims.

8. What is the SET?

The SET is Paraguay’s tax authority. The liquidator must file a final tax return and obtain a clearance certificate from the SET, confirming all tax liabilities have been met, before the company can be formally cancelled.

Liquidate your company in Paraguay with Biz Latin Hub

In times of economic difficulty, quick decisions and action are necessary. Only in this way, you will protect your company assets when faced with an eminent lack of liquidity to honor debts with creditors. Keep in mind that closing a business involves money, so it is not advisable to wait until the last moment.

When liquidating your company, make sure to have a local partner so they can guide you through the complex procedure. Biz Latin Hub has offices located in Paraguay to provide specialist legal and accounting services to manage your exit strategy. Get in touch with us today for your first step in the direction of a new beginning.

Learn more about our team and expert authors.