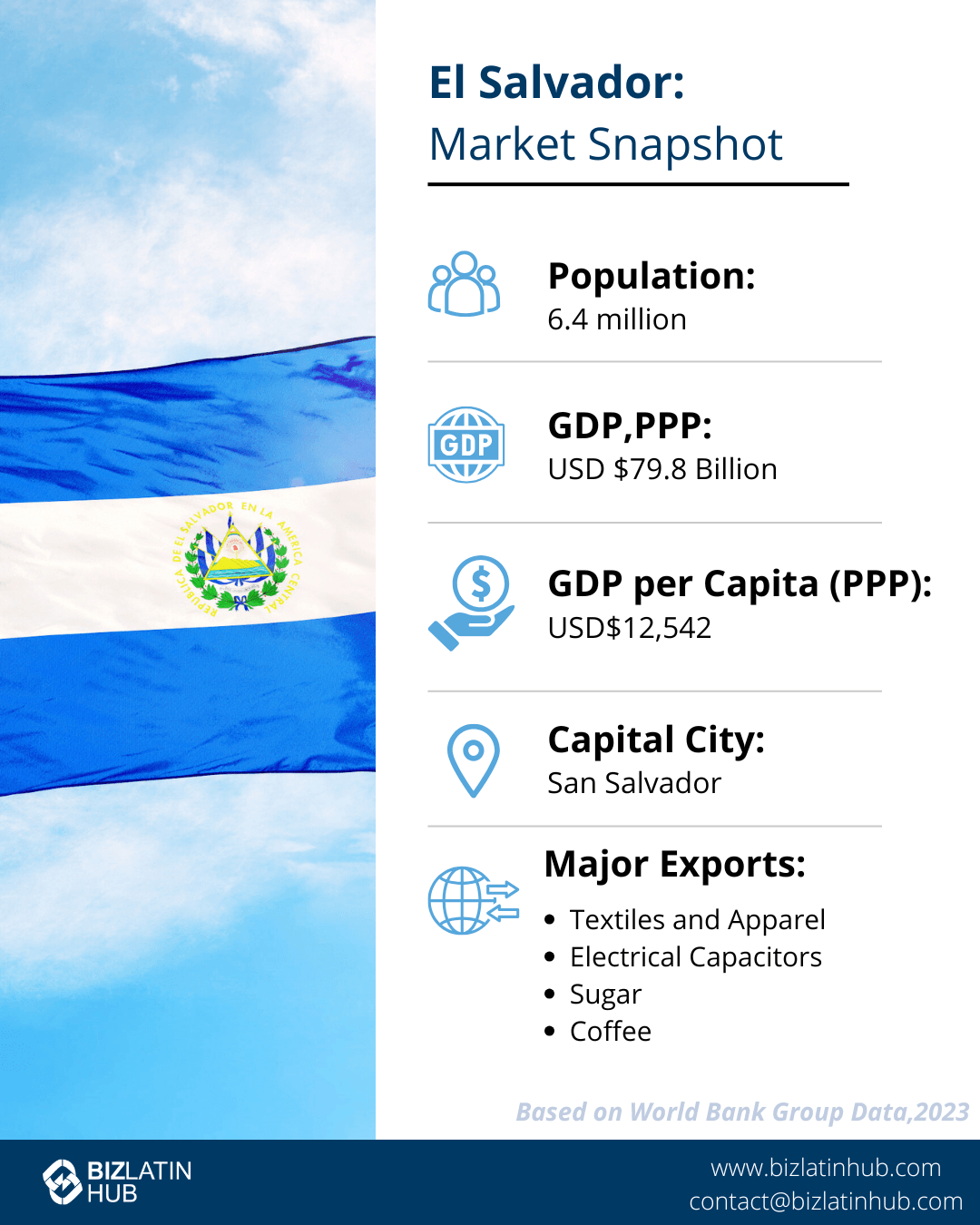

Understand the process to liquidate a company in El Salvador, and find out how to get expert support to carry out the correct procedure. Despite being one of the smallest countries in the Central American region, El Salvador demonstrates high economic potential compared to neighbouring countries. Even with the facilities to successfully do business, in our experience things do not always go as expected after company formation in El Salvador. A change in economic fortunes or a simple pivot in priorities may mean you need to shut up shop professionally.

Key Takeaways:

| Steps to liquidate a company in El Salvador | 1. Agree to dissolve and liquidate a company in El Salvador in the General Meeting of shareholders 2. Appoint a liquidator and auditor 3. Publication of decision to liquidate a company in El Salvador 4. Register dissolution agreement in the trade registration 5. Prepare financial statements and obtain a fiscal opinion 6. Submit financial statements and opinion to Commercial Registry 7. Company liquidation |

| Time generally needed | It should take approximately six months to a year to liquidate a company in El Salvador, if everything is in order. |

| Reasons to liquidate a company in El Salvador | These vary, but the key point is to stay compliant and in good standing with the authorities. |

| Involuntary liquidation | For compulsory liquidation, creditors usually petition the court to liquidate the company. |

Before liquidating your company in El Salvador

Even if your company is inactive (that is, it isn’t performing any kind of commercial activity) it must continue to (amongst other obligations), it must continue to:

- make monthly and annual tax returns

- renew its business registration

- present financial statements.

You must continue to keep tabs on and fulfil your obligations set out by the country’s corporate regulations. It can be useful to get an entity health check for your company to gain a better understanding of the status of your company in the eyes of the government.

Steps to liquidate a company in El Salvador

In the dissolution and liquidation process of companies, the duties and obligations of the company must be clear. The procedure involves updating records in different government institutions, paying taxes, and fulfilling other corporate obligations.

Once the decision is made to liquidate a company in El Salvador, the company must operate in full compliance with local law every step of the way. It must fulfil all obligations of a liquidating company as a priority, above any others it may have later. These priority obligations include immediately paying any outstanding fees to the government, and then creditors.

- 1. Agree to dissolve and liquidate a company in El Salvador in the General Meeting of shareholders

- 2. Appoint a liquidator and auditor

- 3. Publication of decision to liquidate a company in El Salvador

- 4. Register dissolution agreement in the trade registration

- 5. Prepare financial statements and obtain a fiscal opinion

- 6. Submit financial statements and opinion to Commercial Registry

- 7. Company liquidation

Note: liquidating a company in El Salvador is broken into 2 key processes: dissolution and liquidation. The Ministry of Finance must issue a separate solvency certificate to the company for both parts, in order to proceed.

1. Agree to dissolve and liquidate a company in El Salvador in the General Meeting of shareholders

The first step to liquidate your company in El Salvador is to get consensus in the General Meeting of shareholders. Shareholders must meet in an extraordinary session and gain at least 75% consensus to dissolve and liquidate the company.

2. Appoint a liquidator and auditor

In the extraordinary session of the General Meeting, shareholders must appoint a liquidator and auditor of the company.

The liquidator acts as the legal representative during the process, with the same powers as an administrator of the company. The specific functions a liquidator must carry out during the liquidation process in El Salvador include:

- Concluding the social operations pending of the company

- Collecting accounts

- Selling assets of the company

- Continuing with certain economic activities of the company until its conclusion

- Managing and preparing final financial statements.

Companies may choose not to appoint a liquidator and auditor straight away. If this is the case, the company must hold another extraordinary session to later appoint these roles.

3. Publication of decision to liquidate a company in El Salvador

Once the agreement is adopted, a certification must be issued for publication in the Official Gazette, managed by the National Printing Office of El Salvador. This office is responsible for publishing government reports and information required by law to be made available for general public knowledge.

You must also publish the decision to liquidate in another newspaper of greater circulation of the country, which can be private.

Once the certification of the agreement to dissolve the company has been published in both newspapers, the company must wait for a period of approximately 2 months before continuing to dissolve the company. This is to give members of the public to opportunity to present any opposition to the decision to dissolve and liquidate.

4. Register dissolution agreement in the trade registration

After 2 months, you must then approach the country’s Commercial Registry to register the agreement to dissolve and liquidate.

To complete this step, you must present the following documents:

- Certification of the agreement to dissolve and liquidate

- Proof of payment of associated fees to register the agreement

- Formal solvency document acquired from the Ministry of Finance

- Publication of Notice in the Official Gazette

- Publication of the Notice in the newspaper of greater circulation.

After submitting these documents, the Commercial Registry will respond within 5-10 days to confirm the information provided is correct and complete. They will then register the company’s dissolution.

5. Prepare financial statements and obtain a fiscal opinion

After registering the company’s dissolution, the company must then prepare financial statements and get a formal opinion from an auditor.

The appointment of the company’s liquidator and auditor must also be registered with the Commercial Registry.

As previously mentioned, the liquidator must prepare the company’s final financial statements. To do this, the liquidator must engage with an authorized local accountant who will be responsible for reviewing the accounts, books, and social documents to prepare the financial statement.

Once the financial statement is finalized by the accountant, the appointed auditor must then provide a final fiscal opinion of the company. This opinion must then be presented to the General Meeting of shareholders for review. The shareholders can approve this opinion through a certification of Minutes.

6. Submit financial statements and opinion to Commercial Registry

Once the above is completed, companies must submit the following documents to the Commercial Registry:

- Final settlement balance or final financial statements

- Final fiscal opinion from the auditor

- Minutes of the shareholders approving the financial statements

- Proof of payment of the registration fees for the deposit of the financial statements.

The Commercial Registry will take approximately 2 weeks to review and approve these documents. Alternatively, they may request further information from the company.

7. Company liquidation

With the final financial statements registered in the Commercial Registry, companies can formally begin liquidating assets (a process managed by the appointed liquidator) and paying any outstanding debts to creditors and partners in the priority of payment set out in Salvadoran legislation.

Liquidators must present formal company documents (such as the public deed) to a Public Notary to formalize its liquidation. These documents, including the Ministry of Finance’s solvency certificate for liquidation, must again be submitted to the Commercial Registry to move forward with closing the company.

Commercial closure of the company

Once the liquidation deed of the company is registered, the company is officially closed and cannot conduct any further commercial economic activity.

Note that the company may still need to make payments to other government institutions as is required. The previously mentioned entity health check will help identify which final obligations remain for the company.

Some of these final payments include:

- Deregistration at the Fiscal Registry: you will have to appear before the tax authorities to eliminate your fiscal registry so you are disconnected from tax

obligations and payments such as VAT and income. - Closure of municipal account: similar to the Fiscal Registry, you will have to close the company’s activities at the City Hall, and pay any pending municipal taxes if required

- Employer liabilities: You must request from the Salvadoran Social Security Institute (ISSS), proof that the company does not owe any type of salary or benefits to employees at the time of closing the company.

FAQs for liquidating an entity in El Salvador

Based on our extensive experience these are the common questions we receive from clients about liquidating an entity in El Salvador.

1. What is the process of liquidation in El Salvador?

Once the decision is made to liquidate a company in El Salvador, the company must operate in full compliance with local law every step of the way. It must fulfil all obligations of a liquidating company as a priority, above any others it may have later. These priority obligations include immediately paying any outstanding fees to the government, and then creditors.

- 1. Agree to dissolve and liquidate a company in El Salvador in the General Meeting of shareholders

- 2. Appoint a liquidator and auditor

- 3. Publication of decision to liquidate a company in El Salvador

- 4. Register dissolution agreement in the trade registration

- 5. Prepare financial statements and obtain a fiscal opinion

- 6. Submit financial statements and opinion to Commercial Registry

- 7. Company liquidation

2. How long does it take to liquidate a company in El Salvador?

The liquidation process will normally take from six months to a year, assuming the entity is in good standing and no rectification work is required.

3. What are the reasons to liquidate a company in El Salvador?

There are a number of reasons you may do so, such as the venture becoming unworkable, a change in laws or simple failure in the relevant markets. You may wish to close one business in order to start another or you may want to leave the country for other reasons. For whatever reason you eventually decide to liquidate a company in El Salvador, it is best to do so in accordance with the law.

4. Can you be forced to liquidate a company in El Salvador?

Yes, under certain circumstances. For compulsory liquidation, creditors usually petition the court to liquidate the company.

Liquidate a company in El Salvador with the help of Biz Latin Hub

The dissolution and liquidation processes of companies in El Salvador are complex, with a lot of paperwork and government engagement involved. For foreign companies doing business in El Salvador, this can be a costly and time-consuming process if the company is not familiar with the legislation for liquidation in El Salvador.

It’s recommended to seek local advice and support from qualified, bilingual lawyers and accountant who specialize in liquidation. Experienced specialist can help you make a preliminary diagnosis for your company to see the viability of the dissolution process, and guide you through the steps to dissolve and liquidate the company in El Salvador.

At Biz Latin Hub, our local and expatriate professionals are experts in processes of dissolution and liquidation of companies in El Salvador. We provide comprehensive entity health checks and liquidation services that will help make your market exit smooth and with as little delay as possible.

Contact us here at Biz Latin Hub for personalized advice on liquidating your company in El Salvador.

Learn more about our team and expert authors.