Many foreign investors have looked at company formation in Ecuador, but it doesn’t always work out. If your international business expansion isn’t going to plan, it’s important to understand how to liquidate a company in Ecuador. Ecuadorian legislation provides several procedures to liquidate, cancel and dissolve established companies or branches domiciled in the country. In particular, it depends on whether or not there are extant unpaid creditors.

Key takeaways on how to liquidate a company in Ecuador

| Expedited route available: | Companies with no outstanding debts may pursue an expedited petition for liquidation, drastically reducing administrative time. |

| 4-step process for companies with creditors: | Shareholder resolution, asset inventory, submission of liquidation plan, and asset liquidation. |

| Liquidation time varies: | Average process takes 120+ days but may extend based on complexity and real estate holdings. |

| Legal documentation is critical: | Accurate financial reports, tax compliance, and regulatory filings are essential. |

| Different terms for foreign companies: | Local companies are listed as liquidated; foreign branches have permits revoked. |

Liquidate a Company in Ecuador Through an Expedited Petition

If a company has no outstanding creditors, it may request voluntary dissolution, liquidation, and cancellation in a single act. This process, though still formal, is significantly faster and less complex than the standard creditor-involved path.

The legal representative must submit a petition to the Superintendence of Companies, along with a sworn declaration that no debts remain. Supporting documentation typically includes:

- Final balance sheet showing no liabilities

- Statement of tax compliance

- Proof of asset distribution (if any)

Tip: This expedited route can drastically reduce liquidation time. Still, misfiling or incomplete documentation will result in rejection or delays. Hiring a local legal advisor is highly recommended.

Note: The company can be reactivated until full cancellation is officially registered.

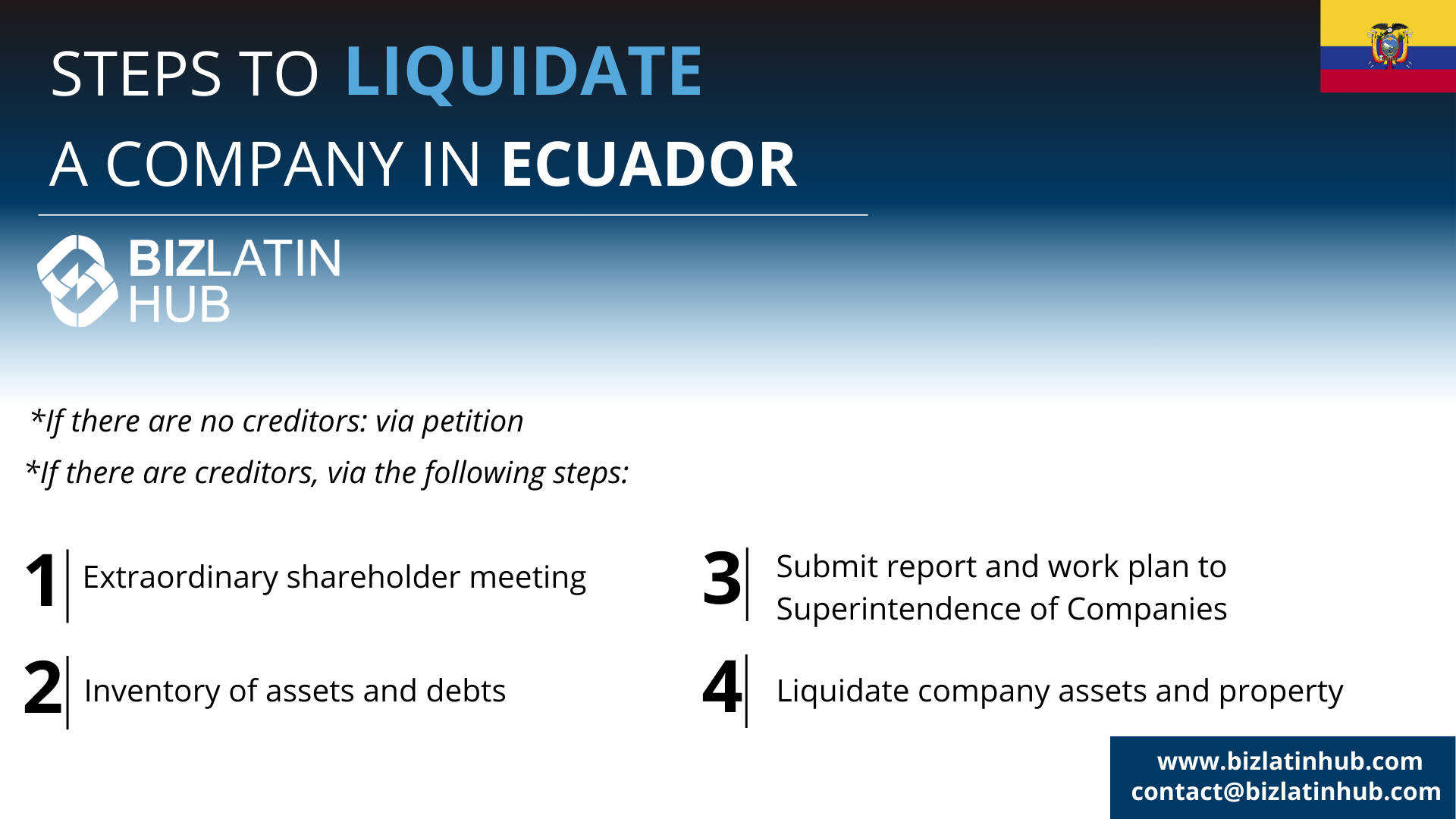

4 Steps to liquidate a company in Ecuador that has creditors

If the company has debts or outstanding obligations, the standard liquidation process follows four formal steps:

Step 1 – Extraordinary Shareholders’ Meeting

Hold an extraordinary shareholders’ meeting to pass a resolution to dissolve the company and appoint a liquidator. This liquidator typically assumes the role of legal representative and oversees the entire process, including notifications, filings, and financial disbursements.

Tip: If the company owns real estate, shareholders must explicitly state whether it must be auctioned or may be handled through private sale.

Step 2 – Inventory of Assets and Debts

The liquidator prepares a comprehensive inventory of the company’s assets and liabilities. This includes:

- Identifying all creditors

- Calculating outstanding debts

- Disclosing any unresolved tax obligations to SRI

- Cataloging tangible and intangible assets (vehicles, property, IP, etc.)

This document becomes the foundation for the liquidation plan and must be signed and notarized.

Tip: Errors or omissions in this stage are one of the most common causes of liquidation delays. Ensure prior bookkeeping is complete and accurate.

Step 3 – Submit Report and Work Plan

Submit a dissolution report and liquidation plan to the Superintendence of Companies. The plan must outline:

- A repayment timeline

- Prioritization of creditor claims

- Strategy for asset disposal

This package also includes a recent financial balance sheet.

Tip: Maintain organized supporting documentation. Inconsistencies between inventory and financial statements may trigger audits or rejection.

Step 4 – Liquidate Company Assets and Property

Once approved, the liquidator begins selling company assets to pay debts. Any remaining value is distributed to shareholders.

Note: Property such as real estate must be auctioned publicly unless explicitly stated otherwise in the shareholder resolution.

Recommendation: Work with an experienced legal advisor to ensure proper creditor ranking, avoid procedural missteps, and reduce the risk of disputes.

How to liquidate a company in Ecuador

Liquidating a company in Ecuador involves a multi-step legal process covering dissolution, liquidation, and cancellation. Ecuadorian law considers a company eligible for dissolution when its accumulated losses equal or exceed half of its capital plus reserves. If shareholders opt not to recapitalize, liquidation procedures begin. Additional triggers include court mandates or creditor pressure.

Processing time for company liquidation

On average, liquidation takes 120+ days, though it may extend up to 6–9 months depending on the complexity of the case.

Factors that affect timing include:

- Whether the company qualifies for the expedited petition process

- Number and type of creditor claims

- Timeliness of filings with SRI and Superintendence

- Real estate ownership, which requires public auction

- Availability of liquidator and legal team

Tip: Start pre-liquidation planning early by hiring an accountant to close fiscal records and an attorney to initiate regulatory coordination. Early submission of clean and compliant documentation is the best way to expedite closure.

Differences in terminology for local foreign company liquidation

While the legal procedures for liquidation are nearly identical, the terminology used differs slightly:

- Local companies are listed as “dissolved, liquidated, and canceled” in public records.

- Foreign branches are described as having their “operating permits revoked.”

This distinction reflects the foreign nature of branch operations but does not affect the practical legal outcome.

Reason: Ecuador’s regulatory framework distinguishes between locally incorporated entities and foreign branches for tax and reporting purposes. However, both must follow similar exit protocols.

Important: Foreign shareholders should assign power of attorney to a local legal representative to handle all necessary filings and appearances.

FAQs for liquidating an entity in Ecuador

Based on our extensive experience these are the common questions we receive from clients about liquidating an entity in Ecuador.

1. What is the process to liquidate a company in Ecuador?

It depends on whether there are outstanding creditors. If not, the legal rep may file an expedited petition for direct cancellation. Otherwise, follow the formal four-step process involving shareholders, Superintendence filings, and asset liquidation.

2. How long does liquidation take?

Liquidation generally takes 120+ days, but may vary depending on the company’s complexity, real estate holdings, and accuracy of submitted documentation.

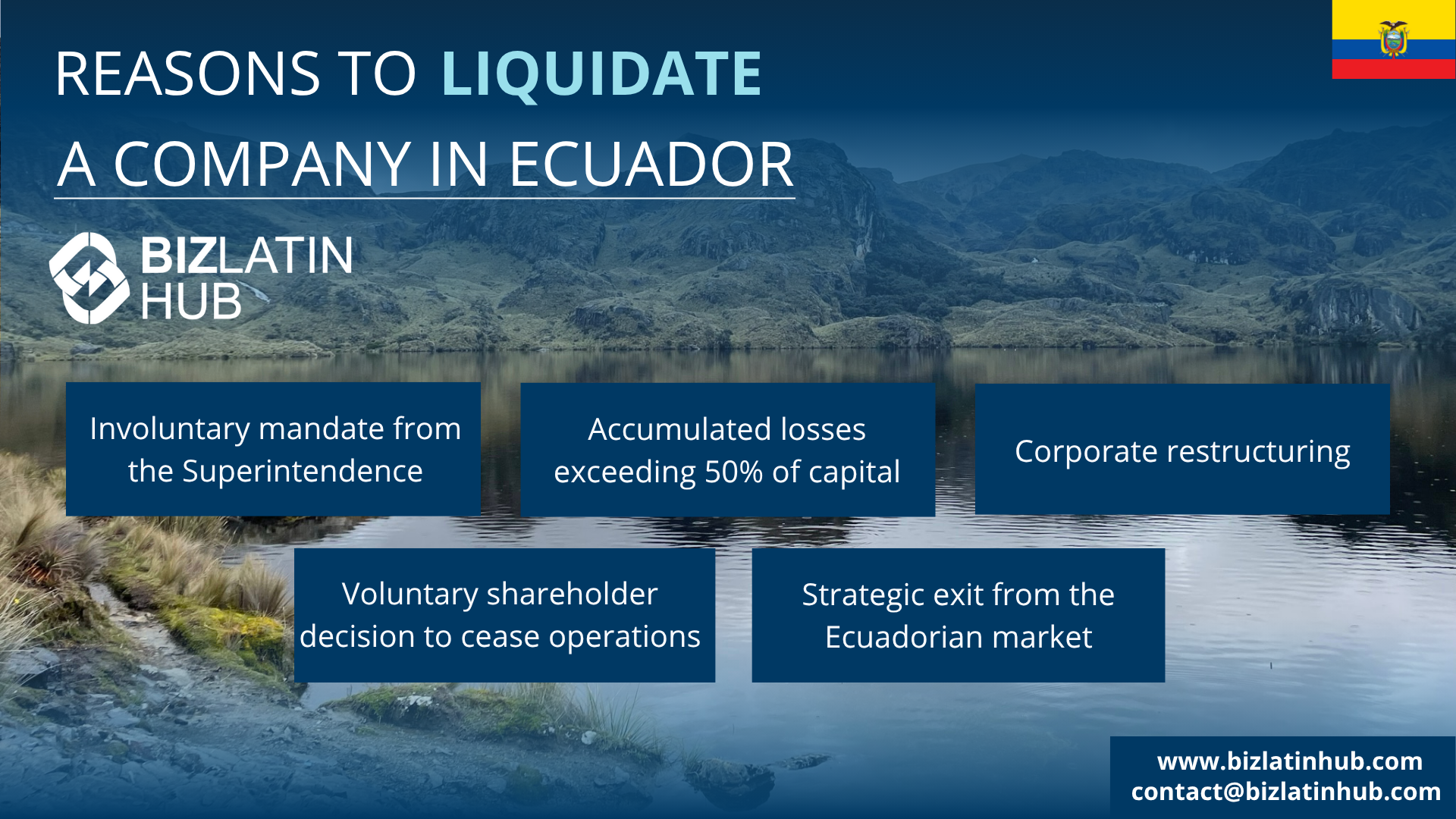

3. Why do companies liquidate in Ecuador?

Typical reasons include:

Involuntary mandate from the Superintendence or court due to regulatory breaches or insolvency

Voluntary shareholder decision to cease operations

Accumulated losses exceeding 50% of capital

Strategic exit from the Ecuadorian market

Corporate restructuring

4. Can companies be forced into liquidation?

Yes. If a company fails to pay its debts, creditors can request court-mandated liquidation. The court may assign a third-party liquidator to take control.

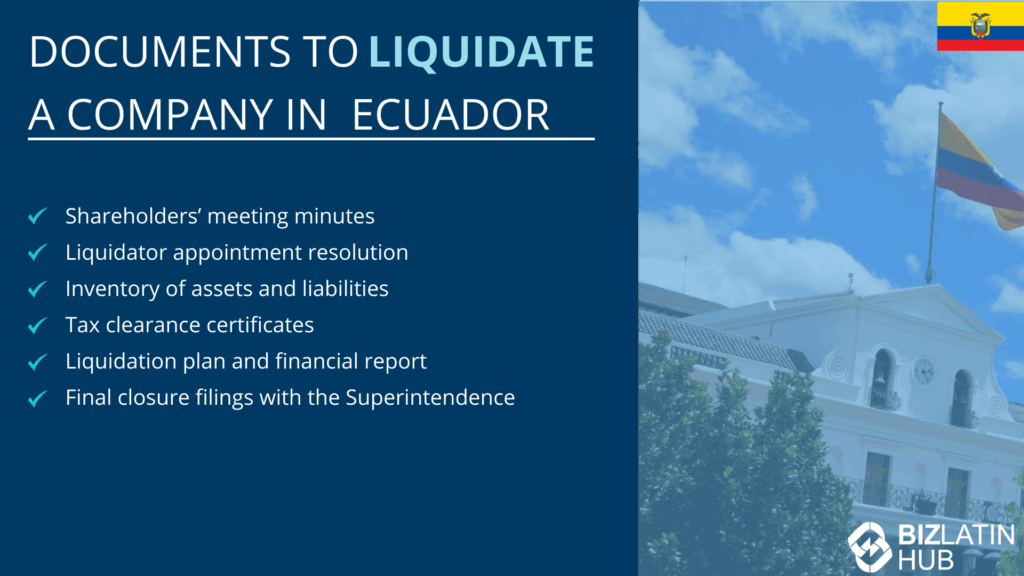

5. What documents are required?

Shareholders’ meeting minutes

Liquidator appointment resolution

Inventory of assets and liabilities

Tax clearance certificates

Liquidation plan and financial report

Final closure filings with the Superintendence

6. Can foreign-owned companies liquidate the same way?

Yes, though the term used is “operating permit revocation.” Local representation is required to manage filings and fulfill legal formalities.

7. What are the risks of non-compliance during liquidation?

Risks include:

- Legal penalties

- Unresolved tax obligations

- Blocking of re-entry to Ecuadorian market

- Continued liabilities for foreign shareholders

8. Can a company re-enter the market after liquidation?

Yes. A new entity can be formed or re-registration can occur, provided the previous liquidation was completed cleanly.

Biz Latin Hub can help you liquidate a company in Ecuador

The legal procedures to liquidate a company in Ecuador can be complex—especially for foreign investors unfamiliar with local laws.

Biz Latin Hub’s bilingual legal and accounting professionals offer:

- Entity review and exit strategy design

- Preparation and filing of all legal documents

- Liaison with Superintendence of Companies and tax authority (SRI)

- Representation through all liquidation phases

Need support closing your Ecuadorian company? Contact our team at Biz Latin Hub for expert assistance tailored to your unique business structure and industry.