Liquidating a company in Colombia involves complying with formal legal and tax processes. Whether due to insolvency, strategic exit, or business restructuring, companies must complete a series of regulated steps to finalize their closure and cancel their registration. This 2025 guide outlines the full 11-step procedure to legally liquidate a company in Colombia, plus key considerations and frequently asked questions. Colombia has been characterized for being an attractive destination for company formation.

Key takeaways on how to liquidate a company in Colombia

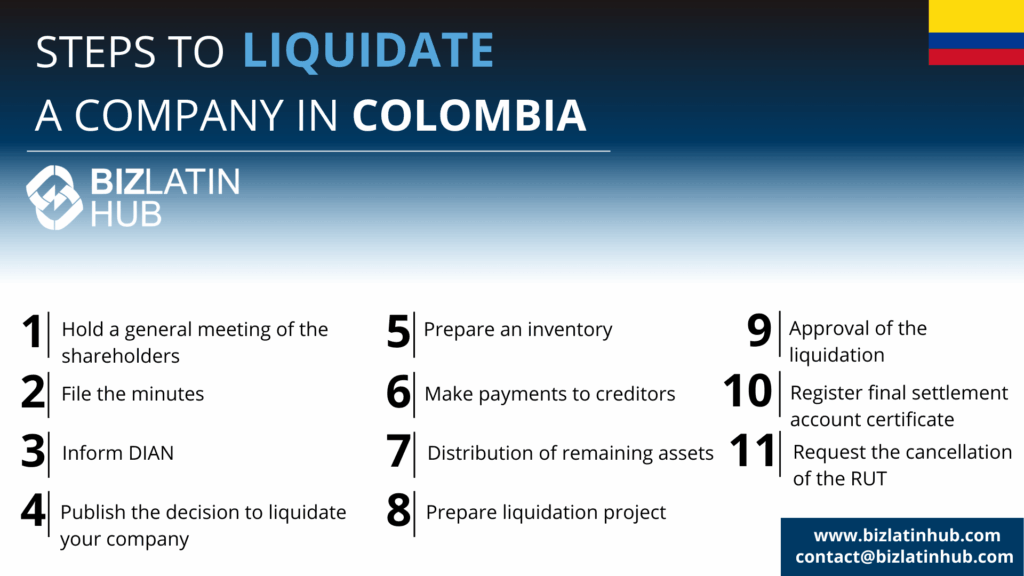

| 11 Steps to liquidate a company in Colombia | Hold a general meeting of the shareholders. File the minutes. Inform DIAN. Publish the decision to liquidate your company. Prepare an inventory. Make payments to creditors. Distribution of remaining assets. Prepare liquidation project. Approval of the liquidation. Register final settlement account certificate. Request the cancellation of the RUT. |

| How long does it take to liquidate a company in Colombia? | It should take approximately six months to a year to liquidate a company in Colombia, if everything is in order. |

| What are the reasons to liquidate a company in Colombia? | These vary, but are usually due to financial insolvency in one way or another. Voluntary liquidation allows you to tie up loose ends in accordance with the law. |

| What causes involuntary liquidation in Colombia? | If a company is unable to pay its legal creditors, said creditors may petition the courts for a winding-up notice in order to recoup some of the debt. |

11 Steps to liquidate a company in Colombia

Step 1: Hold a general meeting of the shareholders

Shareholders must formally agree to dissolve the company. A resolution is passed to initiate the liquidation process and designate a liquidator.

Step 2: File the minutes

The meeting minutes and liquidation resolution must be signed and registered with the Chamber of Commerce, formalizing the company’s intent to dissolve.

Step 3: Inform DIAN

Notify the Colombian Tax Authority (DIAN) of the liquidation process. A written communication must be submitted to update the RUT and start tax compliance closure procedures.

Step 4: Publish the decision to liquidate

Public notice of the liquidation must be published in a national newspaper and through the Chamber of Commerce. This informs creditors and the general public.

Step 5: Prepare an inventory

The liquidator compiles a full inventory of company assets and liabilities, including property, cash, unpaid debts, tax obligations, and employee liabilities.

Step 6: Make payments to creditors

All creditors must be paid in legal order of priority:

- Labor obligations and employee benefits

- Tax liabilities (DIAN and local taxes)

- Secured creditors

- Unsecured creditors

Step 7: Distribution of remaining assets

Once liabilities are paid, any remaining assets or cash are distributed to shareholders according to their ownership stakes.

Step 8: Prepare liquidation project

The liquidator prepares a formal liquidation project including a liquidation balance sheet and a final report detailing asset disposal and payments made.

Step 9: Approval of the liquidation

Shareholders (or court, in judicial cases) must approve the liquidation project and final settlement documentation.

Step 10: Register final settlement account certificate

The approved liquidation account must be registered with the Chamber of Commerce. This step legally confirms the company’s financial closure.

Step 11: Request the cancellation of the RUT

Submit the request to DIAN to cancel the Registro Único Tributario (RUT), officially ending the company’s tax obligations.

Considerations when liquidating a company in Colombia

Before initiating liquidation, companies should ensure they meet the following legal and regulatory requirements:

- Corporate Documentation: Statutory books, shareholder registers, and financial statements must be up to date and legally compliant.

- Tax Compliance: File and settle all outstanding tax returns. DIAN will not cancel the RUT unless the company has zero liabilities.

- Social Security and Labor Obligations:

- Pay all employee salaries, bonuses, vacation days, severance pay, and social contributions (PILA system).

- If applicable, obtain a labor compliance certificate from the Ministry of Labor.

- Asset Valuation: An accurate inventory of all assets must be prepared and matched to accounting books.

- Public Notice Requirements: Ensure timely and proper publication of liquidation notices. This step is critical to alert creditors.

- Liquidator Duties: The liquidator assumes legal responsibility for compliance, payment distribution, and reporting.

- Accounting Finalization: The liquidation balance sheet must be prepared and reviewed in accordance with local accounting standards (Normas de Información Financiera – NIF).

- Municipal Registrations: Cancel any local permits, industry & commerce registrations, and resolve outstanding municipal taxes.

- Timeframe Planning: Allow 6–12 months for voluntary liquidation. For court-managed cases, allow 12–24 months or more.

FAQs on how to liquidate an company in Colombia

Based on our extensive experience these are the common questions and doubts of our clients when liquidating a local entity.

1. What is the process of liquidation in Colombia?

The liquidation process involves the following principal activities:

- Hold a general meeting of the shareholders.

- File the minutes.

- }Inform DIAN.

- Publish the decision to liquidate your company.

- Prepare an inventory.

- Make payments to creditors.

- Distribution of remaining assets.

- Prepare liquidation project.

- Approval of the liquidation.

- Register final settlement account certificate.

- Request the cancellation of the RUT.

2. How long does it take to liquidate a company in Colombia?

The liquidation process will normally take between six months and a year, assuming the entity is in good standing and no rectification work is required.

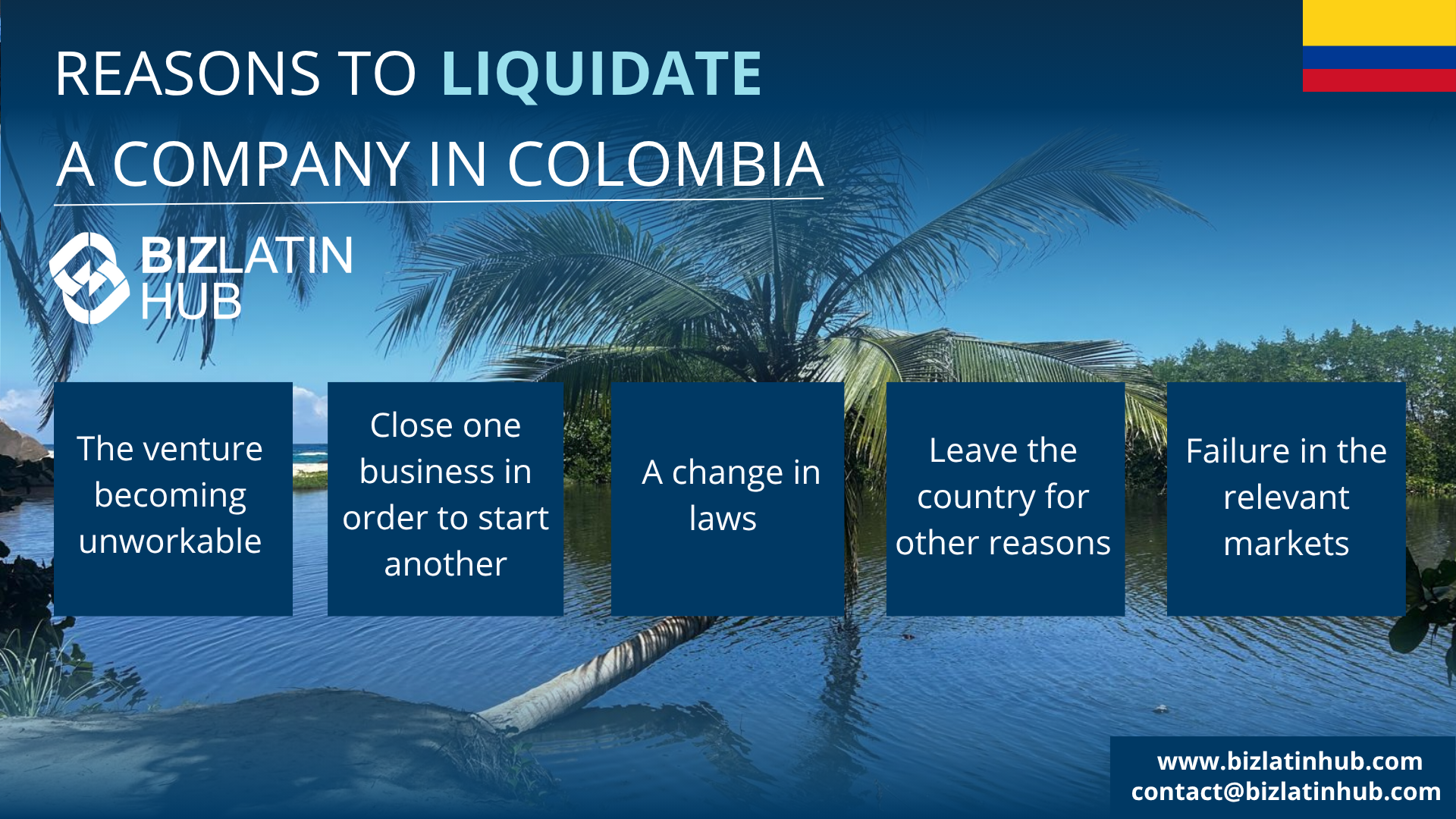

3. What are the reasons to liquidate a company in Colombia?

There are a number of reasons you may do so, such as the venture becoming unworkable, a change in laws or simple failure in the relevant markets. You may wish to close one business in order to start another or you may want to leave the country for other reasons. For whatever reason you eventually decide to liquidate a company in Colombia, it is best to do so in accordance with the law.

4. Can you be forced to liquidate a company in Colombia?

Yes, under certain circumstances. If a company is unable to pay its legal creditors, said creditors may petition the courts for a winding-up notice in order to recoup some of the debt.

5. Can foreign shareholders liquidate a company remotely?

Yes. Foreign owners can appoint a legal representative in Colombia through a notarized and apostilled Power of Attorney (POA) to manage the entire process on their behalf.

6. Is the liquidation process the same for SAS and LTDA entities?

Yes, the steps are broadly the same, but the required documentation may differ slightly depending on the entity type. SAS entities usually have simpler structures, which may shorten processing time.

7. What if my company is inactive but never formally liquidated?

Inactive companies that fail to liquidate remain obligated to file tax and legal reports. Failure to do so may result in fines, blacklisting by DIAN, and eventual forced dissolution.

8. Is a court process always required?

No. Voluntary liquidation is handled by the shareholders unless the company is insolvent. In such cases, creditors may petition the court for judicial liquidation.

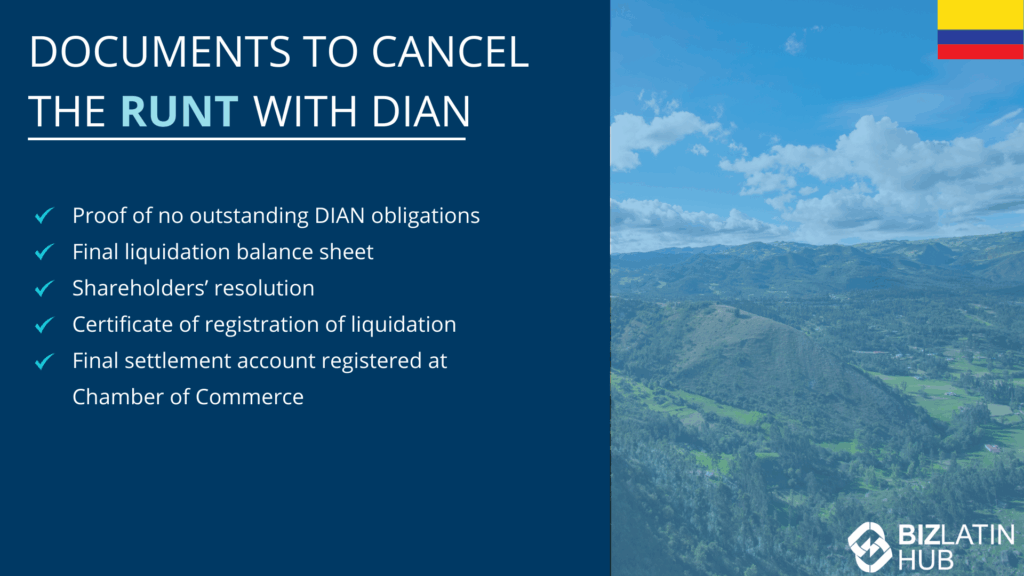

9. What documents are required to cancel the RUT with DIAN?

You will need:

Proof of no outstanding DIAN obligations

Final liquidation balance sheet

Shareholders’ resolution

Certificate of registration of liquidation

Final settlement account registered at Chamber of Commerce

End-to-End Liquidation Support in Colombia

Liquidating a company in Colombia requires coordination with multiple authorities, strict accounting closure, and legal filings. Biz Latin Hub offers bilingual legal and accounting support across all liquidation stages.

Our services include:

• Drafting shareholder resolutions and liquidation acts

• Chamber of Commerce registration and public notice coordination

• Tax filings and DIAN compliance management

• Labor obligation audits and payments

• Liquidation balance sheet and final project preparation

• RUT cancellation and full entity deregistration

Whether you are winding down a SAS, LTDA, or branch entity, we ensure full compliance from start to finish.

Contact us today to begin your company liquidation in Colombia with expert support.