The attraction of company formation in Chile

Key takeaways for company liquidation in Chile

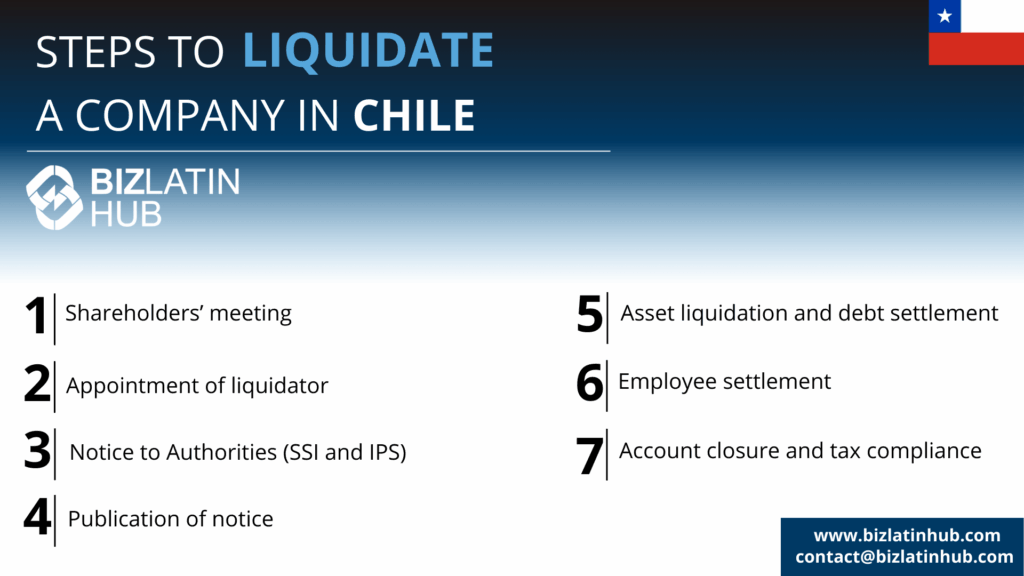

| 7 steps to liquidate a company in Chile: | 1. Shareholders’ Meeting 2. Appointment of Liquidator 3. Notice to Authorities (SII and IPS) 4. Publication of Notice 5. Asset Liquidation and Debt Settlement 6. Employee Settlement 7. Account Closure and Tax Compliance |

| Timeframe: | Approximately 6 to 12 months, assuming full compliance. |

| Common Reasons to Liquidate: | Financial insolvency Strategic market exit Changes in business environment Shareholder decision |

| What Triggers Forced Liquidation? | Creditors can petition a civil court when debts are unpaid or guarantees are insufficient. |

What is the process of company liquidation in Chile?

The liquidation process in Chile has the following 7 steps:

- Shareholders’ Meeting

Convene an official meeting to pass a resolution authorizing the dissolution and liquidation. This must be recorded in the company’s official minutes and signed by the shareholders. - Appointment of Liquidator

Appoint a liquidator—either a third-party professional or an internal representative—responsible for managing the entire process.

Recommendation: Engage a lawyer or specialist familiar with liquidation to ensure legal and tax obligations are met. - Notice to Authorities

Inform key government agencies including SII, IPS, and the relevant municipality. Provide dissolution documents and identification of the appointed liquidator.

Tip: Align dates across notifications to maintain consistency in the closure timeline. - Publication of Notice

Publish the liquidation notice in the Diario Oficial and a local newspaper. The notice must include the decision to dissolve, company details, and the liquidator’s information.

Recommendation: Submit all supporting documentation correctly to avoid delays or rejections. - Asset Liquidation & Debt Settlement

Sell or distribute company assets. Use proceeds to repay creditors based on debt priority.

Tip: Maintain records of sales and payments to avoid disputes during audits. - Employee Settlement

Fulfill all labor obligations. This includes final salary payments, legal severance, and social contributions.

Recommendation: Have employment contracts reviewed by a labor attorney to ensure compliance. - Account Closure & Tax Compliance

Finalize tax returns and close all company bank accounts. Apply for a tax clearance certificate from the SII.

Tip: Work with a tax advisor to properly report final operations and avoid triggering post-closure audits.

What is company liquidation?

Liquidating a company is the process of shutting down all activities and redistributing company assets to creditors. There are various reasons why a founder may want to liquidate their company. The process essentially involves selling off all assets to pay its creditors and distributing any remaining funds among its shareholders.

One of the most common reasons for liquidation is financial insolvency, where a company is unable to pay its debts or sustain its operations due to a lack of revenue. Other reasons may include a change in the business environment, such as new competitors or changes in market demand, or a strategic decision to exit a particular market or industry. Additionally, a company may choose to liquidate if its shareholders wish to pursue other opportunities or investments.

The liquidation process involves completely selling all inventories, physical assets (such as machinery or furniture), and financial assets. Asset sales allow a company to repay its debts, creditors, and shareholders. After all, once a company has repaid all its debts, the company closes and ceases all commercial activity.

Liquidating a company in Chile involves terminating all commercial activities, redistributing company assets, and deregistering from all relevant authorities. It is commonly pursued due to insolvency, strategic exits, or legal requirements. Once debts are paid and remaining assets distributed, the entity is formally closed.

Liquidation in Chile is governed by Law No. 20,720. The Superintendencia de Insolvencia y Reemprendimiento (linked to the Ministry of Economy) manages insolvency proceedings. Filings must also be made with:

- Servicio de Impuestos Internos (SII)

- Instituto de Previsión Social (IPS)

- Diario Oficial

- Local Trade and Companies Register

Tip: Keep a checklist of required submissions and confirm processing timelines with each authority to avoid delays.

The company must also register the dissolution in the Trade and Companies Register, known as the Boletín Oficial del Registro Mercantil (BORME), in all cases.

Before liquidation

Before you start the liquidation process of your company, make sure to carry out these steps first:

- Be up to date on your payments with the state: Pay all outstanding VAT, IRPF, and other tax bills. This includes submitting any delayed filings and reconciling discrepancies.

- Pay your creditors: Settle all invoices accumulated during your company’s operational life to avoid potential litigation.

- Asset allocation: Before any liquidation, you must ensure that all assets are assigned to shareholders or prepared for sale.

- Contact a competent notary: Present your company dissolution to a local notary, who must sign and confirm everything in writing.

Tip: Hiring a bilingual accountant can ensure full financial alignment before submitting documents to the notary.

Determine the Path

Once preparations are complete, determine the route your company should take:

- Transfer of Ownership: You may choose to sell the company to new owners instead of dissolving it, especially if the brand or structure holds market value.

- Voluntary Liquidation: If the company is solvent but no longer needed, shareholders can vote to dissolve. This option offers a structured and orderly exit.

- Insolvency Proceedings: When liabilities surpass assets and obligations cannot be met, court-directed liquidation may be necessary.

Liquidation or insolvency proceedings

First of all, it is essential to specify that an insolvency processor is a judicial procedure whose objective is to achieve a rapid and total liquidation of all the assets (physical and financial) of a company, to pay its creditors. A creditor is a person who holds a right of claim, i.e., a person or entity (company, organization, etc.) to whom someone owes a sum of money.

If you want to liquidate your company in the Chilean legal system, the civil court in your company’s region will consider you as the debtor company facing receivables and debts, and the procedure will be carried out accordingly.

Voluntary Procedure

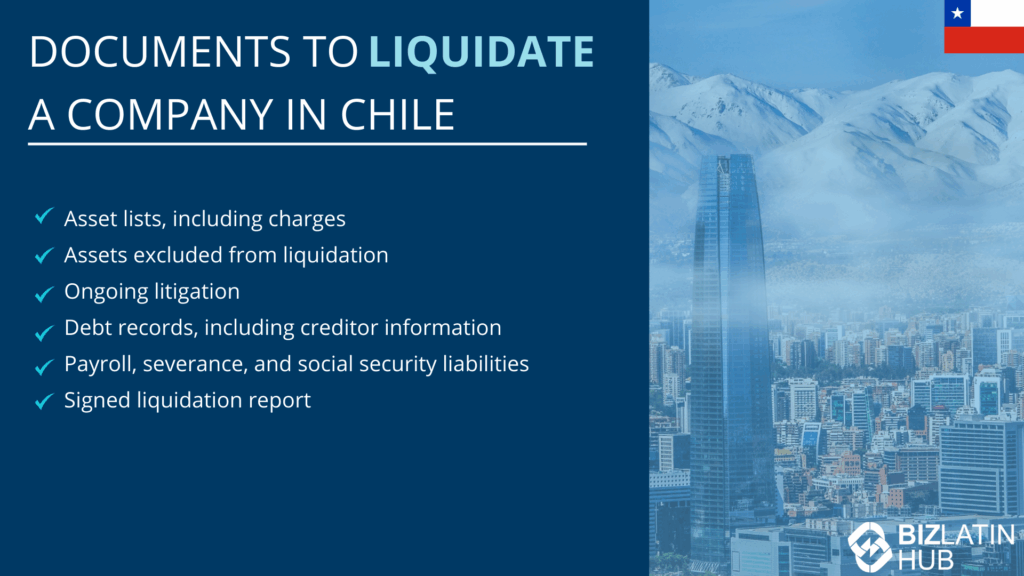

Initiated by the company and filed in court with the following documents:

- Asset lists, including charges

- Assets excluded from liquidation

- Ongoing litigation

- Debt records, including creditor information

- Payroll, severance, and social security liabilities

- Signed liquidation report

Forced Procedure

Initiated by a creditor when:

- You fail to pay obligations

- You do not present sufficient assets when required, especially when multiple bonds are expired and legal actions initiated

Tip: Voluntary procedures are typically faster, less costly, and protect the company’s reputation. Try to reach amicable settlements to avoid court action.

Options for voluntary liquidation

When you organize your settlement, this is voluntary liquidation. In Chile, you can temporarily close your company before taking this liquidation decision. During this period, your company will temporarily suspend tax obligations and payments. You can resume your business activity at any time. If you choose this option, you’ll need to clarify or pay any tax arrears, provide an interim balance sheet, and submit stamped tax documents.

If you choose to close your company permanently, you will have to issue in addition to the closure of all activities. You’ll need to publish your decision to voluntarily liquidate (consented by the company’s partners) in the country’s official gazette or diary called Diario Oficial. You will need to request to close your municipal permit, to stop the municipality from sending invoices.

FAQs on company liquidation in Chile

Based on our extensive experience these are the common questions we receive from clients about liquidating an entity in Chile.

1. What is the process of liquidation in Chile?

It includes seven key steps: shareholders’ meeting, appointment of a liquidator, notifying authorities, publication of the notice, liquidation of assets and debt settlement, employee payments, and tax/account closure.

2. How long does it take?

6 to 12 months, provided no compliance issues arise.

3. What are the reasons to liquidate?

Common drivers include insolvency, market exit, shareholder decision, and economic changes.

4. Can a company be forced to liquidate?

Yes. A creditor can initiate court proceedings if debts remain unpaid or responses are inadequate. This is typically longer and more costly.

5. What documents are needed for voluntary liquidation?

You’ll need asset and liability listings, evidence of employee settlements, pending trial information, tax clearance certificates, and final accounting reports.

6. Is there a tax clearance process?

Yes. Companies must submit final SII returns and receive a tax clearance certificate before closure is completed.

7. Can foreign shareholders authorize liquidation?

Yes. Shareholders located abroad can grant power of attorney to a local legal representative to complete the liquidation.

8. What are the risks of delaying liquidation once the company is inactive?

Delays can lead to accumulating tax liabilities, penalties, or even forced liquidation proceedings by creditors or authorities.

9. Is it necessary to publish in both the Official Gazette and a local paper?

Yes. Chilean law requires notice publication in both for full legal effect and creditor notification.

Biz Latin Hub can help with company liquidation in Chile

Biz Latin Hub’s Santiago-based team provides expert legal and financial support for full company liquidation in Chile. Our services include:

- Reviewing your company’s legal standing

- Preparing and notarizing all necessary documents

- Liaising with SII, IPS, and municipal authorities

- Filing final tax returns and closing accounts

Need to close your company in Chile?

Get in touch with Biz Latin Hub to ensure a smooth, compliant exit strategy tailored to your business structure and industry.