Currently, Bolivia has been working on improving its economic growth and reduce its inflation rate. However, the business environment is not for everyone and business owners may decide to liquidate a company in Bolivia as a final decision. However, you will want to do things by the book to remain in good standing, just as with company formation in Bolivia. The process to liquidate a company in Bolivia is a complex operation, and business owners will need to seek legal support from an expert to comply with all corporate obligations.

Key takeaways on how to liquidate a company in Bolivia

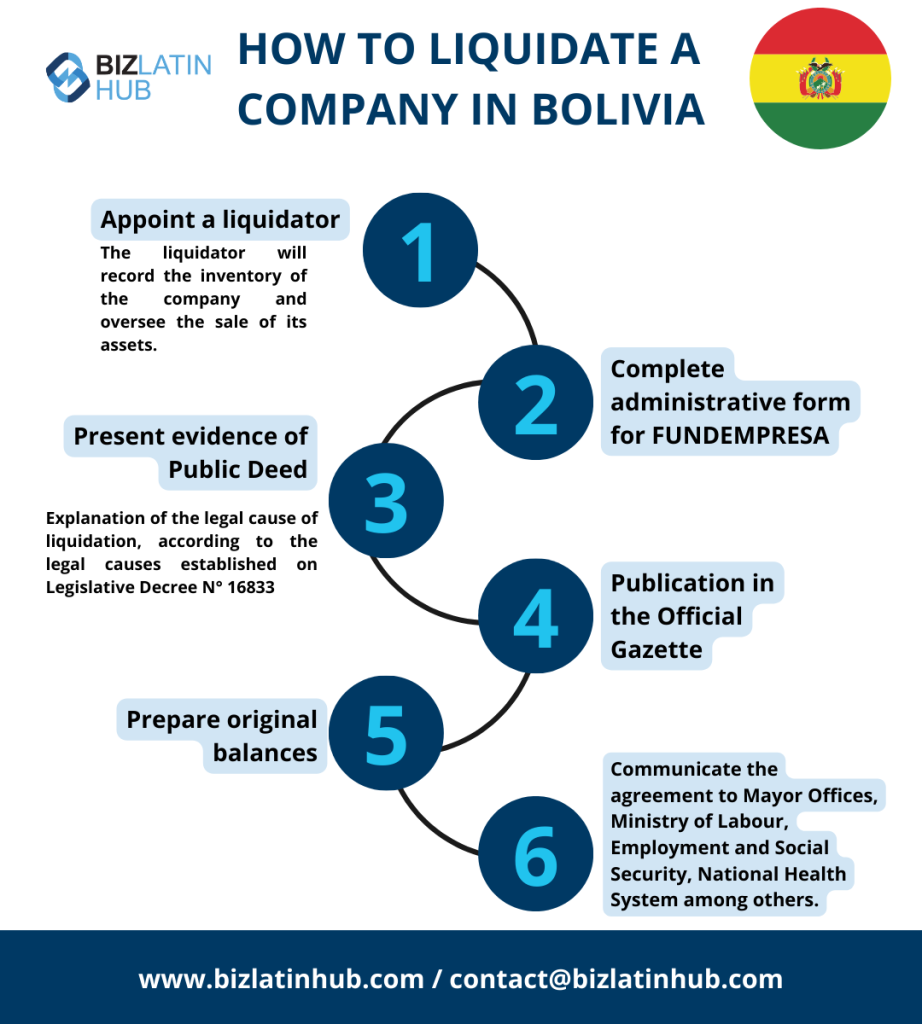

| 6 steps to liquidate a company in Bolivia | 1. Appoint a liquidator. 2. Complete administrative form for FUNDEMPRESA. 3. Present evidence of Public Deed. 4. Publication in the Official Gazette 5. Prepare original balances. 6. Inform local offices. |

| What is the timeframe needed to liquidate a company in Bolivia? | It should take between six months and a year to liquidate a company in Bolivia, if everything is in order. |

| What are the reasons to liquidate a company in Bolivia? | These vary, but the key point is to stay compliant and in good standing with the authorities. |

| What causes involuntary liquidation in Bolivia? | Unpaid creditors can force this as long as they have proof that they have not been paid and have reasonable cause to believe the company cannot pay them. |

How to liquidate a company in Bolivia

Companies must go through a dissolution process before undertaking the liquidation procedure in Bolivia. As previously mentioned, the company’s liquidation and cessation of its commercial activities must be communicated to the Registry of Commerce.

1. Appoint a liquidator

To undertake formal liquidation proceedings, companies must appoint one or more liquidators to manage the process on behalf of the company. The liquidator(s) are appointed by the company’s General Meeting. The liquidator will record the inventory of the company and oversee the sale of its assets.

2. Complete administrative form for FUNDEMPRESA

Once the decision has been made, the first step is to download and complete the Form N° 0090 from FUNDEMPRESA’s website. This form is an Affidavit and has to be duly completed and signed by the legal representative.

3. Present evidence of Public Deed

Furthermore, companies must present evidence of the Public Deed to the Registry of Commerce. This includes the agreement to liquidate the company and explanation of the legal cause of liquidation, according to the legal causes established on Legislative Decree N° 16833, in original or legible copy.

4. Publication in the Official Gazette

The company must then publish the decision to liquidate in Bolivia’s Official Gazette of the Registry of Commerce (FUNDEMPRESA).

Finally, the company must present the updated certificate of registration.

5. Prepare original balances

To finalize liquidation proceedings in Bolivia, the company must prepare the following documents:

Original balance of liquidation and inventory: this document must be signed by the liquidator(s) and experts involved, original professional solvency granted by the Society of Accountants and Auditors.

These experts will proceed with the liquidation of the pending operations as collection of the company’s credits, payment of the company’s debts, transfer or sale of the company’s assets, among others.

Original closing balance (final): this document must be signed by the liquidator(s) and experts involved, original professional solvency granted by the Society of Accountants and Auditors. In case of joint-stock companies, it must also be signed by the trustee.

6. Inform local offices

To completely liquidate a company in Bolivia, you must communicate the agreement to Mayor Offices, Ministry of Labour, Employment and Social Security, National Health System (CNS – Caja Nacional de Salud), AFPs and other entities that still consider the company as active.

Considerations before you liquidate a company in Bolivia

There are some considerations about the company must take into account when a company is liquidated:

- The company keeps its legal status, but it stops the normal activity of the company.

- The corporate purpose is modified to realize the assets and settlement of any of its liabilities.

- When the liquidation process has started, the General Manager ceases activity and the legal representation of the company. At this point, the liquidator(s) takes charge of the company.

- The company must add the expression “In Liquidation” to its company’s name.

The aim of this process is the corresponding distribution of the social assets resulting from liquidation among the shareholders, once all the pending operations have been successfully completed.

Reasons for company liquidation

The liquidation of a business may be for different circumstances pointed in the company’s bylaws and in the Legislative Decree 1/2010 of the Law on Corporations, issued on 2 July 2010. This Decree highlights the key reasons to liquidate a company in Bolivia:

- General Shareholders’ Meeting Agreement, which must be registered and published.

- For the end of duration established in the bylaws.

- After one year since agreed the capital reduction below the legal minimum.

Furthermore, the Decree outlines verification of legal cause to liquidate your Bolivian company, including:

- For the cessation of the corporate purpose’s activities.

- Due to the impossibility of achieving the corporate purpose.

- Due to stoppage of the corporate bodies.

- For losses that reduce net worth to less than half of the share capital.

- Capital reduction below the legal minimum.

- For other reasons established in the bylaws.

The liquidation of the company must be formalized through Public Deed before a public notary and be registered in the Registry of Commerce.

What is FUNDEMPRESA?

FUNDEMPRESA (Fundación para el Desarrollo Empresarial), established in 2002, is a non-profit foundation that operates the Bolivian Registry of Commerce, providing services in certifying the legality of a company.

In doing so, FUNDEMPRESA enables a business to generate a positive reputational perception from clients by granting solvency status. The organization also assists with company registration, promoting companies’ activities and ensuring their legal status, among others.

FAQs on how to liquidate an entity in Bolivia

Based on our extensive experience these are the common questions we receive from clients about liquidating an entity in Bolivia.

1. What is the process of liquidation in Bolivia?

The liquidation process involves the following principal activities:

1. Appoint a liquidator

2. Complete administrative form for FUNDEMPRESA

3. Present evidence of Public Deed

4. Publication in the Official Gazette

5. Prepare original balances

6. Inform local offices

2. How long does it take to liquidate a company in Bolivia?

The liquidation process will normally take between six and 12 months, assuming the entity is in good standing and no rectification work is required.

3. What are the reasons to liquidate a company in Bolivia?

There are a number of reasons you may do so, such as the venture becoming unworkable, a change in laws or simple failure in the relevant markets. You may wish to close one business in order to start another or you may want to leave the country for other reasons. For whatever reason you eventually decide to liquidate a company in Bolivia, it is best to do so in accordance with the law.

4. Can you be forced to liquidate a company in Bolivia?

Yes. An unpaid creditor can petition the courts to issue a liquidation and bankruptcy order if they have not been paid and have reason to believe they will not be paid. To do so, they must provide adequate proof of the situation. It is also possible if they can prove that the company is facing an unavoidable financial crisis from which it cannot return, although this is harder to verify.

Liquidate your company in Bolivia with Biz Latin Hub

When your venture isn’t working out like you expected it to be, liquidation options are important to consider for a company. It will save you costs and damages to your business.

When liquidating your company, make sure to have a local partner so they can help you with the guidance through the complex procedure. Biz Latin Hub has its offices located in Bolivia to provide specialist legal and accounting services to manage your exit strategy. Get in touch today for your first step in the direction of a new beginning.