Navigating the process of liquidating your business in Costa Rica is remarkably uncomplicated. Despite its modest size, Costa Rica stands out as one of the most stable democracies in the region, boasting a reputation for legal security and a steadfast legal framework. The country’s commercial offerings are highly esteemed by citizens, residents, and foreign investors alike.

Key takeaways on how to liquidate your business in Costa Rica

| 6 steps to liquidate a company in Costa Rica | Step 1 – Liquidation agreed by the assembly of shareholder(s). Step 2 – Take inventory of assets and debts. Step 3 – Notify authorities of your company’s liquidation. Step 4 – Publication in the government gazette. Step 5 – Liquidation of Assets and Property. Step 6 – Registration of the dissolution agreement. |

| What is the timeframe needed to liquidate your business in Costa Rica? | It should take approximately six months to a year to liquidate a company in Costa Rica, if everything is in order. |

| What are the reasons to liquidate a business in Costa Rica? | These vary, but the key point is to stay compliant and in good standing with the authorities. |

| What causes involuntary liquidation in Costa Rica? | This type of process in Costa Rica can be initiated by a creditor or by the tax authorities if you have missed more than three corporate tax payments. |

What does it mean to liquidate your business in Costa Rica?

A liquidation implies the cessation of all the company’s activities and redistribution of its assets to the persons or creditors to whom it owes money. If the company cannot pay its obligations (debts, loans, or others), it is considered ‘insolvent.’

- The expiry of the term of office as defined in the constitutive documents.

- The company is unable to perform the partnership agreement.

- The inability of the company to execute the company contract is the company’s corporate purpose.

- The impossibility of complying with the corporate purpose.

- The permanent loss of 50% of the company’s share capital.

- The final dissolution agreement at a shareholders’ meeting.

If any of these circumstances occur, a special meeting of shareholders will be convened to achieve a majority agreement to liquidate the business.

How to Proceed to liquidate your business in Costa Rica?

Despite a growing economy, some businesses may eventually choose to exit the Costa Rican market. This can be the most suitable decision when your commercial strategy moves in a different direction.

Businesses can voluntarily enter liquidation proceedings, and close their commercial operations. This decision must be made by the governing actors in your business in Costa Rica.

There are 5 main steps involved with voluntary liquidation proceedings:

- Step 1 – Liquidation agreed by the assembly of shareholder(s).

- Step 2 – Take inventory of assets and debts.

- Step 3 – Notify authorities of your company’s liquidation.

- Step 4 – Publication in the government gazette.

- Step 5 – Liquidation of Assets and Property.

- Step 6 – Registration of the dissolution agreement.

Under Article 209 of the Costa Rican Commercial Code, shareholders must meet at an assembly and vote to agree to dissolve the company. Shareholders need to achieve a majority vote to liquidate a company in Costa Rica. This agreement should be incorporated into the Book of the General Assembly (Libro de Asamblea de Socios), where regular shareholder meetings are recorded.

At this meeting, shareholders will be required to appoint someone to oversee the liquidation process, known as the ‘Liquidator’. The resolution to appoint the Liquidator must then be formalized and confirmed by a Public Notary who will register it in Costa Rica’s national register. The associated cost for this step is based on the value of the company.

2. Take inventory of assets and debts

At the shareholders’ assembly, the shareholders and appointed Liquidator must make an inventory of all the company’s assets and liabilities.

The company must pay any outstanding corporation tax in order to begin liquidating the assets of the dissolved company. Once the shareholders and the liquidator have approved the inventory and balances of the corporation, the Liquidator may then begin the process to liquidate your business in Costa Rica as agreed by the shareholders and in accordance with local law (step 5).

This includes:

- Transferring the property in the personal name of the shareholders or another legal person

- Selling the corporation’s capital and distributing the proceeds to the shareholders.

- Also, the company must prepare a notice of liquidation and call for payment of all claims to creditors published in the Official Gazette and a local newspaper.

Once a Public Notary has approved the dissolution agreement, the transaction must be submitted to the Trade and Companies Register. This will revoke your company’s name from this register and confirm that you are no longer in business.

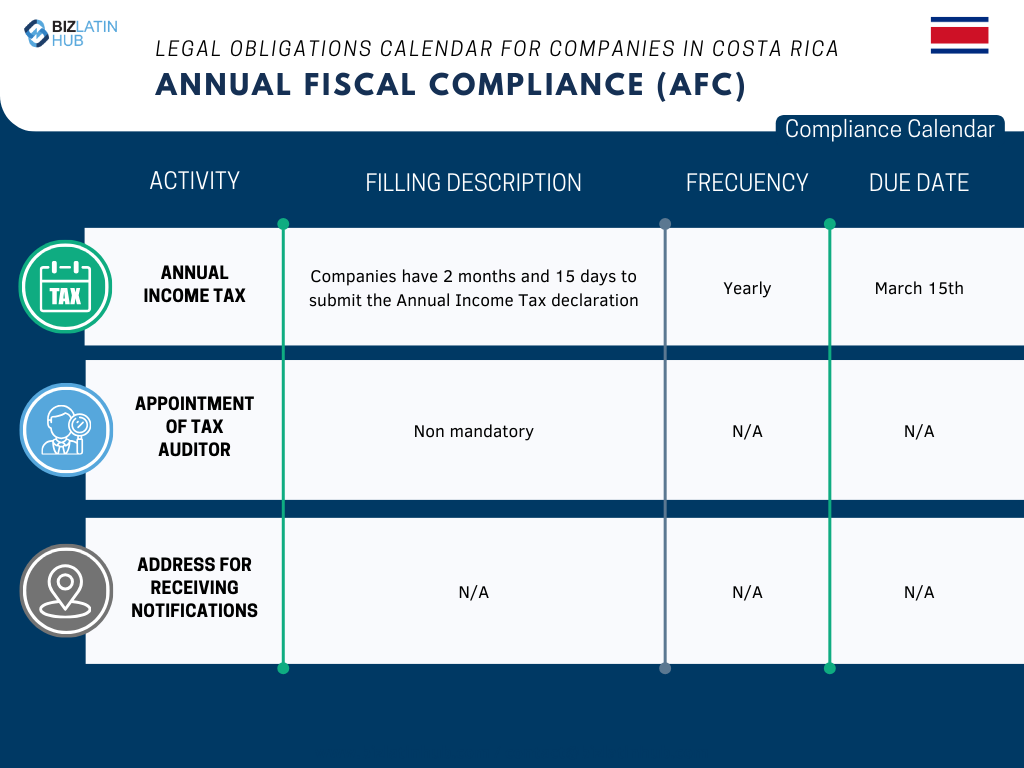

You must then terminate your registration with Costa Rica’s tax authority, Hacienda. In order to do this, you must first provide any outstanding income tax declarations (these are filed annually).Note: you only need to cancel your tax registration if your company is registered with the Revenue Service, and you have recorded income. The cost to terminate your tax registration is US$150.

4. Publication in the government gazette

Once the previous steps have been completed, the company’s shareholders must publish a notice in the government publication, La Gaceta (‘The Gazette’). To do this, you’ll need assistance with producing a formal publication about your company in Spanish. The purpose of this step is to alert creditors of the company about your liquidation so they can make claims to recuperate any bills the company owes them.

If there are no creditors, and there are no assets of the company, the liquidation process becomes void. Nevertheless, it’s mandatory to publish this notice in the government’s Gazette. The cost of posting the notice is US$100.

5. Liquidation of Assets and Property

For this step, the business’ Liquidator will formally liquidate all identified company assets. The business’ holdings, such as real estate, vehicles, or any other property are considered to be assets. The liquidator must first ensure all receivables and debts contracted by the company are paid out to its creditors. Then, the company’s shareholders can be paid.

If the company has no debt, it is recommended to dispose of the assets before entering into the shareholders’ agreement to have a more straightforward and less costly liquidation process.

6. Registration of the dissolution agreement

Once any claims and debts have been repaid, it is up to the shareholders to file the dissolution agreement to complete the liquidation of their business in Costa Rica. The terms of the dissolution must outline paid creditors, asset sharing, and all aspects of the liquidation process.

You must file the dissolution agreement – signed by all the shareholders, the liquidator, and a Public Notary – in the national register. It takes about 2-3 weeks for the registry to review the shareholder agreement and liquidate the business in Costa Rica. The cost of the government fees for this step is US$100.

Insolvency procedure

This type of process in Costa Rica can be initiated by a creditor or by the tax authorities if you have missed more than three corporate tax payments.

Once a creditor has filed a request to claim the money they’re owed, the court managing these proceedings will issue a resolution which gives the debtor 3 days to pay the debt in full, or to meet their obligation with the creditor using the business’ assets. If the debtor does not pay or provide sufficient assets as requested, the court will the debtor to be insolvent, and initiate liquidation proceedings.

In this case, the judge will appoint a Liquidator. The Liquidator is selected from a list of pre-approved lawyers that is prepared and managed by the court. This person cannot be a creditor or a person proposed by a creditor. As per the voluntary liquidation, the Liquidator will be responsible for the management of the debtor company and its assets and must establish a complete inventory of its assets and liabilities.

After the liquidation of the assets and the confirmation of the insolvency proceedings by the judge, the process follows the same procedure as voluntary liquidation, but the process is instead managed by the court.

FAQs on how to liquidate your business in Costa Rica

Based on our extensive experience these are the common questions and doubts of our clients when liquidating a local entity

1. What is the process of liquidation in Costa Rica?

- Step 1 – Liquidation agreed by the assembly of shareholder(s).

- Step 2 – Take inventory of assets and debts.

- Step 3 – Notify authorities of your company’s liquidation.

- Step 4 – Publication in the government gazette.

- Step 5 – Liquidation of Assets and Property.

- Step 6 – Registration of the dissolution agreement.

2. How long does it take to liquidate a company in Costa Rica?

The liquidation process will normally take between (6) and (12) months, assuming the entity is in good standing and no rectification work is required.

3. What are the reasons to liquidate a company in Costa Rica?

There are a number of reasons you may do so, such as the venture becoming unworkable, a change in laws or simple failure in the relevant markets. You may wish to close one business in order to start another or you may want to leave the country for other reasons. For whatever reason you eventually decide to liquidate a company in Costa Rica, it is best to do so in accordance with the law.

4. Can you be forced to liquidate a company in Costa Rica?

Yes, under certain circumstances. This type of process in Costa Rica can be initiated by a creditor or by the tax authorities if you have missed more than three corporate tax payments.

Biz Latin Hub can help you liquidate your business in Costa Rica

Liquidating a business is never an easy thing to do, regardless of the country in which it takes place. Costa Rica is no exception to the rule, and the country’s liquidation procedure must be duly followed. As this is a legal procedure, it is essential to use a knowledgeable lawyer in Costa Rica, who can guide you through voluntary or court liquidation proceedings and offer advice on the next steps.

At Biz Latin Hub, our team of local lawyers and professionals have significant experience with liquidation procedures in Costa Rica.

Contact us now for advice and to get comprehensive support when liquidate your business in Costa Rica.

Learn more about our team and expert authors.