Entity liquidation in Honduras is a strategic process undertaken by companies for various reasons, ranging from financial restructuring to the end of a business’s lifecycle. Understanding the intricacies of entity liquidation is crucial for businesses managing the Honduran legal landscape. In this article, we’ll outline the key steps involved in liquidating a legal entity, shedding light on why companies may need to embark on this path and perhaps restart with new company formation in Honduras.

Key Takeaways on Entity Liquidation in Honduras

| What are the three phases of company liquidation in Honduras? | Phase 1: Dissolution Phase 2: Liquidation Phase 3: Cancellation |

| What is the first step? | A formal declaration of dissolution is the first phase. |

| What timeframe is needed to liquidate a company in Honduras? | The timeframe for liquidating a company in Honduras can take several months to complete. |

| What reasons are there to liquidate a company in Honduras? | These vary, but the key point is to stay compliant and in good standing with the authorities. |

| What is the role of a liquidator? | The appointed liquidator is responsible for selling the company’s assets, paying off all its creditors, and then distributing any remaining funds to the shareholders. |

| What can cause involuntary liquidation? | This can be triggered by not complying with legal responsibilities under the law. |

| Are the authorities involved in the process? | Final tax clearance from the SAR is a mandatory step. |

The 3 Phases of Company Liquidation

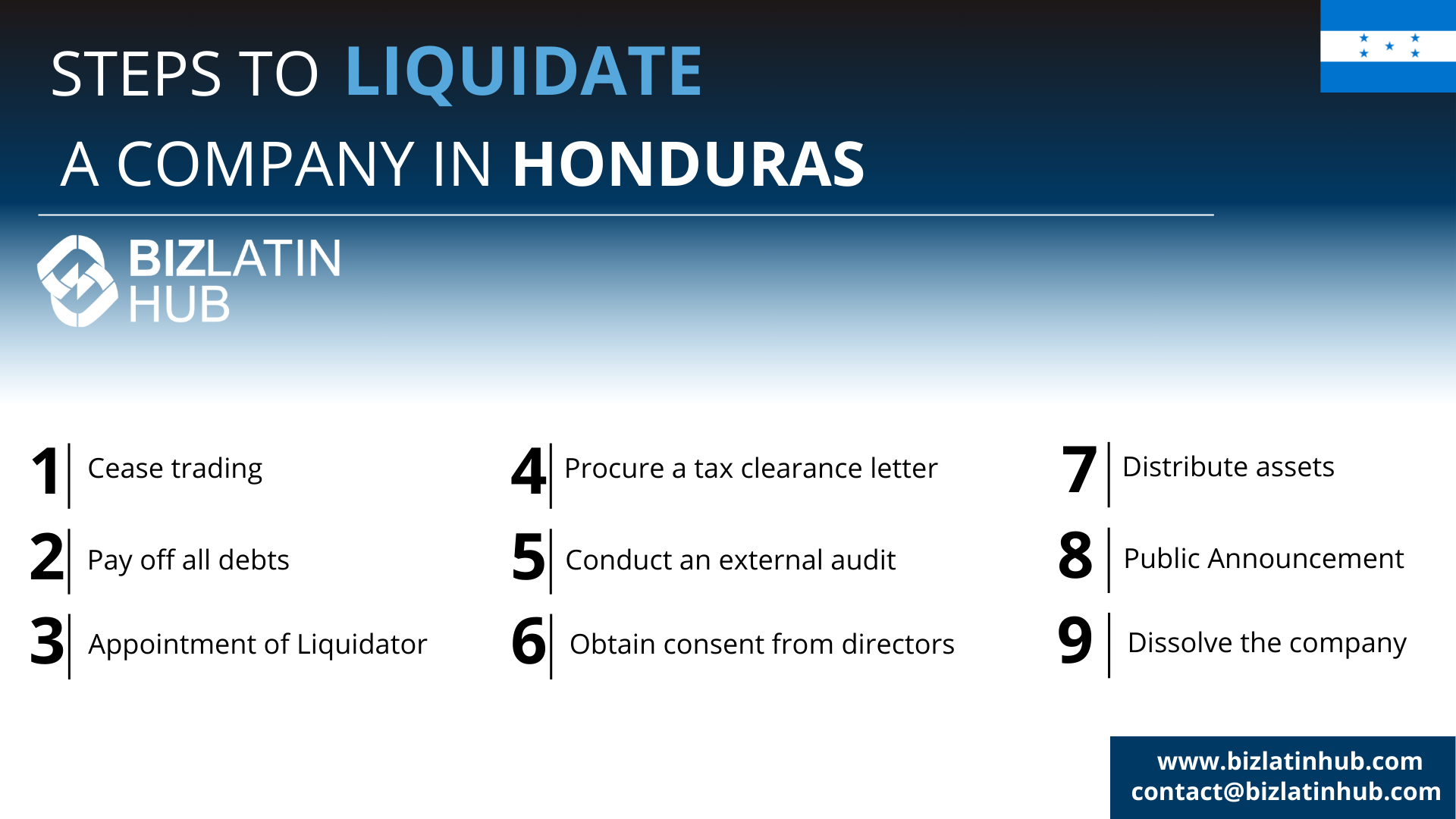

To liquidate a company in Honduras, like an LLC, you need to follow specific steps to make sure everything is done correctly and by the law. These steps are important to make sure the business closes down smoothly and follows all the rules.

Expert Tip: Appointing an Odd Number of Liquidators

From our experience, a unique aspect of Honduran law is that when multiple liquidators are appointed, they must act as a board. To avoid deadlocks in decision-making during the liquidation process, the Commercial Code recommends appointing an odd number of liquidators (e.g., one or three).

We advise clients to follow this recommendation. Appointing a single, trusted liquidator (such as a professional accountant or lawyer) is often the most efficient approach, but if multiple liquidators are needed, appointing an odd number is a simple but effective way to prevent procedural delays.

Phase 1: Dissolution

This phase begins with a resolution by the shareholders in a formal meeting to dissolve the company. This decision is then formalized in a public deed and registered with the Mercantile Registry. From this point, the company can no longer conduct new business.

Cease trading: The company must stop all business activities.

Obtain consent from directors: The company’s directors must consent to the liquidation process.

Phase 2: Liquidation

The appointed liquidator(s) take control of the company. Their responsibilities include preparing a final inventory of assets, collecting debts owed to the company, paying all creditors, and distributing any remaining assets to the shareholders.

Pay off all debts: The company should settle all outstanding debts and liabilities.

Appointment of Liquidator: A liquidator or liquidation committee may need to be appointed to oversee the liquidation process. This individual or committee will be responsible for managing the company’s affairs during the liquidation period, including selling off assets and distributing proceeds to creditors and shareholders.

Distribute assets: The liquidator should distribute the remaining assets to the company’s creditors under the order of priority set by law.

Conduct an external audit: An external audit of the company’s financial statements is required to verify the accuracy of the financial records.

Procure a tax clearance letter: The company must obtain a tax clearance letter from the relevant tax authorities to confirm that all tax obligations have been met.

Phase 3: Cancellation

Once the liquidator has finalized the company’s affairs and obtained tax clearance from the SAR, they prepare a final liquidation balance sheet. This is approved by the shareholders and then registered at the Mercantile Registry, which formally cancels the company’s registration.

Public Announcement: Per Honduran law, a public announcement of the company’s liquidation must be made in a local newspaper. This announcement should include details such as the company name, registration number, date of liquidation, and contact information for creditors to submit claims.

Dissolve the company: After all assets have been distributed and liabilities have been settled, the company can be formally dissolved.

Key Regulatory Bodies

The liquidation process involves interaction with two main regulatory bodies. The Mercantile Registry (Registro Mercantil) is where the public deed of dissolution and final cancellation are recorded. The Revenue Administration Service (SAR) is the tax authority that must provide a final tax clearance certificate before the company can be cancelled.

What is the Process to Appoint a Liquidator in Honduras?

In Honduras, the appointment of a liquidator is a critical step in the entity liquidation process, requiring adherence to a specific set of procedures outlined by local laws and regulations. This structured approach ensures transparency, accountability, and legality throughout the liquidation proceedings.

As a guideline, here is how it should be done:

- Initiate the liquidation procedure: The process can be initiated by the company itself or any creditor

- Appoint a liquidator: The liquidator can be appointed by either the shareholders or the court. The liquidator represents the interests of all creditors during the liquidation process.

- Protect the estate: Once the liquidation proceedings are opened, measures are put in place to protect the estate from the debtor. The debtor is divested of all rights to manage and operate the business, and a liquidator is appointed to assume these responsibilities.

- Inventory assets: The liquidator should inventory all assets of the company and may freeze or seal them to prevent any detrimental actions by the debtor.

- Terminate contracts: The liquidator or court should have the authority to terminate contracts that are not fully performed to protect the interests of all parties involved.

- Implement protective measures: Interim protective measures may include appointing a preliminary liquidator, prohibiting the debtor from disposing of assets, and sequestering assets if necessary.

By following this process, a legal entity in Honduras can effectively appoint a liquidator to oversee the process of liquidation.

FAQs on entity liquidation in Honduras

Based on our extensive experience these are the common questions we receive from clients about liquidating an entity in Belize.

1. What is the process of liquidation in Honduras?

Cease trading: The company must stop all business activities.

Pay off all debts: The company should settle all outstanding debts and liabilities.

Appointment of Liquidator: A liquidator or liquidation committee may need to be appointed to oversee the liquidation process. This individual or committee will be responsible for managing the company’s affairs during the liquidation period, including selling off assets and distributing proceeds to creditors and shareholders.

Procure a tax clearance letter: The company must obtain a tax clearance letter from the relevant tax authorities to confirm that all tax obligations have been met.

Conduct an external audit: An external audit of the company’s financial statements is required to verify the accuracy of the financial records.

Obtain consent from directors: The company’s directors must consent to the liquidation process.

Distribute assets: The liquidator should distribute the remaining assets to the company’s creditors under the order of priority set by law.

Public Announcement: Per Honduran law, a public announcement of the company’s liquidation must be made in a local newspaper. This announcement should include details such as the company name, registration number, date of liquidation, and contact information for creditors to submit claims.

Dissolve the company: After all assets have been distributed and liabilities have been settled, the company can be formally dissolved.

2. How long does it take to liquidate a company in Honduras?

The timeframe for liquidating a company in Honduras can vary depending on factors such as the complexity of the company’s affairs and the efficiency of the liquidation process. It can take several months to complete.

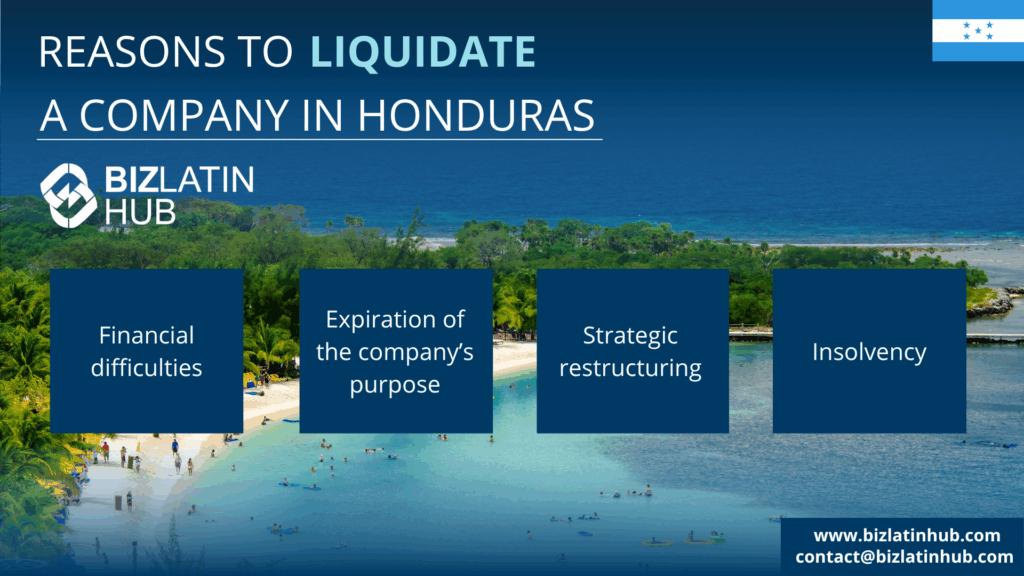

3. What are the reasons to liquidate a company in Honduras?

Companies in Honduras may choose to liquidate due to various reasons such as financial difficulties, insolvency, expiration of the company’s purpose, or strategic restructuring.

4. Can you be forced to liquidate a company in Honduras?

Yes, under certain circumstances.

5. What is the difference between dissolution and liquidation?

Dissolution is the formal decision to end the company’s existence, which is recorded at the Mercantile Registry. Liquidation is the practical process that follows, where the company’s assets are sold, debts are paid, and the remaining funds are distributed.

6. Who can be a liquidator?

The liquidators are typically appointed by the shareholders. They can be company administrators or third-party professionals.

7. What is the SAR?

The SAR (Servicio de Administración de Rentas) is the tax authority of Honduras. A company cannot be formally cancelled until it has settled all its tax liabilities and obtained a final clearance certificate from the SAR.

8. How long does the process take?

The duration of a liquidation can vary significantly based on the complexity of the company’s assets and liabilities. A straightforward liquidation of a solvent company may take several months, while a more complex case can take over a year, largely depending on the time it takes to receive the final tax audit and clearance.

Biz Latin Hub Can Assist With Entity Liquidation in Honduras

Biz Latin Hub offers comprehensive market entry and back-office support across Latin America and the Caribbean, with a presence in key cities.

We also have trusted partners in many other markets. Our unrivaled reach means we are perfectly placed to manage multi-jurisdiction market entries and cross-border operations.

As well as our extensive knowledge of entity liquidation in Honduras, our range of services includes hiring and PEO, accounting and taxation, company formation, bank account opening, and corporate legal services.

Contact us today to learn more about how we can assist you in finding top talent or doing business in Latin America and the Caribbean.

If you found this article on entity liquidation in Honduras useful, check out the rest of our region coverage. Or read about our team and expert authors.