Foreign executives often choose to incorporate a company in the Dominican Republic as a gateway into the Caribbean, as the country has a steady, growing, and reliable economy. When engaging in business in any country one must also consider the need to close up shop and every solid market entry strategy must consider the possibility of an orderly exit. The most common way to withdraw investment in the Dominican Republic is by liquidating a company.

Key takeaways on how to liquidate a company in the Dominican Republic?

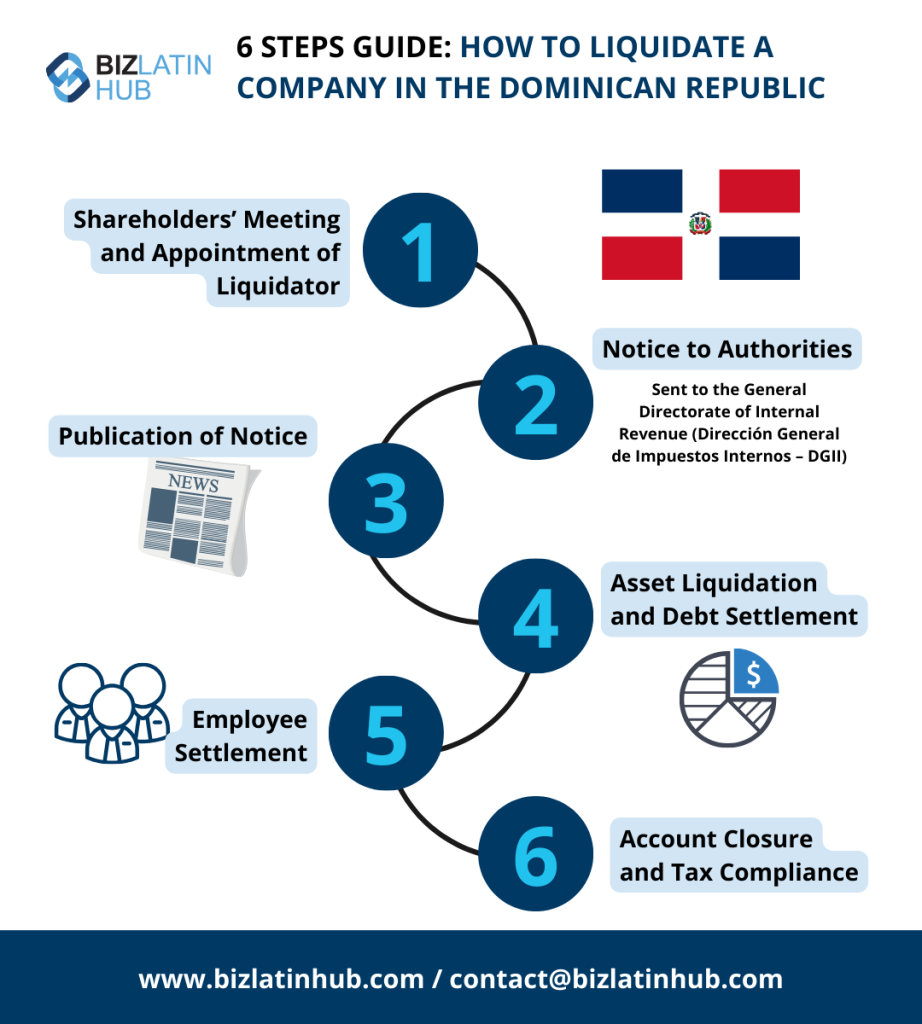

| 7 steps to liquidate a company in the Dominican Republic | Shareholders’ Meeting Appointment of Liquidator Notice to Authorities Publication of Notice Asset Liquidation and Debt Settlement Employee Settlement Account Closure and Tax Compliance |

| What is the timeframe needed to liquidate a company in the Dominican Republic? | The liquidation process will normally take between five and ten months, assuming the entity is in good standing and no rectification work is required. |

| What are the reasons to liquidate a company in the Dominican Republic? | These vary, but the key point is to stay compliant and in good standing with the authorities. |

| What can cause involuntary liquidation in the Dominican Republic? | This typically occurs when the company can no longer pay a creditor. |

Liquidate a company in the Dominican Republic in just a few steps

Shareholders’ Meeting: The company’s shareholders convene a meeting and approve the decision to dissolve the company and initiate the liquidation process and discharge of members of the board of directors.

Appointment of Liquidator: A liquidator and a Commissioner of company Accounts are appointed, who can be a third party or the company’s legal representative. The liquidator is responsible for managing the liquidation process.

Report from the account commissioner, by his appointment.

Report from the Liquidator, by his appointment.

Notice to Authorities: Formal notice of the company’s decision to dissolve and liquidate must be sent to the General Directorate of Internal Revenue (Dirección General de Impuestos Internos – DGII) and other relevant authorities.

Publication of Notice: A notice of the company’s dissolution and liquidation is published in a newspaper to inform creditors and other interested parties.

Asset Liquidation and Debt Settlement: The company proceeds to liquidate its assets and settle its debts, ensuring proper distribution of funds to creditors.

Employee Settlement: Settlement of employee obligations, including payment of wages, severance, and other entitlements by labor laws.

Account Closure and Tax Compliance: Closure of the company’s accounts and fulfillment of tax obligations, including the submission of final tax returns.

Who do you deal with when you liquidate a company in the Dominican Republic?

The country’s Chamber of Commerce is the first entity you must approach when looking to liquidate a company in the Dominican Republic. This is to ensure that the Company’s registration is active and valid. In case it is inactive, the company must renew it or obtain a notarized statement indicating the register is lost.

The registration at the Chamber of Commerce includes the company’s by-laws which have a liquidation clause, and the minutes of general meetings, which need to refer to the pertinent approval to dissolve the company.

Furthermore, the company must appoint a liquidator to draft a ‘liquidation report’. Note that this report must be approved by a member of the company. Then, a formal Declaration of Solvency must be drafted, followed by the approval of the ‘liquidation report’. This is a crucial step when you liquidate a company in the Dominican Republic.

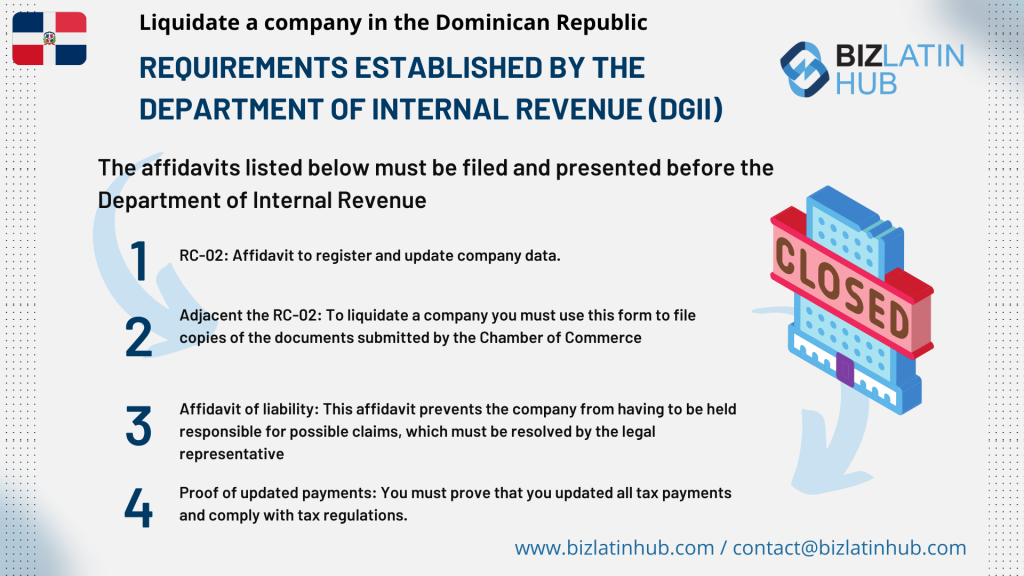

Requirements established by the Department of Internal Revenue (DGII)

To Liquidate a Company in the Dominican Republic, the affidavits listed below must be filed and presented before the Department of Internal Revenue.

- RC-02: Affidavit to register and update company data.

- Adjacent the RC-02: To liquidate a company you must use this form to file copies of the documents submitted by the Chamber of Commerce.

- Affidavit of liability: This affidavit prevents the company from having to be held responsible for possible claims, which must be resolved by the legal representative. Depending on the type of legal person, the liquidator, the manager, the president, or even the company’s secretary can sign this affidavit.

- Proof of updated payments: You must prove that you updated all tax payments and comply with tax regulations.

In short, to successfully liquidate a company in the Dominican Republic, you need to complete the following key steps:

- You must understand and comply with corporate governance procedures.

- Register legal corporate paperwork before the Chamber of Commerce.

- File pertinent affidavits and documents.

FAQs for Liquidating an Entity in the Dominican Republic

Based on our extensive experience these are the common questions we receive from clients about liquidating an entity in the Dominican Republic.

1. What is the process of liquidation in the Dominican Republic?

Shareholders’ Meeting: The company’s shareholders convene a meeting and approve the decision to dissolve the company and initiate the liquidation process and discharge of members of the board of directors.

Appointment of Liquidator: A liquidator and a Commissioner of company Accounts are appointed, who can be a third party or the company’s legal representative. The liquidator is responsible for managing the liquidation process.

Report from the account commissioner, by his appointment.

Report from the Liquidator, by his appointment.

Notice to Authorities: Formal notice of the company’s decision to dissolve and liquidate must be sent to the General Directorate of Internal Revenue (Dirección General de Impuestos Internos – DGII) and other relevant authorities.

Publication of Notice: A notice of the company’s dissolution and liquidation is published in a newspaper to inform creditors and other interested parties.

Asset Liquidation and Debt Settlement: The company proceeds to liquidate its assets and settle its debts, ensuring proper distribution of funds to creditors.

Employee Settlement: Settlement of employee obligations, including payment of wages, severance, and other entitlements by labor laws.

Account Closure and Tax Compliance: Closure of the company’s accounts and fulfillment of tax obligations, including the submission of final tax returns.

2. How long does it take to liquidate a company in the Dominican Republic?

The liquidation process will normally take between five and ten months, assuming the entity is in good standing and no rectification work is required.

3. What are the reasons to liquidate a company in the Dominican Republic?

There are a number of reasons you may do so, such as the venture becoming unworkable, a change in laws or simple failure in the relevant markets. You may wish to close one business in order to start another or you may want to leave the country for other reasons. For whatever reason you eventually decide to liquidate a company in the Dominican Republic, it is best to do so in accordance with the law.

4. Can you be forced to liquidate a company in the Dominican Republic?

Yes, under certain circumstances. This typically occurs when the company can no longer pay a creditor. In this case, that creditor can petition a court for a winding up order for the company.

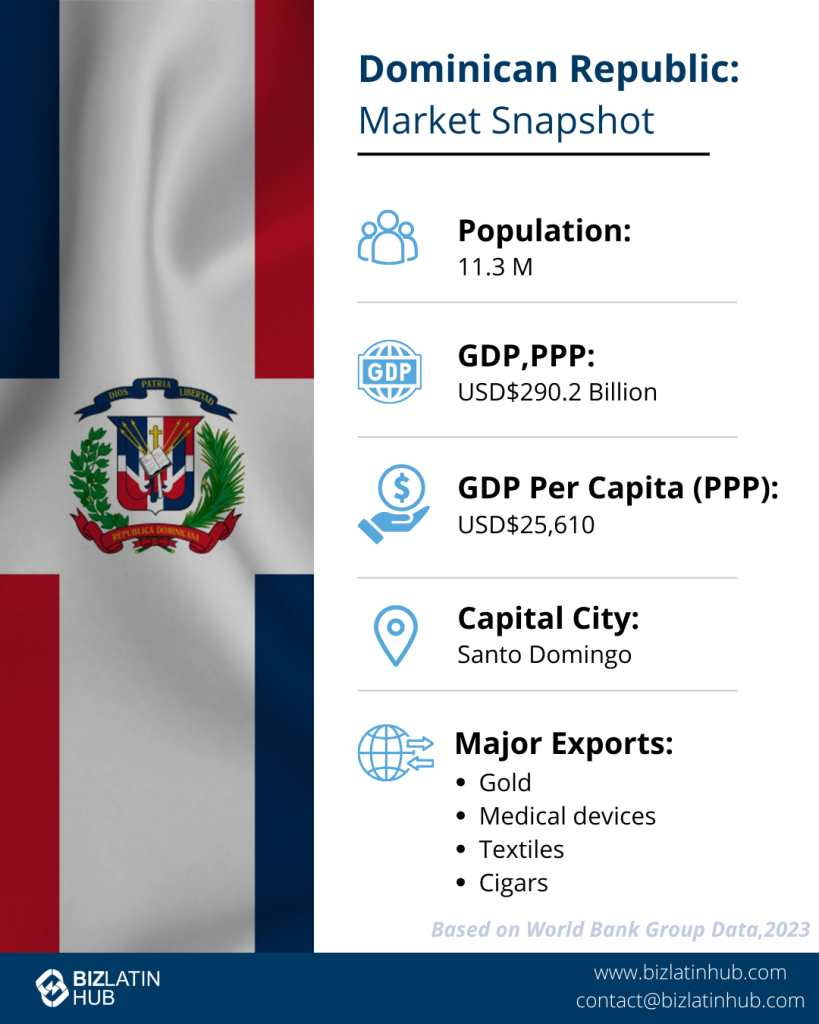

Why Engage in Business in The Dominican Republic

The Dominican Republic presents a compelling case for businesses considering expansion or investment. When looking to liquidate a company in the Dominican Republic, the country offers a range of advantages that make it an attractive choice.

Firstly, the Dominican Republic’s robust legal framework provides clear and efficient procedures to liquidate a company in the Dominican Republic. This streamlined process minimizes bureaucratic hurdles and saves time for businesses.

Furthermore, the nation’s strategic location in the heart of the Caribbean positions companies to access a broad regional market. When seeking to liquidate a company in the Dominican Republic, businesses can take advantage of various trade agreements that facilitate international commerce.

In addition to a business-friendly environment, the Dominican Republic boasts a well-developed infrastructure, including modern ports and transportation networks. This facilitates the movement of goods and materials for companies in the process of deciding to liquidate a company in the Dominican Republic.

Moreover, the country offers an ample and skilled labor force, making it easier to find qualified professionals when it’s necessary to liquidate a company in the Dominican Republic.

In conclusion, the Dominican Republic’s business-friendly climate, strategic location, legal framework, and infrastructure make it an attractive destination for businesses, including those considering the decision to liquidate a company in the Dominican Republic, providing opportunities for growth and success in the Caribbean region.

Liquidate a company in The Dominican Republic with support from local legal experts

Although the Dominican Republic is a favorable business destination, foreign executives operating in the country might decide to undertake a liquidation process based on different circumstances. The liquidation process in the Dominican Republic can be complex and requires a sound understanding of local regulations. Therefore, it is vital to seek expert advice to liquidate a company in the Dominican Republic.

At Biz Latin Hub, our experienced team of local and expatriate legal and accounting advisors are able to guide you through a liquidation process while complying with all the local legislation. With our full suite of bilingual market entry and back-office services, we can ensure you meet all the necessary requirements and make the best decisions to liquidate your company in the Dominican Republic. Contact us now to find out how we can help you with your business.

Learn more about our team and expert authors.