Paraguay is an attractive destination for multinationals and foreign executives. For those who already have a business in the country, choosing to import from Paraguay to Argentina is a very attractive option to expand Latin America.

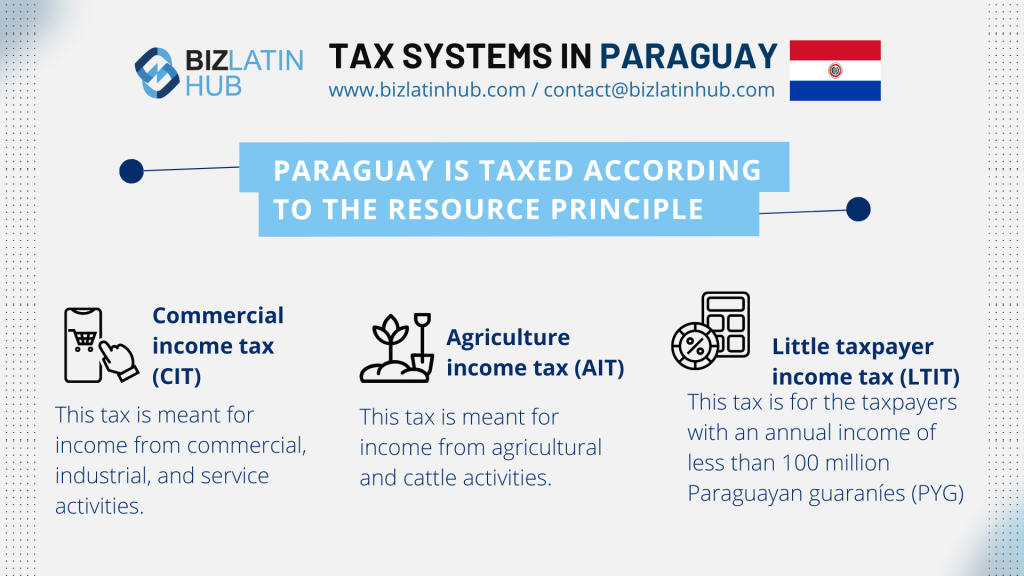

For years, many Argentines, as well as other business owners in the region, decided to create companies in the country thanks to the combination of tax incentives, legal certainty and macroeconomic stability that the country offers to import from Paraguay to Argentina.

According to the Organization for Economic Cooperation and Development (OECD), Paraguay is the country with the least tax burden in South America (only 15% of GDP), making the country an attractive focus for those who want to import from Paraguay to Argentina.

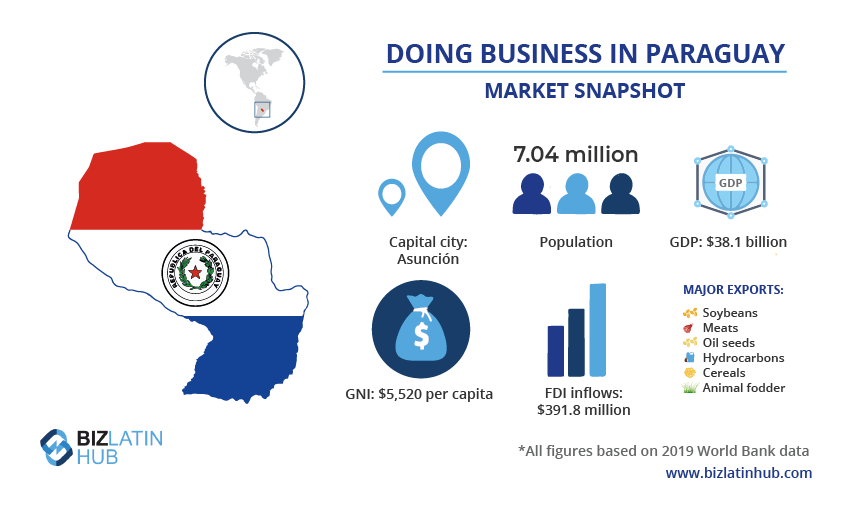

Background: Imports and Exports of Paraguay

Among the main products that are most imported from Paraguay to Argentina are:

- Soybeans and corn (Represented with approximately 70%)

- Fuels

- Electric power

- Mineral oils

- Machinery

- Red meats

- Leather

Despite having a series of trade agreements and having the option of using the Paraguay-Paraná Waterway, the majority of imports from Paraguay to Argentina are made by land and air, due to time and flexibility of processes.

Incentives to import from Paraguay to Argentina

Over the years, both countries have developed a series of legislative changes, free trade agreements, and other incentives, making importing from Paraguay to Argentina much more profitable and easier for those who do or want to do business in the country.

Maquila regime

In Paraguay, the Maquila Regime was created by Law No. 1064 of 1997 “On the Maquiladora Export Industry” and is regulated by Decree – Law No. 9585 of 2000. Its main objective is to promote the establishment and regulate maquiladora companies operations in Paraguay.

The companies within the Maquila Regime are exempt from all taxes or fees related to the production process. They are also exempt from the payment of Value Added Tax (VAT) on the export of their products or goods, the suspension of import tariffs and other tax exemptions.

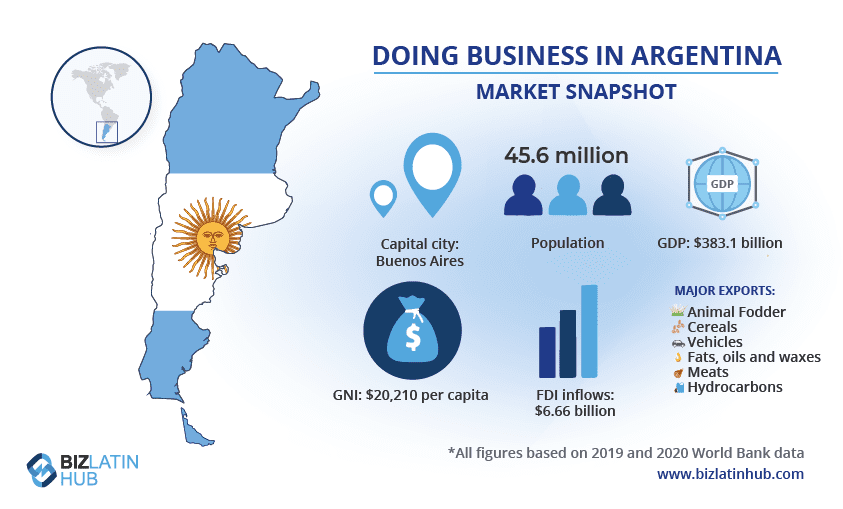

The main destinations of the products under this regime are Brazil with 81.6 percent participation, while Argentina and the United States follow with 7.1 and 4 percent, respectively.

The maquila offers a unique opportunity to investors who want to take advantage of the preferential conditions that Paraguay offers to considerably increase their competitiveness by importing, for example, from Paraguay to Argentina.

ALADI

Like other member countries of the Latin American Integration Association ALADI. Argentina and Paraguay benefit from a preferential trading system that leans in favor of the relatively less economically developed countries.

ALADI has special cooperation programs and compensatory measures in favor of landlocked countries, with the objective of helping Paraguay achieve greater access and integration in the region.

Process to import from Paraguay to Argentina

1. Define your category of exports

There are two main categories of exports in Paraguay and you need to define which will be most convenient for you.

- Temporary exports: Refers to goods shipped for a temporary period.

- Definitive exports: Exports that remain outside the territory for an indefinite period of time. This generally includes products made entirely in Paraguay.

2. Research import requirements

It is important to investigate the import requirements, regulations and prohibitions of your destination country, in this case Argentina. Expert legal assistance is recommended as documentation and requirements may vary in both countries. A supplier with presence in both countries can be your best ally by guiding you through the import/export process avoiding delays.

3. Choose a supplier

Before you import from Paraguay to Argentina, ensure that your supplier in Paraguay is registered as an exporter with the National Customs Office. Once you contact the exporter in Paraguay, they will send you a quote as a Purchase Order. If prices are considered convenient and satisfactory for the parties, the Purchase Order can be agreed upon.

4. Hire a customs broker

The customs broker will file your export declaration.

5. Register as an importer or exporter

Register at the General Directorate of Customs in Argentina. The process can take about 2 or 3 weeks from your enrollment request. You must also register with the General Tax Directorate (AFIP-DGI) where you will receive a Unique Tax Identification Code (CUIT).

6. Pay for goods

Agree on the form of payment and proceed to pay the supplier to dispatch the merchandise. Once the payment is completed, the merchandise will arrive at the Argentine destination port.

Local customs pay the taxes and the dispatcher informs the importer of the rights (customs duties and taxes) that must be deposited with the National State through the General Directorate of Customs. This is all in order to free the merchandise in Argentine territory.

Biz Latin Hub can help you import from Paraguay to Argentina

Paraguay’s stability makes it a great place to carry out export and import operations. The country’s low cost of taxes and public services contributes to attracting foreign companies. Its close relationship with Argentina and the commercial relations between both countries will be a competitive advantage for your business.

At Biz Latin Hub, we help executives from all over the world to carry out their commercial activities in Latin America, including the importation of products from Paraguay to Argentina.

Our team offers specialized advice and guidance providing support on a range of market entry and back-office needs, including international trade, legal services, company incorporation, visa services and more. Get in touch with our team today to get started.

Learn more about our team and expert authors.