Work Visa & Company Formation Peru: Did you know that Peru will let you go from a tourist visa to a work visa as an entrepreneur? Furthermore, this only takes a very short period of time. Well, as you know when travelling the world, generally all countries require tourist visas and, so does Peru. As tourism in Peru can be truly amazing, many people start to adore the country and decide to stay for a longer period of time. A tourist visa however can only be extended to 183 days, which represents a huge problem to many, this leaving only a few options available to officially continue to stay in the country. One of them being to apply for a Peruvian working visa.

Work Visa & Company Formation Peru

When digging a little deeper, you will probably find that obtaining a work visa (which requires a work contract) is not easy. Finding a company, willing to contract you before you have the official Peruvian foreign resident ID card (Carnet de Extranjería) can be difficult. In general, Peruvian companies prefer to hire Peruvians or foreigners who already have the official resident card.

Hiring a foreigner on a tourist visa is complicated as well as being expensive for Peruvian or international companies. Moreover, with the newly applied Peruvian immigration law, visa runs (which consist in exiting the country to re-enter it in order to renew a visa) are not an option anymore. Thus, without a relevant work visa, it is not possible to stay in the country for more than six months. So, many are wondering what they can do to able to stay in the country for longer.

Our recommendation: creating a company and becoming an entrepreneur in order to obtain a work visa. We at Biz Latin Hub have written an informative step by step guide which explains how to get a self-employed working visa.

Which types of business are you allowed to create?

The Peruvian foreign ministry (Ministerio de Relaciones Exteriores) does not provide any restrictions when it comes to foreigners carrying out any business activity or property ownership in Peru. Therefore, the first step in the company formation process is to decide which company type you want to choose to form. This is important as it will be a crucial part of your business strategy.

Just like in every country, Peru has several different types of companies. Depending on the activity you plan to carry out, you will be tied to one of the 5 different types of legal entities (regulated by the Peruvian Company Law) which are listed below:

- Joint Stock Company (Sociedad Anónima or S.A).

- Private Closed Corporation (Sociedad Anónima Cerrada or S.A.C).

- Public Corporation (Sociedad Anónima Abierta).

- Limited Liability Company (Sociedad Comercial de Responsabilidad Limitada or S.R.L).

- Branch (Sucursal).

The easiest and cheapest company type in Peru is a S.A. or a S.A.C. This is primarily due to both not having a minimum share capital required and only a minimum of two shareholders needed. When forming a S.A.C. you don’t need a Board of Directors on the other hand in an S.A. you must have a minimum of three individuals involved. Ultimately it can be said that opening a S.A.C. is the easiest way of doing business in Peru.

Find a company within your skill

Depending on the field of business you want to establish yourself in, the most appropriate company type to be chosen. The most important thing for you is to open up a company within your skillset. Make sure not to deviate from your area of business and knowledge. First, think of easier things such as an English teaching company, web designing, graphic designing, or import/export services.

Remember the importance of limiting financial risk and keeping investment as low as possible. After having established your first company you will gain experience in entrepreneurship, meaning that moving to other sectors of the economy should be easier the second time round.

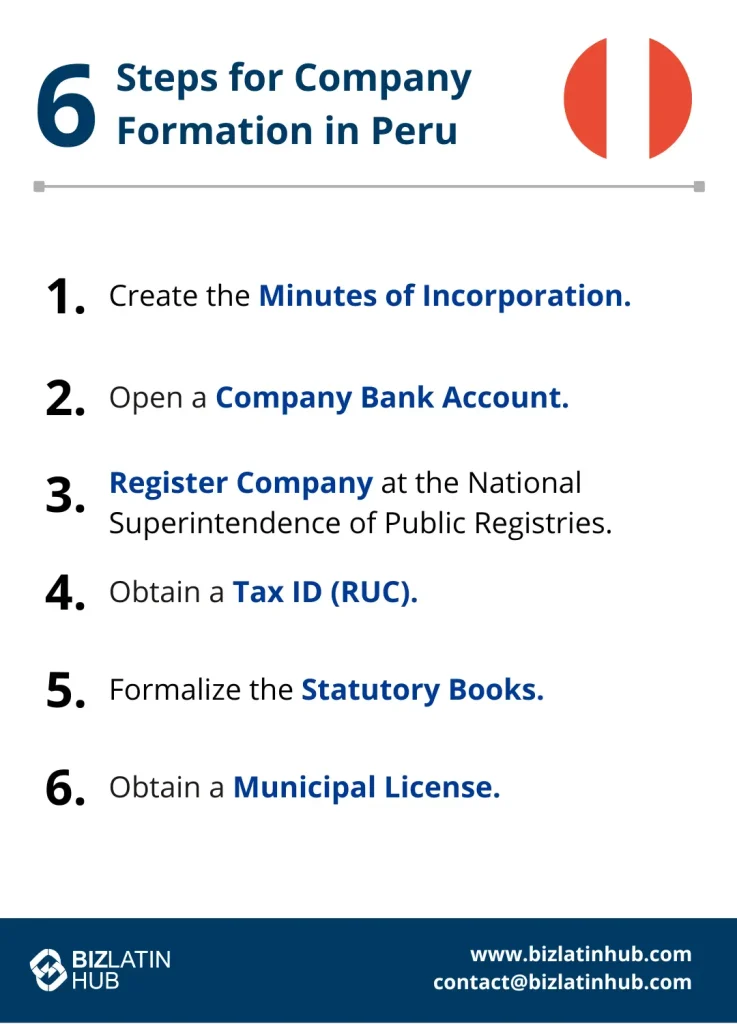

6 Steps to Form a Company in Peru

Here you can follow the 6 steps to form a company in Perú:

- Step 1: Create the Minutes of Incorporation.

- Step 2: Open a Company Bank Account.

- Step 3: Register Company at the National Superintendence of Public Registries (SUNARP).

- Step 4: Obtain a Tax ID (RUC – Registro Único de Contribuyente).

- Step 5: Formalize the Statutory Books.

- Step 6: Obtain a Municipal License.

When creating a company in Peru, the services of a lawyer are required during the entire company formation process. The company is also obliged to have a legal representative based in Peru, therefore a power of attorney has to be drafted and signed, in order for the representative to form the company in a lawful manner. Besides that, the help of a lawyer is essential for the preparation of all legal documents, the incorporation contract, the draft of constitution, the elevation of the public deed and the registration in public records (legally the Spanish version of any contract needs to be signed in Spanish).

During the company forming process a lawyer is required for the preparation of the work contract, affidavits, requests and other requirements needed by the public entities in charge of the process. In Peru, all companies need a legal rep as well as a fiscal/domicile address. Generally, it can be said, that opening a company in Peru takes around 4 weeks, including the opening of a Peruvian company bank account.

Get Worker contract in Peru

Assuming you have a tourist visa you will need start by obtaining a special permission from the migration office in order to be able to sign your working contract. Once you have obtained the permission, you can sign your contract and go through the immigration process. In order for you to be the general manager of your company, you need to sign a specific work contract, prepared by a lawyer and a notary. Thereafter, this contract has to be presented in front of the ministry of labor (Ministerio de Trabajo) as well as having to be approved by the national superintendence of migrations (Migraciones). As working contracts for foreigners tend to be specific while containing different rules and statuses, we recommend hiring a lawyer. This will help to obtain the visa without any problems.

¿How is the Immigration process to get your permanency in Peru?

The process from a tourist visa to a work visa, contains several steps and can be complicated if not handled by a professional. The whole process can take up to 3 months, involving visits to the Interpol and the preparation of several papers, such as the working contract. As mentioned above, the working contract has to be presented at the ministry of labor by a lawyer. Before doing so the lawyer has to schedule a meeting at the relevant ministry and then present the contract. Generally, it is easier for a Peruvian lawyer to schedule a meeting and to present the documents at the relevant authorities.

Once the contract and documents are presented the process of changing your migratory status takes up to 2 months. After all relevant documents are presented, you will obtain your foreign resident ID card (carnet de extranjería) for the duration time of your work contract. Keep in mind that during the whole process certain fees have to be paid to the Peruvian government in order to obtain the visa in the end.

How to Manage Your Company in Peru?

What now? Your company is formed and you have obtained your work visa and foreign resident ID card (carnet de extranjería). Now, you have to start to manage your company, promote your business, and pay taxes to the Peruvian national tax authority (SUNAT).

What are Your Obligations as Company Owner in Peru?

When opening up a company in Peru, several obligations have to be fulfilled by the company, and different tax factors have to be taken into account, such as corporation tax or sales tax rates. Yes, all companies which are registered in Peru are considered residents in Peru and therefore have to pay taxes to the national tax authority called SUNAT. All companies are subject to a corporation tax of 29,5% and in order to meet their annual income tax liability, entities should make monthly advance payments by submitting 1.5% of their net monthly income.

Additionally, all companies registered have to pay the monthly income tax, as well as the sales tax. Furthermore, accounting principles such as IAS/IFRS have to be considered and financial statements have to be prepared on an annual basis. If tax declarations are not filed on time, or false data on figures and numbers are submitted, fines have to be paid. Other taxes to be considered are payroll taxes for pension and health contributions. Therefore, employers shall apply monthly withholdings for pension fund contributions equal to 13% of the remuneration received by the employee, as well as pay health system contributions.

Outsource your accountancy needs in Peru

In order to meet all Peruvian accounting and tax requirements mentioned above, we recommend that you outsource your accountant services, especially if you are not a senior accountant familiar with the Peruvian tax and accounting system. Contracting accounting services will bring several benefits to the company, such as secure book-keeping and accounting, savings on processing time, assistance of experts, met requirements and the benefit of avoiding penalties during tax processing.

Your employee status in Peru

Apart from the company management, you also need to think of your status as an employee. You will have to pay yourself a monthly salary, which is subject to income tax, as well as contribute to health and pension funds.

How to pay yourself within your Peruvian company?

In order to pay yourself the payment must be made with funds that were initially invested at the time of the formation of the company or that have been gained during its lifetime. The other way round this is voluntary contributions from shareholder or majority partners. Either of the above options will be needed to have to pay staff, or potentially to pay yourself and pay social contributions. This is assuming that there are funds in the company’s account.

- A contract between the worker and the company must be signed.

- Subscribe to the T-register of the national tax authority (SUNAT), with the information contained in the contract.

- Once you get your payroll by the company, the company must comply with the monthly presentation of the PDT PLAME of SUNAT. There you enter the salary values, retentions to workers and contributions to the health and pension system.

- Being on payroll the worker has the right to social benefits, such as: CTS (Service compensation), Gratuities (July & December), Holiday (30 calendar days per year of service).

The payment of the remuneration can be paid in parts, if agreed upon in the contract. Meaning 1 single payment at the end of the month or paid in biweekly payments, every 15 days.

Which benefits do you get as Peruvian Taxpayer?

When officially employed, taxes have to be paid. Therefore, once taxes are paid you are automatically part of the Peruvian health and pension system which means you are socially secured in Peru. When owning your own company, you can decide whether to contribute to the national or to the private health and pension system. If you decide to contribute to the private pension system, when leaving the country, you can take out your paid-in pension money with you. Regarding the private health system there are several advantages as well as disadvantages. Another advantage of the Peruvian tax system is that you would receive two gratuities in July and December and you have the right to take a holiday for up to 30 calendar days per year.

What are Your obligations as an employee in Peru?

As already mentioned above, when you have a company in Peru or when working independently, taxes have to be paid to the Peruvian national tax authority, SUNAT. You are considered to be a resident in Peru, once you have lived in Peru for more than 183 days within a 12-months period. Therefore, being a resident means you have to pay taxes on your personal income. Income taxes are calculated in the so-called UIT, which is the Peruvian tax unit. The amount of the tax unit is determined every year and the applicable tax rate for this year is PEN 4,050 equaling 1 UIT. Therefore, the percentage of your personal income tax depends on how many tax units you earn on a yearly basis.

Outsource your payroll needs in Peru

If your company’s accounting is already outsourced, you should let them manage your tax obligations as an employee as well. This will be a relief for you and you can concentrate on working on your company’s management and marketing, without having to think about accounting and taxes. Having these services outsourced will save you a lot of time and you can focus on the management of your newly established company.

Conclusion – Company formation and work visa process in Peru

The major objective of this article was to reveal how to get a work visa in Peru by forming your own company. As many have seen recently the application of the new Peruvian immigration law, limits the possibility of border hopping. Furthermore, many have noticed just how hard it is to come across a work contract with a duration of a year without having a carnet extranjería, as well as not knowing what your skills are. The time lags involved will most likely take longer than your allowed stay in Peru. For this reason, the easiest way of obtaining a work visa in Peru is often form a company there. Doing so, you are able to work and operate your own company while having the same rights as Peruvian nationals.

Get expert support for your business visa in Peru

To do businesses in Peru, there are many types of visas to choose from. Obtaining a business visa can be complex, especially in an unknown environment. Make sure to connect with a local immigration expert to coordinate your transition into Peru.

At Biz Latin Hub, our team of local and expatriate professionals in Peru can support this process to ensure you are in full compliance with the local law. As a market leader for corporate immigration, legal, and accounting services in Latin America, we are your point of contact for multilingual market entry, exit, and back-office services.

Contact our specialists in Peru for a personalized visa strategy and legal support.

Learn more about our team and expert authors.