Colombia’s economy is showcasing an increasing amount of commercial talents, and has emerged as a strong regional power and the third largest economy in Latin America. Its economic versatility has drawn investors and entrepreneurs to its shores in droves. For those looking to bring goods or services to the country, an import license in Colombia will be necessary to keep things above board.

Designed and intended for those investing in the country, getting an import license in Colombia allows a parent company to establish a business and trade its products in the country. This may involve setting up a local branch of your established operation, or you may prefer to incorporate a company in Colombia.

Whichever option you prefer, it makes sense to partner with an experienced operator in the local market to get an import license in Colombia. That’s where Biz Latin Hub can step in to help you out. Our array of back office services is designed to support your foray into the region at every step. With 18 dedicated offices throughout Latin America and the Caribbean, we can help you out wherever you are.

Import License in Colombia – Why conduct foreign trade operations in Colombia?

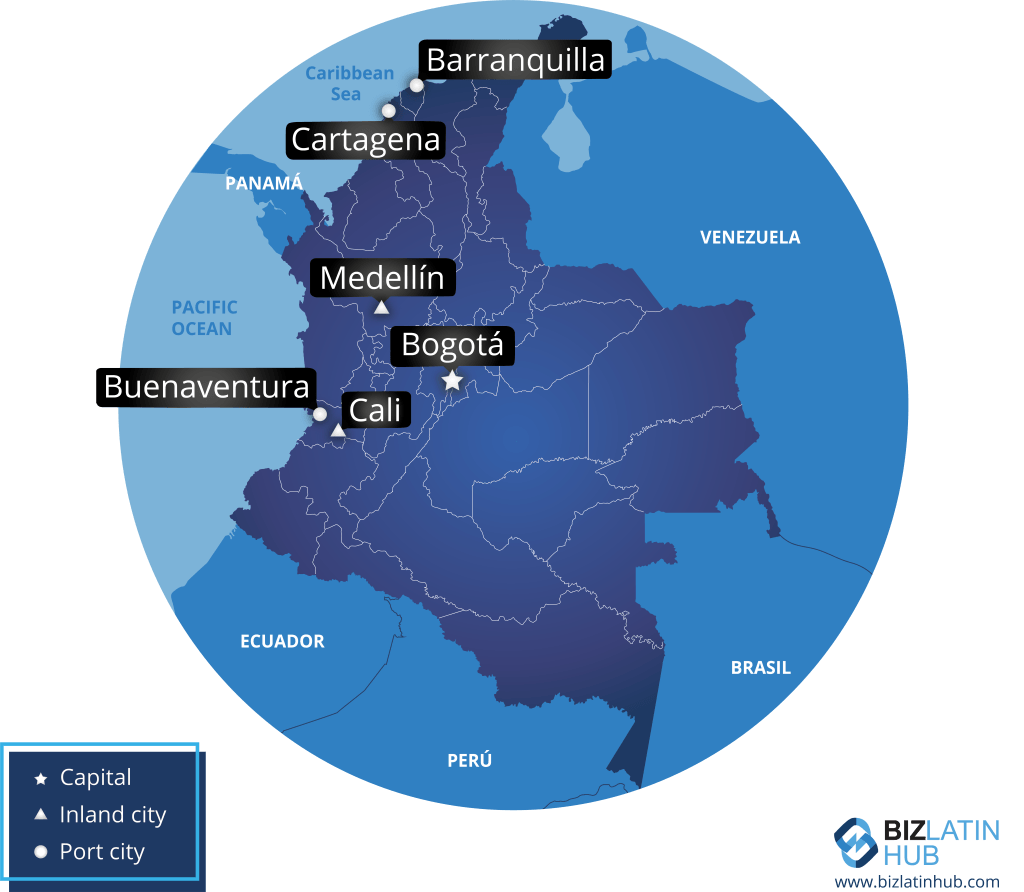

Working in a growing economy, and one of the strongest economies in Latin America, is an opportunity to have a well-positioned presence in the region. Colombia’s geographic location allows for expansive access to various trading partners in the region, considering it has access to both the Pacific and the Atlantic Oceans (the second via the Caribbean Sea).

Colombia’s international connectivity is highly covetable. As a member of the Pacific Alliance, Colombia enjoys preferential trade access to major players in the region (Chile, Mexico, and Peru). Its proximity to the US also enables businesses to supply to a large North American consumer market.

In addition, Colombia’s Free Trade Zones offer preferential trade access and regulation. These zones will not only boost your business but will qualify it for certain tax benefits. The main cities, such as Bogotá, Medellin and Cartagena, different in their own rights, demonstrate Colombia is a nation growing in confidence and diversity, further asserting its dominance as an international global force.

Incorporate or form a company

When incorporating or forming a business, take your time deciding on the different entities available to you in Colombia. The 3 structures available to you are the Limited, Joint-stock or Simplified Stock (SAS) companies.

The latter tends to be the easiest option for foreign investors. SAS entities eliminate personal liability of shareholders, should the business experience financial issues. This structure allows for unlimited shareholders, and in Colombia, SAS company documentation isn’t made public. Processing time for SAS companies – once you’ve submitted all the necessary documentation – can take around 2-3 weeks.

The company formation process includes opening a bank account. Thankfully, this is fairly straightforward. Different banks may individually have specific requirements, but generally, you’ll need to provide:

- a certificate confirming your registered business (from the Chamber of Commerce)

- your tax identification certificate (known as a RUT)

- identification of your legal representative

- your company’s opening balance sheet

- your company´s certificate of equity composition.

Getting your import license

This license is issued by the Ministry of Commerce. In order to get it, once you have incorporated your company, the first step is to include the “importer” classification in your Tax Registration Certificate (RUT) before the national tax authority, the National Tax and Customs Directorate of Colombia (DIAN).

Afterwards, you must register your legal representative’s signature, which you can do before “Certicamara”, the certified entity that registers this information before the Ministry of Commerce. This signature registration is valid for between 1 to 2 years and it must be renewed once it expires.

Which documents do you need?

- Products List: This list is required not only for the import license but to have the record if your products require extra registration before sanitary control entities. You’ll need to submit this to the National Institute of Medications and Food Control (known as Instituto Nacional de Vigilancia de Medicamentos y Alimentos, or INVIMA).

Note: If you will be importing pharmaceutical, food, or biologic products, you must register your products before INVIMA, before you apply for the import license. - Tariff subheading: The DIAN determines a tariff heading before the products are imported. Accordingly, you must determine an approximate value of the tariffs you will have to pay when importing your products. This subheading must be presented before the Ministry of Commerce.

- Identification of your legal representative: This can be in the form of a passport, driver’s license or other photo identification

- Chamber of Commerce Certificate of Incorporation.

Once you have all the documents required, you can proceed with the registration before the Ministry. It is up to the discretion of the Ministry to decide to issue you an import license, and any extra requested documents or permits for the import of your products. Please note the import license will be given just for the products included in the products list and the tariff subheading.

FAQs regarding an import license in Colombia

Yes, Colombian businesses can be 100% foreign-owned

This license is issued by the Ministry of Commerce. In order to get it, once you have incorporated your company, the first step is to include the “importer” classification in your Tax Registration Certificate (RUT) before the national tax authority, the National Tax and Customs Directorate of Colombia (DIAN).

You will likely need the following, although for certain products there may be additional documentation:

Products List: This list is required not only for the import license but to have the record if your products require extra registration before sanitary control entities. You’ll need to submit this to the National Institute of Medications and Food Control (known as Instituto Nacional de Vigilancia de Medicamentos y Alimentos, or INVIMA).

Note: If you will be importing pharmaceutical, food, or biologic products, you must register your products before INVIMA, before you apply for the import license.

Tariff subheading: The DIAN determines a tariff heading before the products are imported. Accordingly, you must determine an approximate value of the tariffs you will have to pay when importing your products. This subheading must be presented before the Ministry of Commerce.

Identification of your legal representative: This can be in the form of a passport, driver’s license or other photo identification

Chamber of Commerce Certificate of Incorporation.

Incoterms are developed and regulated by the International Chamber of Commerce (ICC). With 3 distinct letters, the ICC uses incoterms to define the responsibilities and obligations of the exporter and importer. It takes into account, in particular, loading and transport information, type of transportation used, insurance, risks, and place of delivery.

Biz Latin Hub can help with an import license in Colombia

Colombia’s economic terrain is diverse, the people are warm and the commercial opportunities are present. Owing to its stunning natural beauty and stable incubator for your investment needs, it’s indeed the perfect place to invest, work and live.

At Biz Latin Hub, we have a team of professional lawyers who specialize in investment and trade law, ready to help with any queries you may have.

For more information on how to invest in Colombia and tips on incorporating a business here, reach out to our team now.