If you wish to form an NGO in Peru, you must be aware of the key steps and legal requirements involved in the process. They are intended for individuals or groups that aim to have a positive impact on the country and its communities, or to improve the economy. Thus, they must not be for profit motives and can take up to 5 months to complete registration.

In Peru, if you form an NGO, it is not recognised as a separate legal entity but a sub-category of NPOs (non-profit organizations). Meeting certain criteria may entitle an NGO to certain tax exemptions in the country. Discover the essential information and steps needed to successfully form an non profit organization or to later incorporate a company in Peru.

Biz Latin Hub can help you form an NGO in Peru, as well as support you throughout your company’s life cycle. Our array of market leading back-office services is here to make sure you stay fully compliant with both legal and fiscal obligations under local laws so that you can relax and focus on what you do best – running your organization.

What is an NGO in Peru?

An NGO, or non-governmental organization, operates without governmental control. Its operations are non-profit oriented and its objective serves a social purpose. An NGO can maintain itself through private donations, membership or government support, grants, or the sale of goods and services.

In contrast to other countries, Peruvian NGOs are not recognized as a separate legal entity; rather, they make up part of a subgroup of non-profit organizations (NPOs) with the addition that NGOs can engage in international technical cooperation.

What are the different types of non-profit organizations?

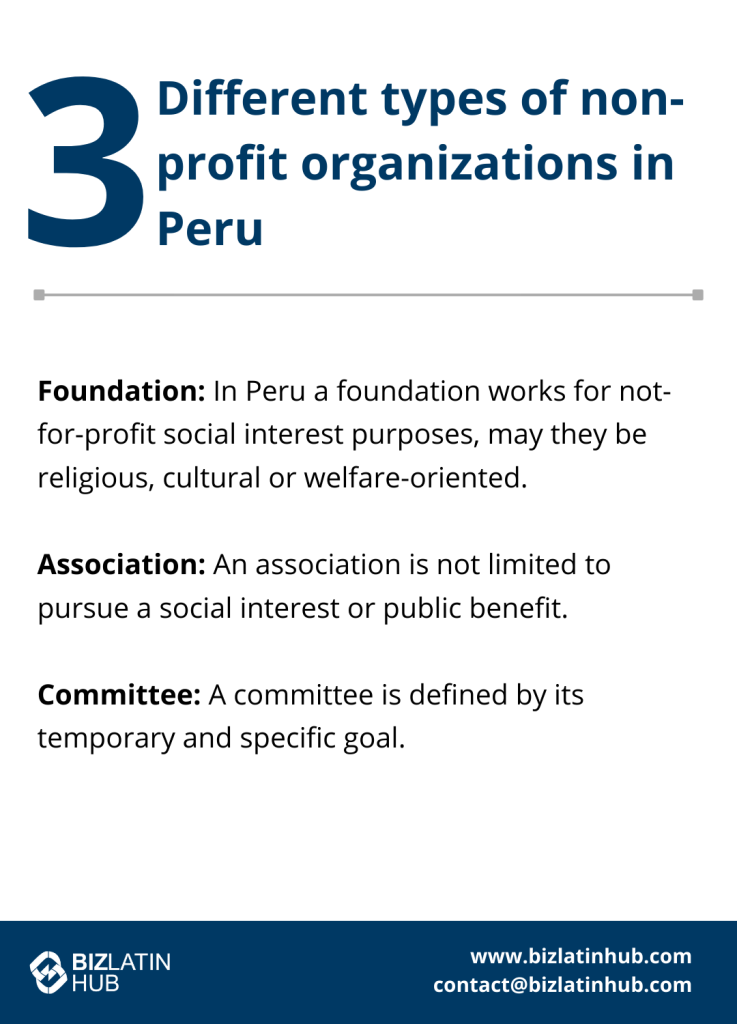

There are 3 different types of NPOs in Peru:

- Association: An association is not limited to pursue a social interest or public benefit. An association may work for any common activity, as long as the goal is not profit-oriented.

- Foundation: In Peru a foundation works for not-for-profit social interest purposes, may they be religious, cultural or welfare-oriented. This type of NPO, however, is less popular, as foundations are strictly regulated and founders do not have unlimited power over operations.

- Committee: A committee is defined by its temporary and specific goal.

What is the process to form an NGO in Peru?

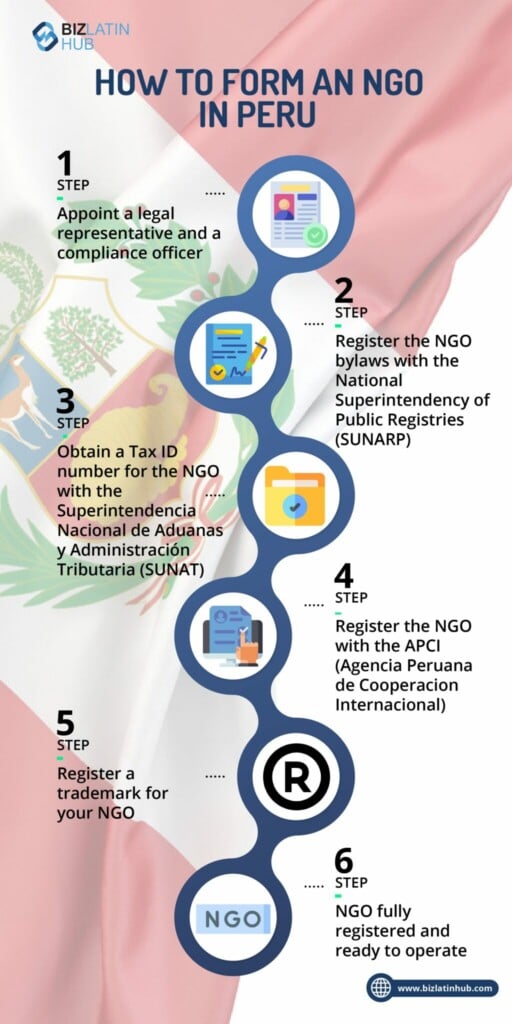

There are 5 main steps to forming an NGO in Peru. This process can take between 3-5 months.

- Step 1 – Appoint a legal representative and a compliance officer.

- Step 2 – Register the bylaws of the NGO.

- Step 3 – Obtain tax identification.

- Step 4 – Register the NGO.

- Step 5 – Register a trademark for your NGO.

Note that as a foreign national on a tourist visa, you must obtain a permit from Migraciones in order to be able to sign contracts.

1. Appoint a legal representative and a compliance officer

To form an NGO in Peru, these entities require 2 key appointments: a legal representative and a compliance officer.

Your legal representative may be a Peruvian citizen or foreign national, but must hold a valid Peruvian visa. The role of the legal representative is to carry out all relevant legal activities on behalf of the NGO. They must act in the best interests of the NGO in Peru and are considered the legal face of the entity.

The compliance officer is a necessary appointment for an NGO in Peru. The compliance officer is in charge of the management of assets and funds received by the NGO, and must act in accordance with Unidad de Inteligencia Finaciera (UIF) regulations in the country.

Be sure to engage with people or third party services providers that you can trust and who will support your best interests in Peru.

2. Register the bylaws of the NGO

The NGO must be constituted by public deed at Registro Público. Its Bylaws will require the following:

- The appointment of associates, also referred to as owners or founders. Associates could be natural or legal persons. A natural person will need to include a hard copy of their identification, and a legal entity must provide a document validating the entity as an owner

- Appointment of 3 individuals (minimum) as directors of your NGO. These could be Peruvian citizens or foreign nationals

- Appointment of the legal representative

- A clear scope of actions that the NGO will have, outlining the objectives of the NGO, how it will accomplish these objectives, how it is financed, and the rights and duties of the associates and directors

- Internal anti-money laundering and anti-terrorism policies, which should be aligned to the UIF

- The appointment of the compliance officer.

NGO owners must also provide a Peruvian DNI (local identification) or other proof of citizenship. This must be stated on the bylaws and is a requirement from Registro Público.

3. Obtain tax identification

Once the above is approved by Public Deeds, then you must obtain a tax identification number to form your NGO in Peru. This is issued by the tax administration office in Peru (SUNAT).

The objectives outlined in the NGO bylaws are what the SUNAT will review to determine your eligibility for certain tax exemptions.

4. Register the NGO

To form an NGO in Peru you must register it as a Non-Governmental Development Organization in APCI (Agencia Peruana de Cooperacion Internacional.

For this, you must provide a DNI or other proof of identity, the bylaws and proof of appointments of the legal representative and compliance officer. You must also have the permission to sign contracts mentioned above, which can be obtained online.

5. Register a trademark for your NGO

Protect the distinctive signs, packaging, and other elements of your NGO’s brand and register a trademark at INDECOPI, the country’s intellectual property protection agency. There are several mains steps to this proces:

- Conducting a trademark search in Peru

- Preparing and submitting your application to INDECOPI

- Application review

- Publication of the application in the Peruvian Official Journal

- Receive and respond to any comments from third parties

- Finally, approval of your trademark.

It’s key to protect your unique signs and your organization’s credibility. By owning a trademark to your distinctive signs, you gain exclusive rights to their use and can take legal action against anyone using those signs for their own commercial gain.

6. Hiring staff? Comply with local labor laws

If you have paid employees, you must comply with local labor laws. The Peruvian Department of Labour will dictate which employee benefits you must pay.

If you have foreign unpaid staff, or volunteers, make sure that they enter Peru on a volunteer visa.

What are the objectives of an NGO in Peru?

Generally, an NPO or NGO must engage in lawful, not-for-profit activity. The objective(s) of the NGO must serve a general social interest.

An NPO or NGO must stick to its specialization clarified in its documents of incorporation. The objectives of the organisation must be of a social nature and they must be active in one or more of the following sectors:

- Art

- Charity

- Culture

- Education

- Housing

- Literature

- Politics

- Science

- Social assistance

- Unions.

An NGO in Peru is allowed to engage in economic and commercial activities, as long as it is part of its social purpose, and as long as it is not-for-profit. That means that all returns and income must be dedicated to the NGO’s maintenance or the fulfilment of its social purpose.

Income tax exemption for NGOs in Peru

There are certain income tax exemptions for eligible NGOs in Peru. To obtain these, the organisation needs to fulfill a purpose in one of the fields mentioned above (charity, culture, education, social assistance, science, art, literature, athletics, and politics).

Exemptions are made on the following conditions:

- The organisation follows a clear-cut cause

- The NGO includes mechanisms to prevent the owners from receiving profits from the organisation for their private interest.

- The SUNAT makes an official determination on income tax exemption.

The SUNAT maintains the Income Tax Exemption Registry, and keeps track of those organizations that meet the requirements for a tax exemption. This institution will deny applications for exemption if the purposes of the NGO only partially contributes to those purposes mentioned above. In this case, the total income of an organisation is taxed.

You must file your application for a tax exemption within the first 45 days of operations. Tax exemptions need to be renewed every 2 years.

Note: An NGO in Peru also needs to pay taxes on its assets such as vehicles or buildings.

Maintaining your NGO in Peru

There are several requirements for an owner of an NGO to comply with in order to maintain their entity in Peru:

- File a renewal for relevant tax exemptions every 2 years

- Submit Annual Declaration Report of Activities with the International Cooperation Resources

- Produce an Annual Plan of Activities for the initial year

- Present the programs to be developed by the NGO in Peru in the next 2 years.

First, an NGO is an official legal entity, and its founders gain benefits and protection. In case of death of the founders, the NGO would continue to exist. Forming an NGO in Peru also comes with a range of potential monetary benefits, such as tax exemptions. Additionally, you will be able to receive international donations and declare donation receipts. This way you may receive a tax reduction.

FAQs on how to form an NGO in Peru

Yes, foreign ownership is 100% allowed for most projects.

Generally, an NPO or NGO must engage in lawful, not-for-profit activity. The objective(s) of the NGO must serve a general social interest.

An NPO or NGO must stick to its specialization clarified in its documents of incorporation. The objectives of the organisation must be of a social nature and they must be active in one or more of the following sectors:

Art

Charity

Culture

Education

Housing

Literature

Politics

Science

Social assistance

Unions.

An NGO in Peru is allowed to engage in economic and commercial activities, as long as it is part of its social purpose, and as long as it is not-for-profit. That means that all returns and income must be dedicated to the NGO’s maintenance or the fulfilment of its social purpose.

There are 5 main steps to forming an NGO in Peru. This process can take between 3-5 months.

NGO owners must provide a Peruvian DNI (local identification) or other proof of citizenship. This must be stated on the bylaws and is a requirement from Registro Público.

There are certain income tax exemptions for eligible NGOs in Peru. To obtain these, the organisation needs to fulfill a purpose in one of the fields mentioned above (charity, culture, education, social assistance, science, art, literature, athletics, and politics).

Exemptions are made on the following conditions:

The organisation follows a clear-cut cause

The NGO includes mechanisms to prevent the owners from receiving profits from the organisation for their private interest.

The SUNAT makes an official determination on income tax exemption.

The SUNAT maintains the Income Tax Exemption Registry, and keeps track of those organizations that meet the requirements for a tax exemption. This institution will deny applications for exemption if the purposes of the NGO only partially contributes to those purposes mentioned above. In this case, the total income of an organisation is taxed.

You must file your application for a tax exemption within the first 45 days of operations. Tax exemptions need to be renewed every 2 years.

Form your NGO in Peru with expert local legal support

Forming an NGO in Peru is a great way to promote social and other non-profit causes. Peru offers the facilities and benefits necessary for your NGO to succeed and grow. Forming your NGO in cooperation with a local, bilingual legal expert removes the language barrier, speeds up the process, and assures you to comply with local laws.

Our team of legal and accounting experts can guide you through all required company formation processes, providing security and assurance of the correct establishment and compliance of your NGO in Peru. Contact us today for more information.

Learn more about our team and expert authors.