Learn how to form an NGO in Brazil (also known as a non-governmental organization). These organizations operate with a social focus but disconnected from the state. This can be successful in the country because of a strong economy for private enterprise. According to their local association, ABONG, there are now more than 300,000 NGOs in Brazil.

If you seek to become one of them, read on to find information about the laws and procedures to form an NGO in Brazil. These structures can be morally very rewarding and get a lot done where the state can’t. There are an increasing number of people looking into this, and also into the idea of company formation in Brazil.

Biz Latin Hub can help you in a variety of ways, whether that’s local recruiting through a PEO, full company formation or how to form an NGO in Brazil. Our array of market leading back office services is designed to fully support you from the start, through annual legal and fiscal compliance right up to eventual liquidation if necessary. That allows you to relax and focus on what you do best – building your business.

The legal status of NGOs in Brazil

The Third Sector Law, nº 9.790, from 1999, provides the qualification of private legal entities as nonprofit Civil Society Organizations of Public Interest (Organizações da Sociedade Civil de Interesse Público, known as OSCIPs).

This law disciplines and establishes the partnerships to be formed with the state and private companies. There are several types of institutions that comprise the Third Sector in Brazil including associations and private foundations.

When an organization exists for more than one year, it can request to be qualified as OSCIP at the Ministry of Justice. This qualification allows an NGO to establish a relationship with the government. This gives the organization access to public resources through a Partnership Agreement (Termo de Parceria).

This partnership agreement is a legal document for establishing partnerships between the government and the non-governmental organization.

Qualified under this law, an OSCIP can:

- Experiment with non-profit, new socio-productive models and alternative systems of production, trade, employment, and credit.

- Produce studies and research, development of alternative technologies and dissemination of information and technical and scientific knowledge.

Additionally, an NGO in Brazil can be those institutions which promote:

- Economic and social development and fight poverty.

- Ethics, peace, citizenship, human rights, democracy, and other universal values.

- Culture, protection, and conservation of historic and artistic heritage

- Established rights, construct new rights, and offer free legal advisory

- Food security and nutrition, free education, free health services, social welfare, volunteerism.

- Sustainable development and protect, preserve and conserve the environment

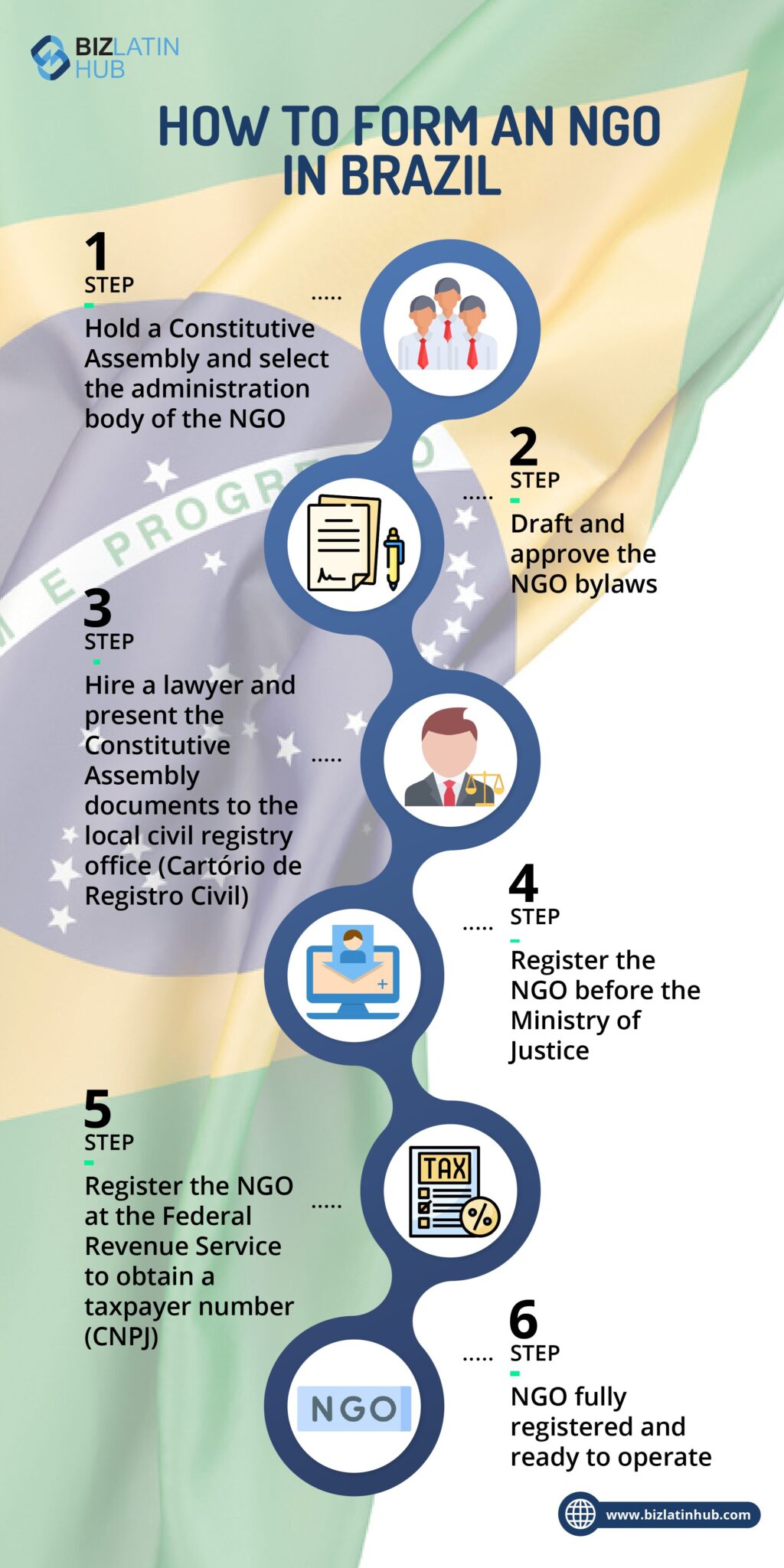

The process to form an NGO in Brazil

There are 5 key steps to form an NGO in Brazil. This process can take between 2-4 months.

1. Convocation

The first step is to gather a group with the same ideas and goals to create an NGO. This group will research the viability to create the institution.

To form an NGO there is no minimum or a maximum number of people, but it is advisable to have at least a number of positions covering the managing positions and the board of directors. By cooperatives, it is required that the NGO has at least seven integrant members.

2. Set up a general meeting for the constitution of the association

During the constituent assembly, all members of the NGO meet to discuss the future of the organisation. Important points like the name, goal, mission, headquarters, and management of the NGO will be approved. These points are presented in the NGO’s bylaws draft, which will be discussed and modified if necessary and then approved during the meeting.

Before starting the meeting, the chairperson of the meeting should be chosen. Next to that, the secretary who takes notes of the topics discussed should be assigned, too. These notes will be recorded in the minutes of the meeting.

3. Drafting of bylaws

Essential aspects that should be included in the statutes of the NGO are:

- General meeting, a board of directors, supervisory board

- Duration

- Goals and objectives

- Headquarters and jurisdiction

- How the entity is dissolved

- How the statutes are modified

- The liability for the obligations of the organization

- Members and their types, input and output, rights and duties

- Name and acronym of the organization

- What is the destination of the assets in case of dissolution

- Who is responsible for the entity

4. Announcement of the administration body

The election of the board of directors has to follow what was agreed in the NGO’s statute. After the election, they receive ownership of the positions they were elected for.

When this is finalized, the NGO is founded. However, it still does not have the status of a legal entity; this only occurs after the procedures of the following bureaucratic steps.

5. Legal registration

When registering an NGO in Brazil, the members must be prepared to cover the costs of registration and third parties, since it is necessary to contract the services of a lawyer or an accountant.

When the bylaws are approved, and the minutes and attendance lists are signed, the NGO must hire a lawyer to legitimize the documents adopted at the meeting and forward it to the local civil registry office (Cartório de Registro Civil) together with other documents.

Most of the required documents are:

- Book of original proceedings

- Copies of the qualified relationship management (name, position, marital status, birth, address, occupation, identity, and social security numbers)

- Payment of the Civil Registry Office fees

On top of that, you must provide 3 copies of each of the following:

- The minutes of the General Meeting, signed by the NGO’s president and other officers

- List of charter members

- The NGO’s bylaws on the letterhead of the NGO

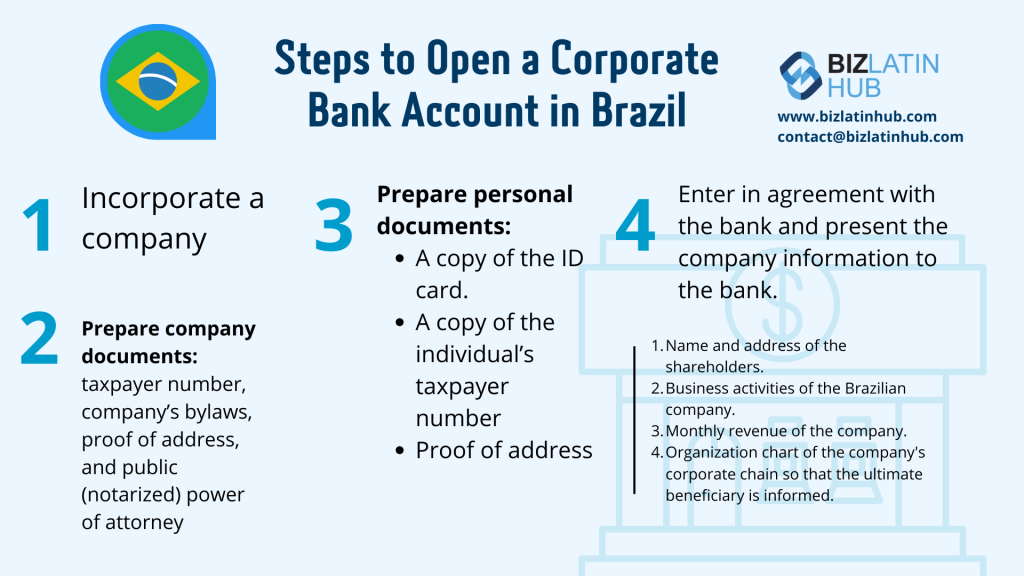

After this, the NGO is legally registered before the Ministry of Justice. However, it is also necessary to register at the Federal Revenue Service. NGOs need an accountant or accounting firm that is qualified and will provide the tax records, labor and acquire the registration for obtaining the CNPJ (taxpayer number for legal entities).

With this CNPJ, NGOs can access a bank account, make terms of partnerships and contracts, hire employees, receive resources, issue receipts, and other actions.

Requirements to maintain your NGO in Brazil

In Brazil, an NGO is usually registered as an association. According to Brazilian law, the bylaws of the associations must establish the criteria for the approval of the accounts. Associations must keep accounts in accordance with regular standards and ensure their accounts are approved annually through a general meeting. In some cases, a supervisory board may need to be established.

If the association does not have any type of tax benefit, all tax returns must be submitted to the tax authorities according to the terms defined by law, being certain that such obligations may be monthly, quarterly and annually according to the respective tax.

In addition, the associations must be aware of the term of office of their directors, respecting the election deadlines defined in the bylaws.

FAQs on how to form an NGO in Brazil

Yes, foreign ownership is 100% allowed for most projects.

Qualified under this law, an OSCIP can:

Experiment with non-profit, new socio-productive models and alternative systems of production, trade, employment, and credit.

Produce studies and research, development of alternative technologies and dissemination of information and technical and scientific knowledge.

Additionally, an NGO in Brazil can be those institutions which promote:

Economic and social development and fight poverty.

Ethics, peace, citizenship, human rights, democracy, and other universal values.

Culture, protection, and conservation of historic and artistic heritage

Established rights, construct new rights, and offer free legal advisory

Food security and nutrition, free education, free health services, social welfare, volunteerism.

Sustainable development and protect, preserve and conserve the environment

This process can take between 2-4 months.

Most of the required documents are:

Book of original proceedings

Copies of the qualified relationship management (name, position, marital status, birth, address, occupation, identity, and social security numbers)

Payment of the Civil Registry Office fees

On top of that, you must provide 3 copies of each of the following:

The minutes of the General Meeting, signed by the NGO’s president and other officers

List of charter members

The NGO’s bylaws on the letterhead of the NGO

According to Brazilian law, the bylaws of the associations must establish the criteria for the approval of the accounts. Associations must keep accounts in accordance with regular standards and ensure their accounts are approved annually through a general meeting. In some cases, a supervisory board may need to be established.

If the association does not have any type of tax benefit, all tax returns must be submitted to the tax authorities according to the terms defined by law, being certain that such obligations may be monthly, quarterly and annually according to the respective tax.

Biz Latin Hub can help you form an NGO in Brazil

Forming an NGO in Brazil is a great way to promote social and non-profit causes. Brazil offers the facilities necessary for your NGO to succeed and grow.

Our team of legal and accounting experts can guide you through all required company formation processes, providing security and assurance of the correct establishment and compliance of your NGO in Brazil.

We offer a full suite of multilingual market entry and back-office services, enabling you to expand into Brazil and Latin America with a single point of contact.

Contact us now for more information.

Learn more about our team and expert authors.