Understanding the characteristics of legal entities in Uruguay is essential for choosing the right corporate structure when looking to register a company in Uruguay. Understanding and adhering to all legal and accounting requirements specific to the legal entities in Uruguay is essential for smooth operations and compliance. Collaborating with local experts allows you to navigate the regulatory framework with confidence and clarity. Whether opting for flexibility or liability protection, at Biz Latin Hub, we provide the knowledge and support you need to ensure seamless integration into the Uruguayan entrepreneurial ecosystem.

Key Takeaways

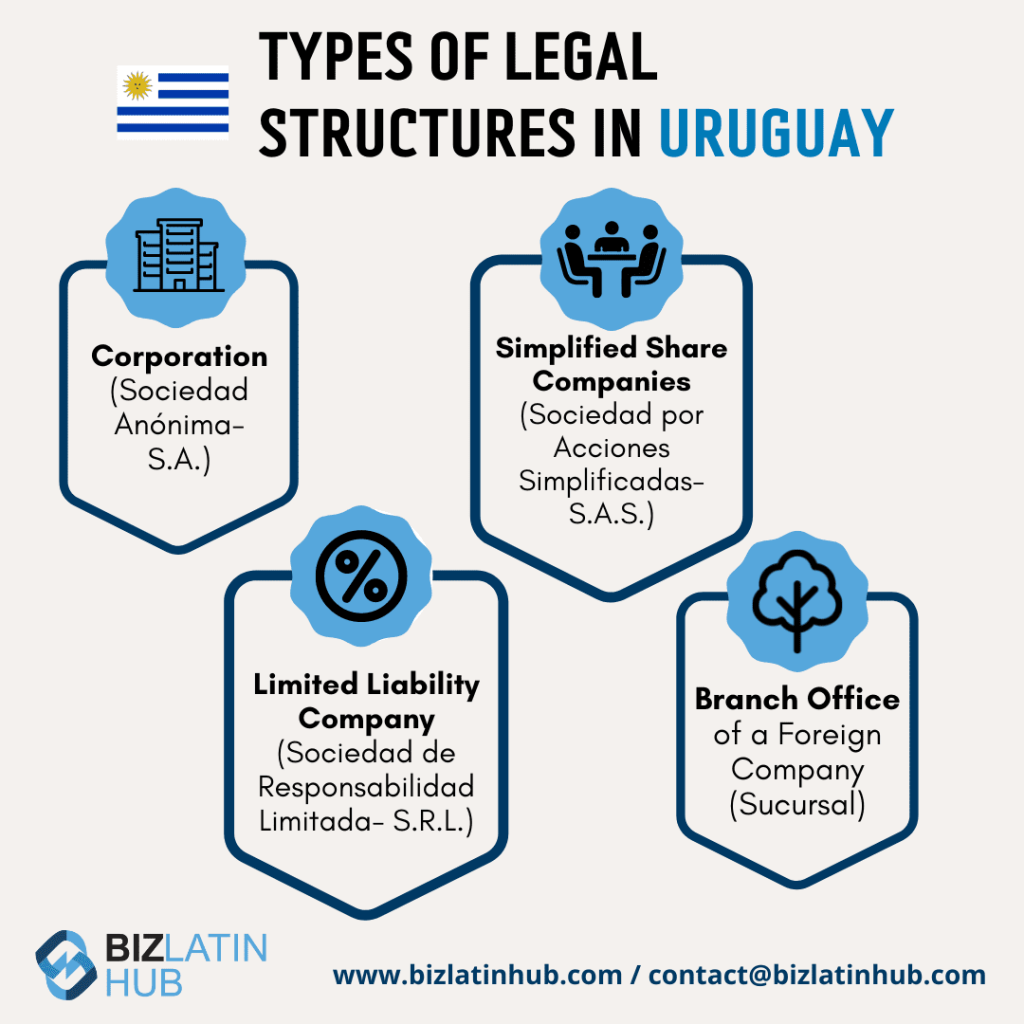

| Common legal entity types in Uruguay | Simplified Joint Stock Company (Sociedad por Acciones Simplificada – S.A.S.). Limited Liability Company LLC (Sociedad de Responsabilidad Limitada – S.R.L.). Corporations (Sociedades Anonimas – S.A.). Branch Offices (Sucursal). Free Trade Zone Corporations (Sociedades Anónimas de Zona Franca – SZFA). |

| What is the most common Uruguayan legal entity? | The most commonly found type of company in Uruguay is the Corporation, which is like an LLC in the US. It offeres strong protections and enables seamless business operations in the country. |

| What are the primary considerations when choosing a business entity in Uruguay? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

5 Types of Companies in Uruguay

There are various types of legal entities in Uruguay available for foreign investors, these include:

- Simplified Joint Stock Company (Sociedad por Acciones Simplificada – S.A.S.).

- Limited Liability Company LLC (Sociedad de Responsabilidad Limitada – S.R.L.).

- Corporations (Sociedades Anonimas – S.A.).

- Branch Offices (Sucursal).

- Free Trade Zone Corporations (Sociedades Anónimas de Zona Franca – SZFA).

While the majority of companies in Uruguay are Corporations (S.A), keep in mind that the type of legal entity that you chose to incorporate will depend on your company’s business needs and requirements. All these legal entities must have a company legal representative and a legal/fiscal address in Peru. They also must make monthly and annual tax declarations to the local tax authorities.

Keep reading if you are interested in doing business in Uruguay and need to find out about the different types of companies available.

1. Simplified Joint Stock Company (Sociedad por Acciones Simplificada – S.A.S.)

The Simplified Joint Stock Company (S.A.S.) is a modern and flexible corporate structure introduced in Uruguay to encourage entrepreneurship and streamline the business incorporation process. It is particularly suited for startups, small businesses, and companies seeking a simple and cost-effective way to establish operations.

The following are the key characteristics and requirements of a Simplified Joint Stock Company (S.A.S.) in Uruguay:

- Shareholders: Can be established by a single shareholder or multiple shareholders, who can be individuals or legal entities of any nationality.

- Liability: Shareholders enjoy limited liability, meaning their personal assets are protected from the company’s debts and obligations.

- Capital Requirements: There is no minimum capital requirement, but the capital must be sufficient to cover the company’s operations. Contributions can be in cash or kind.

- Management: The company can be managed by a single director or a board of directors, depending on the size and complexity of the business.

- Share Issuance: Shares can be issued and transferred freely unless restricted by the bylaws.

- Legal Requirements:

- A fiscal address in Uruguay is mandatory.

- Registration with the General Registry of Companies.

- A legal representative must be appointed.

- Taxation: Subject to Uruguayan corporate taxes on income generated within the country.

2. Limited Liability Company LLC (Sociedad de Responsabilidad Limitada – S.R.L.)

The Limited Liability Company LLC (S.R.L.) is a popular business structure in Uruguay, particularly for small and medium-sized enterprises (SMEs). It offers a balance between operational simplicity and limited liability protection, making it a suitable choice for family-owned businesses or partnerships.

The following are the key characteristics and requirements of an SRL in Uruguay:

- Partners: Requires a minimum of two and a maximum of 50 partners. Partners can be individuals or legal entities of any nationality.

- Liability: Partners’ liability is limited to their contributions, protecting their personal assets.

- Capital Requirements: There is no fixed minimum capital requirement, but contributions must be clearly defined and paid during incorporation.

- Management: The company is managed by one or more administrators, who may be appointed from among the partners or externally.

- Transfer of Ownership: Ownership interests (quotas) cannot be freely transferred without the approval of the other partners, ensuring control remains within the group.

- Legal Requirements:

- A fiscal address in Uruguay is required.

- Registration with the General Registry of Companies.

- Appointment of a legal representative is necessary.

- Taxation: SRLs are subject to corporate taxes on income generated within Uruguay.

3. Corporations (Sociedades Anónimas – S.A.)

The corporation (S.A.) is a traditional corporate structure widely used by medium and large businesses in Uruguay. It is especially suitable for companies planning to raise significant capital or operate in highly regulated industries.

The following are the key characteristics and requirements of a Corporation (S.A.) in Uruguay:

- Shareholders: Requires a minimum of two shareholders, with no maximum limit. Shareholders can be individuals or legal entities of any nationality.

- Liability: Shareholders’ liability is limited to the value of their shares, ensuring personal asset protection.

- Capital Requirements: A minimum capital contribution of USD $1 is required, with at least 25% paid at the time of incorporation.

- Management Structure: Managed by a board of directors and a General Manager, whose roles and responsibilities are defined in the company’s bylaws.

- Share Issuance: Shares are freely transferable unless restrictions are imposed by the bylaws.

- Legal Requirements:

- A fiscal address in Uruguay is mandatory.

- Registration with the General Registry of Companies and the Tax Administration Office.

- Appointment of a legal representative is required.

- Taxation: Subject to corporate income tax (IRAE) on profits generated in Uruguay.

4. Branch Offices (Sucursal)

A Branch allows foreign companies to establish a presence in Uruguay without creating a separate legal entity. The branch operates as an extension of the parent company, sharing its legal identity, liabilities, and obligations.

The following are the key characteristics and requirements of a Branch Office in Uruguay:

- Legal Status: The branch is fully dependent on the parent company, which is responsible for all liabilities incurred in Uruguay.

- Taxation: Subject to Uruguayan taxes on income generated within the country, including corporate income tax (IRAE).

- Registration Requirements:

- The branch must be registered with the General Registry of Companies.

- The parent company must provide its incorporation documents, translated into Spanish and notarized.

- Capital Requirements: No minimum capital is required, but the parent company must provide sufficient funds to support the branch’s operations.

- Fiscal Address: A registered fiscal address in Uruguay is required.

- Legal Representative: A Uruguayan resident legal representative must be appointed to oversee compliance and local operations.

- Bank Account: The branch may need to open a local bank account to facilitate its operations.

5. Free Trade Zone Corporations (Sociedades Anónimas de Zona Franca – SZFA)

The Free Trade Zone Corporations (SZFA) are special corporations established within Uruguay’s Free Trade Zones (FTZs). They are designed to attract foreign investment by offering significant tax and customs benefits, making them ideal for export-oriented businesses and international trade operations.

The following are the key characteristics and requirements of a Free Trade Zone Corporation (SZFA) in Uruguay:

- Location: Must operate within one of Uruguay’s designated Free Trade Zones.

- Tax Benefits: SZFAs are exempt from all national taxes, including corporate income tax (IRAE) and VAT, provided they comply with Free Trade Zone regulations.

- Shareholders: Requires a minimum of two shareholders, who can be individuals or legal entities of any nationality.

- Capital Requirements: No minimum capital requirement, but sufficient capital must be declared to support operations.

- Management Structure: Similar to standard S.A.s, SZFAs must have a board of directors and a General Manager.

- Operations: The company must focus on activities such as manufacturing, logistics, storage, or services intended for export or foreign markets.

- Legal Requirements:

- Registration with the General Registry of Companies and Free Trade Zone authorities.

- A fiscal address within the Free Trade Zone is mandatory.

- Appointment of a legal representative is required.

- Compliance: SZFAs are subject to audits and must comply with reporting requirements set by the Free Trade Zone authorities.

Key Considerations When Choosing Legal Entities in Uruguay

Ownership Structure

Uruguay offers a favorable environment for foreign investors, permitting 100% foreign ownership in nearly all industries. There are no restrictions on foreign ownership of businesses, making it a highly attractive destination for international investors. However, certain regulated sectors, such as telecommunications, energy, and mining, may require specific government approvals. A thorough understanding of industry-specific regulations ensures compliance and smooth operations.

Tax Efficiency

Analyze how Uruguay’s tax system impacts your business. Uruguay operates a territorial tax system, meaning that only income generated within the country is subject to taxation. The corporate income tax rate (Impuesto a las Rentas de las Actividades Económicas or IRAE) is 25%, while VAT stands at 22%, with a reduced rate of 10% for essential goods and services. Dividends paid to non-residents are subject to a 7% withholding tax. Businesses in specific sectors or those operating within Free Trade Zones (Zonas Francas) can benefit from exemptions on corporate income tax, VAT, and customs duties. Strategic tax planning is critical to optimizing costs while ensuring compliance with Uruguay’s tax regulations.

Profit Distribution

Consider the implications of distributing profits in Uruguay. Dividends paid to non-residents are subject to a 7% withholding tax, which may be reduced under Uruguay’s network of double taxation treaties with countries such as Spain, Germany, and Argentina. Developing an efficient profit repatriation strategy helps maximize shareholder returns while minimizing tax liabilities.

Transfer Pricing

Comply with Uruguay’s transfer pricing regulations, which align with OECD guidelines. Cross-border transactions between related parties must reflect arm’s-length pricing. Companies are required to prepare annual transfer pricing documentation if they meet certain thresholds. Non-compliance can result in penalties and increased scrutiny from tax authorities, making proper documentation and reporting essential for multinational businesses.

Compliance

Prepare for Uruguay’s regulatory compliance requirements. Businesses must register with the National Trade Registry (Registro Nacional de Comercio) and the General Tax Directorate (DGI). Financial reporting must adhere to International Financial Reporting Standards (IFRS), with annual filings required for most entities. Monthly tax filings for VAT, payroll taxes, and employee contributions to the social security system (Banco de Previsión Social or BPS) are mandatory. Labor compliance, including adherence to Uruguay’s labor laws regarding employee benefits, severance pay, and collective agreements, is critical to avoid penalties and maintain legal standing.

Flexibility

Select a business structure that aligns with your operational goals and offers adaptability for future growth. Common types of legal entities in Uruguay include:

- Joint Stock Company (Sociedad Anónima or S.A.): Ideal for medium to large businesses, offering limited liability and the ability to issue shares. It requires at least two shareholders and greater regulatory oversight.

- Private Limited Liability Company (Sociedad de Responsabilidad Limitada or SRL): A popular choice for small to medium-sized businesses, offering limited liability and simpler governance. It requires a minimum of two partners and allows up to 50 partners.

- Simplified Stock Company (Sociedad por Acciones Simplificada or SAS): A flexible structure for businesses of all sizes. It allows for sole ownership, fewer corporate formalities, and adaptability in ownership changes or capital increases.

- Foreign Branch (Sucursal): A structure for foreign companies looking to establish a direct presence in Uruguay. The branch operates as an extension of the parent company and is subject to Uruguayan regulations.

- Individual Entrepreneur (Empresa Unipersonal): A simple structure for sole proprietors. While easy to establish, it lacks the benefit of limited liability.

Our Recommendation: In our experience, we recommend our clients to typically establish a Sociedad Anónima (S.A.) which is like an LLC in the US.

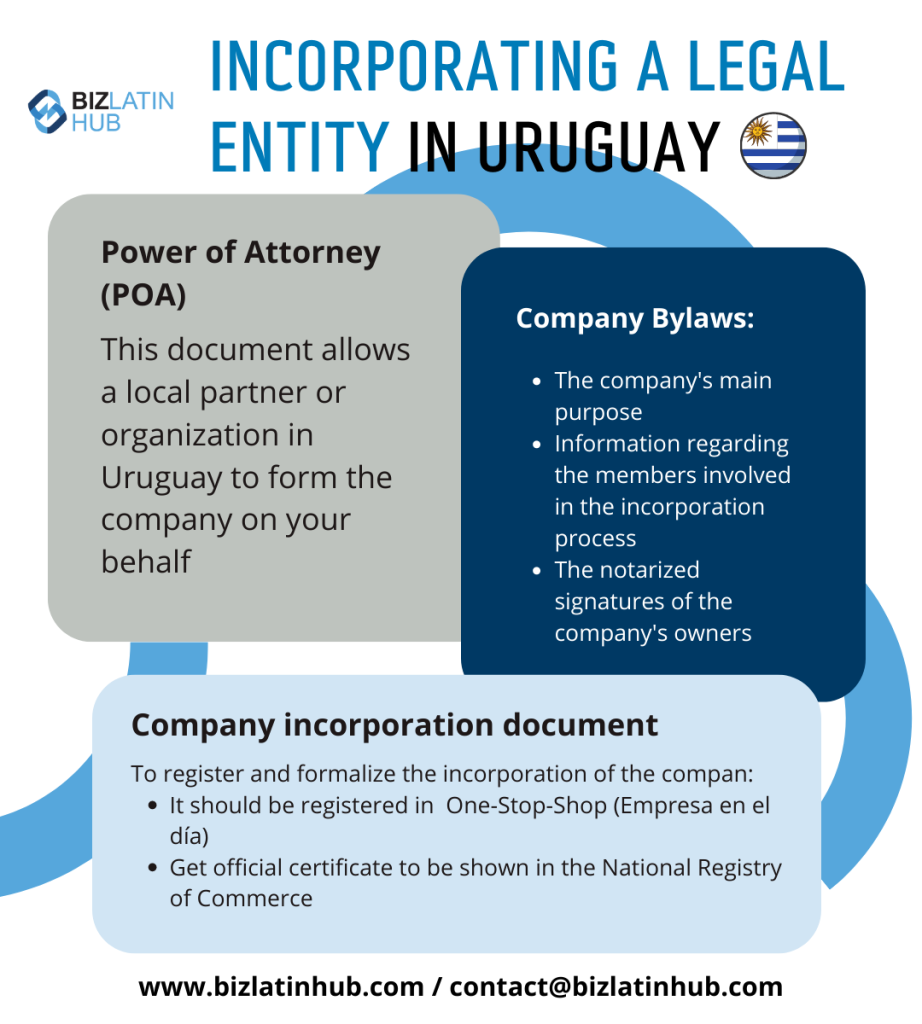

Incorporating a legal entity in Uruguay

There are different ways of incorporating a legal entity in Uruguay. These include the following documents and procedures:

- Power of Attorney (POA): A legal entity in Uruguay can be incorporate through a Power of Attorney (POA) that should be drafted and signed. This document allows a local partner or organization in Uruguay to form the company on your behalf, without the need for you to physically be in the country during the incorporation process.

- Company Bylaws: When incorporating a legal entity in Uruguay, you must carry out a search of your company´s name and get it officially approved by the local government. Additionally, the company bylaws should include the following: the company’s main purpose, information regarding the partners or members involved in the incorporation process and the notarized signatures of the company’s owners.

- Company Incorporation Document: To register and formalize the incorporation of the company, it should be registered in the Government’s One-Stop-Shop (Empresa en el día). All the registration fees for corporations or ‘SA’ companies are paid through this local authority. Likewise, a public notary will provide you with an official certificate that should be shown in the National Registry of Commerce in order to complete the company registration process.

Registration of company with local tax authorities

Tax Administration Directorate (Dirección General Impositiva) is the entity where the company will pay taxes. The National Registry will stamp the book of shares, the letter copybook, the register of minutes of the board meetings and the register of minutes of shareholder´s meetings.

Once this is completed, the company will be able to obtain its local Tax ID (‘RUT‘).

Open a Corporate Bank Account

The final step when incorporating a legal entity in Uraguay when expanding your business in the country is to open a corporate bank account. Once you have obtained your Ta company Tax ID, you will be able to open your corporate account.

FAQs on Types of Legal Structures in Uruguay

1. Can a foreigner register a company in Uruguay?

Yes, foreign investors can register a company in Uruguay. The country welcomes foreign investment and provides various legal structures for foreigners to establish businesses, including Limited Liability Companies for Duty-Free Zones (Sociedades de Zona Franca – SAU), Branch Offices (Sucursal), and Corporations (Sociedades Anónimas – SA).

2. What type of legal entity is recommended in Uruguay?

The recommended legal entity type in Uruguay depends on factors such as the nature of the business, investment objectives, and taxation considerations.

3. How do I create an SAU in Uruguay?

To create a Limited Liability Company for Duty-Free Zones (SAU) in Uruguay, foreign investors must follow the registration procedures outlined by the Uruguayan government.

4. What is an LLC in Uruguay?

In Uruguay, an LLC refers to a Limited Liability Company for Duty-Free Zones (Sociedades de Zona Franca – SAU).

Why Invest in Uruguay?

Expanding your business or incorporating a company in Uruguay offers numerous opportunities, supported by the variety of legal entities available. Uruguay stands out as a prime investment destination due to its stable political climate, sound legal framework, and reputation as one of the most transparent and least corrupt countries in Latin America.

The country’s rapid economic growth has made it one of the fastest-growing economies in the region. Its liberal economic policies foster an open market environment, characterized by minimal trade restrictions and one of the least restrictive service-based economies in Latin America. Uruguay also offers strategic advantages, including a central location within Mercosur, providing seamless access to regional markets like Brazil and Argentina.

Investors benefit from a highly skilled workforce, a robust infrastructure, and incentives such as tax exemptions for foreign investment in key sectors. Additionally, Uruguay’s commitment to innovation is evident in its advanced digital and technological ecosystem, making it an ideal location for companies in tech, logistics, agriculture, and renewable energy.

When planning to expand or establish your business in Uruguay, expert legal and accounting guidance is essential to navigate regulatory compliance and take full advantage of the country’s investor-friendly policies.

Seeking more information about legal entities in Uruguay?

Uruguay holds great potential for business investors and entrepreneurs. However, doing business in a new environment can prove to be somewhat complicated. Working with a local partner who can support you throughout the entire incorporation process is highly recommended.

For this reason, we highly recommend cooperating with a local partner when entering the Uruguayan market. Get in contact with Biz Latin Hub and our team of local experts and professionals will provide you with a range of professional services, including accounting & taxation and legal services, to support you in establishing your business in Uruguay.

Learn more about our team and expert authors.