You may know that Barbados is a tropical island and popular tourist destination – or how the nation left the Commonwealth in 2021 and became a republic. But did you know that a growing number of businesses and investors are considering a company formation in Barbados because of the advantages the jurisdiction provides, such as as tax benefits? Consider the island either to form a company or open a bank account in Barbados.

Key Takeaways On How To Form a Company in Barbados

| Is Foreign Ownership Permitted in Barbados? | Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals). |

| Key steps to register a company in Barbados: | Step 1 – Create your company’s name Step 2 – Prepare a Memorandum of Association (MOA) document Step 3 – Obtain and complete an Article of Incorporation document Step 4 – Submit all the correct documentation to the relevant Barbadian authorities Step 5 – Receive a Certificate of Incorporation Step 6 – Finally, begin the process of opening a corporate bank account in Barbados |

| What Are The Common Legal Entity Types In Barbados? | The RBC (similar to a corporation) and SRL (similar to an LLC) business types are the most common and can be turned into an IBC or International Business Company. |

| What Details Are Necessary To Incorporate a Company in Barbados? | A name for your legal entity. Shareholder identification documentation and personal details of directors (minimum 1) Confirm the business activities and corporate purpose. Minimum initial capital to be registered. Barbadian address |

| Why choose to form a company in Barbados? | The country has a solid economy and that friendly tax system for foreign investors means that company formation in Barbados is very attractive. Also, an Anglophone populace and rights to secrecy. |

Company formation in Barbados: A 6-step guide

This is the breakdown of the steps necessary to form a company in Barbados:

- Step 1 – Create your company’s name

- Step 2 – Prepare a Memorandum of Association (MOA) document

- Step 3 – Obtain and complete an Article of Incorporation document

- Step 4 – Submit all the correct documentation to the relevant Barbadian authorities

- Step 5 – Receive a Certificate of Incorporation

- Step 6 – Finally, begin the process of opening a corporate bank account in Barbados

On average, it takes about six weeks to incorporate a business in Barbados, and that’s not including the time it takes to set up a corporate bank account.

The process of incorporating in Barbados can at once be straight-forward and complicated. When you’ve decided to move forward with a company formation in Barbados, it’s best to hire a local legal expert who knows how to navigate the legal, regulatory and financial landscape.

Create your company’s name

You should have two backup alternative names in case the business name is already taken, or if it’s too alike an already-established business. These names then must be submitted to the Barbadian Companies Registry

Prepare a Memorandum of Association (MOA) document

Prepare a Memorandum of Association (MOA) document that spells out the scope of the company’s business activities and why it must be incorporated

Obtain and complete an Article of Incorporation document

This will be given out from the Business Office and will mark your official intent to make your firm a legal reality.

Submit documents

Which documents you need to submit, and to what government body, will depend on the type of business you are incorporating. Be prepared to wait a while for paperwork to be completed.

Receive a Certificate of Incorporation

This must be issued by the Business Office and will confirm that you are ready to set up and begin operations. After this, you need to open a bank account. You will also be able to consider changing the terms of your operation to being an IBC.

Open a bank account in Barbados

To start the process of opening a corporate bank account in Barbados, you will be required to complete a comprehensive application and provide the following information:

- Complete the bank’s application paperwork.

- Submit certified copies of corporate filings.

- Provide copies of government-issued identification and related proofs for each shareholder and director.

- Submit company financials and additional required documents.

- Generally, most banks in Barbados follow these procedures for opening a corporate bank account.

Company types in Barbados

There are many kinds of companies that foreigners can register in Barbados, the most common being limited liability companies (SRLs) and Regular Business Companies (RBCs).

Limited Liability Company (SRL): Standing for Society with Restricted Liability, this type of company is ideal for businesses where liability protection for the owners is desired. It combines the flexibility of a partnership with the liability protection of a corporation. SRLs in Barbados are governed by the Companies Act of 1982 and provide limited liability for their members.

Regular Business Company: A private limited company or corporation in Barbados is used for local business operations. It limits the liability of shareholders and is often chosen by those looking to operate within the domestic market. The company must have at least one director and one shareholder, who can be the same person.

External Company: This type of company is suitable for businesses planning to enter the market under a foreign umbrella. It essentially means operating as a branch office.

International Business Company (IBC): This is the most common and popular type of company in Barbados. IBCs are used for international trade, investment, holding assets, and other business activities. They offer benefits such as tax exemptions on income earned outside Barbados, confidentiality for shareholders and directors, and ease of formation. However, they cannot operate within the territory or send profits to residents of the CARICOM area.

What do you need to form a company in Barbados?

To proceed with company formation in Barbados, you will need to provide the following:

- A name for your legal entity.

- Shareholder identification documentation and personal details of directors (minimum 1)

- Confirm the business activities and corporate purpose.

- Minimum initial capital to be registered.

- Barbadian address

Important Tip: We always recommend having a preferred legal name and two alternatives in case the primary legal name is unavailable.

FAQs on company formation in Barbados

Answers to some of the most common questions we get asked by our clients.

Can a foreigner own a business in Barbados?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

How long does it take to register a company in Barbados?

On average, it takes about six weeks to incorporate a business in Barbados, and that’s not including the time it takes to set up a corporate bank account.

What does an SRL company name mean in Barbados?

It is a type of business entity where the liability of its members (shareholders) is limited to their contributions to the company’s capital. This means that the personal assets of the members are protected from the company’s debts and liabilities.

What does an RBC company name mean in Barbados?

A private limited company or corporation in Barbados is used for local business operations. It limits the liability of shareholders and is often chosen by those looking to operate within the domestic market. The company must have at least one director and one shareholder, who can be the same person.

What entity types offer Limited Liability in Barbados?

The LLC and RBC offer limited liability

Benefits of company formation in Barbados

- Has Double Tax Agreements with more than 40 countries

- No residency requirement for incorporation

- Well-educated, English-speaking labor force

- Shareholders/beneficiary details can be kept private

- Business-friendly environment

- Social, political and economic stability

The above list is not exhaustive. There are many more reasons why a company formation in Barbados would be a smart move for many foreign businesses and investors.

Top 6 reasons why foreign companies should consider company formation in Barbados

1. DTA treaties with most developed economies

Barbados has entered into Double Tax Agreements (DTAs) with many major economies. A DTA is a treaty between two or more nations that don’t subject individuals or companies to double taxation of income and property. Company formation in Barbados would likely be an attractive option for those countries which have DTAs in place with the island nation, including Canada, China, Finland, Germany, Norway, Sweden, Switzerland, the United Kingdom and the United States.

2. No residency required for Company formation in Barbados

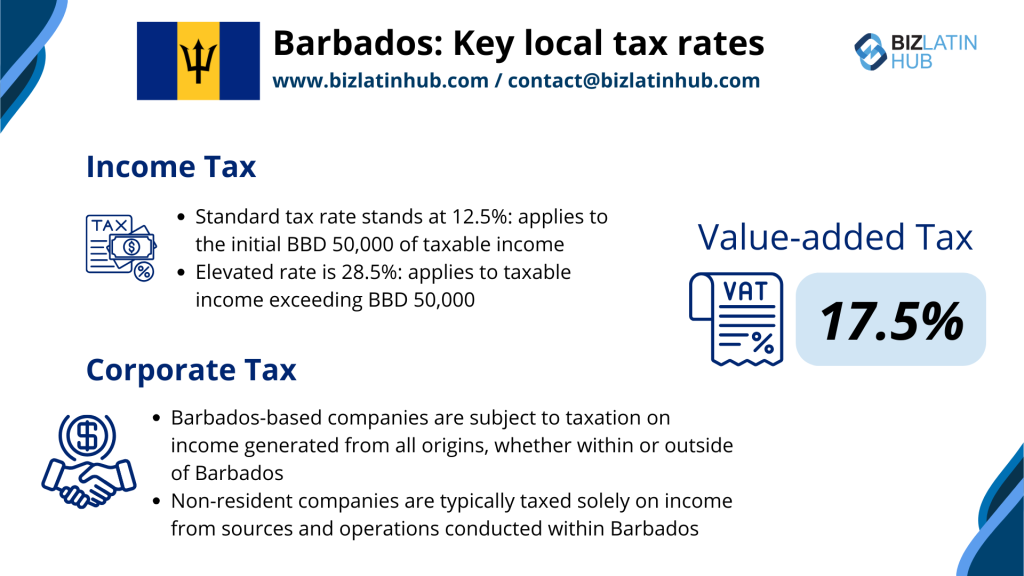

There are different sets of rules depending on what type of company one plans to form in Barbados, but unlike other jurisdictions, residing in Barbados is not required. In terms of location, a Barbadian business address (which may be that of your office) is all that is required to set up a company. Non-resident companies are subject to tax only on income generated on the island.

3. A highly skilled, English-speaking labor market

Just under 150,000 of the island’s 287,000 residents make up Barbados’s labor force. There are plenty of young, well-educated and highly skilled employees in the labor market, and that figure is growing. There is no shortage of Barbadian talent in the tech and services sectors, the majority of whom work in the corporate/financial services sector – in fact, just under 80 percent of Barbadians are employed in these sectors. And unlike other jurisdictions in the region, Barbados is an English-speaking country, so communication is not an issue.

4. Shareholder/beneficiary details can be kept private

Many countries in Latin America and the Caribbean require foreign investors and businesses to divulge details about their shareholders, beneficiaries, executives and managers, etc. Not so in the island nation. Company formation in Barbados will likely appeal to companies that wish to keep details about their senior leadership and shareholders confidential.

5. A business-friendly environment

Barbados offers a well-regulated, transparent, and supportive business environment for investors and company formation in Barbados. There are no restrictions on foreign ownership of businesses or real estate, and the government works to make it as easy as possible for you to do business on the island. Barbados ranked 128 out of 190 countries in the World Bank’s 2020 Ease of Doing Business Report, giving it a “Medium” grade in terms of doing business on the island.

6. A highly stable political system and economy

Barbados transitioned from the Commonwealth and became a sovereign republic in November 2021, but this had little-to-no social, political or economic impact on the country. It has a long tradition of democratic governance and well-established property rights, rule of law, and boasts low crime and low corruption rates. All these conditions make it a conducive jurisdiction for company formation in Barbados.

Biz Latin Hub can help you with company formation in Barbados

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivalled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about company formation in Barbados, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise doing business in Latin America and the Caribbean.

If this article about company formation in Barbados was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.