Company formation in Antigua and Barbuda offers investors access to a growing economy, a stable political environment, and a business-friendly framework. Therefore, starting a business in Antigua and Barbuda provides advantages such as strategic geographic location, competitive operating costs, and investor-centric policies. At Biz Latin Hub, we specialize in Caribbean business services, providing expert guidance to facilitate a smooth company formation process. This guide details the process for establishing an International Business Company (IBC), a vehicle offering significant tax advantages and operational flexibility.

Key Takeaways On Company Formation in Antigua and Barbuda

| Is Foreign Ownership Permitted? | Yes, 100% foreign ownership is allowed. |

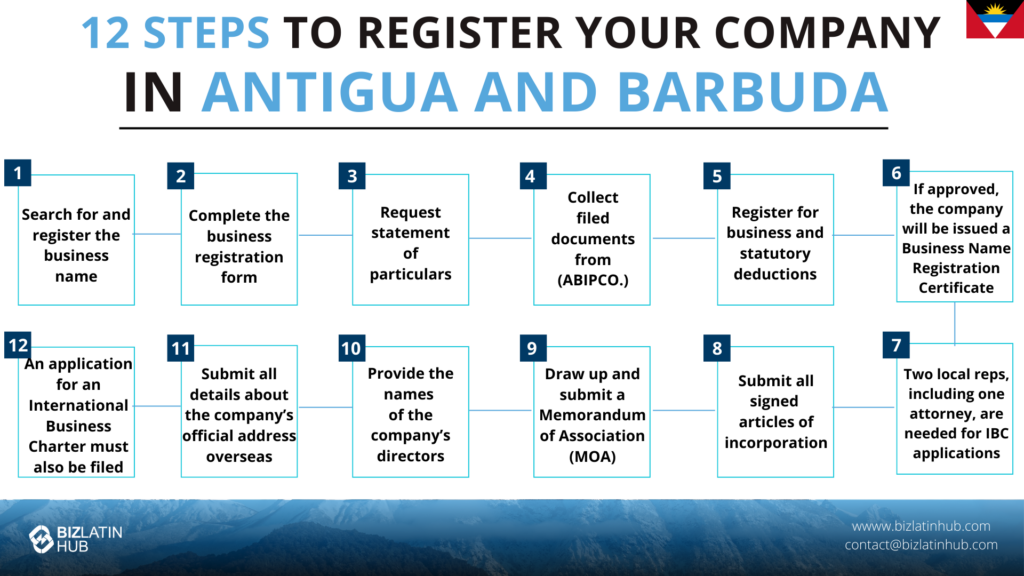

| Steps for Company Formation in Antigua and Barbuda: | Step 1 – Search for and register the business name. Step 2 – Complete the business registration form. Step 3 – Request statement of particulars. Step 4 – Collect filed documents from the Antigua and Barbuda Intellectual Property and Commerce Office (ABIPCO.) Step 5 – Register for business and statutory deductions. Step 6 – If approved, the company will be issued a Business Name Registration Certificate. Step 7 – Two company representatives who are both citizens and residents of Antigua and Barbuda are required to begin the IBC application process. At least one of those reps should be an attorney. Step 8 – Submit all signed articles of incorporation. Step 9 – Draw up and submit a Memorandum of Association (MOA). Step 10 – Provide the names of the company’s directors. Step 11 – Submit all details about the company’s official address overseas. Step 12 – An application for an International Business Charter must also be filed. |

| What Are The Common Entity Types In Antigua and Barbuda? | Private or public Limited Liability Companies (LLCs) Non-profit companies International Business Corporations (IBCs) |

| Why Incorporate a Company in Antigua and Barbuda? | International Business Corporations have no exchange controls, allowing free movement of funds in and out of the island. These companies are effective for international trade and investment. |

Company formation in Antigua and Barbuda: A 12-step guide

The following steps outline company formation in Antigua and Barbuda as well as International Business Corporation registration.

- Step 1 – Search for and register the business name.

- Step 2 – Complete the business registration form.

- Step 3 – Request statement of particulars.

- Step 4 – Collect filed documents from the Antigua and Barbuda Intellectual Property and Commerce Office (ABIPCO.)

- Step 5 – Register for business and statutory deductions.

- Step 6 – If approved, the company will be issued a Business Name Registration Certificate.

- Step 7 – Two company representatives who are both citizens and residents of Antigua and Barbuda are required to begin the IBC application process. At least one of those reps should be an attorney.

- Step 8 – Submit all signed articles of incorporation.

- Step 9 – Draw up and submit a Memorandum of Association (MOA).

- Step 10 – Provide the names of the company’s directors.

- Step 11 – Submit all details about the company’s official address overseas.

- Step 12 – An application for an International Business Charter must also be filed.

Expert Tip: Beneficial Ownership Declaration

From our experience, while Antigua offers confidentiality, it strictly adheres to international compliance standards. You must provide a “Declaration of Beneficial Ownership” to your local registered agent. This information is kept at the registered office and is not public, but it must be accurate and up-to-date. Failure to provide complete due diligence on the ultimate owners will stall the incorporation process with the service provider immediately.

Company Formation in Antigua and Barbuda: 3 Types of Business Structures.

- Private or public Limited Liability Companies (LLCs) – Antigua and Barbuda-based companies that do business on the islands. Owners, directors and/or shareholders enjoy limited liability for the debts and obligations of the LLC.

- Non-profit companies – A non-profit organization must have one of the following focuses to qualify: patriotic, religious, philanthropic, charitable, educational, scientific, literary, historical, artistic, social, professional, fraternal, sport or athletics.

- International Business Corporations (IBCs) – Companies or investors that set up a subsidiary of their global operations in Antigua and Barbuda. This can be a physical or on-paper-only presence. These entities are free to do business internationally without limitations on international money transfers.

Businesses that do business/generate profits in the domestic market are subject to a 25-percent income tax rate. For this article, we will focus on the type of company where the real attraction lies – IBCs.

Also known as offshore companies, global corporations or investors domiciled in Antigua and Barbuda as an IBC enjoy several perks.

What are the Advantages of registering an IBC in Antigua and Barbuda?

Investors, companies, and/or multinational corporations that register in the island nation as an IBC will enjoy the following benefits:

- IBCs can conduct international business with no limits on where the corporation moves its money

- No tax obligation in Antigua and Barbuda

- No requirement to file accounts

- Company ownership is not publicly disclosed

- IBCs have the option to establish a physical office in Antigua

- IBCs are free to bank anywhere

- Tax exemption for business-related customs and duties

There are even more goodies on offer for foreign investors who don’t mind making a larger footprint on the island nation. Aside from company formation in Antigua and Barbuda, foreigners who invest USD$100,000 or more on the island are entitled to apply for dual citizenship. By purchasing a home or other property, contributing to the state university fund or making any kind of business investment, the investor and their dependents are all eligible to become citizens of Antigua and Barbuda.

And since there is no wealth or inheritance tax or capital gains tax on any global income, the investor’s children and other family members can receive their inheritance tax-free.

The Role of ABIPCO

The Antigua and Barbuda Intellectual Property and Commerce Office (ABIPCO) is the government registry. All incorporation documents for both domestic and international companies must be filed here to gain legal status.

Frequently asked questions when incorporating a company in Antigua and Barbuda

According to our experience, these are the most common questions that our clients have when incorporating a company in Antigua and Barbuda.

1. Can a foreigner have a business in Antigua and Barbuda?

Yes, foreigners can own and operate businesses in Antigua and Barbuda. The country welcomes foreign investment and offers various options for foreign entrepreneurs to establish businesses.

2. What is the Antigua Barbuda Company Tax ID?

The Antigua Barbuda Company Tax ID is often referred to as the Tax Identification Number, which is obtained by completing forms CB001 and F16 to apply for a TIN.

3. How long does it take to register a company in Antigua and Barbuda?

Once the service provider has all due diligence documents, the actual incorporation at ABIPCO can be completed in as little as 24 hours.

4. What is the meaning of an LLC company in Antigua and Barbuda?

In Antigua and Barbuda, an LLC stands for ‘Limited Liability Company’. An LLC is a legal entity that combines elements of both a corporation and a partnership, providing its members with limited liability protection and flexibility in management.

5. What types of entities offer limited liability in Antigua and Barbuda?

Several business entities in Antigua and Barbuda can provide limited liability to their owners, including companies limited by shares, limited liability companies, and International Business Companies (IBCs).

6. What are the main characteristics of an LLC in Antigua and Barbuda?

The main characteristics of an LLC in Antigua and Barbuda typically include:

- Limited liability for its members.

- Flexibility in management structure.

- Pass-through taxation, where income is reported on the member’s tax returns.

- Simplicity in formation and maintenance.

- Ability to be used for various business purposes.

7. What are the main sectors targeted for investment in Antigua and Barbuda?

The industries eligible for Concessions under the revised Antigua and Barbuda Investment Authority Act of 2019 encompass a diverse range, including Agriculture, Fisheries & Agri-business, Business Process Outsourcing, Creative Industry, Energy, Financial Services, Health & Wellness, ICT, Manufacturing, and Tourism.

8. What are the tax benefits of an IBC?

Antigua IBCs are generally exempt from corporate tax, withholding tax, and capital gains tax on income generated outside of Antigua for a period of 50 years.

9. Is an annual audit required?

Generally, IBCs do not require an annual audit unless they are in a regulated industry like banking or insurance. However, they must keep financial records.

10. Can I be the sole director and shareholder?

Yes, a single person can hold both roles. Corporate directors are also permitted.

Why Choose to Incorporate a Comapny in Antigua and Barbuda?

The economy of Antigua and Barbuda grew by over 5% in 2023 with the tourism and construction sectors providing strong returns. When this growth is combined with the strong investor protection offered by the local legal system, the attraction of company formation in Antigua and Barbuda is clear.

Another enticing reason for investors is that company formation in Antigua and Barbuda is a relatively straightforward process.

Biz Latin Hub can help you with company formation in Antigua and Barbuda

At Biz Latin Hub, our multilingual team of company formation specialists has broad experience supporting foreign executives starting businesses throughout Latin America and the Caribbean. We have offices in over 16 countries in the region and trusted partners in many more. With our strong track record of providing comprehensive back-office services to foreign investors — including legal, accounting, and recruitment support — we are ready to help you achieve your business goals in Antigua and Barbuda.

Reach out to us now for personalized assistance in opening a company in Antigua and Barbuda.

Learn more about the region and our team and expert authors.