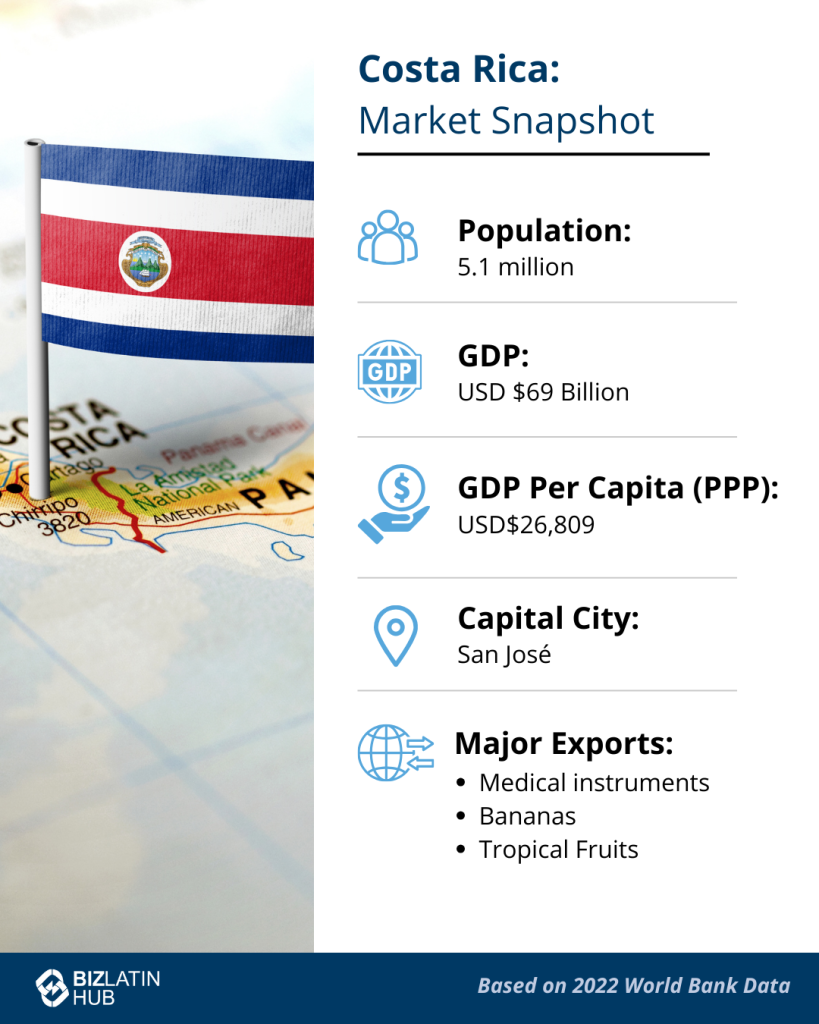

Operating a company in a Free Trade Zone in Costa Rica can provide significant cost savings. Better still, it also facilitates agile logistics and access to skilled labor. In addition, if you register a company in Costa Rica you benefit from a stable political environment and well-developed infrastructure. This will further enhance your competitiveness in the global marketplace.

For decades, Costa Rica has implemented policies aimed at attracting international companies, and it is safe to say that these initiatives have been overwhelmingly successful. One of the main strategies employed by this Central American nation to attract international companies, both large and small, is allowing the establishment of a company in a Free Trade Zone in Costa Rica.

The zones offer a number of attractive benefits for both foreign and local investors (.pdf). For example, there are tax incentives and import duty exemptions. Key policies such as this make them very attractive places to do business. Certain business sectors are particularly encouraged within these special economic areas, including service provision under certain conditions.

In summary, establishing a company in a Free Trade Zone in Costa Rica represents a strategic opportunity for companies looking to expand their international presence and take advantage of the many benefits offered by Costa Rica’s business-friendly policies and favorable economic climate. Biz Latin Hub can help you set up shop and support you doing business over the years to come.

Company in a Free Trade Zone in Costa Rica: Industries That Flourish

There are over 40 FTZ parks in the country, especially around the Greater Metropolitan Area (GMA), near San José. However, given Costa Rica’s privileged position on both the Caribbean and the Pacific Oceans, FTZ parks can also be found near the main ports.

Some of the most common fields include:

- Aerospace engineering.

- Automotive parts manufacturing.

- Biotechnology.

- Consumer electronics.

- Electronic components assembly.

- Machine repair/maintenance.

- Medical devices.

- Metal work.

- Pharmaceuticals.

- Renewable energy.

- Software development.

- Telecommunications.

Merchandise of every description may be held in FTZs, so if you are not in one of the industries listed above, fear not. For companies that want to be in a Free Trade Zone in Costa Rica, there may be a specialized zone out there that caters to your particular industry.

Costa Rica is making a huge effort on several fronts to be considered a pioneer in FTZ parks. Factors such as an increasing development of local technology work hand in hand with the overall sustainable policies. This means that Costa Rica’s FTZ parks have been the recipients of several awards.

Furthermore, Costa Rica just passed legislation allowing international businesses that work outside an FTZ but within the Greater Metropolitan Area to apply to be categorized as a company in a Free Trade Zone in Costa Rica. Companies operating both outside an FTZ and the GMA may also apply to receive FTZ status, so long as they meet all the requirements.

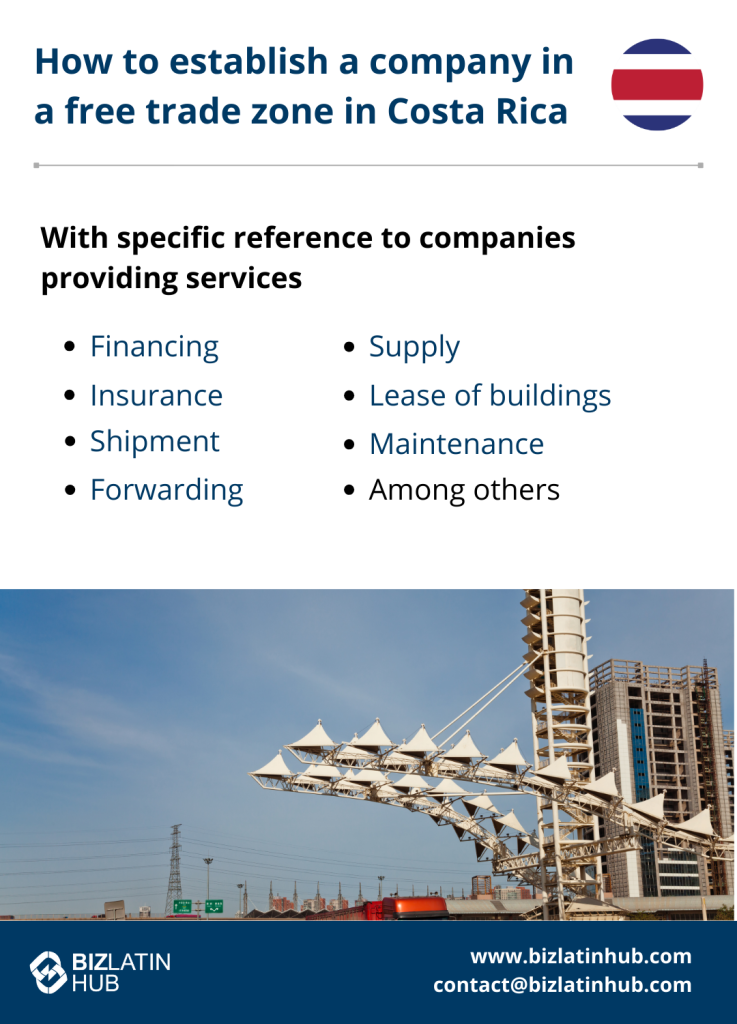

There is also another avenue for companies that work in service provision. For certain services, such as the ones listed in the picture below, outsourcing is possible under the law, as long as those are not given to companies within Costa Rica and outside a FTZ. For those that want to work within the purely international market, there are much fewer restrictions.

8 Benefits of Operating a Company in a Free Trade Zone in Costa Rica

Costa Rica’s Free Trade Zone scheme grants beneficiary companies a wide range of benefits, including:

- Full exemption on import duties on raw materials, machine components and other goods for up to 12 years.

- Full exemption on corporate income tax.

- Full income tax exemption for an eight-to-10-year period.

- Tax exemptions on domestic purchases of goods and services.

- Full exemption on export taxes, local sales tax and VAT.

- No restrictions on capital/profit repatriation or foreign currency management.

- Expedited on-site customs clearance.

- Possibility to sell to exporters within Costa Rica.

The zones are overseen by the export organization PROCOMER, which is part of the Costa Rican Ministry of Foreign Trade. Their Free Zone guide spells out all the rules, regulations, minimum requirements and prohibited activities for a company in a Free Trade Zone in Costa Rica.

Types of companies permitted to operate in a Free Trade Zone in Costa Rica

Here are some of the types of companies permitted to operate in a free trade zone in Costa Rica:

- Trading companies are permitted, as long as they do not produce goods, but rather simply manipulate, repackage, or redistribute non-traditional products for export.

- Companies that provide services to people or companies domiciled in Costa Rica, abroad or to other companies in an FTZ.

- Administrators, and/or companies that are dedicated to the administration of parks and office spaces, etc., for other companies operating in an FTZ.

- Manufacturers that transform raw material into finished or semi-finished products.

What are the FTZ requirements?

To form a company in a free trade zone in Costa Rica you must follow these requirements:

- A minimum investment requirement of between USD$100,000 and USD$2,000,000 depending on the company’s location and type of economic activity.

- Minimum of USD$10 million investment for commercial activity deemed to be a megaproject, regardless of the location.

- Employment of at least 15 employees on payroll. Manufacturing companies require maintaining a minimum of at least 200 employees on the payroll at the start of productive operations. Megaprojects must maintain at least 100 employees on the payroll.

- All companies must keep detailed and accurate records of the operations of the company related to the goods they produce or handle.

- Payment of monthly fee to the Foreign Trade Agency of Costa Rica, starting at $200 USD and going up, according to the type of company operating in an FTZ.

- Companies submit an annual report proving that the entity is fulfilling all the rules and regulations outlined in the Free Trade Zone guide.

- A fixed assets book and policy must be kept at hand and updated on a monthly basis.

- For a service operator, they must belong to a strategic sector, comply with a new investment and be exempt from income tax. They must also comply with the strategic eligibility index for services, which assesses wage outlay against investments in fixed assets.

Are any commercial activities prohibited in Costa Rica’s FTZs?

Yes. In order to operate in a free trade zone in Costa Rica, you must avoid the following activities:

- Mining extraction.

- Exploration or extraction of hydrocarbons.

- Production or commercialization of weapons and ammunition containing depleted uranium.

- Companies that are dedicated to the production or commercialization of any type of weapons.

- Companies that are dedicated to the generation of electrical energy, unless the generation is for self-consumption.

- Banking, financial and insurance services.

- Natural or legal persons dedicated to providing professional services.

FAQs on Free Trade Zone in Costa Rica

Yes, foreign companies can operate a company in a Free Trade Zone in Costa Rica by following the designated registration procedure and fulfilling regulatory requirements.

A minimum investment requirement of between USD$100,000 and USD$2,000,000 depending on the company’s location and type of economic activity.

Full exemption on corporate income tax.

Full income tax exemption for an eight-to-10-year period.

Tax exemptions on domestic purchases of goods and services.

Full exemption on export taxes, local sales tax and VAT.

Yes. In order to operate in a free trade zone in Costa Rica, you must avoid the following activities:

Mining extraction.

Exploration or extraction of hydrocarbons.

Production or commercialization of weapons and ammunition containing depleted uranium.

Companies that are dedicated to the production or commercialization of any type of weapons.

Companies that are dedicated to the generation of electrical energy, unless the generation is for self-consumption.

Banking, financial and insurance services.

Natural or legal persons dedicated to providing professional services.

Yes, but under some conditions. They must belong to a strategic sector, comply with a new investment and be exempt from income tax. They must also comply with the strategic eligibility index for services, which assesses wage outlay against investments in fixed assets.

Biz Latin Hub can help you start a company in a Free Trade Zone in Costa Rica

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in San José as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivalled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about companies entering a Free Trade Zone in Costa Rica, our portfolio of services includes hiring & PEO accounting & taxation, company formation, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top tech talent, or otherwise do business in Latin America and the Caribbean.

If this article about companies entering a Free Trade Zone in Costa Rica was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.