Closing a company in Mexico requires a structured legal process that varies depending on whether the business is solvent or insolvent. In this 2025 guide, we explain how to liquidate a company in Mexico through voluntary dissolution or judicial insolvency, based on the latest legislation. We also outline each step involved in the liquidation process, from shareholder resolution to tax cancellation, and provide expert insights to help businesses exit the market efficiently and compliantly.

Key Takeaways on How to Liquidate Your Company in Mexico

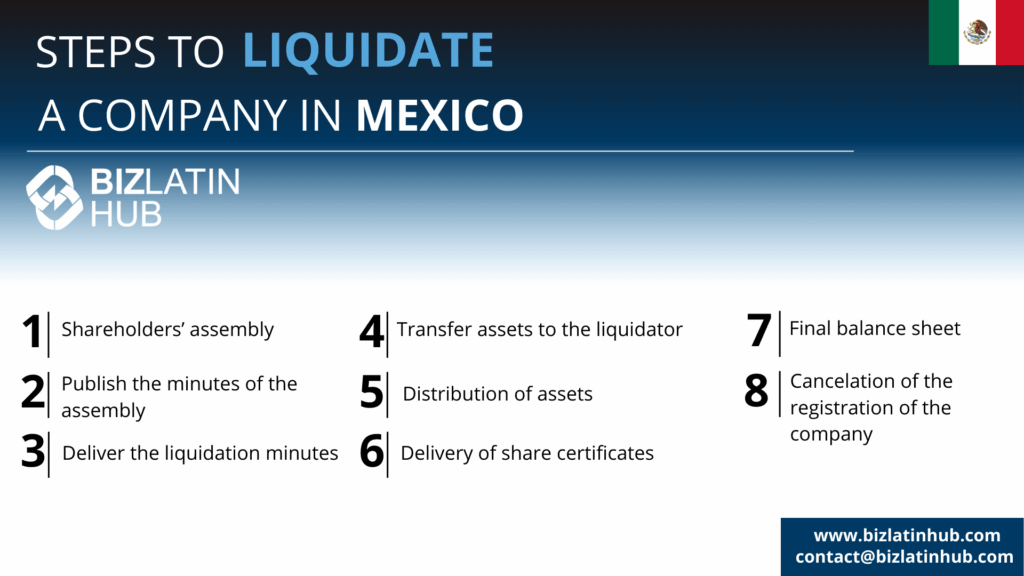

| 8 Steps to liquidate a company in Mexico | Step 1 – Shareholders’ assembly Step 2 – Publish the minutes of the assembly Step 3 – Deliver the liquidation minutes Step 4 – Transfer assets to the liquidator. Step 5 – Distribution of assets Step 6 – Delivery of share certificates Step 7 – Final balance sheet Step 8 – Cancelation of the registration of the company |

| What is the timeframe needed to liquidate a company in Mexico? | The liquidation process will normally take between one and two years. |

| What are the reasons to liquidate a company in Mexico? | These vary, but the key point is to stay compliant and in good standing with the authorities. |

| What causes involuntary liquidation in Mexico? | Legal proceedings can be initiated by one of your creditors when you can no longer repay your debts. |

What is the liquidation procedure in Mexico?

The liquidation procedure in Mexico must follow a structured legal sequence under the General Law of Commercial Companies (LGSM). Below are the eight formal steps for voluntary liquidation, which must be executed and documented accordingly.

Step 1 – Shareholders’ Assembly

Shareholders convene and vote to dissolve the company and begin liquidation. A resolution is passed, and one or more liquidators are appointed to manage the process.

Step 2 – Publish the Minutes of the Assembly

The notarized minutes are published in the Electronic System of Public Commercial Publications (PSM) and/or a local newspaper to notify third parties and creditors of the pending liquidation.

Step 3 – Deliver the Liquidation Minutes

Submit the liquidation agreement and liquidator appointment to the Public Registry of Commerce. This makes the liquidation legally enforceable and allows the liquidator to act on behalf of the company.

Step 4 – Transfer Assets to the Liquidator

The liquidator receives control over all company assets, including physical goods, bank accounts, and receivables. These assets are used to pay outstanding debts and obligations.

Step 5 – Distribution of Assets

The liquidator sells company assets, settles debts with creditors, and distributes any remaining funds to shareholders. Zero-debt certificates should be secured from tax authorities and social security institutions.

Step 6 – Delivery of Share Certificates

Shareholders surrender their original share certificates, which are annulled or archived by the liquidator to finalize the dissolution of ownership.

Step 7 – Final Balance Sheet

A final liquidation balance is prepared and approved by shareholders. It must summarize all liquidation activities and remaining accounts.

Step 8 – Cancelation of the Registration of the Company

Submit deregistration forms to the Public Registry of Commerce and request the RFC cancellation from the Tax Administration Service (SAT). Final tax returns must be filed, and legal and accounting records must be retained for 10 years.

Expert Tip: RFC cancellation is critical. Failing to deregister with SAT may expose shareholders to ongoing tax obligations even after the business has ceased activity.

What does it mean to liquidate a company?

Liquidation is the formal legal process of closing a business entity in Mexico. It involves settling debts, distributing any remaining assets, and officially dissolving the legal registration of the company. The process can be voluntary (initiated by shareholders) or court-mandated due to insolvency. Proper liquidation protects stakeholders, ensures tax compliance, and avoids penalties or long-term liabilities for inactive entities.

Insolvency procedures

All insolvency proceedings are governed by Mexican Commercial Bankruptcy Law (LCM). Legal proceedings can be initiated by one of your creditors when you can no longer repay your debts. You will then be considered as the debtor company. The Federal Institute of Specialists in Commercial Bankruptcy Proceedings will be the main authority in these procedures.

Insolvency proceedings consist of two steps: conciliation and bankruptcy. Conciliation has a statutory conciliation time frame of 185 days once the judge’s ruling (beginning of the insolvency procedure) is published in the Mexican Federal Official Gazette. It’s during this conciliation period that you may prove your solvency and express your desire to continue operating.

During the conciliation phase, the debtor must either try to reach an agreement with its creditors or carry out a reorganization plan. If a reorganization agreement is reached, then the judge issues a resolution. If it approves the agreement, the proceedings are terminated. If no agreement is reached between the two parties, it is then possible to establish a reorganization plan without the vote of all creditors. Only when if certain mandatory conditions and specific percentages of votes are respected, according to the texts of the LCM.

Reorganization agreement and plan

- A reorganization agreement is entered into in the event of insolvency procedure when you liquidate a company in Mexico. This agreement must be found between the company (debtor) and the creditors and aims to avoid the bankruptcy or liquidation of the company (debtor).

A private conciliator, designated by both parties, will consequently take the role of intermediary between the two parties. During this conciliation period, the aim will be to preserve the operation of the company (debtor). This agreement must contain reorganization plan. - A reorganization plan, therefore, follows a reorganization agreement between the company (debtor) and the creditors. A reorganization plan describes the process of modifying a business to help it pay its debts and receivables and thus continue its activity.

General Corporations Law reform

Recent updates to the General Law of Commercial Companies (Ley General de Sociedades Mercantiles) streamline corporate governance procedures in Mexico. These reforms clarify responsibilities during dissolution and liquidation, giving more legal certainty to shareholders and liquidators. For instance, electronic filings and standardized shareholder resolutions are now accepted in more jurisdictions, helping to reduce administrative delays.

A more straightforward procedure: liquidate a company in Mexico voluntarily

New, simplified steps for voluntary liquidation include:

- Step 1 – Carry out a shareholders’ assembly to define the resolutions of the liquidation and appoint the liquidators.

- Step 2 – Publish the minutes of the assembly in the publication of commercial entities website (Publicaciones de Sociedades Mercantiles or PSM); no need to formalize them before a notary public.

- Step 3 – With the authorization of the Mexican Ministry of Economy, deliver the liquidation minutes in the Public Registry of Commerce.

- Step 4 – All the company’s assets, property, records, and documents are transferred to the liquidator.

- Step 5 – Distribution by the liquidator of the remaining assets to the shareholders, according to their shares.

- Step 6 – Delivery of share certificates to the liquidator by all shareholders.

- Step 7 – The liquidator publishes the final balance sheet of the company in the PSM.

- Step 8 – The Mexican Ministry of Economy will submit the cancelation of the registration of the company in the Public Registry of Commerce and notify the Mexican tax authorities of it.

FAQs for Liquidating an entity in Mexico

Based on our extensive experience these are the common questions and doubts of our clients when liquidating a local entity in Mexico.

1. What is the process of liquidation in Mexico?

- Step 1 – Carry out a shareholders’ assembly to define the resolutions of the liquidation and appoint the liquidators.

- Step 2 – Publish the minutes of the assembly in the publication of commercial entities website (Publicaciones de Sociedades Mercantiles or PSM); no need to formalize them before a notary public.

- Step 3 – With the authorization of the Mexican Ministry of Economy, deliver the liquidation minutes in the Public Registry of Commerce.

- Step 4 – All the company’s assets, property, records, and documents are transferred to the liquidator.

- Step 5 – Distribution by the liquidator of the remaining assets to the shareholders, according to their shares.

- Step 6 – Delivery of share certificates to the liquidator by all shareholders.

- Step 7 – The liquidator publishes the final balance sheet of the company in the PSM.

- Step 8 – The Mexican Ministry of Economy will submit the cancelation of the registration of the company in the Public Registry of Commerce and notify the Mexican tax authorities of it.

2. How long does it take to liquidate a company in Mexico?

The liquidation process will normally take between (12) and (20) months, assuming the entity is in good standing and no rectification work is required.

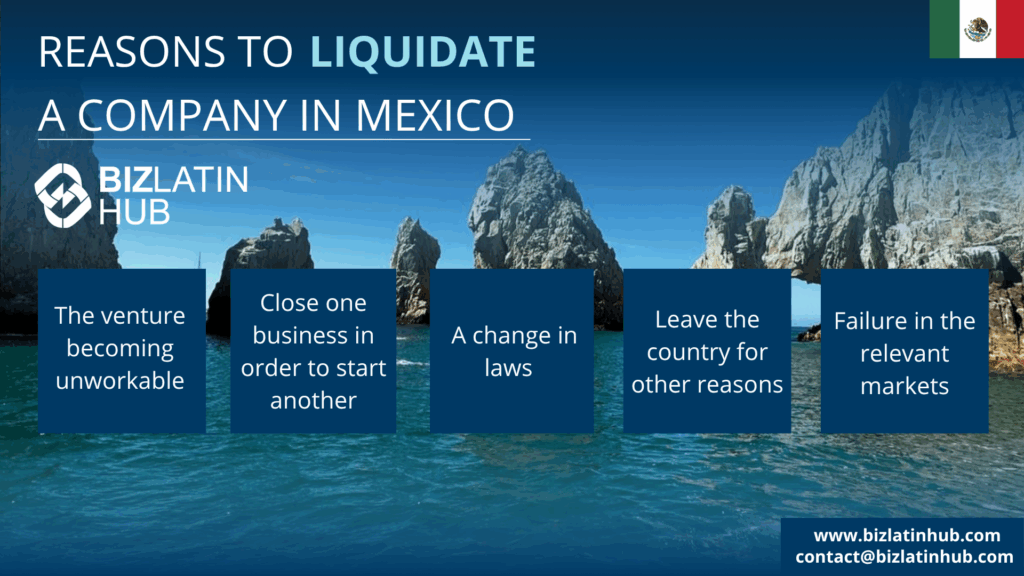

3. What are the reasons to liquidate a company in Mexico?

There are a number of reasons you may do so, such as the venture becoming unworkable, a change in laws or simple failure in the relevant markets. You may wish to close one business in order to start another or you may want to leave the country for other reasons. For whatever reason you eventually decide to liquidate a company in Mexico, it is best to do so in accordance with the law.

4. Can you be forced to liquidate a company in Mexico?

Yes, under certain circumstances. All insolvency proceedings are governed by Mexican Commercial Bankruptcy Law (LCM). Legal proceedings can be initiated by one of your creditors when you can no longer repay your debts. You will then be considered as the debtor company. The Federal Institute of Specialists in Commercial Bankruptcy Proceedings will be the main authority in these procedures.

5. What is the liquidation process in Mexico?

It involves eight legal steps: shareholder assembly, public notice, filing minutes, transferring and liquidating assets, settling debts, returning share certificates, preparing the final balance, and deregistering with SAT and the commercial registry.

6. How long does it take to liquidate a company in Mexico?

Voluntary liquidation usually takes 6 to 12 months, assuming all filings and compliance matters are in order. Delays may arise from missing tax certificates or pending employee claims.

7. Can a company be forced into liquidation in Mexico?

Yes. Insolvency procedures can be triggered by unpaid creditors through court action under the Ley de Concursos Mercantiles. This judicial path is typically more complex and time-consuming.

8. What documents are needed to cancel the RFC?

You’ll need the final liquidation balance, assembly resolution, tax compliance certificates, and the SAT’s specific deregistration forms. A certified accountant should manage this step.

9. What’s the difference between voluntary liquidation and insolvency?

Voluntary liquidation is company-initiated, orderly, and applies when assets exceed liabilities. Insolvency is court-supervised and triggered when a company can no longer meet its financial obligations.

10. How long must records be kept after liquidation?

Companies are legally required to retain books and accounting records for 10 years after liquidation is finalized.

Work with local experts to simplify liquidation in Mexico

Biz Latin Hub specializes in legal entity dissolution, voluntary liquidation, and tax deregistration processes across Mexico. Our bilingual legal and accounting teams ensure full compliance with the General Corporations Law, SAT obligations, labor requirements, and public registry filings.

Whether you’re winding down a subsidiary or exiting the Mexican market, we help you close cleanly and avoid ongoing liabilities.

Contact us today to speak with a local legal expert.