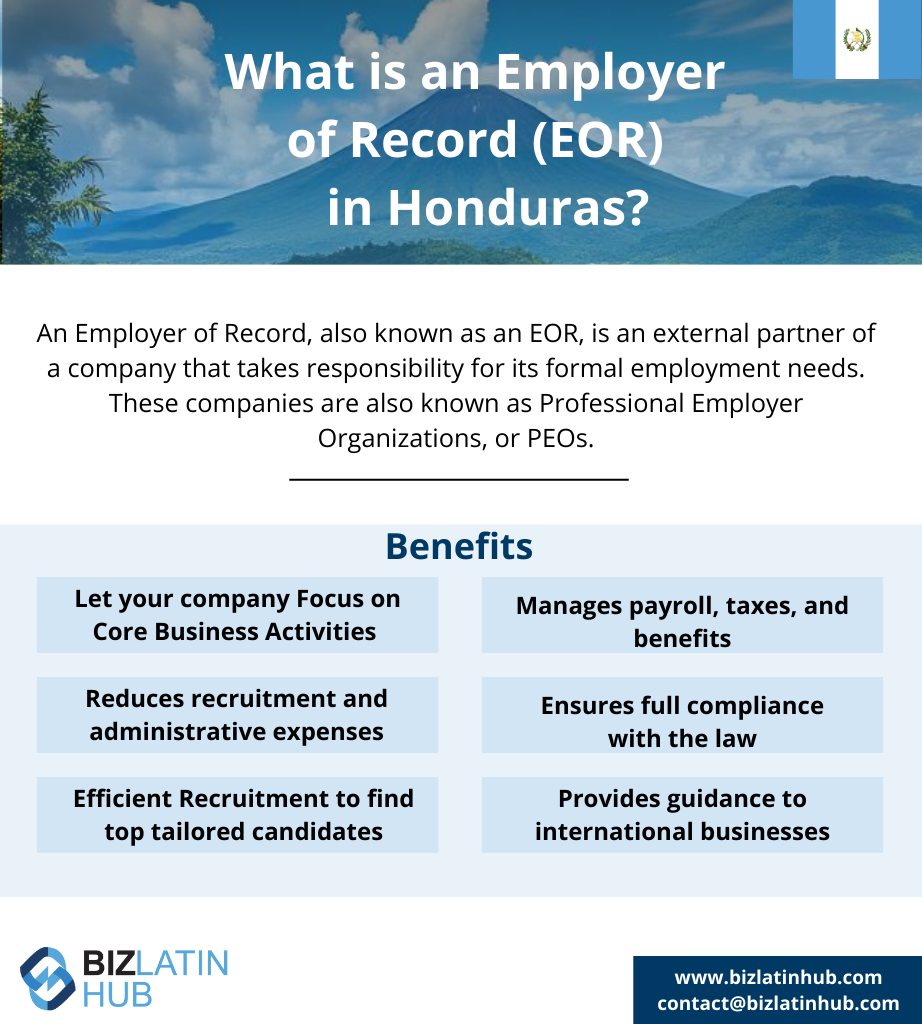

An Employer of Record (EOR) in Honduras can also be known as a professional employer organization (PEO), and one of the most common services they provide is payroll outsourcing. Payroll outsourcing in Honduras involves the EOR only managing the payroll of staff, meaning that you will retain full control over their schedules and duties while avoiding the need to go through company formation in Honduras. Biz Latin Hub can help with any of this, as well as company formation in the future if you so wish.

Key Takeaways

| Is it legal to hire in Honduras through EOR services? | Hiring through EOR services are legal in Honduras. |

| What are the benefits of hiring through an EOR in Honduras? | Hiring through a PEO in Honduras enables rapid market entry without requiring a local entity, allowing businesses to concentrate on scaling operations. |

| Steps to hire through a EOR in Honduras | Sign an agreement with the EOR service provider. Confirm the employment offer for the identified candidate. Deliver the employment offer to the candidate. Once the candidate accepts, the EOR drafts and finalizes the employment contract. The candidate reviews and signs the contract. The EOR completes all necessary employee registrations with Honduran authorities. The employee begins work, reporting directly to the hiring foreign company. |

| Why employ Honduran workers? | Hiring employees in Honduras allows businesses to tap into a skilled and cost-effective workforce in a matter of days without the hassle of onboarding. |

What Does an Employer of Record in Honduras do?

An employer of record in Honduras will hire staff on your behalf via its locally registered entity. While those workers will officially be employees of the EOR, they will report directly to you, and you will have total control over their duties and schedules. As such, they will effectively be your employees.

The upshot of that arrangement is that you will have local staff in only the time it takes to find them, while your exit from the market can be completed in just the time it takes for a statutory termination period to be completed.

An employer of record in Honduras will also have an established recruitment network, meaning that they will be ideally placed to lead the hiring process, and offer valuable advice about the strengths of different candidates’ profiles.

As part of payroll outsourcing in Honduras — which could be the entire service you contract them for or a part of it — the EOR will also guarantee the timely payment of salaries and oversee deductions from salaries and employer contributions, guaranteeing compliance with the law and maintaining your good standing in the market.

Your employer of record in Honduras will generally provide its services on a cost-per-employee basis, which can be significantly less costly than establishing and maintaining your own local entity.

Benefits of Hiring Via an Employer of Record in Honduras

The benefits of hiring via an EOR in Honduras include:

Reduced commitment: When you hire via an employer of record in Honduras, you minimize your commitment to the market, providing you with the chance to build familiarity ahead of a deeper investment, and withdraw at short notice and limited cost.

Local connections: Your EOR in Honduras will have a wealth of local knowledge and connections that could be beneficial to your business, not only during the recruitment process, but also when it comes to identifying new partners and providers.

Cost efficiency: While working with an employer of record comes with a fee, that will often be lower than the cost involved in company formation and liquidation, and handling the likes of payroll and compliance in-house.

Time-saving: Hiring via an employer of record in Honduras means getting staff quickly. That can be weeks, or even just days, depending on the profile of the person being hired.

Service options: When you work with an EOR, you can choose from a broad range of services, which start with payroll outsourcing in Honduras, and extend to include recruitment support, as well as assistance with the onboarding and offboarding processes.

When you choose a provider that offers a broader range of back-office services, they can also support you if you subsequently decide to deepen your engagement in the market through the likes of company formation.

How to Partner With an Professional Employer Organization in Honduras?

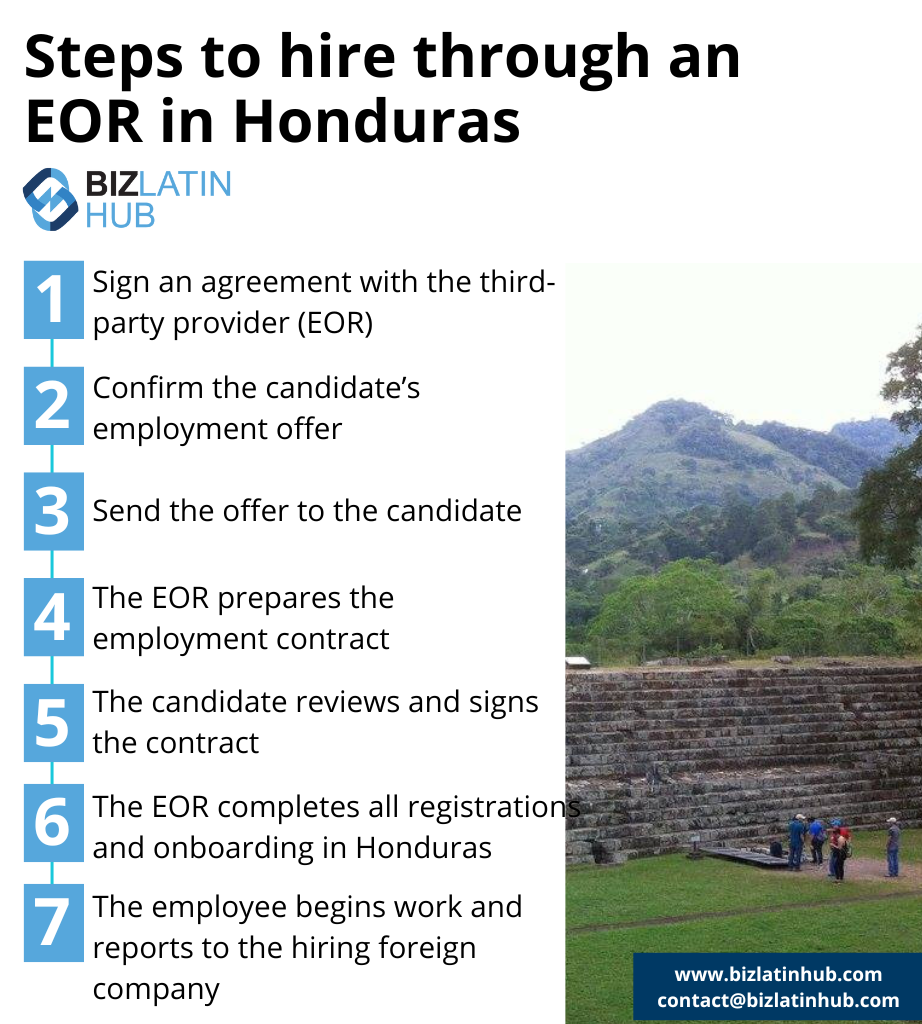

To partner with an Employer of Record (EOR) in Honduras, the hiring company signs an agreement with a third-party provider that becomes the official employer for the staff they wish to hire. This arrangement makes the EOR fully responsible for ensuring compliance with Honduran labor laws, handling all employment documentation, and meeting local regulatory requirements.

This setup simplifies the hiring process for foreign companies, removing the complexities of navigating Honduras’s employment regulations. It reduces the risk of legal non-compliance, allowing the company to focus on business expansion and growth in the Honduran market.

The process of hiring through an EOR in Honduras is clear and follows these steps:

- Sign an agreement with the EOR service provider.

- Confirm the employment offer for the identified candidate.

- Deliver the employment offer to the candidate.

- Once the candidate accepts, the EOR drafts and finalizes the employment contract.

- The candidate reviews and signs the contract.

- The EOR completes all necessary employee registrations with Honduran authorities.

- The employee begins work, reporting directly to the hiring foreign company.

EOR vs. PEO in Honduras – What’s the Difference?

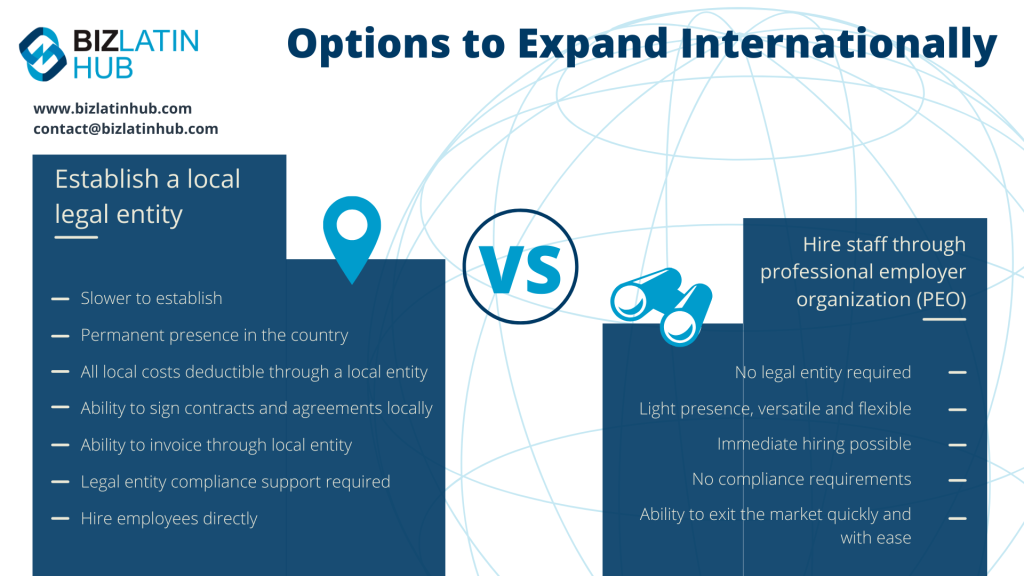

When expanding into Honduras, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR services are legal in Honduras.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms. In Honduras specifically, an EOR can also be known as a PEO.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Honduras. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate Honduras’ labor regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

What Labor Laws Will an Employer of Record in Honduras Involve?

A PEO is also able to offer support with your market incorporation, providing legal and accounting advice. Likewise, an employer of record in Honduras is responsible for compensating staff in the event of resignation, dismissal, or retirement. Note that a PEO is also in charge of paying staff severance, unused vacations, and any other required payments.

Some of the key elements are:

Employee Probation Period: During the initial assessment phase, a probationary period not exceeding 60 days is observed.

Working Hours: Typically, the duration of work per day should not surpass eight hours, and the cumulative weekly limit is 44 hours. For individuals working night shifts, the weekly workload must not exceed 36 hours. For those working a combination of day and night shifts, the upper limit stands at 42 hours per week.

Annual Leave in Honduras: The allocated minimum vacation duration for employees under the Honduran jurisdiction is as outlined:

- 10 days of vacation following the completion of the first year of employment

- 12 days after the second year

- 15 days following three years of service

- 20 working days for a tenure of four years or more.

Sick Leave: Employees have the right to receive paid sick leave when facing short-term incapacitation due to an occupational accident. This compensation is granted at a rate of two paid sick days per month within the initial 12 months of employment and subsequently at a rate of four paid sick days per month. The cumulative allowance extends to a maximum of 120 paid sick days.

Maternity Leave: As stipulated by the Labor Code, employees are entitled to a span of 10 weeks or 70 days for paid maternity leave. To receive this benefit, a worker is required to provide the employer with a medical certificate detailing the pregnancy, anticipated delivery date, and the intended commencement date of the maternity leave. This period encompasses 4 weeks preceding the birth and 6 weeks succeeding it.

How to Use a Payroll Calculator

If you want to get an idea of the possible costs involved in payroll outsourcing in Honduras, using a payroll calculator is one way to get a good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to evaluate options while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

- Step 1: Select the country.

- Step 2: Select the currency you wish to deal in.

- Step 3: Indicate an employee’s monthly income.

- Step 5: Compare your costs to other options.

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Pound Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Honduras would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs on an Employer of Record (EOR) in Honduras

Based on our extensive experience these are the common questions and doubts of our clients on hiring through an employer of record in Honduras:

1. How does one hire employees in Honduras?

You can hire an employee by incorporating your own legal entity in Honduras, and then using your own entity to hire employees or you can hire through an employer of record (EOR), which is a third party organization that allows you to hire employees in Honduras by acting as the legal employer. With an employer of record in Honduras you do not need your own legal entity to hire local employees.

2. What is in a standard employment contract in Honduras?

A standard Honduras employment contract should be written in Spanish (and can also be in English) and must contain the following information:

- ID and address of the employer and employee.

- City and date.

- The location where the service will be provided.

- Type of tasks to be carried out.

- Remuneration and bonifications/commissions (if applicable).

- Method payment frequency.

- Duration of the contract.

- Probation period.

- Work hours.

- Additional benefits (if applicable).

3. What are the mandatory employment benefits in Honduras?

The mandatory employment benefits in Honduras are the following:

- Working tools necessary to carry out the work (if applicable).

- Payment of social security contributions (health, pension, and labor risks).

- Social benefits (severance pay, Christmas bonus, maternity, or paternity leave, mid year bonus).

- Paid time-off (vacation and a day off).

- Transportation allowance (if applicable).

- Overtime and surcharges (if applicable).

For more information on mandatory employment benefits read our recent article on employment laws in Honduras.

4. What is the total cost for an employer to hire an employee in Honduras?

The total cost for an employer to hire an employee in Honduras can vary based on the salary; however, indicatively the employer cost for mandatory employment benefits is 15.37% to percent of the gross employee salary and benefits.

Please use our Payroll Calculator to calculate employment cost.

5. How does the process of forming a legal entity differ from hiring through an EOR?

Forming a legal entity is different to hiring an EOR in the following ways:

- It is more time-consuming.

- Creates a permanent presence in the country.

- Expenses are deductible through a local entity.

- Enables the ability to execute contracts and agreements locally.

- Facilitates invoicing through a local entity.

- Requires compliance support.

- Empowers direct hiring of employees.

6. What sets apart a PEO from an EOR?

A PEO operates as a co-employer alongside your company, whereas an EOR serves as the official employer of your staff. An EOR typically offers a broader range of services than a PEO.

Why Invest in Honduras?

A number of factors combine to make Honduras an attractive destination for investment, including strong historic growth, a competitive and young labor pool, an improving security situation, and geographical and logistical assets, being located close to the United States and being home to the largest and deepest port in Central America.

The country is also party to a number of free trade agreements (FTAs), offering preferential access to key markets around the world, including Canada, the European Union, Mexico, the United States, and the United Kingdom. Honduras has enjoyed consistent and almost continuous growth over recent years, with gross domestic product (GDP) hitting USD$31.7 billion in 2022,

While the Honduran market is not the best-known investment destination in Latin America, foreign direct investment leapt 60% in the first half of 2021. The country is well known for its agricultural output, with bananas, coffee, and fish being key export products. It also has a sizable industrial base, with manufactured goods such as electrical equipment and garments also significant to the export economy.

Biz Latin Hub can be your employer of record in Honduras

At Biz Latin Hub, our multilingual team of corporate support specialists is available to assist you entering and doing business in the Honduran market.

We offer a comprehensive portfolio of back-office services, including company formation, accounting & taxation, hiring & EOR, visa processing, and legal services.

That means that we can be your single point of contact and support you in every aspect of doing business, including but not limited to being your employer of record in Honduras.

We have teams in place in 16 countries around Latin America and the Caribbean, and trusted partners that extend our coverage to almost every corner of the region.

Contact us today to find out more about how we can be your EOR in Honduras, as well as providing a range of other services.

Or read about our team and expert authors.