Hiring and managing employees efficiently is critical for business success. Guatemala offers a unique labor landscape that combines both opportunities and challenges for employers navigating this market. Understanding this environment is essential for effective workforce management.

Guatemala’s labor laws dictate how employers should interact with their employees. Various types of employment contracts, recruitment strategies, and payroll processes affect how businesses operate. Compliance with regulation ensures smoother hiring and management practices that are both legal and equitable.

This article outlines essential aspects of hiring and managing employees in Guatemala. It will detail labor laws, employment contracts, recruitment strategies, payroll, and more. Readers will gain practical knowledge for efficient employee management in Guatemala’s labor market.

What are Guatemala’s Labor Laws?

Guatemala’s labor laws ensure fair treatment for employees. These laws cover minimum wage, working hours, paid leave, and termination policies. Employers must provide notice when terminating employment. The notice period ranges from one week if employed for less than six months to one month if employed for over five years.

If an employee faces unjustified dismissal, they receive severance pay. Severance equates to one month’s salary for each year of service, calculated using the last six months’ salary, including benefits. Discrimination based on medical records, financial history, or other personal information is illegal. This policy protects employees’ rights to work.

Labor laws also include health and safety standards. Employers must comply with these regulations. This compliance includes providing necessary training. The laws aim to minimize workplace hazards and promote a safe environment.

Key Provisions:

- Minimum Wage: Regulated by law

- Notice Period: Varies by service length

- Severance: One month’s salary per service year

- Discrimination: Prohibited in hiring

- Health and Safety: Mandatory standards and training

These laws are vital for employee rights in Guatemala. They aim to create a fair and secure work environment.

What are the Types of Employment Contracts in Guatemala?

Guatemala classifies employment contracts into two main types: indefinite-term and fixed-term contracts. Additionally, there is a probationary period for new employees. This structure ensures clarity and legal compliance in the employment relationship.

Indefinite Contracts

Indefinite contracts are the most common in Guatemala. They do not have a specified end date and provide job stability for full-time employees. Employers must justify any termination to protect the employee’s rights. If the employer terminates the contract without cause, they must offer severance pay, which is a safeguard for employees.

During the first two months, the contract acts as a probation period. In this period, employers can terminate the contract without reason. All elements such as salary, job duties, and working hours must be covered in the contract, and it must be written in Spanish.

Fixed-Term Contracts

Fixed-term contracts suit temporary or seasonal jobs. These contracts must clearly state the employment duration. The law requires these details to ensure compliance with Guatemalan labor standards.

Multiple renewals of a fixed-term contract can lead to reclassification as an indefinite contract. Therefore, employers should use fixed-term contracts cautiously. Once the job’s specific task ends, the contract concludes automatically.

Probationary Contracts

A probationary period in Guatemala typically lasts for two months for indefinite contracts. During this period, employers can end the employment without any justified reason, providing them flexibility. This period can extend to six months if both parties agree.

Probationary contracts allow employers to evaluate new hires’ performance. If the employee completes this period successfully, the employment may continue with a permanent contract. Both the employer and the employee can terminate during this period without cause or compensation.

Effective Recruitment Strategies for Guatemala

Recruiting employees in Guatemala involves understanding local practices and labor laws. Employers should leverage social networking sites and popular job boards like Opcion Empleo, Computrabajo, Tecoloco, LinkedIn, and Go Abroad. Conducting background checks requires written consent from candidates for accessing non-disclosed information. The Guatemalan Labor Code prohibits discrimination, ensuring a fair recruitment process. Employers can boost their recruitment by hiring a Human Resources manager experienced in Guatemalan labor law. For those unable to hire one, using standard templates for employment documents ensures legal compliance and streamlines onboarding.

Advertising Job Openings

To attract candidates, Guatemalan employers use online job portals and newspaper ads. Social media channels also play a key role in extensively advertising job openings. Word-of-mouth referrals remain effective, especially in smaller communities. Applications can be submitted electronically or in person, with resumes and cover letters as key components.

- Use local newspapers

- Leverage social media

- Encourage word-of-mouth referrals

Screening Resumes

The screening process begins with reviewing resumes and cover letters to shortlist candidates. Employers compare candidates’ qualifications with job requirements. Some companies conduct brief phone screenings to assess candidates’ suitability. Validating credentials and experience through background checks is essential. Employers gather applications via online job boards and recruitment agencies.

- Review resumes and cover letters

- Conduct phone screenings

- Validate credentials through background checks

Conducting Interviews

Employers in Guatemala conduct interviews after screening resumes. In-person interviews often involve one or more rounds. Types of interviews include structured, behavioral, and competency-based. Structured interviews use predetermined questions, while behavioral interviews focus on past experiences as indicators of future performance.

- Initial resume screening

- Use of structured interviews

- Conduct behavioral and competency-based interviews

Onboarding New Hires

Onboarding in Guatemala emphasizes continuous feedback and team integration. New employees undergo orientation sessions and receive detailed job descriptions. Assigning a mentor during the probationary period helps new hires adjust. While no specific laws govern onboarding, completing paperwork for social security and benefits is essential.

- Provide orientation sessions

- Assign a mentor for support

- Ensure paperwork for social security and benefits is completed

This structure ensures that each section is clear, concise, and aligned with the guidelines provided, while also being engaging for readers.

Payroll Cycle Overview

In Guatemala, payroll cycles are flexible and can be customized based on the employment agreement. Salaries can be paid monthly, bi-monthly, weekly, daily, or hourly. This variation depends on the type of work and agreements between the employer and employee.

Employees are entitled to mandatory bonuses: a 13th-month salary, also known as “Aguinaldo,” and a 14th-month bonus. Employers distribute these bonuses in July and December, respectively. Employers in Guatemala should clearly outline payroll cycles within employment contracts. This ensures compliance with Guatemalan labor laws and maintains transparency.

The fiscal year in Guatemala extends from January 1st to December 31st. This period is key for effective tax and payroll planning.

Payroll Schedule Options:

- Monthly

- Bi-monthly

- Weekly

- Daily

- Hourly

By understanding these cycles, employers can effectively manage payroll and adhere to legal standards.

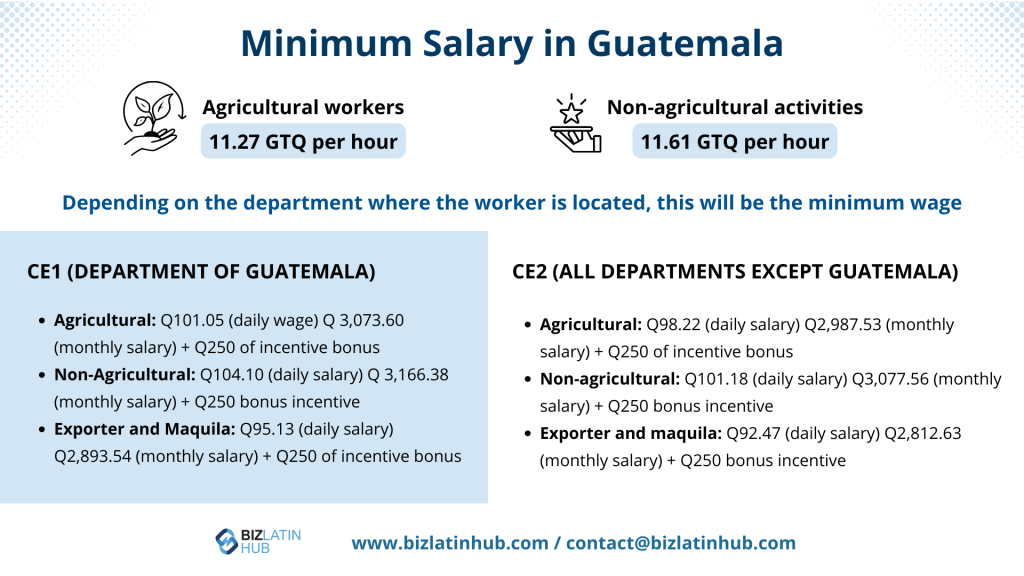

Minimum Wage Regulations

Minimum Wage Regulations in Guatemala

Guatemala has specific minimum wage rates, depending on the industry. The minimum wage ranges from GTQ 3,062.63 to GTQ 3,416.38 per month.

- Agricultural Sector: GTQ 3,323.60 monthly

- Non-Agricultural Sector: GTQ 3,416.38 monthly

- Export Activities and Maquiladoras: GTQ 3,062.63 monthly

- Other Agricultural Departments: GTQ 3,237.53 monthly

The national commission sets these wages. The Ministry of Labour and Social Welfare must then approve them.

2024 Minimum Daily Wages:

- Agricultural Activities: GTQ 107.11

- Non-Agricultural Activities: GTQ 110.97

- Export Activities and Maquiladoras: GTQ 101.41

These regulations ensure fair pay, keeping workers’ welfare in mind. The rates vary by sectors to reflect the different demands and conditions of each.

Employee Benefits in Guatemala

In Guatemala, employee benefits are a crucial part of employment agreements. Employees receive mandatory benefits, such as:

- Annual leave

- Public holidays

- Maternity and paternity leave

- Sick leave

- Overtime pay

- A 13th-month Christmas bonus

Employers enroll employees in the social security system (IGSS). This system manages healthcare, maternity leave, and pensions.

Employers can increase job appeal by offering:

- Private health insurance

- Transportation allowances

These additional perks help attract and retain talent in the competitive Guatemalan job market.

The number of vacation days grows with each employee’s service years. This policy encourages long-term employment.

While health benefits are not a legal requirement, many employers provide them as a competitive edge. This approach enhances their value as employers.

Here’s a quick reference table for mandatory benefits:

| Benefit | Description |

|---|---|

| Annual Leave | Accrued over years of service |

| Public Holidays | Paid days off for national holidays |

| Maternity/Paternity | Leave for new parents |

| Sick Leave | Paid leave during illness |

| Overtime Pay | Extra pay for work beyond regular hours |

| 13th-Month Bonus | Extra payment during Christmas |

These benefits contribute significantly to the employment relationship in Guatemala.

Compliance with Tax Obligations

Employers in Guatemala must contribute 12.67% of their payroll to cover taxes and social security costs. These contributions are vital for compliance. Employees are subject to a progressive income tax rate of 5% for incomes up to 300,000 GTQ and 7% for higher incomes. Both employers and employees contribute to the Guatemalan Social Security Institute (IGSS). Employers can use an Employer of Record (EOR) service to manage tax filings and payments efficiently. National and regional holidays can impact business schedules, so understanding them is key for labor regulation compliance.

Tax Registration for Employers

Employers must register with the Tax Administration Superintendency (SAT) to get a Tax Identification Number (NIT). This process usually takes 1-2 weeks. Employers must maintain accurate payroll records. This includes wage details, deductions, and contributions, which may be audited by tax authorities. Employers also need to withhold income tax from employees’ wages and pay it to the tax authority each month. Non-compliance can lead to penalties, making tax registration and reporting adherence crucial.

Employee Withholding Taxes

In Guatemala, employers must withhold income taxes from employee wages. The rates are 5% for incomes up to 300,000 GTQ and 7% for income above that. Employers contribute 4.83% of their employees’ monthly salary to the IGSS, capped at 20,000 GTQ. These social security premiums are shared between employers and employees, with employees contributing 4.83%. Employers must keep precise payroll records of withheld taxes and contributions, which tax authorities may audit.

Work Visas and Permits for Foreign Workers

Guatemala offers various work visas and permits for foreigners. These visas allow people to live and work in the country legally. Employers in Guatemala must verify visa statuses while ensuring compliance with local labor laws. Obtaining a work visa often requires documents from a Guatemalan employer and other supporting materials.

Types of Work Visas

- Temporary Work Visa: For short-term jobs or projects. Requires a job offer from a Guatemalan employer.

- Resident Visa for Work Purposes: For long-term employment. Valid for two years.

- Business Visa: For conducting business activities without being employed by a Guatemalan company.

- Freelance Visa: For those working independently, without a Guatemalan employer.

- Temporary Resident Visa for Work Purposes: Valid for one year. Requires proof of funds and a clean criminal record.

Application Process for Work Permits

To work in Guatemala, foreign nationals must first obtain a residence permit. This process starts after entering on a tourist visa. You apply for residence with the Institute of Immigration. The residence permit lasts one to five years.

After securing the residence permit, you apply for a work permit with the Labour Ministry. A work permit is valid for one year and can be extended. It is granted three months from the application date.

Employers can perform background checks during hiring. However, the Guatemalan Constitution protects the right to work, so police and criminal records cannot restrict this right. The Labour Code prohibits employment discrimination, ensuring fair treatment for all candidates.

Working Hours Regulations

Guatemala has specific labor laws to regulate working hours. Understanding these regulations is vital for employers and employees.

Standard Working Hours

The standard workweek in Guatemala is set at 44 hours. Employees typically spread these hours over six days. Daily shifts are often 8 hours long. Night shift workers have a cap of 36 hours per week, with a maximum of 6 hours per day. Mixed shift workers are limited to 42 hours weekly and 7 hours daily. Regular work hours usually run from 8:00 AM to 5:00 PM.

Employees must have at least 12 consecutive rest hours between workdays. During each work day, workers are guaranteed a minimum 30-minute break.

Overtime Regulations

Any hours worked beyond the standard 44-hour workweek are considered overtime. Overtime is compensated at 150% of the employee’s regular hourly wage. Employees can work up to 4 overtime hours daily. Work on official holidays and annual leave earns a higher pay rate of 200% of the normal pay.

Employers must approve any overtime in advance. This ensures adherence to Guatemalan labor laws. Compensation for overtime should be paid in the following week. This ensures timely payment for extra hours worked.

| Shift Type | Weekly Hours | Daily Hours |

|---|---|---|

| Day Shift | 44 | 8 |

| Night Shift | 36 | 6 |

| Mixed Shift | 42 | 7 |

Understanding these regulations helps maintain compliance and ensures fair compensation for workers in Guatemala.

Leave Policies

In Guatemala, employees have a right to a range of paid leave options. These options help meet personal needs, while ensuring that income is protected. Leave varies by service length and is part of employment agreements.

Sick Leave Requirements

Guatemalan law grants employees paid sick leave. This leave depends on the duration of the illness and salary amount. The Social Security system covers up to Q150 per day. Employers must provide sick leave, whether or not they are registered with Social Security.

A list of key sick leave terms includes:

- Maximum payment: Q150 per day

- Payment provider: Social Security

- Eligibility: Varies by service length and workplace policy

Such leave safeguards employees’ income during recovery from illness or injury.

Maternity Leave Policies

Female employees in Guatemala get 84 days of paid maternity leave. This leave divides into 30 days before childbirth and 54 days post-natal.

A summary of maternity leave provisions includes:

- Paid leave duration: 84 days

- Pre-childbirth leave: 30 days

- Post-natal leave: 54 days

- Salary payment: 100%, via Social Security

Any change in this schedule needs a medical prescription. These policies aim to support new mothers during critical life changes, providing needed time for recovery and bonding.

Guatemala’s labor courts manage employment disputes through a tiered system. This system includes the Courts of First Instance, Labor Courts of Appeals, and the Supreme Court of Justice (Labor Chamber). The Labor Code governs this process. Typical disputes involve wrongful termination, unpaid wages, and workplace discrimination. Arbitration is an emerging method for resolving disputes. It offers a less formal avenue with binding arbitrator decisions. The Guatemalan constitution and labor act prohibit job-based discrimination. Employers must not base unfair decisions on medical records or financial history. They must also compensate employees for unjust dismissals. Employees can sue for unpaid salaries, severance pay, and other litigation losses.

Common Dispute Scenarios

Guatemala’s labor courts frequently handle disputes like wrongful termination, unpaid wages, and discrimination. The Labor Code outlines the process. It involves filing claims, exchanging evidence, and attending hearings. There are also opportunities for appeals. Arbitration is increasingly used to settle disputes quickly. Selected arbitrators make the final decisions. Employees dismissed without justification, especially after the probation period, receive compensation. This is one month’s salary for each year of service. Employees can also sue for outstanding salaries and severance payments. Laws allow recovery of litigation costs and compensation for lost earnings.

Resolving Conflicts

Labor Courts in Guatemala manage disputes with structured steps. These steps include filing claims, presenting evidence, and attending hearings. Judicial decisions can be appealed. Arbitration offers a less formal resolution route with binding outcomes. Employees have rights to legal action over unpaid wages and severance. Compensation might cover up to 12 months of lost earnings. Incorrect worker classification can lead to penalties. This misclassification necessitates back pay and benefits for the affected worker. Employers must carefully classify workers to avoid these penalties. This system helps ensure fairness in employment relationships.

Effective Employee Management in Guatemala

Navigating Guatemala’s labor landscape effectively requires expertise and attention to compliance. Understanding labor laws, managing employment contracts, recruiting efficiently, and accurately handling payroll are essential to your business’s success.

Partnering with a trusted Employer of Record (EOR) simplifies these tasks. An EOR expertly manages employment contracts, payroll, tax compliance, and employee management. This approach reduces operational complexities, mitigates compliance risks, and ensures a fair and secure working environment.

By leveraging local expertise, your business can minimize risks, enhance operational efficiency, and attract top talent. An EOR ensures you remain legally compliant while enabling you to focus on your core business objectives.

Optimize your employee management in Guatemala by leveraging professional EOR support, ensuring your operations run smoothly and strategically aligned for growth. Get started today.