Incorporate a Company in Colombia: Everything You Need to Know

Incorporating a company in Colombia involves several steps, but it is not a complicated process once you have the right help and information. This article describes the steps necessary to incorporate a company in Colombia. Incorporating a company in Colombia is a simple process, with clear rules and procedures for company registration.

The first step to incorporating a company in Colombia is to establish the foundations of the company and choose the business structure that best suits your needs and objectives. The most common business structures in Colombia are Limited Liability Companies (SAS), Corporations (SA) and Simplified Joint Stock Companies (SAS).

Table of Contents

Biz Latin hub can help you enter this dynamic economy as smoothly as possible, as our depth of knowledge is unparalleled in the country. With our help, incorporating a company in Colombia will be as smooth as possible and not only that, but our market leading array of back-office services will keep you fully compliant. That all allows you to concentrate on what you do best – growing your business.

Why choose Colombia to incorporate a company?

Before we dive into how to incorporate a company in Colombia, let’s review why Colombia is a great place to do business. The country has an array of advantages that businesses can capitalize on. Its strategic location in South America provides easy access to regional and international markets. Colombia has a rapidly growing economy that is a hotspot for innovation.

The substantial number of young and skilled workers leads to competitive labor costs. Colombia’s growing workforce is a big reason businesses have been looking to expand into the country. Colombia has made significant strides in improving its business climate through regulatory reforms that simplify bureaucratic processes and provide incentives for foreign investment. For example, the government offers tax incentives and has established free trade zones for foreign entrepreneurs to incentivize company incorporation.

Colombia has abundant natural resources, especially agriculture, mining, and renewable energy. The ongoing enhancements in infrastructure and transportation networks also streamline business operations. Additionally, the country’s diverse and growing consumer base makes Colombia a promising market for companies seeking growth in Latin America.

4 Types of Company Formations in Colombia

Colombian law recognizes various forms of business entities, but the most common ones are:

- Sociedad Anónima (S.A.): This type of company is similar to a public limited company (PLC). It requires at least five shareholders and a minimum capital contribution of 100 times the monthly legal minimum wage.

- Sociedad Limitada (Ltda.): This is similar to a limited liability company (LLC) in other countries. It requires at least two partners and a minimum capital contribution of 100 times the monthly legal minimum wage.

- Sociedad por Acciones Simplificada (SAS): This is a simplified stock corporation designed to provide a more straightforward and faster incorporation process compared to the traditional S.A. and Ltda. companies. It requires at least one partner and has no minimum capital requirements. In our experience, this is what we almost always recommmend.

- Empresa Unipersonal: This is a sole proprietorship, where the business is owned by a single individual. There is no minimum capital requirement, and the owner is responsible for all obligations of the business.

What are The Minimum Requirements to Incorporate a SAS in Colombia?

The minimum requirements to incorporate a SAS – Sociedad de Acciones Simplificada in Colombia are:

- Confirm the legal name of the entity.

- A minimum of (1) shareholder, which can be either a natural person (i.e. individual) or legal person (i.e. entity.)

- Appoint a legal representative within the bylaws of the company.

- Confirm the business activities and corporate purpose of the company.

- A minimum capital of USD$400 should be transferred by the shareholder upon opening the bank account.

- Register a fiscal address within the country and use it for official correspondence.

Important Tip(s):

The founding shareholders do not need to physically travel to the country as the establishment can be completed via a power of attorney.

Based on experience, we would always recommend a minimum capital of USD$1,000 and should be commensurate with the type of business activities.

What do You Need to Get Started With Your Company Formation in Colombia?

To proceed with incorporating an SAS in Colombia, you will need to provide the following:

- A name for your legal entity.

- Shareholder identification documentation.

- Confirm the business activities and corporate purpose.

- Minimum initial capital to be registered.

Important Tip: We always recommend having a preferred legal name and two alternatives in case the primary legal name is unavailable.

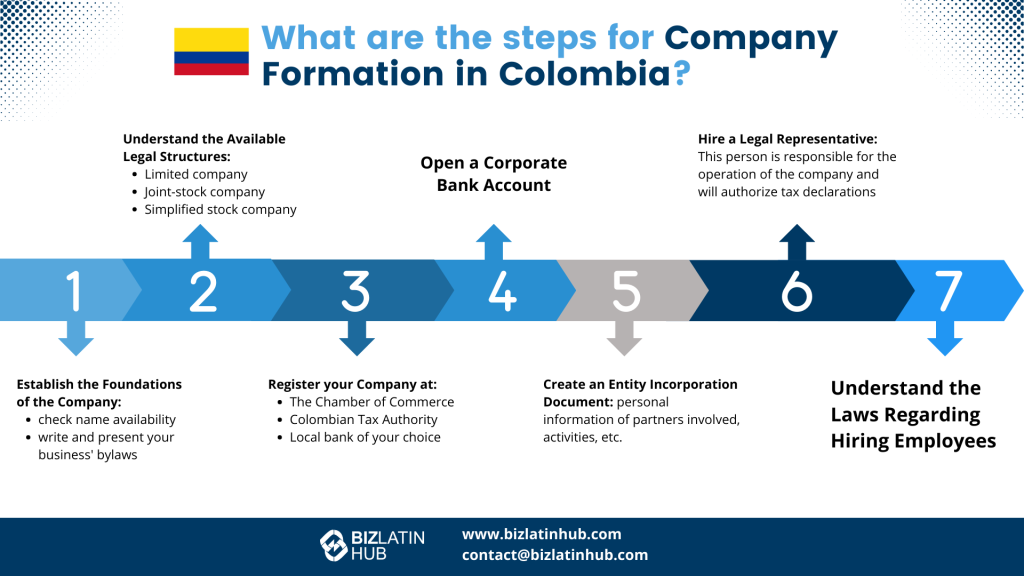

7 Steps to Create, Incorporate, and Register a Company in Colombia

These are the 7 steps that describe the process of incorporating a company in Colombia:

- Step 1: Establish the foundations of the company.

- Step 2: Understand the available legal structures.

- Step 3: Register your company at public institutions to incorporate a company in Colombia.

- Step 4: Open a corporate bank account.

- Step 5: Create an entity incorporation document.

- Step 6: Hire a legal representative to incorporate a company in Colombia.

- Step 7: Comply with the laws regarding hiring employees.

1. Establish the foundations of the company

To establish a company in Colombia, it’s essential to verify the availability of your chosen company name. Your legal business name and trademark can be different.

Be sure to write and present your business’ bylaws. This agreement should include all relevant information on your company, such as how it will function and the activities it will be involved with.

If you are establishing a company in Bogotá, the full process of getting a Tax ID (Registro Único Tributario or RUT) can be completed in the Chamber of Commerce. However, if you are going to be located in another city, additional steps will be needed. First, you must apply for a provisional RUT, and only after receiving it can you apply for the final RUT before DIAN. This is a crucial step.

2. New company formation: Understand the available legal structures

There are three legal structures a company can fall into in Colombia. You can choose the one that best suits your needs. They include:

- Limited company.

- Joint-stock company.

- Simplified stock company.

A simplified stock company (SAS) is the simplest option for most foreign investors incorporating a company in Colombia because it requires fewer formalities. The law permitting the establishment of a SAS was passed in 2008, and it remains an ideal option for both local and foreign investors.

3. Register your company at public institutions to incorporate a company in Colombia

There are three primary institutions you will deal with when incorporating a company in Colombia. They include:

- The Chamber of Commerce.

- Colombian Tax Authority (DIAN).

- Local bank of your choice.

The Chamber of Commerce is responsible for regulating the creation of new companies in Colombia. It ensures that your registration adheres to the current legal structures and policies. It will also provide a certificate that demonstrates the existence and legal status of your company.

This certificate will be requested by most private and public entities existing in Colombia once you begin operating your business.

The Tax Authority registers your business into the tax system. This registration earns you a unique tax number (NIT), which will serve as a general identification and enable you to present the mandatory tax declarations.

Additionally, you’ll be required to establish a company bank account, which will serve operational purposes and receive foreign investments.

4. Open a corporate bank account

Opening a corporate bank account is a straightforward process. You will need to present the Existence Certificate from the Chamber of Commerce, the Tax ID certificate (RUT), the ID of the legal representative, and the opening balance sheet of the company.

Keep in mind that some banks have specific requirements for opening an account.

5. Create an entity incorporation document

You will need an incorporation document highlighting the names and personal information of all partners involved in the business. It should also indicate the name of the company and the activities it will be performing in Colombia.

Other things the incorporating document must include

- Capital structure.

- The board of directors.

- Partner responsibilities.

- Causes of termination.

6. Hire a legal representative to incorporate a company in Colombia

Your company must have a legal representative who can be different from the company owners. This person is responsible for company operations, authorizing tax declarations, and signing all contracts and legal documents.

7. Comply with the laws regarding hiring employees

The final step in the process of incorporating a company in Colombia affects the hiring of employees. You must register your business with the Family Compensation Fund, the Colombian Family Institute, and the Governmental Learning Service, and fill out a unique form for all these agencies.

You will also need to register your employees for public health coverage. Employees have the right to choose their desired provider, to which your company has to submit the required form.

Your company must also affiliate itself with a pension system. You can register with the public fund or other private funds. However, you can’t choose the pension fund for your employees as they have the right to choose their preferred fund.

Registering your business with the Labor Risks Administrator is also essential. This agency helps in covering professional illness and workplace injury cases. You have to pay monthly contributions to the program and protection starts 24 hours after submitting the form.

FAQs to incorporate a company in Colombia

Answers to some of the most common questions we get asked by our clients.

Can a foreigner own a business in Colombia?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

What is the Colombia Company Tax ID (NIT)?

The Colombia Company Tax ID is known as NIT (Número de Identificación Tributaria), a unique identification number for tax purposes in Colombia.

How long does it take to register a company in Colombia?

Registering a company in Colombia takes four weeks.

What does an LTDA company name mean in Colombia?

LTDA in a company name in Colombia refers to a Sociedad de Responsabilidad Limitada, which is similar to a Limited Liability Company. This type of corporate structure is characterized by the partners’ liability being limited to their contributions to the company’s capital.

In an LTDA, partners are not personally responsible for the company’s debts beyond their investment, providing a level of protection for individual assets. Small to medium-sized businesses frequently use it in Colombia because it combines elements of partnership and corporate structures, providing flexibility and legal protections.

What does an S.A.S company name mean in Colombia?

S.A.S means Sociedad por Acciones Simplificada, which is similar to a Joint Stock Company. This is a type of commercial company with legal presence and assets independent from those of its owners. Shareholders are liable only up to the amount of their respective contributions corresponding to the integration of the shares they subscribe to or acquire. Shareholders are not liable for labor, tax, or any other type of obligations incurred by the company beyond its contribution, except if the legal presence of the company is declared unenforceable.

What entity types offer limited liability in Colombia?

Both the Sociedad por Acciones Simplificada (S.A.S) and Sociedad de Responsabilidad Limitada are Limited Liability Companies in Colombia.

Differences between an LTDA and a S.A.S. in Colombia

| Incorporation | Established through an authenticated private document | Established through a public deed before a notary |

|---|---|---|

| Number of Shareholders | A minimum of one | A minimum of two shareholders and a maximum of 25 shareholders |

| Liability | Shareholders are liable only up to the amount of their respective capital contributions | Shareholders are liable only up to the amount of their respective capital contributions |

| Capital | Capital is divided into shares of equal value, and the payment is not stipulated | Capital is divided into equal-value portions and must be fully paid at the time of the company’s incorporation |

Biz Latin Hub can help you to incorporate a company in Colombia

Colombia is an attractive destination if you are looking to expand your business operations or start a new business. However, before you get everything up and running, you need to complete the company registration process.

Biz Latin Hub offers tailored business services, including company formation, legal services, accounting/taxation services, and visa processing. Contact us now and see how we can assist you in registering your new company in Colombia.

Learn more about our authors and team.