To expand in Uruguay, foreign investors must first decide which type of entity best suits their needs. One of the best solutions is to form a branch in Uruguay, if you want to avoid incorporation, but the company is too large to outsource payroll. In recent decades, Uruguay has experienced exponential growth in both gross domestic product (GDP) and gross national income (GNI) per capita, and in the Global Peace Index it is listed as the most peaceful and stable country in Latin America. If you are thinking of opening a business in Uruguay, but are unsure which type of entity is best for you, read on to learn more about the advantages and the process involved in setting up a branch in “the Switzerland of South America”.

What are the Advantages of Forming a branch in Uruguay?

If you form a branch in Uruguay you will have to comply with Law No. 16.060, enacted in September 1989. This law regulates many aspects of company formation in Uruguay.

Article 192 of that law highlights how an entity established by a foreign company must be treated equally by authorities as a locally headquartered entity. Meanwhile, Article 194 governs the separation of the branch finances from those of its parent organization overseas and stipulates that all documentation in relation to the branch must be kept in Spanish.

Given the relatively straightforward process involved when you form a branch in Uruguay, one of the key advantages is the possibility for your business to get productive in a short space of time.

Another advantage is the fact that by establishing a branch, a company establishes a legal presence in the country, without carrying the same legal responsibility as a company headquarters or independently formed company. Because certain legal responsibilities will rest with the company HQ elsewhere.

In terms of costs, it is generally less expensive to form a branch in Uruguay than to go through company formation, making it a popular option for investors when they initially enter the market.

What Taxes are involved in Foming a Branch in Uruguay?

After you form a branch in Uruguay, it will be liable for the following taxes:

- Income Tax on Economic Activities (IRAE): A foreign company that chooses to operate in Uruguay through a branch will be an IRAE taxpayer for any income generated by the branch. The tax rate is 25 percent of net taxable income.

- Non-Resident Income Tax (IRNR): The remittance of profits and benefits of the branch is taxed by IRNR at a rate of 7 percent.

- Value-added Tax (IVA): An indirect tax levied on the circulation of goods and the provision of services within the national territory. As a rule, sales will be subject to a basic tax rate of 22 percent.

- Equity Tax (IP): A tax levied on equity that is determined by the difference between assets and liabilities adjusted for tax purposes. The patrimony will include all goods located, placed, or used commercially in Uruguay. The rate for taxpayers is 1.5 percent of the calculated equity.

- Special Contributions to Social Security (CESS): Contributions made by employers and workers to state social security funds.

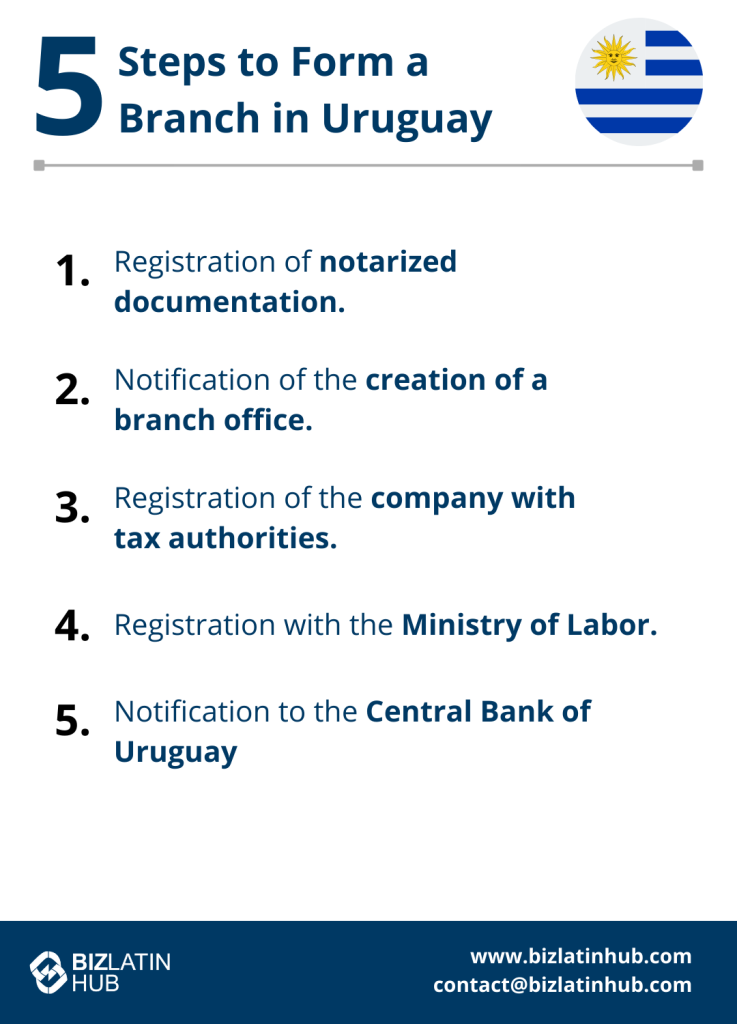

5 Steps to Form a Branch in Uruguay

If you decide to form a branch in Uruguay, you can expect the process to be completed in just a few weeks. In general terms, the process involves the following:

- Step 1 – Registration of notarized documentation with the National Registry of Commerce. Foreign documentation must be apostilled and translated into Spanish.

- Step 2 – Notification of branch formation published in Uruguay’s official daily journal, Diario Oficial.

- Step 3 – Registration of the company with tax authorities at least 10 days prior to starting commercial activities in the country.

- Step 4 – Registration with the Ministry of Labor.

- Step 5 – Notification to the Central Bank of Uruguay, including the registry of final beneficiaries (with severe penalties imposed for failure to comply).

Form a branch in Uruguay with the help of Biz Latin Hub

Would you like to form a branch in Uruguay, or do you need other professional advice related to commercial operation in the country? Contact Biz Latin Hub now to connect with our multilingual legal, accounting, and back-office specialists to discuss branch formation or get advice and a free quote on any of our other key services.

Learn more about our teams of experts based throughout Latin America and the Caribbean.