If you wish to enter Panama, you may find it useful to open a local branch rather than a subsidiary. You can form a branch in Panama more quickly than completing a full incorporation process. You will also maintain considerably more control over the entity compared to registering a subsidiary.

A branch serves as a legal entity located in one jurisdiction but linked to a head office in another location. This arrangement allows the head office to form a branch in Panama and exert significant influence over day-to-day operations and strategic direction. In addition, the head office assumes a substantially greater level of responsibility for the actions of the branch than it would for a subsidiary. This means greater financial and legal liability if the entity does not fully comply with local regulations.

For anyone planning a short-term or limited-scale engagement with the Panamanian market, another option available is to hire staff via a professional employer organization (PEO) in Panama. In that instance, the PEO firm will be the official employer of those employees and manage their payroll, while those employees report directly to the client, who manages their schedules and workloads.

However, for those businesses and investors planning full market entry, choosing to form a branch in Panama offers a range of benefits.

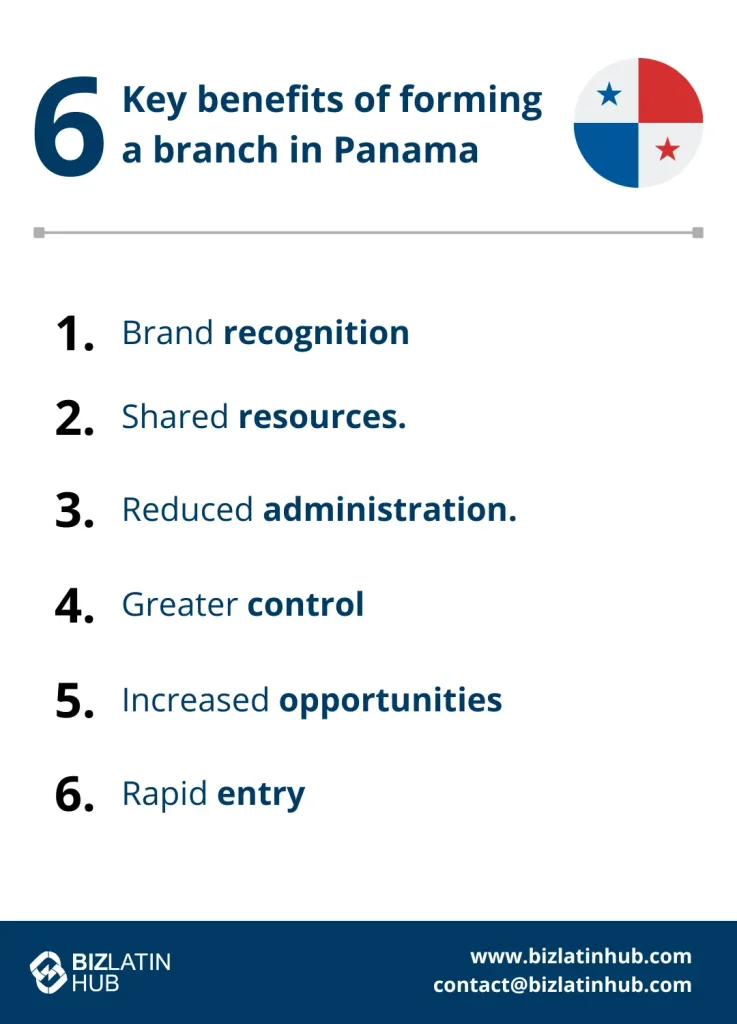

Form a branch in Panama: 6 Benefits

When you form a branch in Panama, it is obligatory to trade under the same name as the head company. You must also have the same — or equivalent — structure. For example, if your head office is a limited liability company (LLC), when you form a branch in Panama, you must also constitute it as an LLC.

As long as meeting those requirements is not problematic for you, the benefits when you form a branch in Panama include:

- Brand recognition: While you may not already be trading in Panama you may have a brand that is recognized in the market. You will be able to capitalize on that recognition by trading under the same name or offering the same product.

- Shared resources: When you form a branch in Panama, you benefit from the opportunity to share resources, be that products or marketing efforts due to the similar branding, or administrative functions due to the branch being run with the same systems as the head office.

- Reduced administration: On top of being able to share administrative resources, another advantage is the reduced burden related to the likes of tax filing and other administrative necessities.

- Greater control: As mentioned above, when you form a branch in Panama, you retain greater control. This means that while you carry more liability, you also have greater ability to guarantee compliance and avoid any regulatory inconveniences.

- Increased opportunities: Your increased liability reduces the risk government entities face when considering you for projects. That puts you in a strong position to win contracts with state entities.

- Rapid entry: The process to form a branch is rapid and straightforward, taking approximately five to seven days. However, it is worth keeping in mind that almost all aspects of the process will be in Spanish.

How to form a branch in Panama in 3 steps

To form a branch in Panama, you must follow the following three steps:

- Step 1 – Legalize key documents.

- Step 2 – Submit minutes to the Public Registry.

- Step 3 – Complete the process to form a branch in Panama by obtaining a local Tax ID.

1. Legalize key documents

When you register a branch in Panama, you will need to have the following documents legalized by notarization or an equivalent process:

- Document of incorporation of the company and any amendments that may exist.

- Document issued by the corresponding government entity in the company’s country of origin.

2. Submit minutes to the Public Registry

Next you must provide Panama’s Public Registry with the minutes or resolution of the Board of Directors — or an equivalent corporate body — in which the following is agreed:

- Establishment and opening of the branch in Panama.

- A minimum of USD$10,000 of capital for operations in Panama.

- Designation of the Resident Agent of the branch.

- Appointment of a legal representative in Panama to attend to the operation of the branch.

- Balance sheet of the company certified by an authorized public accountant of the country of origin.

Note that Panamanian law requires that all documentation must be in Spanish and apostilled.

3. Complete the process to form a branch in Panama by obtaining a local Tax ID

The final step in the process to form a branch in Panama is to obtain a local Tax identification number from the national tax authority. This will be used for filing taxes as well as for identifying the entity on the likes of invoices. With this step complete, your branch is ready to begin trading.

FAQ on How to Form a Branch in Panama

1. Can a foreigner own a branch in Panama?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. How long does it take to register a branch in Panama?

It takes 8 weeks to register an operating company in Panama.

3. What are the primary benefits of forming a branch in Panama?

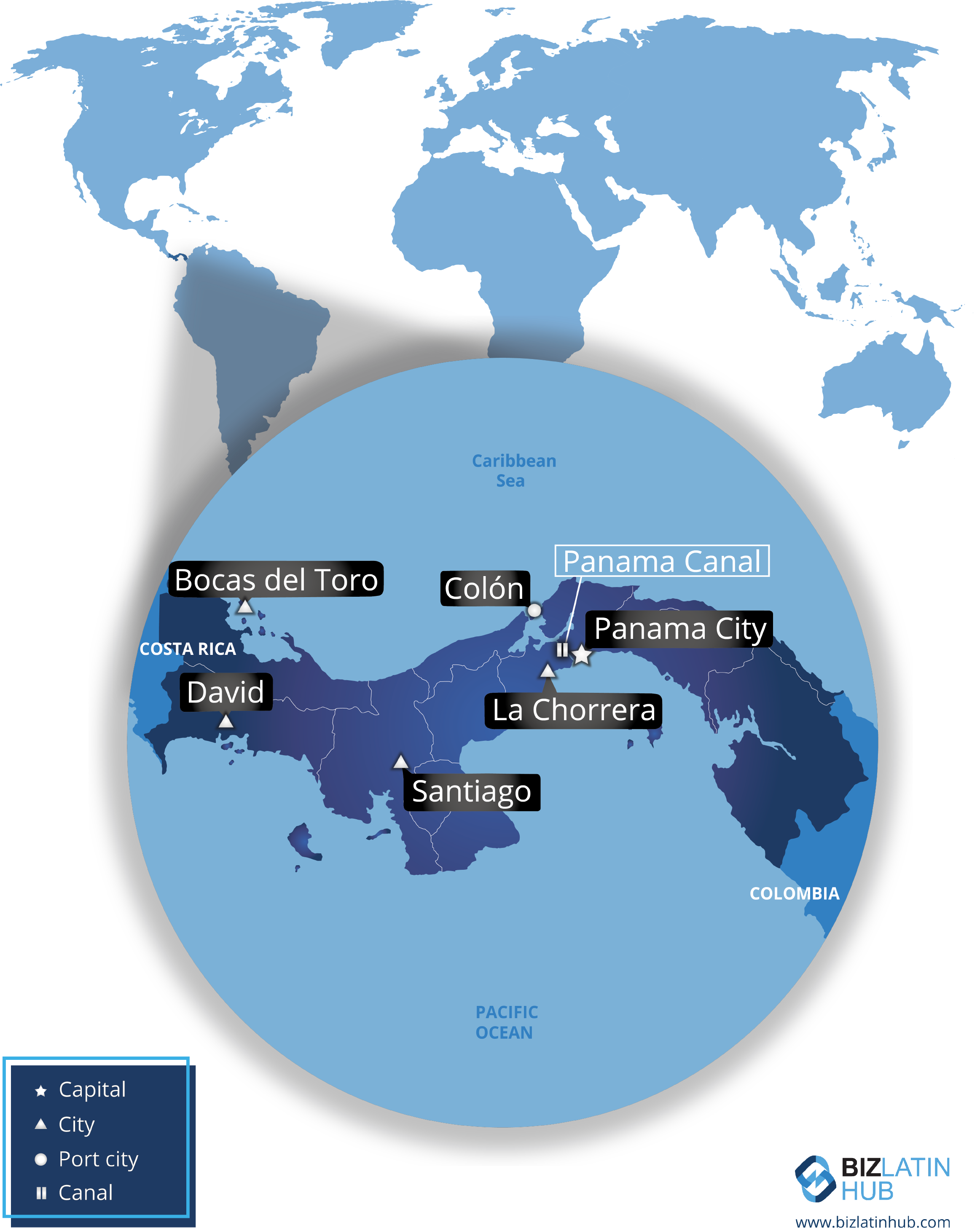

Establishing a branch in Panama offers benefits such as favorable tax policies, strategic location, and access to a thriving economy.

4. What steps are involved in establishing a branch in Panama?

Tasks such as company registration, obtaining necessary permits, ensuring regulatory compliance, and leveraging strategic networking opportunities to facilitate business setup.

5. How does Panama’s strategic location benefit businesses?

Panama’s strategic location offers businesses access to major shipping routes and air transportation hubs. This facilitates seamless connectivity with markets worldwide and enhances logistics and supply chain efficiency.

Form a branch in Panama with the help of Biz Latin Hub

At Biz Latin Hub, our team of multilingual company formation experts is equipped to help you establish yourself in the Panamanian market. We have a complete portfolio of corporate support and back-office solutions, including legal, accounting and recruitment services. This means we can be your single point of contact to enter and operate in Panama. Additionally, we can do the same in 17 jurisdictions around Latin America and the Caribbean where we have teams in place.

Reach out to us now for a consultation or free quote.

Or read about our team and expert authors.