If you are interested in doing business in Mexico and you already have a business in another jurisdiction, one option available is to form a branch. Because when you form a branch in Mexico, you establish a legal entity that is an extension of your business elsewhere, over which you will maintain broad control from your headquarters, while having the opportunity to build your brand internationally.

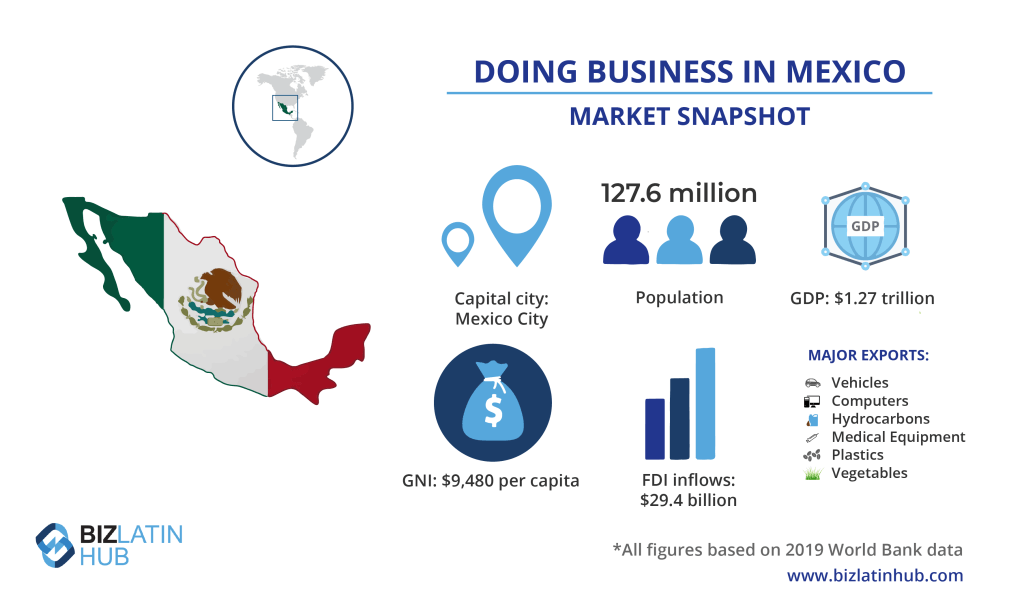

Mexico is the second-largest economy in Latin America, with a gross domestic product (GDP) that hit $1.27 trillion in 2019 (all figures in USD). That same year, the country recorded a gross national income (GNI) of $9,430 per capita, a figure that places it among upper-middle-income nations according to classifications established by the World Bank.

Being one of the main recipients of foreign direct investment (FDI) in the region, with FDI inflows exceeding $29 billion in 2019, Mexico is one of the four “MINT” countries, along with Indonesia, Nigeria, and Turkey, that has long been touted to experience strong growth and offer good returns to investors. The North American nation is also the 17th-largest exporter in the world and maintains an extensive network of free trade agreements (FTAs).

In addition, Mexico is an official member of the Pacific Alliance — a regional trade integration that also includes major regional markets Chile, Colombia, and Peru, and has ambitions to expand beyond Latin America and the Caribbean. The country’s prime export commodities include oil, vehicles, and electrical machinery. The United States is Mexico’s top trade partner, with other export destinations including Canada, Germany, China, and Japan.

If you are considering doing business in the country, read on to learn how to form a branch in Mexico, or go ahead and reach out to us now to discuss your market entry options.

Form a branch in Mexico: what does it mean?

Unlike a subsidiary, a branch in Mexico is not established as a separate legal entity from its parent company and is considered an extension of the business headquartered elsewhere. Therefore, if you choose to form a branch in Mexico, you will be able to manage and supervise all administration activities, while having a greater level of control over important decisions and being able to re-calibrate business practices if needed.

The process of forming a branch in Mexico is considerably faster than incorporating other types of entities in the country, allowing you to secure a fast market entry. However, since a branch does not have its own legal personality, its tax obligations can be assigned to the parent company.

Note that a branch in Mexico can be managed by a local or foreign director who legally resides in the country.

Main advantages of forming a branch

If you form a branch in Mexico, you will enjoy multiple benefits that can drive the success of your international business strategy, such as:

Greater control: Unlike other types of entities, a branch in Mexico offers you a greater level of control, giving you peace of mind that your business operations will not be affected by poor decisions from third parties.

Market recognition: If you form a branch in Mexico, you will be able to benefit from the recognition in the market that you have already acquired in other countries. This will make your company more competitive and increase the chances of commercial success.

Time and cost saving: By forming a branch in Mexico, you will not have to conduct a full company formation process, saving money and valuable time that you can use to build your business. Note that it is strongly recommended to engage with a trusted legal advisor with ample knowledge of local regulations to avoid unnecessary expenses that could jeopardize your business operations.

How to form a branch in Mexico

The process to form a branch in Mexico involves two key steps and can take up to 25 days. Those steps are:

Step 1: Request authorization from the Ministry of Economy of Mexico

When you request authorization from the Ministry of Economy of Mexico, you will have to prove that your company has been legally incorporated in the country of origin and that its bylaws do not violate Mexican corporate regulations. You must also demonstrate that you have appointed a legal representative in the country and provide the following documents:

- Bylaws and articles of incorporation duly legalized and officially translated into Spanish

- Power of attorney granted to the legal representative who must reside in the country and have a Tax Identification Card (CIF)

- Proof of payment of the legal fee for this procedure

Once the request has been formally presented, the authority must pronounce itself within a maximum period of 15 days

Step 2: Register your company with the National Registry of Foreign Investments (RNIE)

Once you obtain authorization from the Ministry of Economy of Mexico, you must register your company with the National Registry of Foreign Investments (RNIE). Note that this process can be done online, and involves presenting the following documentation:

- Official form specifying the economic activities to be carried out in Mexico

- Power of attorney granted to the legal representative

- Copy of the identification of the legal representative

- Local tax identification (RFC)

If the RNIE does not request more documents or information within 10 days, your registration will be considered complete.

Fiscal considerations for branches in Mexico

Although a branch in Mexico is subject to the permanent supervision and administration of the parent company, it must comply with tax obligations like any other entity established in the country. Therefore, if you form a branch in Mexico, you must obtain a local tax identification (RFC) and register a tax address within a month after the start of business activities.

To obtain the local tax identification number, you must submit the following documents in the Tax Administration System (SAT):

- Bylaws and articles of incorporation duly legalized and officially translated into Spanish

- Document that proves the validity of the tax identification number of the company in its country of origin

- Power of attorney duly legalized and officially translated into Spanish

- Identification and tax identification number of the legal representative.

- Proof of address of the company in your country of origin

- Proof of address of the branch in Mexico

Note that this procedure can be done virtually through the SAT website, but must be completed in person by the legal representative of the branch in Mexico.

Form a branch in Mexico with the help of Biz Latin Hub

At Biz Latin Hub, our team of multilingual company formation agents can help you successfully form a branch in Mexico to take advantage of business opportunities in the country. With our full suite of high-quality HR, legal, accounting, and tax advisory services, we can be your single point of contact to establish or manage any type of legal entity in Mexico, or any of the other 15 countries across Latin America and the Caribbean where we have a presence.

Contact us now to find out how our services can be tailored to your specific needs.

Learn more about our team and expert authors.