If you want to do business in the country but aren’t ready to incorporate a company in the Dominican Republic, there are options for companies wishing to expand. Among them, the creation of a branch office emerges as a good choice for many companies. By choosing to form a branch in the Dominican Republic, significant control over the entity is maintained, allowing it to effectively leverage existing brand recognition while taking advantage of the burgeoning opportunities in this rapidly expanding market, recognized as the largest economy in the Caribbean.

A branch differs from a subsidiary in that it is not established as a separate legal entity from its parent company and is considered to be an extension of the business headquartered elsewhere. Hence, when choosing to form a branch in the Dominican Republic, you will be able to manage and supervise all administrative activities, while, at the same time, having more control over key decisions and being able to re-calibrate business practices if needed.

It is also worth keeping in mind that the process to form a branch in the Dominican Republic is generally significantly faster than establishing other entities in the country, meaning that your market entry can be completed quickly.

Regardless of the entity type you set up, you are going to need a good corporate lawyer in the country to assist you in the process, so if you have any doubts about whether a branch, subsidiary, or brand new company suits you best, your chosen attorney will be able to give you good advice.

Read on to understand some of the main advantages of forming a branch in the Dominican Republic and the key steps involved in the process, as well as to get some insight into what makes the Dominican economy so attractive for investment.

Why form a branch in the Dominican Republic?

While the Dominican Republic is perhaps best known as a tourist destination, with an abundance of commercial opportunities available in the tourism sector, the country offers a wide array of possibilities for foreign investors.

While tourism is crucial to the Dominican economy and forms a large part of the more than 60% of GDP that the service sector contributes to the economy, the country also boasts a large agricultural sector, contributing more than 5% of GDP, as well as a well-established industrial base, contributing almost 27% of GDP.

The country has witnessed rapid economic growth over recent years, with GDP increasing fourfold between 2004 and 2019 to hit USD$88.9 billion. That makes the Dominican Republic the largest economy in the Caribbean and the eighth-largest in Latin America and the Caribbean.

Among the country’s major export products are tobacco, fruits and nuts, electrical machinery, medical equipment, and garments. While the Dominican Republic also has significant gold deposits, with the precious mineral another key product for the international market.

For foreign investors looking to form a branch in the Dominican Republic or any other type of entity, the country is made all the more attractive by the fact it has a network of dozens of free trade zones, offering attractive tax incentives for investment. Moreover, via its participation in the Caribbean Community and the Dominican Republic-Central America-United States Free Trade Agreement (CAFTA-DR), locally based business enjoy preferential access to numerous local markets, as well as the massive US market.

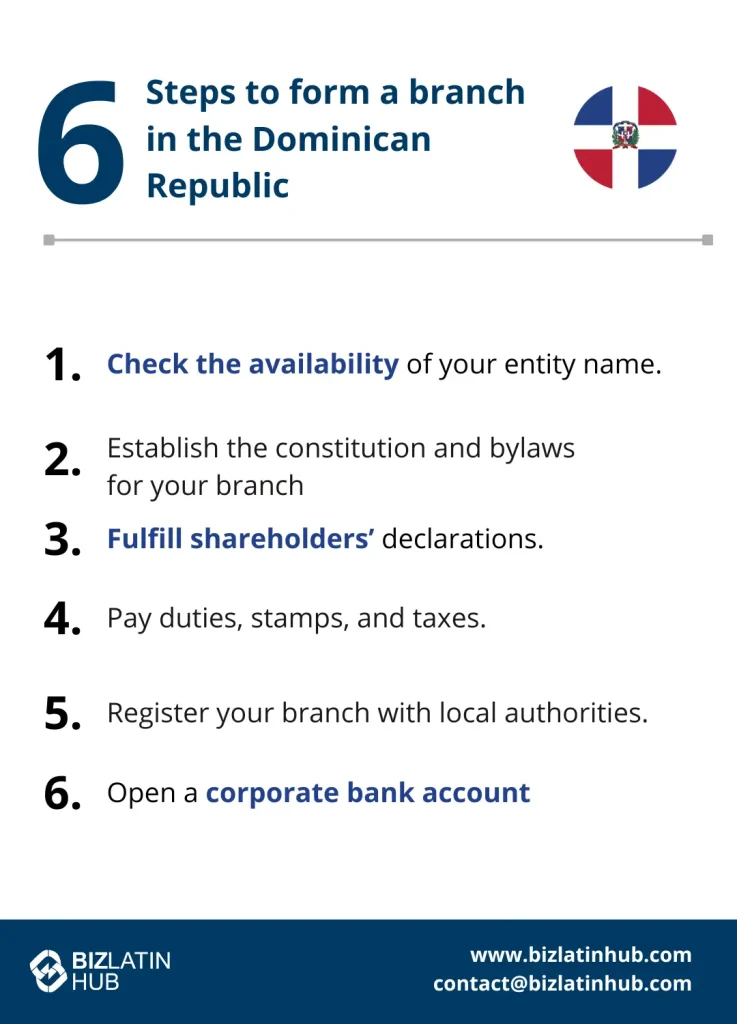

6 Steps to form a branch in the Dominican Republic

When you form a branch in the Dominican Republic, you will need to go through the following six key steps:

- Step 1 – Check the availability of your entity name.

- Step 2 – Establish the constitution and bylaws for your branch in the Dominican Republic.

- Step 3 – Fulfill shareholders’ declarations.

- Step 4 – Pay duties, stamps, and taxes.

- Step 5 – Register your branch in the Dominican Republic with local authorities.

- Step 6 – Open a corporate bank account to form a branch in the Dominican Republic.

Step 1. Check the availability of your entity name

Before you form a branch in the Dominican Republic, you will need to check that the name you intend to give the entity is available.

Given that one of the biggest benefits when you form a branch is the opportunity to carry your brand recognition into the new market, you will want to make sure that there are no companies already operating with a similar name.

Your chosen lawyer will be able to undertake a verification process through the database of the Dominican Trademark Office (ONAPI).

Step 2. Establish the constitution and bylaws for your branch in the Dominican Republic

While your constitution and bylaws will likely be similar to those used by the parent company elsewhere, you will need your lawyer in the Dominican Republic to go over them to make sure they fit in with local regulations.

This will establish the legal framework for how your branch is organized, and clarify the likes of funding sources and in order to remain in compliance with those norms, you may need to make some modifications to those that govern your parent organization.

Step 3. Fulfill shareholders’ declarations

All shareholders hold an official Shareholder’s Assembly and declare that they have:

- Been formally appointed in a Meeting of Partners

- Agreed to form a company

- Approved the bylaws

- Signed the deed of incorporation

Once all of these steps are complete, the branch may be registered before the Commercial Registry.

Step 4. Pay duties, stamps, and taxes

Before you can complete the process to form a branch in the Dominican Republic, you are obliged to pay the fees, taxes and stamps established by law for the creation of a new company.

The Commercial Registry will review the fulfillment of these obligations as part of the process of confirming your branch registration.

Step 5. Register your branch in the Dominican Republic with local authorities

Before you can start doing business, you must register your newly formed branch with the National Taxpayers Registry (RNC). This is a crucial step that must be undertaken in order for you to open a corporate bank account and be able to begin trading.

Step 6. Open a corporate bank account to form a branch in the Dominican Republic

The final step to form a branch in the Dominican Republic is to open a corporate bank account. Note that the turnaround time for this process can depend on the bank you choose, which may be influenced by your business focus or location.

Your chosen lawyer in the Dominican Republic will be able to advise you on which providers may best suit your needs when it comes to opening a corporate bank account.

FAQs on how to form a branch in the Dominican Republic

In our experience, these are the most common questions we receive about how to form a branch in the Dominican Republic.

1. Can a foreigner own a business in the Dominican Republic?

Yes, a business can be 100% foreign owned by either legal persons (“legal entities”) or natural persons (“individuals”).

2. How long does it take to register a company in the Dominican Republic?

Registering a company in the Dominican Republic takes between 10 to 14 weeks.

3. What does SRL company name mean in the Dominican Republic?

SRL in the Dominican Republic stands for “Sociedad de Responsabilidad Limitada,” which translates to Limited Liability Company in English. This legal entity operates independently from its shareholders, offering them limited liability. SRL companies are prevalent due to their simplified requirements, making them a popular choice for business structures.

4. What does an S.A. company name mean in the Dominican Republic?

The S.A. in a company name in the Dominican Republic refers to a “Sociedad Anónima,” which translates to a “Joint Stock Company.” This legal framework establishes the company as a separate entity from its shareholders, with each shareholder possessing shares that represent their ownership stake. Importantly, the financial responsibility of shareholders is confined solely to the value of their shares, crafting a safeguarded boundary. The S.A. structure holds substantial prominence in the Dominican Republic due to its exceptional adaptability and flexibility, rendering it the favored option for a diverse range of business ventures.

5. What entity types offer Limited Liability in the Dominican Republic?

In the Dominican Republic, both Sociedad Anónima (S.A.) and “S.R.L” (Sociedad de Responsabilidad Limitada) are limited liability entity types.

6. What are the main differences between S.A. and SRL in the Dominican Republic?

- A: Administrative Body: SAs are managed by a board of directors made up of at least 3 members, while SRLs will be managed by one or several managers who must be natural persons and may or may not be partners of the company.

- B: Supervision: An SA is supervised by one or more account commissioners, while SRL may or may not designate one or several account commissioners to supervise the company. For these types of companies, the appointment of an account’s commissioner is not mandatory.

- C: Responsibility of the shareholders: In both SA and SRL, the owners are usually responsible for the amount of their contributions.

Form a branch in the Dominican Republic with the help of Biz Latin Hub

At Biz Latin Hub, our team of multilingual company formation experts is equipped to help you form a branch in the Dominican Republic.

With our complete portfolio of corporate support and back-office solutions, including legal, accounting, and recruitment services, we can be your single point of contact for entering and operating in the Dominican Republic or any of the other 17 jurisdictions around Latin America and the Caribbean where we are present.

Contact us now to get assistance or a free quote.

Learn more about our team and expert authors.