Peru’s growing economy and investor-friendly environment have made it an attractive destination for foreign business. However, selecting the correct legal entity to register a company in Peru is a vital first step for compliance and successful operation. This guide breaks down the main company types in Peru (including SAC, SRL, SAA, and foreign branches) and provides guidance on how to choose the best structure for your business.

Key Takeaways

| Common legal entity types in Peru | Joint Stock Company (Sociedad Anónima – S.A.). Private Closed Corporation (Sociedad Anónima Cerrada – S.A.C.). Public Corporation (Sociedad Anónima Abierta). Limited Liability Company (Sociedad Comercial de Responsabilidad Limitada – S.R.L.). Foreign Branch (Sucursal). |

| What is the most common Peruvian legal entity? | One of the most common entity types in Peru is the a Closely Held Company (S.A.C) which is like an LLC in the US. Although a Board of Directors is not necessary, the corporation must have a General Manager. |

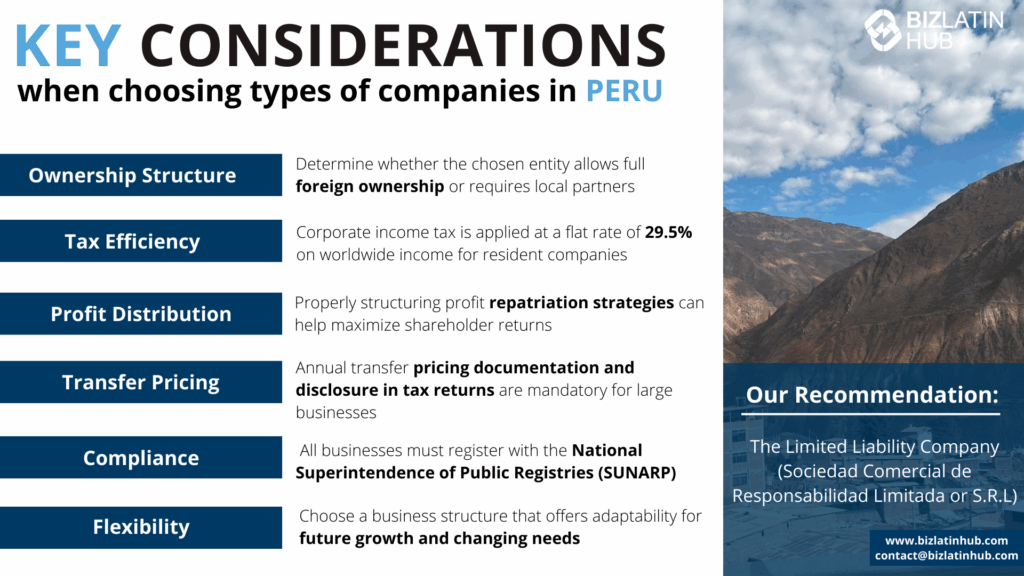

| What are the primary considerations when choosing a business entity in Peru? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

Main Legal Entity Types in Peru

Here are the 5 types of legal entities in Peru:

- Joint Stock Company (Sociedad Anónima – S.A.).

- Private Closed Corporation (Sociedad Anónima Cerrada – S.A.C.).

- Public Corporation (Sociedad Anónima Abierta).

- Limited Liability Company (Sociedad Comercial de Responsabilidad Limitada – S.R.L.).

- Foreign Branch (Sucursal).

All these legal entities must have a company legal representative and a legal/fiscal address in Peru. They also must make monthly and annual tax declarations to the local tax authorities.

Keep reading if you are interested in doing business in Peru and need to find out about the different types of companies available.

Comparison Table: Key Legal Entity Types in Peru

| Entity Type | Best For | Shareholders | Liability | Legal Personality | Tax Status |

|---|---|---|---|---|---|

| SAC (Closed Corporation) | Private companies with fewer shareholders | 2–20 | Limited to capital | Yes | Corporate tax applies |

| SRL (Limited Liability Co.) | SMEs and partnerships | 2–20 | Limited to capital | Yes | Corporate tax applies |

| SAA (Public Corporation) | Large public or listed companies | 750+ shareholders or listed | Limited to capital | Yes | Corporate tax applies |

| Sociedad Colectiva | Partnerships with shared liability | 2+ | Unlimited | Yes | Corporate tax applies |

| Branch | Multinationals operating directly | 1 (foreign HQ) | Parent company liable | Yes | Taxed as a local company |

SAC – Sociedad Anónima Cerrada

Who should choose this: Private or family-run businesses looking for a flexible but formal structure, with limits on share transfers and a simple governance model.

SRL – Sociedad de Responsabilidad Limitada

Who should choose this: Ideal for small partnerships with close control over ownership and management, offering limited liability and simplified administration.

SAA – Sociedad Anónima Abierta

Who should choose this: Best suited for companies intending to raise public capital or list shares on the stock exchange.

Sociedad Colectiva

Who should choose this: Used mostly for professional partnerships where all partners are jointly and personally liable for company debts.

Branch

Who should choose this: Foreign companies expanding operations into Peru while maintaining full control from their headquarters abroad.

1. Sociedad Anónima (S.A.)

The Sociedad Anónima (S.A.) is the most widely used legal structure in Peru, known for its simplicity and flexibility. This structure is popular among businesses due to its straightforward incorporation process and adaptability to various types of ventures. It is particularly suitable for medium and large-scale businesses looking to benefit from limited liability and raise capital through share issuance.

The following are the key characteristics and requirements of a Joint Stock Company (S.A.) in Peru:

- Shareholders: Requires a minimum of two shareholders, with no maximum limit. Shareholders can be individuals or legal entities of any nationality.

- Capital Requirements: An initial capital contribution of at least S/.1000 (approximately $350) is required, which can be made in cash or kind.

- Liability: Shareholders’ liability is limited to their contributions, protecting personal assets from business liabilities.

- Management Structure: The company must have a Board of Directors and a General Manager. The Board is responsible for strategic decision-making, while the General Manager oversees daily operations.

- Share Issuance: Shares can be freely issued, transferred, and traded unless restrictions are imposed by the bylaws.

- Legal Requirements:

- A fiscal address in Peru is required.

- Registration with the National Superintendency of Public Registries (SUNARP).

- Appointment of a Peruvian legal representative.

- Taxation: Subject to corporate income tax on worldwide income if domiciled in Peru.

2. Sociedad Anónima Cerrada (SAC)

The Sociedad Anónima Cerrada (S.A.C.) is a legal structure designed for smaller businesses with limited shareholders. It is particularly suitable for family-owned businesses or private companies looking to maintain greater control and privacy in their operations.

The following are the key characteristics and requirements of a Private Closed Corporation (S.A.C.) in Peru:

- Shareholders: Requires a minimum of two and a maximum of 20 shareholders. Shareholders can be individuals or legal entities, either Peruvian or foreign.

- Board of Directors: Unlike the S.A., a Board of Directors is not mandatory for an S.A.C. However, the company must appoint a General Manager to oversee operations.

- Liability: Shareholders’ liability is limited to their contributions, ensuring their personal assets are protected.

- Share Transfer Restrictions: Shares cannot be freely traded and are subject to transfer restrictions, ensuring the company retains its “closed” nature.

- Legal Requirements:

- A fiscal address in Peru is mandatory.

- Registration with SUNARP is required.

- A Peruvian legal representative must be appointed.

- Taxation: Subject to corporate income tax on worldwide income if domiciled in Peru.

3. Sociedad Anónima Abierta (SAA)

The Sociedad Anónima Abierta (S.A.A.) is a public corporation structure specifically designed for companies with a large number of shareholders. It is commonly used by businesses planning to raise capital through public offerings and operate in regulated industries.

The following are the key characteristics and requirements of a Public Corporation (S.A.A.) in Peru:

- Shareholders: Must have more than 750 shareholders or distribute over 35% of share capital among more than 175 shareholders.

- Initial Public Offering (IPO): To establish an S.A.A., the company must undertake an IPO and list shares on the stock exchange.

- Capital Requirements: No specific minimum capital requirement, but the capital must be sufficient to attract investors and support the company’s operations.

- Liability: Shareholders’ liability is limited to their capital contributions.

- Management Structure: Must have a Board of Directors and a General Manager to manage strategic and operational activities.

- Regulations and Transparency: Subject to strict reporting and compliance requirements under the supervision of the Peruvian Securities and Exchange Commission (SMV).

- Legal Requirements:

- Must be registered with SUNARP and the SMV.

- Requires a fiscal address in Peru and a legal representative.

- Taxation: Subject to corporate income tax on worldwide income if domiciled in Peru.

4. Sociedad de Responsabilidad Limitada (SRL)

A minimum of two and a maximum of twenty partners are allowed. All partners have limited liability and capital is divided up amongst them. This company corporation does not issue shares and its procedures are the same as those of other corporations.

The Sociedad Comercial de Responsabilidad Limitada (S.R.L.) is a business structure designed for small and medium-sized businesses seeking limited liability without the need to issue shares. It is particularly suited for family businesses or partnerships where operational control is shared among the partners.

The following are the key characteristics and requirements of a Limited Liability Company (S.R.L.) in Peru:

- Taxation: Subject to corporate income tax on worldwide income if domiciled in Peru.

- Partners: Requires a minimum of two and a maximum of 20 partners. Partners can be individuals or legal entities, either Peruvian or foreign.

- Capital Contributions: Capital is divided into participation quotas, which represent each partner’s ownership. Quotas must be fully paid at incorporation and are not represented by shares.

- Liability: Partners’ liability is limited to their contributions, protecting their personal assets from business liabilities.

- Management: The company is managed by one or more administrators appointed by the partners.

- Transfer of Quotas: Quotas cannot be freely transferred and require the consent of the other partners, ensuring control remains within the group.

- Legal Requirements:

- A fiscal address in Peru is required.

- Registration with SUNARP is mandatory.

- Appointment of a legal representative is required.

5. Branch of a Foreign Company

Another one of the legal entity in Peru is the Branch (Sucursal). Established outside its legal address, the branch should realize the same activities as its head office. The branch has the same status as a head office but can be considered as an independent company for tax purposes. To open a branch, a permanent legal representative or General Manager must be present.

Our recommendation: The Limited Liability Company (Sociedad Comercial de Responsabilidad Limitada or S.R.L) structure typically involves simpler incorporation procedures compared to other legal entity types, making it an attractive option for businesses looking for efficiency and ease of establishment. It is well-suited for small to medium-sized enterprises and foreign businesses seeking to establish a presence in Peru.

Should you require more information regarding each of these legal entities, we recommend that you make contact with a local professional company like Biz Latin Hub that has an extensive understanding of the legal entities in Peru and has experience in the formation and incorporation of companies depending on the types of operations being conducted.

How to Choose the Right Legal Structure in Peru

Ownership Structure

Evaluate whether your chosen business entity allows for foreign ownership. Peru generally permits 100% foreign ownership across most industries, making it an attractive destination for international investors. However, specific sectors such as natural resources, defense, and public utilities may involve government oversight or special permits. Understanding the regulatory framework for your industry is essential to ensure compliance and avoid delays in operations.

Tax Efficiency

Analyze the implications of Peru’s tax system on your business. Corporate income tax is applied at a flat rate of 29.5% on worldwide income for resident companies, while non-resident companies are taxed only on their Peruvian-sourced income. Dividends are subject to a withholding tax of 5%. The General Sales Tax (IGV) is 18%, applied to most goods and services. Peru offers tax incentives for companies operating in specific industries, such as agriculture, mining, or renewable energy, and for businesses established in Special Economic Zones (Zonas Económicas Especiales or ZEE). Strategic tax planning is key to optimizing costs while remaining compliant with Peru’s tax regulations.

Profit Distribution

Understand the tax implications of profit distribution in Peru. Dividends distributed to non-residents are subject to a 5% withholding tax, which may be reduced under Peru’s network of double taxation agreements with countries such as Spain, Canada, and Chile. Properly structuring profit repatriation strategies can help maximize shareholder returns while minimizing tax burdens and ensuring compliance with Peruvian tax laws.

Transfer Pricing

Comply with Peru’s transfer pricing regulations, which adhere to OECD guidelines. Businesses involved in cross-border transactions with related parties must ensure that these transactions reflect arm’s-length market values. Companies are required to prepare transfer pricing documentation and submit an annual transfer pricing report if they meet certain thresholds. Non-compliance can result in penalties and increased scrutiny from tax authorities, so accurate reporting is critical.

Compliance

Prepare for Peru’s regulatory compliance requirements. All businesses must register with the National Superintendence of Public Registries (SUNARP) and the National Superintendence of Customs and Tax Administration (SUNAT). Companies must also adhere to International Financial Reporting Standards (IFRS) for financial reporting. Filing monthly tax declarations for VAT, payroll taxes, and social security contributions is mandatory, as are annual income tax declarations. Labor compliance, including adherence to Peru’s strict employment laws and social benefits such as mandatory bonuses and severance payments, is essential to avoid legal penalties and maintain operational stability.

Flexibility

Choose a business structure that aligns with your operational goals and offers flexibility for growth. The most common types of legal entities in Peru include:

- Joint Stock Company (Sociedad Anónima or S.A.): A versatile and widely used structure, suitable for medium to large businesses. It requires a minimum of two shareholders and offers limited liability. Shareholders’ information is public.

- Private Closed Corporation (Sociedad Anónima Cerrada or S.A.C.): Ideal for small to medium-sized companies with a maximum of 20 shareholders. It provides limited liability, simplified governance, and allows for restrictions on the transfer of shares, making it suitable for closely held businesses.

- Public Corporation (Sociedad Anónima Abierta or S.A.A.): Designed for companies that plan to raise capital through public offerings. It requires stricter governance, registration with Peru’s Securities Market (SMV), and is suitable for large businesses or those seeking public investment.

- Limited Liability Company (Sociedad Comercial de Responsabilidad Limitada or S.R.L.): Suited for small businesses with up to 20 partners. It provides limited liability, simpler management, and prohibits the issuance of shares, instead dividing ownership into quotas.

- Foreign Branch (Sucursal): A structure for foreign companies wishing to establish a presence in Peru. The branch operates as an extension of the parent company and is subject to Peruvian regulations.

Steps to Incorporate a Company in Peru

- Step 1 – Understand the types of legal entities available.

- Step 2 – Appoint a legal representative.

- Step 3 – Choose Your Company Name.

- Step 4 – Identify Your Shareholders.

- Step 5 – Establish a Fiscal Address.

- Step 6 – Prepare and Sign the Public Deed.

- Step 7 – Register for Your Tax ID.

- Step 8 – Open a Corporate Bank Account and Deposit Your Company Share Capital.

- Step 9 – Legalize Your Company’s Accounting Books.

Company incorporation in Peru typically takes 4–6 weeks if everything is in order. However, if special licenses or permits are needed for certain fields, this can delay the process.

Compliance Tip:

All legal entities in Peru must register with SUNARP, obtain a RUC (tax ID) from SUNAT, and enroll employees with EsSalud, pension funds (AFP or ONP), and occupational risk insurers.

Common Pitfalls When Choosing a Legal Entity inPeru

- Registering a Sociedad Colectiva without understanding unlimited liability

- Choosing an SRL without knowing it limits share transferability

- Setting up a branch without accounting for parent company liability

- Not appointing a legal representative with a Peruvian tax ID

- Missing industry-specific licensing or capital requirements

Partnering with Biz Latin Hub for Company Formation in Peru

At Biz Latin Hub, we can be your single point of contact for entering and doing business in Peru. Our bilingual team of corporate support experts based in Lima is available to provide you with legal services in Peru as part of an integrated package tailored to your needs, including the likes of company formation, accounting & taxation, corporate legal support, hiring & PEO, and visa processing.

Contact us today to discuss how we can assist you in Peru, or any of the other 17 markets around Latin America and the Caribbean where we have teams in place.

Or read about our team and expert authors.

FAQs: Legal Entities in Peru

1. Can a foreigner register a company in Peru?

Yes, the Peruvian government encourages foreign investment and has established clear regulations for foreigners looking to establish businesses in the country. However, certain restrictions and requirements may apply depending on the type of legal entity chosen and the nature of the business.

2. What type of legal entity is a Joint Stock Company (Sociedad Anónima or S.A) in Peru?

A Joint Stock Company (Sociedad Anónima or S.A) in Peru is a type of corporation where ownership is represented by shares of stock. It is a legal entity separate from its shareholders and offers limited liability protection to its owners. Joint Stock Companies are regulated by Peruvian corporate laws and are commonly used for large-scale business ventures.

3. How do I create a Private Closed Corporation (Sociedad Anónima Cerrada or S.A.C) in Peru?

To create a Private Closed Corporation (Sociedad Anónima Cerrada or S.A.C) in Peru, one must follow the legal procedures outlined by the Peruvian government. It’s recommended to consult with a legal expert or business advisor familiar with Peruvian corporate law for personalized guidance.

4. What is an LLC in Peru?

In Peru, a Limited Liability Company (Sociedad Comercial de Responsabilidad Limitada or S.R.L) is a business structure that combines the limited liability protection of a corporation with the operational flexibility of a partnership. An LLC is a separate legal entity from its owners (known as members) and provides protection against personal liability for business debts and obligations.

5. What Acts Exempt Companies from Registration with SUNARP in Peru?

According to corporate regulations, the following actions are not required to be registered with SUNARP:

- Judgments pertaining to company or branch debts.

- Associative contracts specified under the applicable law.

- Transfers of shares or bonds issued by the company, including redemptions, divisions, creation, alteration, termination of rights, liens, or injunctions involving these shares or bonds.

6. What is the most common legal structure for businesses in Peru?

The Sociedad Anónima Cerrada (SAC) is the most popular for private businesses due to its flexibility and formal corporate protections. It allows up to 20 shareholders and is simpler than a public corporation.

7. Can a foreigner fully own a company in Peru?

Yes. Foreigners can own 100% of a Peruvian SAC, SRL, or SAA. However, at least one legal representative must reside in Peru and hold a local tax ID.

8. What’s the difference between SAC and SRL?

While both are suitable for SMEs, the SAC allows issuance of shares and is structured more formally, whereas the SRL works more like a partnership and limits share transfers.

9. How long does it take to incorporate a company in Peru?

The incorporation process typically takes 3–5 weeks, depending on document preparation, notarization, and registry approval timelines.

10. What taxes are companies in Peru subject to?

Entities are subject to corporate income tax (29.5%), VAT (18%), and payroll taxes. Monthly and annual filings with SUNAT are mandatory.

11. Can I convert from SRL to SAC later?

Yes, you can change the company structure through a formal legal process, but it involves shareholder consent, corporate bylaws updates, and re-registration.

8. Are branches taxed differently from local companies?

No. Branches of foreign companies are subject to the same tax rules as locally incorporated businesses in Peru.

Why Choose to Invest in Peru?

Peru is among the fastest-growing economies in Latin America, with an impressive average annual growth rate of 6.4% since 2002. This sustained expansion has been driven by robust external demand, particularly for Peru’s rich natural resources, and the consistent growth of fixed investment in infrastructure and industry.

As of 2022, Peru’s economy is projected to maintain its upward trajectory, supported by favorable global market conditions and domestic efforts to enhance productivity and attract investment. These factors underscore Peru’s resilience and potential as an emerging economic hub in the region.

Economic growth has spurred a significant increase in foreign direct investment (FDI), particularly in the mining and export sectors, which are central to Peru’s economy.

The country’s vast mineral reserves, including copper, gold, and silver, have attracted global investors seeking stable returns, while trade liberalization policies and export-oriented industries further bolster FDI inflows.