If you are looking to register a business, you will need to establish a fiscal address in Mexico. Because even if you do not need physical premises for your business to operate, your fiscal address will be where all official correspondences, including all tax-related matters is directed.

Read on to understand more about why you need a fiscal address in Mexico, as well as some more considerations related to doing business in the country. The economy of the country has been growing for years and shows no signs at all of slowing down. With increased fears over global trade routes, nearshoring has also grown in popularity for US-based businesses.

Biz Latin Hub can help you with a fiscal address in Mexico and with any other matters related to compliance with local laws and regulations. Our array of back office services is designed to help you with company formation in Mexico and to keep that business above board and in good standing in the eyes of the law. Not only that, but our network of dedicated local offices across the region means we can help you do business anywhere in Latin America and the Caribbean.

Why invest in Mexico?

Mexico boasts the second-largest economy in Latin America based on gross domestic product (GDP), behind only Brazil. While GDP has fluctuated, it has continued on a generally upward trajectory, increasing almost six-fold in the three decades after 1989 to hit 1.41 trillion in 2022, following three years of strong growth (all figures in USD).

The country’s increase in GDP has been met by a concomitant rise in prosperity, with gross national income hitting $10,210 per capita in 2022 — a figure that placed the country as an upper-middle income nation based on classifications established by the World Bank.

Mexico is a major trade hub in the Americas, with high-volume ports serving both the Pacific Ocean and the Gulf of Mexico, and the country is the 17th-largest exporter in the world. Meanwhile more than $1.7 billion of goods transit its 3,145 km (1,954 mile) border with the United States every day.

Businesses based in Mexico benefit from preferential access to the massive US and Canadian markets thanks to the United States-Mexico-Canada Agreement (USMCA) — a free trade arrangement signed in 2018 to replace the North American Free Trade Agreement (NAFTA) and which came into force in 2020.

Mexico also has a slew of FTAs in place with major economies from around Latin America, as well as Japan, while it is also a founder member of the Pacific Alliance — a ten year old economic integration initiative that also includes Chile, Colombia, and Peru, and which has ambitions to extend beyond the Western Hemisphere.

While Mexico’s agricultural sector only accounts for less than 4% of GDP, fresh produce such as corn, tropical fruits, and vegetables are major export products. Meanwhile, the country has a highly developed manufacturing sector accounting for more than 30% of GDP, with computers, medical equipment, and vehicles among the most important goods exported.

However, the services sector is the most important economically, generating more than 60% of GDP. While the country is home to a growing professional services industry, it also boasts considerable development in IT and technology, and is a major hotspot for innovation and tech outsourcing.

All of these factors contribute to make LLC formation in Mexico popular and the Mexican market one of the top destinations for foreign direct investment (FDI) in Latin America, with more than $38.59 billion in FDI inflows registered in 2022.

Why do you need a fiscal address in Mexico?

Your company’s fiscal address in Mexico will generally be where your operations are headquartered and where core administrative, commercial, and managerial operations are carried out.

As such, it will be the address that is lodged with authorities, including the Mexican tax authorities, for correspondence on taxes and other compliance matters.

You will therefore need to have this address when you register for your tax identification number, known in Mexico as an RFC.

You will also need it for the likes of:

- Company registration

- Opening a corporate bank account

- Participation in tenders

In the event that you are planning to run a business in Mexico that does not require a physical location, you will still need to have a fiscal address to receive such official correspondences. One service a back-office services provider will be able to offer you is a fiscal address to which correspondences can be directed.

Note that in Mexico you must have a physical premises, not just a fiscal address, even if they are the same place.

The process to register a fiscal address in Mexico will usually take between two and three weeks. It is worth keeping in mind that to modify a registered fiscal address in Mexico it is necessary to amend the bylaws of the entity.

Most common legal entities in Mexico

If you are looking to register a fiscal address in Mexico in support of company formation, you will need to choose which type of entity to form. The most common types of entities used by foreign investors include:

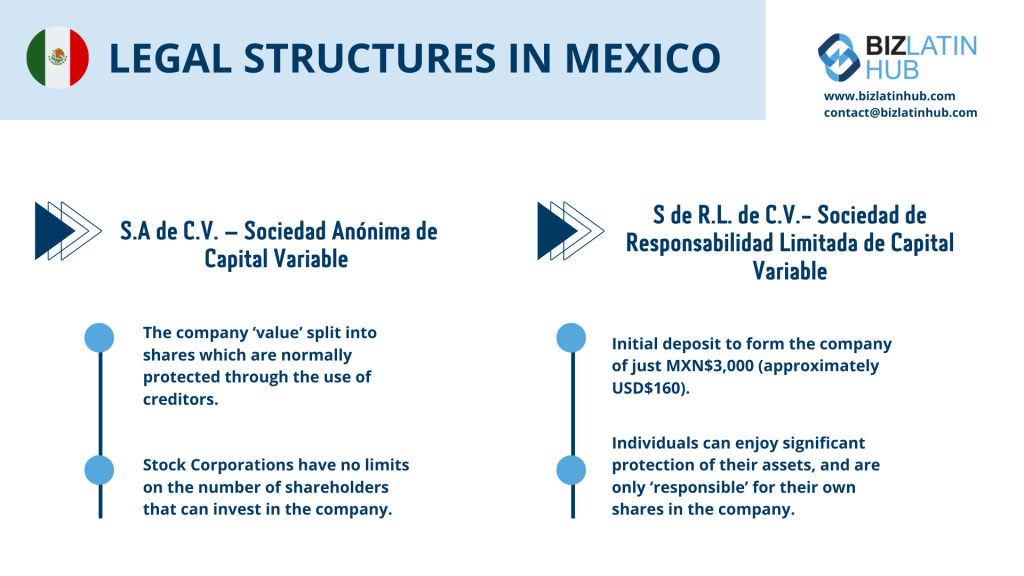

Sociedad Anónima de Capital Variable (S.A. de C.V.): This type of company is similar to a corporation in the US. It requires at least two shareholders and has the flexibility to increase or decrease its capital over time. It is suitable for larger businesses or those planning to go public in the future.

Sociedad de Responsabilidad Limitada de Capital Variable (S. de R.L. de C.V.): This is similar to an LLC in the US. It requires at least two partners and offers limited liability protection. It is suitable for smaller businesses or those with fewer shareholders.

Sociedad Anónima Promotora de Inversión de Capital Variable (S.A.P.I de C.V.): This is a subtype of S.A. de C.V. It is designed for companies that promote investment and innovation. It has fewer restrictions on the transfer of shares and is suitable for companies seeking to attract foreign investment.

FAQs on fiscal address in Mexico

Your company’s fiscal address in Mexico will generally be where your operations are headquartered and where core administrative, commercial, and managerial operations are carried out. Even if you do not need physical premises for your business to operate, your fiscal address will be where all official correspondences, including all tax-related matters is directed.

Yes, that is a necessary part of the process.

Yes, it is necessary.

It will be the address that is lodged with authorities, including the Mexican tax authorities, for correspondence on taxes and other compliance matters.

It should take between two and three weeks if all the paperwork is in order.

You do not, although many companies do so for reasons of convenience. In certain situations, such as a largely remote workforce, it may not be worthwhile to do so.

Get a fiscal address in Mexico with the help of Biz Latin Hub

At Biz Latin Hub, we assist companies and entrepreneurs to enter and do business in Latin America and the Caribbean through the provision of tailored packages of back-office services.

We have teams in place in 16 markets around the region and our portfolio includes company formation, accounting & taxation, corporate legal services, due diligence, hiring & PEO, and visa processing, among others.

In the event you plan to start a business that does not require a physical premises, we can provide you with a fiscal address in Mexico.

Contact us now to find out more about how we can support you doing business in Mexico.

Or learn more about our team and expert authors.