If you are looking to register a business, you will need to establish a fiscal address in Costa Rica. Because even if you do not need physical premises for your business to operate, your fiscal address will be where all official correspondences, including all tax-related matters is directed.

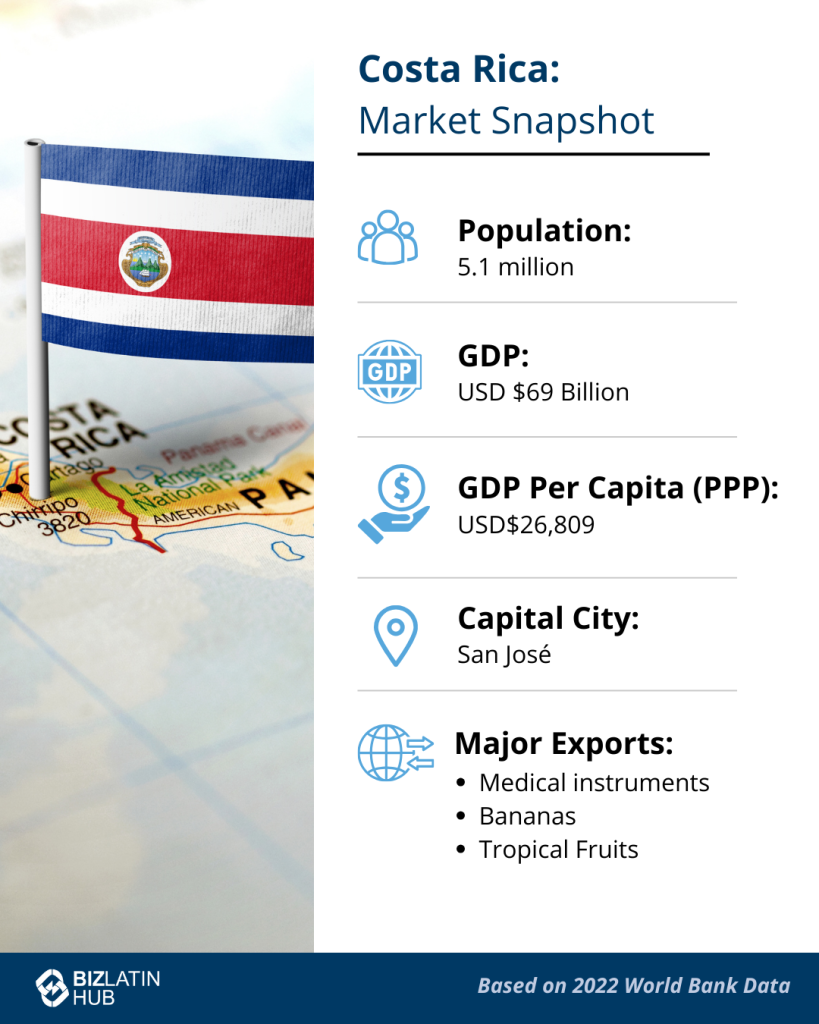

Read on to understand more about why you need a fiscal address in Costa Rica, as well as some more considerations related to doing business in the country. Although often overshadowed by bigger regional neighbors, the country boasts an impressive GDP per capita and solid trading links, plus an enviable location.

Biz Latin Hub can help you with a fiscal address in Costa Rica and with any other matters related to compliance with local laws and regulations. Our array of back office services is designed to help you to register a company in Costa Rica and to keep that business above board and in good standing in the eyes of the law. Not only that, but our network of dedicated local offices across the region means we can help you do business anywhere in Latin America and the Caribbean.

Why invest in Costa Rica?

Costa Rica is well-known for having no standing army, instead relying on the support of the United States — its close ally and number one trade partner — to guarantee national security.

The Central American nation is able to adopt such a policy because of the long-standing political and economic stability the country has enjoyed, as well as the strong political and cultural ties it has with its regional neighbour.

That includes a large population of expats, including investors, remote workers, and retirees, attracted by low violent crime levels and one of the highest levels of English proficiency in the region. Recently the government has been making significant efforts to rejuvenate the economy.

Recently, starting a business in Costa Rica was made even more attractive when the government announced new measures to encourage FDI by slashing taxes and easing residency requirements for investors. That same month, a law was also introduced to attract more foreign remote workers to the country. The Costa Rican government has also introduced a scheme, known as the Green Protocol, offering more credit for environmentally-friendly businesses.

All of these factors combine to make starting a business in Costa Rica an attractive prospect for foreigners and there has never been a better time to do it. The future is bright for this small but well-positioned nation, currently boasting an economy worth more than USD$65bn despite only having 5 million residents.

Why do you need a fiscal address in Costa Rica?

Your company’s fiscal address in Costa Rica will generally be where your operations are headquartered and where core administrative, commercial, and managerial operations are carried out.

As such, it will be the address that is lodged with authorities, including the Costa Rican tax authorities, for correspondence on taxes and other compliance matters.

You will therefore need to have this address when you register for your tax identification number, known in Costa Rica as a NIT.

You will also need it for the likes of:

- Company registration

- Opening a corporate bank account

- Participation in tenders

In the event that you are planning to run a business in Costa Rica that does not require a physical location, you will still need to have a fiscal address to receive such official correspondences. One service a back-office services provider will be able to offer you is a fiscal address to which correspondences can be directed.

Note that, any entity that has a stock of goods must have a physical premises, not just a fiscal address, even if they are the same place.

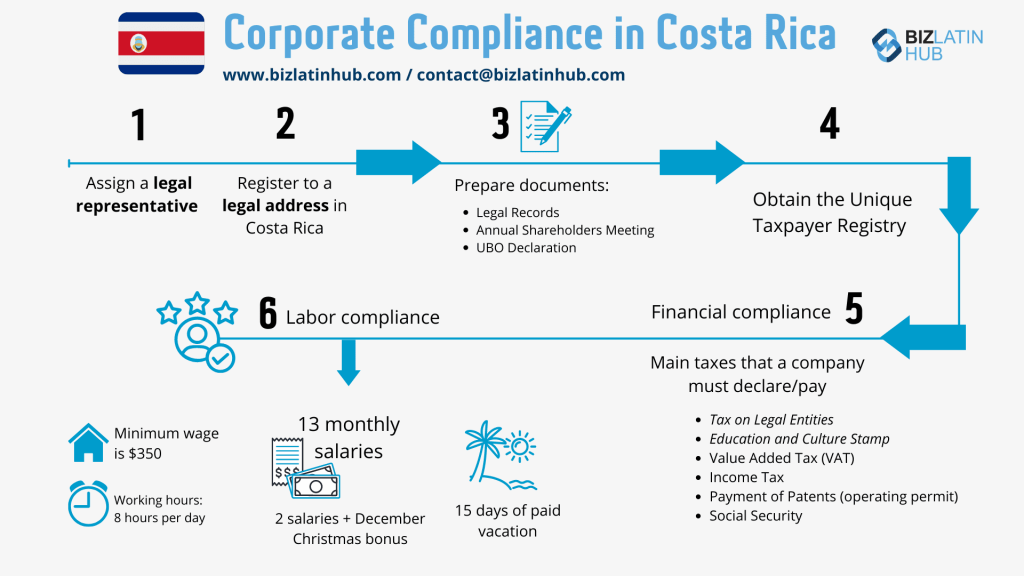

The process will usually take between two and three weeks. It is worth keeping in mind that to modify the details in Costa Rica it is necessary to amend the bylaws of the entity.

Most common legal entities in Costa Rica

If you are looking to register a fiscal address in Costa Rica in support of company formation, you will need to choose which type of entity to form. The most common types of entities used by foreign investors include:

- Branches of foreign companies.

- Corporation/Joint Stock Companies (Sociedad Anónima – S.A).

- Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L).

FAQs on fiscal address in Costa Rica

Your company’s fiscal address will generally be where your operations are headquartered and where core administrative, commercial, and managerial operations are carried out.

As such, it will be the address that is lodged with authorities, including the Costa Rican tax authorities, for correspondence on taxes and other compliance matters.

When starting a business in Costa Rica, you will need to register as a taxpayer in the country, which involves filing a D-140 form, which will provide details such as the economic activity, company name, and the fiscal address.

Yes, this is necessary.

It will be the address that is lodged with authorities, including the Costa Rican tax authorities, for correspondence on taxes and other compliance matters.

It should take two to three weeks if everything is in order.

No, although many companies do exactly this for the sake of convenience.

Get a fiscal address in Costa Rica with the help of Biz Latin Hub

At Biz Latin Hub, we assist companies and entrepreneurs to enter and do business in Latin America and the Caribbean through the provision of tailored packages of back-office services.

We have teams in place in 16 markets around the region and our portfolio includes company formation, accounting & taxation, corporate legal services, due diligence, hiring & PEO, and visa processing, among others.

In the event you plan to start a business that does not require a physical premises, we can provide you with a fiscal address in Costa Rica.

Contact us now to find out more about how we can support you doing business in Costa Rica.

Or learn more about our team and expert authors.