If you are looking to register a business, you will need to establish a fiscal address in Colombia. Because even if you do not need physical premises for your business to operate, your fiscal address will be where all official correspondences, including all tax-related matters is directed.

Read on to understand more about why you need a fiscal address in Colombia, as well as some more considerations related to doing business in the country. The country is developing quickly, although the market remains one with room to grow.

Biz Latin Hub can help you with a fiscal address in Colombia and with any other matters related to compliance with local laws and regulations. Our array of back office services is designed to help you with company formation in Colombia and to keep that business above board and in good standing in the eyes of the law. Not only that, but our network of dedicated local offices across the region means we can help you do business anywhere in Latin America and the Caribbean.

Why invest in Colombia?

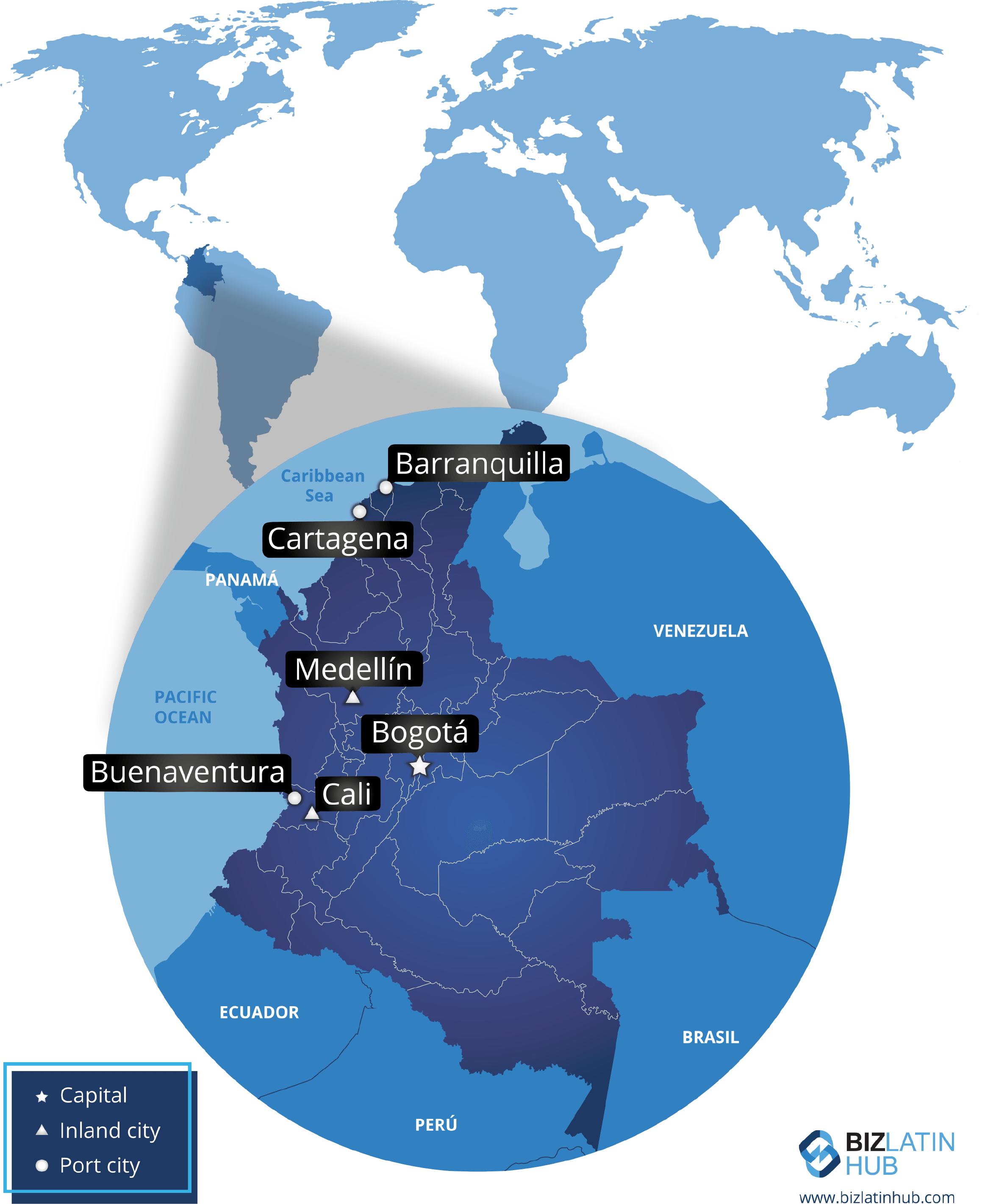

Before we dive into how to incorporate a company in Colombia, let’s review why Colombia is a great place to do business. The country has an array of advantages that businesses can capitalize on. Its strategic location in South America provides easy access to regional and international markets. Colombia has a rapidly growing economy that is a hotspot for innovation.

The substantial number of young and skilled workers leads to competitive labor costs. Colombia’s growing workforce is a big reason businesses have been looking to expand into the country. Colombia has made significant strides in improving its business climate through regulatory reforms that simplify bureaucratic processes and provide incentives for foreign investment. For example, the government offers tax incentives and has established free trade zones for foreign entrepreneurs to incentivize company incorporation.

Colombia has abundant natural resources, especially agriculture, mining, and renewable energy. The ongoing enhancements in infrastructure and transportation networks also streamline business operations. Additionally, the country’s diverse and growing consumer base makes Colombia a promising market for companies seeking growth in Latin America.

Why do you need a fiscal address in Colombia?

Your company’s fiscal address in Colombia will generally be where your operations are headquartered and where core administrative, commercial, and managerial operations are carried out.

As such, it will be the address that is lodged with authorities, including the Colombian tax authorities DIAN, for correspondence on taxes and other compliance matters.

You will therefore need to have this address when you register for your tax identification number, known in Colombia as a NIT.

You will also need it for the likes of:

- Company registration

- Opening a corporate bank account

- Participation in tenders

In the event that you are planning to run a business in Colombia that does not require a physical location, you will still need to have a fiscal address to receive such official correspondences. One service a back-office services provider will be able to offer you is a fiscal address to which correspondences can be directed.

Note that, any entity that has a stock of goods must have a physical premises, not just a fiscal address, even if they are the same place.

The process to register a fiscal address in Colombia will usually take between two and three weeks. It is worth keeping in mind that to modify a registered fiscal address in Colombia it is necessary to amend the bylaws of the entity.

Most common legal entities in Colombia

If you are looking to register a fiscal address in Colombia in support of company formation, you will need to choose which type of entity to form. The most common types of entities used by foreign investors include:

Empresa Unipersonal: This is a sole proprietorship, where the business is owned by a single individual. There is no minimum capital requirement, and the owner is responsible for all obligations of the business.

Sociedad Anónima (S.A.): This type of company is similar to a public limited company (PLC). It requires at least five shareholders and a minimum capital contribution of 100 times the monthly legal minimum wage.

Sociedad Limitada (Ltda.): This is similar to a limited liability company (LLC) in other countries. It requires at least two partners and a minimum capital contribution of 100 times the monthly legal minimum wage.

Sociedad por Acciones Simplificada (SAS): This is a simplified stock corporation designed to provide a more straightforward and faster incorporation process compared to the traditional S.A. and Ltda. companies. It requires at least one partner and has no minimum capital requirements. In our experience, this is what we almost always recommmend.

FAQs on fiscal address in Colombia

Your company’s fiscal address in Colombia will be the address that is lodged with authorities for correspondence on taxes and other compliance matters. You will therefore need to have this address when you register for your tax identification number, known in Colombia as a NIT.

You will also need it for the likes of company registration, opening a corporate bank account or participation in tenders.

Yes, this is an absolutely necessary part of the process.

Yes, this is an absolutely necessary part of the process.

Your company’s fiscal address in Colombia will be the address that is lodged with authorities for correspondence on taxes and other compliance matters.

The process in Colombia will usually take between two and three weeks.

Although many companies do exactly this, it isn’t necessary. If your entire business is remote, for example, you may not need a full physical office.

Get a fiscal address in Colombia with the help of Biz Latin Hub

At Biz Latin Hub, we assist companies and entrepreneurs to enter and do business in Latin America and the Caribbean through the provision of tailored packages of back-office services.

We have teams in place in 16 markets around the region and our portfolio includes company formation, accounting & taxation, corporate legal services, due diligence, hiring & PEO, and visa processing, among others.

In the event you plan to start a business that does not require a physical premises, we can provide you with a fiscal address in Colombia.

Contact us now to find out more about how we can support you doing business in Colombia.

Or learn more about our team and expert authors.