If you are looking to register a business, you will need to establish a fiscal address in Chile. Because even if you do not need physical premises for your business to operate, your fiscal address will be where all official correspondences, including all tax-related matters is directed.

Read on to understand more about why you need a fiscal address in Chile, as well as some more considerations related to doing business in the country. The country has long been a regional economic powerhouse, meaning that it is a stable place in which to do business.

Biz Latin Hub can help you with a fiscal address in Chile and with any other matters related to compliance with local laws and regulations. Our array of back office services is designed to help you with company formation in Chile and to keep that business above board and in good standing in the eyes of the law. Not only that, but our network of dedicated local offices across the region means we can help you do business anywhere in Latin America and the Caribbean.

Why invest in Chile?

As the global economy struggles with high inflation and logistics issues, Chile remains a safe bet for business. It has a stable economy supported by the booming mining sector and low corruption rates.

Economists forecast Chile’s inflation to decrease this year, while the country’s new constitution should be ratified in the coming months, easing political tensions.

The expanding tech sector is one of the most promising sectors with high growth potential. There are over 8,000 IT companies in Chile with this number set to increase as the 5G telecommunications network widens.

Chile Digital 2035, a new strategy introduced by the Chilean government in May 2022, aims to reduce digital inequality and foster the digital transformation of the country.

The strategy’s key objectives include promoting digital rights, developing digital infrastructure, enhancing cybersecurity, and digitalizing the public sector. As of 2022, 86 percent of public services are already digitalized, and the government aims to achieve 95 percent digitalization by 2025 and 100 percent by 2035.

IT Chile business investment opportunities lie in the 5G network, data analytics, cloud computing, cybersecurity, and artificial intelligence.

Why do you need a fiscal address in Chile?

Your company’s fiscal address in Chile will generally be where your operations are headquartered and where core administrative, commercial, and managerial operations are carried out.

As such, it will be the address that is lodged with authorities, including the Chilean tax authorities, for correspondence on taxes and other compliance matters.

You will therefore need to have this address when you register for your tax identification number, known in Chile as a RUT. When a company deals with taxation compliance, this number is required in order to deal with the national tax authorities.

You will also need it for the likes of:

- Company registration

- Opening a corporate bank account

- Participation in tenders

In the event that you are planning to run a business in Chile that does not require a physical location, you will still need to have a fiscal address to receive such official correspondences.

One service a back-office services provider will be able to offer you is a fiscal address to which correspondences can be directed.

Note that, any entity that has a stock of goods must have a physical premises, not just a fiscal address, even if they are the same place.

The process to register a fiscal address in Chile will usually take between two and three weeks. It is worth keeping in mind that to modify a registered fiscal address in Chile it is necessary to amend the bylaws of the entity.

Most common legal entities in Chile

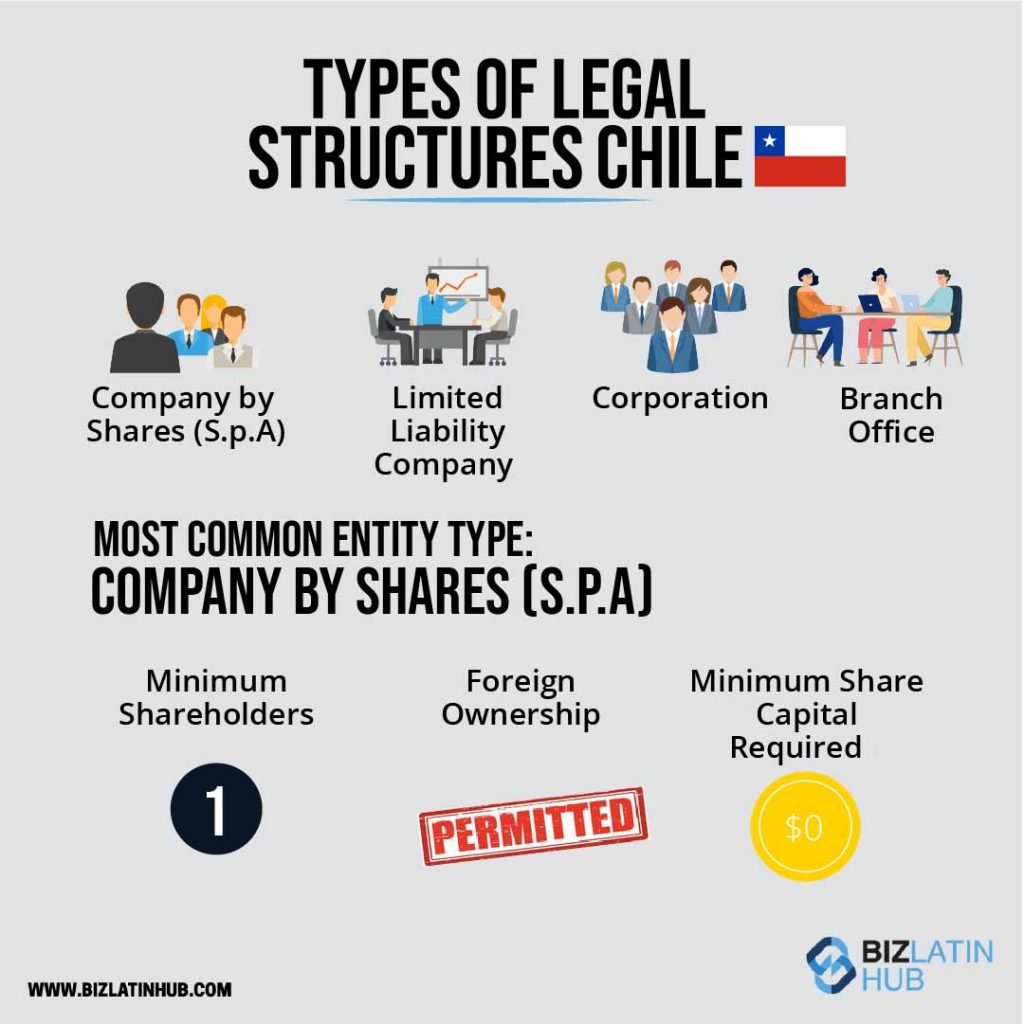

If you are looking to register a fiscal address in Chile in support of company formation, you will need to choose which type of entity to form. Company formation in Chile is a multi-step process, and one of the initial and most crucial decisions you’ll make is selecting the right type of company structure.

The type of company you choose will have significant implications on aspects such as liability, taxation, and administrative requirements. In Chile, there are several types of companies to choose from, each with its own set of characteristics and requirements.

Here are the 4 types of Chilean companies:

Stock Company (SpA).

Individual Limited Liability Company (EIRL).

Limited Liability Company (LLC).

Corporation (SA).

FAQs on fiscal address in Chile

Your company’s fiscal address in Chile will be the address that is lodged with authorities, including the Chilean tax authorities, for correspondence on taxes and other compliance matters.

You will therefore need to have this address when you register for your tax identification number, known in Chile as a RUT. When a company deals with taxation compliance, this number is required in order to deal with the national tax authorities.

You will also need it for the likes of company registration, opening a corporate bank account, participation in tenders.

Yes, it is a necessary part of that process.

Yes, it is a necessary part of that process.

It will be the address that is lodged with authorities, including the Chilean tax authorities, for correspondence on taxes and other compliance matters.

The process in Chile will usually take between two and three weeks.

No, you do not. Many companies do this as it is most convenient for the majority of companies. However, if for example your business is entirely remote, you may decide not to bother maintaining a fully equipped office.

Get a fiscal address in Chile with the help of Biz Latin Hub

At Biz Latin Hub, we assist companies and entrepreneurs to enter and do business in Latin America and the Caribbean through the provision of tailored packages of back-office services.

We have teams in place in 16 markets around the region and our portfolio includes company formation, accounting & taxation, corporate legal services, due diligence, hiring & PEO, and visa processing, among others.

In the event you plan to start a business that does not require a physical premises, we can provide you with a fiscal address in Chile.

Contact us now to find out more about how we can support you doing business in Chile.

Or learn more about our team and expert authors.