If you are looking to register a business in Brazil, you will need to establish a fiscal address. Because even if you do not need physical premises for your business to operate, your fiscal address in Brazil will be where all official correspondences, including all tax-related matters.

Read on to understand more about why you need a fiscal address in Brazil, as well as some more considerations related to doing business in the country. The country is so enormous that there is a plethora of options available to you, whether that’s exporting from Brazil or selling to the vast internal market.

Biz Latin Hub can help you with a fiscal address in Brazil and with any other matters related to compliance with local laws and regulations. Our array of back office services is designed to help you with LLC formation in Brazil and to keep that business above board and in good standing in the eyes of the law. Not only that, but our network of dedicated local offices across the region means we can help you do business anywhere in Latin America and the Caribbean.

Why invest in Brazil?

Brazil is the largest nation in Latin America — in terms of landmass, population, and economy size — and on that basis the country is widely known as “The Giant of South America.”

In 2020, Brazil registered a gross domestic product (GDP) of $1.44 trillion, a figure roughly equal to the combined GDP of the rest of South America, despite representing a decline on the previous year owing to the effects of the COVID-19 pandemic.

The country witnessed a similar decline in gross national income (GNI) — a key indicator of general prosperity — however the figure of $7,850 per capita registered in 2020 still firmly places the country as an upper-middle income nation by international standards.

Brazil is well-known for its abundance of natural resources, including large deposits of precious metals, gems, and oil, while coffee, soybeans, and timber are all key export goods produced by the country’s massive agricultural sector.

Brazil also has a highly-developed manufacturing sector, while the services sector is of increasing importance — generating more than 60% of GDP since 2015. That includes a growing professional services industry concentrated in major cities such as Sao Paulo and Rio de Janeiro.

The country is also a founding member of the Southern Common Market (Mercosur) — a 30-year-old economic integration initiative that also includes Argentina, Paraguay, and Uruguay, and to which Bolivia is awaiting formal acceptance as a member.

Why do you need a fiscal address in Brazil?

Your company’s fiscal address in Brazil will generally be where your operations are headquartered and where core administrative, commercial, and managerial operations are carried out.

As such, it will be the address that is lodged with authorities, including the Brazilian Federal Revenue (“Receita Federal”) service and state or city tax authority, for correspondence on taxes and other compliance matters.

You will therefore need to have this address when you register for your tax identification number, known in Brazil as a Cadastro Nacional das Pessoas Jurídicas (CNPJ).

You will also need it for the likes of:

- Company registration

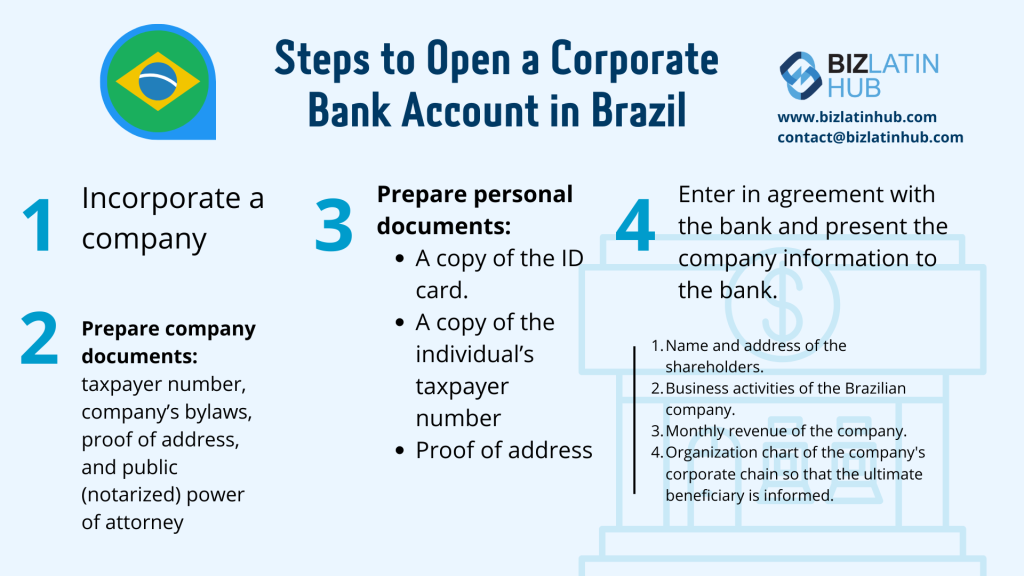

- Opening a corporate bank account

- Participation in tenders

In the event that you are planning to run a business in Brazil that does not require a physical location, you will still need to have a fiscal address to receive such official correspondences. One service a back-office services provider will be able to offer you is a fiscal address to which correspondences can be directed.

Note that, any entity that has a stock of goods must have a physical premises, not just a fiscal address.

The process to register a fiscal address in Brazil will usually take between two and three weeks. It is worth keeping in mind that to modify a registered fiscal address in Brazil it is necessary to amend the bylaws of the entity.

Most common legal entities in Brazil

If you are looking to register a fiscal address in Brazil in support of a company formation, you will need to choose which type of entity to form. The most common types of entities used by foreign investors include:

- Limited Liability Company (“Limitada” / “Ltda.”)

This is one of the most common types of entities used in Brazil, for which at least two shareholders are needed, with each shareholder’s responsibility limited to the amount of capital invested. No minimum or maximum capital is required to establish such an entity - Limited Liability Corporation – S/A (“Sociedade Anônima” / “S.A.”)

These entities are regulated by a specific law, and shareholders’ liability is limited to the payment of shares to which the shareholders have subscribed. These entities also require at least two shareholders, and must have a Board of Directors.

FAQs on a fiscal address in Brazil

Your company’s fiscal address in Brazil will generally be where your operations are headquartered and where core administrative, commercial, and managerial operations are carried out.

As such, it will be the address that is lodged with authorities, including the Brazilian Federal Revenue (“Receita Federal”) service and state or city tax authority, for correspondence on taxes and other compliance matters.

Yes, this is an absolutely necessary part of the process. You will therefore need to have this address when you register for your tax identification number, known in Brazil as a Cadastro Nacional das Pessoas Jurídicas (CNPJ).Yes, this is an absolutely necessary part of the process.

Yes, this is an absolutely necessary part of the process.

Your company’s fiscal address in Brazil will be the address that is lodged with authorities for correspondence on taxes and other compliance matters.

The process in Brazil will usually take between two and three weeks.

Although many companies do exactly this, it isn’t necessary. If your entire business is remote, for example, you may not need a full physical office. Note that any entity that has a stock of goods must have a physical premises, not just a fiscal address.

Get a fiscal address in Brazil with the help of Biz Latin Hub

At Biz Latin Hub, we assist companies and entrepreneurs to enter and do business in Latin America and the Caribbean through the provision of tailored packages of back-office services.

We have teams in place in 16 markets around the region and our portfolio includes company formation, accounting & taxation, corporate legal services, due diligence, hiring & PEO, and visa processing, among others.

In the event you plan to start a business that does not require a physical premises, we can provide you with a fiscal address in Brazil.

Contact us now to find out more about how we can support you doing business in Brazil.

Or learn more about our team and expert authors.