If you are looking to register a company in Bolivia, lodging a fiscal address with local authorities is a crucial step in the process of getting your commercial operations off the ground. So better understanding the process of getting a fiscal address in Bolivia should be useful to anyone planning on doing business in the South American nation.

If you are looking into business opportunities in Bolivia or have already started a company formation process, read on to understand the importance of getting a fiscal address in Bolivia. Compliance is absolutely essential in any country in the world, and that applies here too. The country is growing and modernizing, meaning meaning it is increasingly in line with international norms.

Biz Latin Hub can help you with a fiscal address in Bolivia and with any other matters related to compliance with local laws and regulations. Our array of back office services is designed to keep your business above board and in good standing in the eyes of the law. Not only that, but our network of dedicated local offices across the region means we can help you do business anywhere else in Latin America and the Caribbean.

Why invest in Bolivia?

Bolivia had one of the fastest-growing economies in Latin America during the second decade of the 21st Century.

The Andean nation — the fifth-largest by area while being one of the least-populated in South America — has maintained consistent gross domestic product (GDP) growth throughout that period, rising as high as 6.8% per year and never dropping below 3.4% between 2008 and 2018, according to the World Bank.

Although things have recently slowed down a bit as the country went through the COVID pandemic, it remains a dynamic and rapidly growing economy.

The landlocked country shares borders with Argentina, Brazil, Chile, Paraguay, and Peru, and offers an unsaturated market with enormous potential for foreign companies looking to invest in various sectors such as hydrocarbons, mining, natural resources, transport, and communications.

Bolivia’s top exports include oil, gas, zinc, gold, and soybean meal, and the country is in the process of joining the Southern Common Market (Mercosur), a regional economic bloc currently comprised of Argentina, Brazil, Paraguay, and Uruguay.

Why do you need a fiscal address in Bolivia?

Registering a fiscal address in Bolivia is the final step in a company incorporation process. A fiscal address is where the administration and commercial operations of an organization established in Bolivia usually take place. It is also the place where the Bolivian tax authority (Autoridad de Impugnación Tributaria – AIT) will contact you for tax compliance purposes.

When registering a fiscal address in Bolivia for your new company, you will obtain a business registration number and the AIT will issue you with a taxpayer identification number (Número de Indentificación Tributaria — NIT). This information is essential to demonstrate that the company is legally established in the country and is required for different procedures, including:

- Obtaining the operating license granted by the local council where the company will operate

- Opening a corporate bank account

- Participating in local tenders

- Registering the company before the Chambers of Commerce

- Receiving official notifications from local government entities

Most common types of legal entities in Bolivia

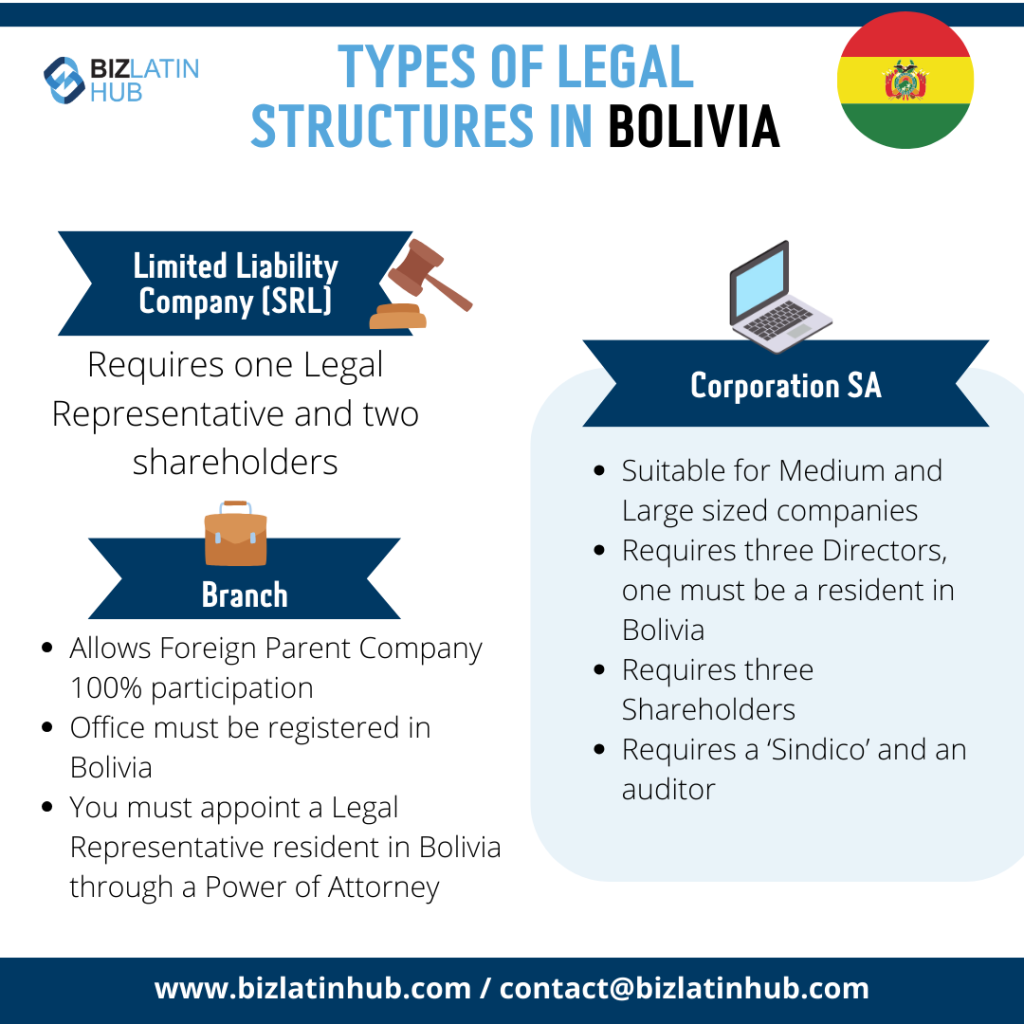

Before incorporating a company and obtaining a fiscal address in Bolivia, you must decide on the type of legal entity to establish in the country. The most popular types of legal entities among foreign investors doing business in Bolivia are:

Limited Liability Company (LLC): An LLC is the most common type of legal entity in Bolivia and the easiest one to incorporate. An LLC requires between two and 25 shareholders to be established. When incorporating this type of entity, a deed of incorporation must specify the shareholders’ liability, which is limited according to the number of their contributions.

Corporation: In a corporation, the capital stock is divided into shares that can be freely transferred. For this type of legal entity, there are no restrictions on the maximum number of shareholders that can participate, but a minimum of three is required. However, a board of directors composed of at least three members and a maximum of 12 must be appointed. Note that the president of the board of directors must be the legal representative of the company.

Branch of a foreign company: A branch is a legal entity subordinate to a parent company operating abroad. Thus, according to Bolivian corporate regulations, liability to third parties is assumed by the parent company.

Key requirements to form a company in Bolivia

Once you decide which type of legal entity you want to establish, you will be able to form a company and obtain a fiscal address in Bolivia. Some of the main requirement to do so include:

- Shareholders: Shareholders can be nationals or foreign, natural or legal persons.

- Legal representative: Regardless of the type of legal entity you establish, the legal representative must live in Bolivia. Foreigners appointed as the legal representative of a company must have a permanent residence visa to legally reside in the country.

- Capital: The subscribed capital of the company must be specified in the company’s incorporation documents.

- Authenticated foreign documents: To be valid, any required document of foreign origin must be properly authenticated at a Bolivian consulate located in the country of origin.

- Fiscal address in Bolivia: The legal address of a company must be established in Bolivia and must be registered with the AIT.

FAQS on a fiscal address in Bolivia

A fiscal address is where the administration and commercial operations of an organization established in Bolivia usually take place. It is also the place where the Bolivian tax authority (Autoridad de Impugnación Tributaria – AIT) will contact you for tax compliance purposes.

Yes, this is an absolutely necessary part of the process.

Yes, this is an absolutely necessary part of the process.

Your company’s fiscal address in Bolivia will be the address that is lodged with authorities for correspondence on taxes and other compliance matters.

The process in Bolivia will usually take between two and three weeks.

Although many companies do exactly this, it isn’t necessary. If your entire business is remote, for example, you may not need a full physical office.

Get a fiscal address in Bolivia with the help of Biz Latin Hub

At Biz Latin Hub, we’re committed to supporting foreign executives doing business in Bolivia, as well as many other countries in Latin America and the Caribbean. With our full suite of market entry and back-office services, we can provide comprehensive company formation, as well as an array of corporate legal and accounting support.

Contact us now for further advice or a free quote

Learn more about our team and expert authors.