Last year, Mexico became the Latin American nation with the most registered fintech companies as it recorded 80 new start-ups in just one year. With the industry growing so fast and the country quickly becoming a global fintech hub, the Mexican government has taken steps to regulate the industry and make it the first Latin American country to establish a legal framework for fintech. In the following article we give an overview of the Mexican fintech market in and how it will be affected by the new Fintech Law in Mexico.

Company formation – overview of the fintech industry in Mexico

By July 2017, Mexico’s fintech industry had become the largest in Latin America with 238 financial technology institutions (FTIs) recorded, a growth of about 50% compared to the previous year.

This saw Mexico take first place overtaking Brazil (219 FTIs) that is followed by Colombia (124) and Chile (75). Mexico has long been a huge opportunity for fintech startups considering about 40% of the 127 million population doesn’t have a bank account according to data from the World Bank. And furthermore, according to a Gallup survey, more than 75% of those who do have a bank account are indifferent or unhappy with their bank. This is mainly due to low availability of cash in bank machines and high fees. A high percentage of unbanked citizens combined with an environment supportive of entrepreneurship and e-commerce, and a high smartphone and internet usage, makes Mexico a particulalry attractive destination within Latin America for fintech startups. Currently in 2018, Mexico’s fintech industry is the fastest growing in the LATAM region and it boasts 280 FTIs.

Last year, Mexico’s economic growth was driven almost exclusively by private consumption. As the disposable income of the average Mexican increases, more and more opportunities present themselves for innovative fintech startups to offer a more efficient alternative to traditional banking and shift the balance in an economy that is highly reliant on cash. Mexico City is where most of the Mexican fintech startups have based themselves with 71% of them originating in the capital, followed by Monterrey with 11% and Guadalajara with 10%. In terms of internationalization, 90% of the startups state to operate only in Mexico, and only 10% of them already operate outside of Mexican borders.

How does Fintech Law affect business in Mexico?

The Fintech Law contains 145 articles divided into seven titles and has the objective of regulating services such as credit provision, crowdfunding, transactions with cryptocurrencies or virtual securities and everything that has to do with the implementation of technological innovations in financial services.

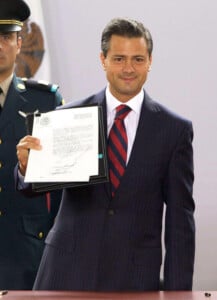

On 8 March 2018, the bill for the Law was passed and President Enrique Peña Nieto initiated a new phase for the sector. As Mexico is one of the few countries in the world to regulate fintech, the law is expected to attract foreign investment as it will provide more regulatory certainty in the sector.

“The Fintech Law has legitimised financial services. The industry is coming of age in Mexico and the government has recognised that it’s here and it’s here to stay. Until now there’s been little alternative to cash, so currently the opportunities in the sector are huge considering that electronic payments provide a solution to a variety issues in the country such as money laundering, the informal sector and increased private consumption.” said Paul Coppinger of Unipagos, a leading provider of financial inclusion services in Mexico.

Paul is an entrepreneur and technologist from the USA who moved to Mexico in 2013 and set up Unipagos after noticing the potential for fintech enterprises in the country. He developed a mobile money system operable by smartphone that caters for small businesses and the millions of unbanked Mexicans. Since its inception, Unipagos has grown exponentially and it is expected to grow further following the passing of Fintech Law and the certainty it brings to a previously unregulated sector.

Forming a fintech company in Mexico

The Fintech Law itself is an extensive 52 page long draft with 145 articles divided into seven titles written in Spanish. In the following, we summarise the major points to consider for current owners of FTIs or those considering forming a FTI:

- To form an FTI, you must obtain authorisation from the CNBV (Comisión Nacional Bancaria y de Valores), together with support from the Committee of Financial Technology Institutions.

- Existing FTIs will have 6 months after the inauguration of the law to obtain the authorisation in order to keep operating.

- The structure of the company must be a Limited Company and meet certain requirements of capitalisation, internal policies for the prevention of money laundering, disclosure of risks and operations as well as control of operational risks and security.

- Furthermore, confidentiality, conflict of interest resolution and fraud prevention should also be respected to operate as an FTI.

- The company name must include either “institución de financiamiento colectivo” (“crowdfunding institution”) or “institución de Fintech Law fondos de pago electrónico” (“electronic funds transfer institution”).

- Every client transaction must be recorded. Information of account owners and balances must be identified and kept by the FTI.

- The clients’ funds must be kept separate from the funds of the company.

- Independent external auditors have to check the annual Financial statement once a year.

- FTIs will have to report their activities and transactions to CNBV, the CONDUSEF and to the Bank of Mexico.

- Companies participating in this industry must use bank accounts maintained by authorised financial institutions.

- The use of cash in transactions is limited only to specific situations as permitted by the authorities.

Find out more about doing business in the fintech industry in Mexico

Investing in the fintech industry in Mexico may seem promising but it certainly comes with its difficulties due to language barriers, a different business culture and new regulations. In order to help you get a better insight into the different steps of the process, our team of local and expat business experts can provide you with the information you need to ensure your Latin American business venture is a success. We can even hire the staff you need on your bahelf via our hiring & PEO services.

Contact us now for further information.

Check out our video to find out how to form a company in Mexico!