Company regulatory compliance in Mexico is designed to promote economic growth, safeguard workers, and maintain a competitive business environment. Understanding these regulations is crucial for registering a business in Mexico and avoiding penalties. Biz Latin Hub offers comprehensive support with its full suite of back-office services, addressing all your compliance needs under a single service agreement. With customized solutions, you can optimize operations and concentrate on growth in one of Latin America’s most vibrant markets.

Key takeaways on company regulatory compliance in Mexico

| Fiscal Address Requirements: | A registered office address or local fiscal address is required for all entities in Mexico for the receipt of legal correspondence and governmental visits. |

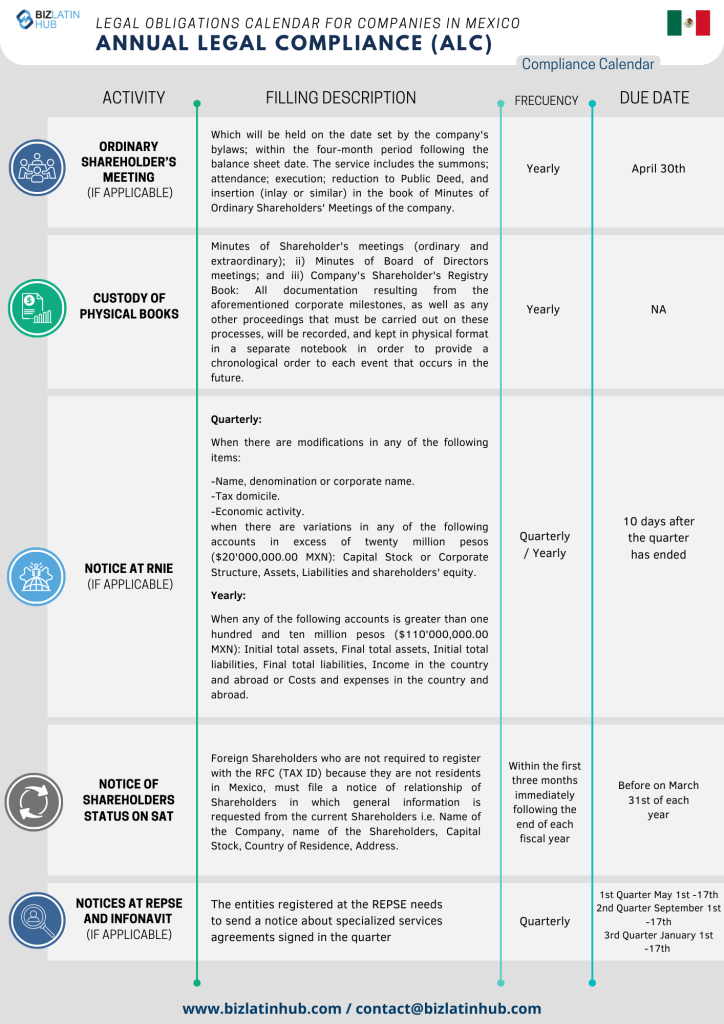

| What Are The Steps For Annual Legal Compliance? | Ordinary Shareholers Meeting Custody of Physcial Books Notice at RNIE Notice of Shareholders Status on SAT Notices at RESPSE and INFONAVIT |

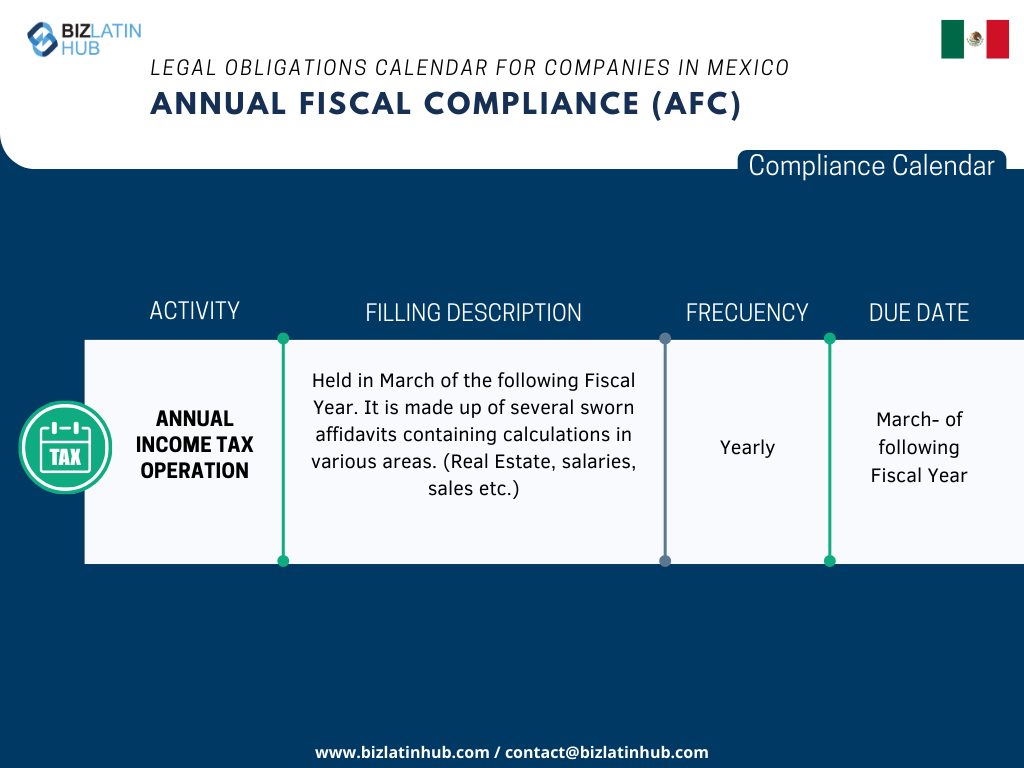

| What Needs To Be Given For Annual Fiscal Compliance? | Annual Income Tax Operation |

| Why invest in Mexico? | Mexico ranks among the world’s top countries for productive investments, driven by factors like its strategic geographical location. |

Financial Regulatory Compliance in Mexico: Key Responsibilities

While financial regulatory compliance in Mexico may vary based on your company’s type of legal structure, the following aspects of corporate compliance are generally applicable to all. Note that in Mexico the financial year runs from January 1 to December 31.

Hold an annual general meeting: The AGM is a crucial requirement of corporate compliance in Mexico. All shareholders must be provided proper prior notification of the AGM, and it must be held within the first four months of the year. During this meeting, shareholders must approve the financial statements, administrator reports, dividends, and other aspects of performance from the previous financial year.

Update corporate books: The AGM will feed into another critical compliance issue, which is the proper updating of corporate books, including minutes from the AGM and any annual resolutions that were agreed upon.

Shareholders report to the Tax Authority: When a Mexican company has shareholders or partners without a Mexican tax number – meaning they do not pay tax in Mexico – a shareholders report must be presented to the Tax Authority before March 31st. The report must contain personal details of the shareholders or partners, including information on where they do pay taxes.

Mexican companies with foreign investments must submit annual and quarterly reports before the RNIE. It is required to submit these reports if it meets any of the following criteria:

- Changes in the corporate name, tax domicile, or business activities

- Modifications in the company’s capital stock and/or shareholding structure, under certain circumstances

- Movements in at least one of their accounts, exceeding an amount of MXN 20,000,000

- New contributions, reserves, or withdrawal, which does not affect the capital stock of the company

- Retained profits of the last fiscal year and disposal of retained profits

- Receivables or payable loans to subsidiaries residing abroad, the head office, foreign investors residing abroad with ownership interest as shareholders or partners, and residents abroad which are part of the same corporate group

Annual economic report: Companies that reach a certain size (based on active total, liabilities, and outflows) must submit an annual economic report to the National Registry of Foreign Investments. Submission is due in either April or May each year.

Quarterly economic reports: Companies that meet particular financial benchmarks must submit quarterly reports to the National Registry of Foreign Investments within 10 business days of the end of each period.

Update Mexican Entrepreneurial Information System (SIEM): All corporations are obliged to register with the government-run SIEM and and keep their information up to date, with fines levied upon those who do not comply.

Stated above are key requirements related to financial regulatory compliance in Mexico. Beyond those, the following demands must also be met:

Renewal of employer registration with immigration authorities: In order to hire foreign staff, a company must be registered with the Mexican immigration authorities, known as INAMI. This license must be updated at least 30 days prior to the expiry of the outstanding license, and accompanied with the presentation of a recent tax return.

Review and modification of internal labor policies: All companies in Mexico are obliged to follow labor regulations in keeping with Mexican labor law, and to modify their policies consistent with changes made to those regulations. The policies and subsequent changes must be registered with Mexico’s labor courts.

Preparing labor contract addendums: Any salary raise or other critical change in working conditions must be supported with an addendum to that employee’s contract.

Data protection and intellectual property: Company policies with regard to data protection and intellectual property must be in line with the most up-to-date regulations. Therefore, they must be periodically reviewed and where applicable, modified.

Renew leases: To ensure financial regulatory compliance in Mexico, companies must have up-to date leases on any property used by the business. Company leases must be renewed in a timely manner, so that the information held by authorities is correct.

Provide information to bank(s): Each year, banks servicing corporate accounts will request up to date information from account holders. This must be provided in a timely manner. Failure to do so could result in the bank account(s) of the business being frozen.

Common Questions on Entity Legal Compliance in Mexico

Based on our extensive experience these are the common questions and doubts of our clients on entity legal compliance in Mexico:

The following are the most common statutory appointments for Mexican legal entities:

– An appointed legal representative who will be personally liable, both legally and financially, for the good operation and standing of the company. These appointments are required in front of both the Mexican Tax Administration and the Mexican Social Security Institute (i.e. 2 x appointments). This person can either be a local national or a foreigner, however, if a foreigner, then a Mexican Legal Representative must be designated to act on their behalf. For these appointments, the person must be a local national or a foreigner with residency in Mexico and will represent the company in front of the Mexican tax authorities (“SAT”). Also, the legal representative must be registered before the RFC Federal Taxpayers Registry

Yes, a registered office address or local fiscal address is required for all entities in Mexico for the receipt of legal correspondence and governmental visits.

An Ordinary Shareholders Meeting in Mexico will be held on the date set by the company´s bylaws; within the four-month period following the balance sheet date and by the deadline of April 30th. The service includes: the summons; attendance; execution; reduction to Public Deed, and insertion (inlay or similar) in the book of Minutes of Ordinary Shareholders Meetings of the company.

You must notify RNIE quarterly when there are modifications in any of the following items:

– Name, denomination or corporate name

– Tax domicile

– Economic activity

– When there are variations in any of the following accounts in excess of twenty million pesos ($20,000,000.00 MXN): Capital Stock or Corporate Structure

– Assets

– Liabilities

– Shareholders Equity

Also, you must notify RNIE yearly when any of the following accounts are greater than one hundred and ten million pesos ($110,000,000.00 MXN):

– Initial total assets

– Final total assets

– Initial total liabilities

– Final total liabilities

– Income in the country and abroad

– Costs and expenses in the country and abroad

The Annual Income Tax Operation is made up of several sworn affidavits containing calculations in various areas (real estate, salaries, sales, etc). This is held in March of the following fiscal year in Mexico.

Company Cosec – Mexican Market Offers Investment Opportunities

Mexico is the second-largest economy in Latin America, with a GDP of more than $1.4 trillion (all figures in USD) – a figure only exceeded in the region by Brazil. In just the first H1 of 2023 alone, Mexico generated more than $38.6 billion in foreign direct investment (FDI). While FDI as a percentage of GDP has fluctuated over recent years, it has followed a generally upward trend, almost tripling between 1990 and 2020, a sign of Mexico’s increasing popularity among foreign investors. General prosperity has also improved, with gross national income per capita tripling during the same period.

Mexico is known for being a hub for trade in the Americas, with high-volume ports serving the Pacific and Atlantic oceans, and more than $1.7 billion in goods crossing the border with the United States each day. That movement of goods is bolstered by a series of bilateral and multilateral free trade agreements (FTAs), that provide Mexican companies with preferential access to key markets around the world. Significant trade agreements include the US-Mexico-Canada Agreement (USMCA), which replaced the North American Free Trade Agreement (NAFTA) in 2020, and FTAs with the European Union, Central America, and Japan.

On top of that, Mexico is a founding member of the Pacific Alliance – a decade-old economic association with Chile, Colombia, and Peru as members. The Pacific Alliance is expanding. Ecuador recently made a formal application and in late 2021 Singapore was inaugurated as associate member. If the Pacific Alliance’s long-rumored desire to expand into the Asia-Pacific region is true, Australia, Canada, New Zealand, and South Korea are among the nations that could follow. Furthermore, Mexico is well-known for its agricultural and industrial output. It boasts considerable facilities and manpower for investors seeking to enter those sectors. Less well-known is the fact that the country generates more than 60% of GDP from its services sector.

Mexico is also increasingly recognized as a source of skilled talent, including tech talent. The cities of Guadalajara and Monterrey have emerged as a hub for innovation and been characterized as one of Latin America’s ‘new’ Silicon Valleys.

Biz Latin Hub Can Help With Your Financial Regulatory Compliance in Mexico

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean. We have offices in 18 key cities around the region, making us ideal partners to support multi-jurisdiction market entries and cross-border operations.

Our portfolio includes accounting & taxation, company formation, due diligence, hiring & PEO, and corporate legal services.

Contact us today to find out more about how we can assist you.

If you found this article on financial regulatory compliance in Mexico of interest, you may want to check out the rest of our coverage of this massive North American economy. Or read about our team and expert authors.