Corporate Entity Regulatory Compliance in Guatemala aims to foster economic growth, safeguard workers, and maintain a competitive business environment. Understanding these regulations is essential for registering a business in Guatemala and avoiding penalties. Biz Latin Hub can simplify compliance with its full suite of back-office services, covering all your needs under a single service agreement. With tailored support, you can streamline operations and focus on growth in Central America’s largest market.

Key Takeaways on Corporate Entity Regulatory Compliance in Guatemala

| Is a Fiscal Address necessary to operate a business in Guatemala? | A registered office address or local fiscal address is required for all entities in Guatemala for the receipt of legal correspondence and governmental visits. |

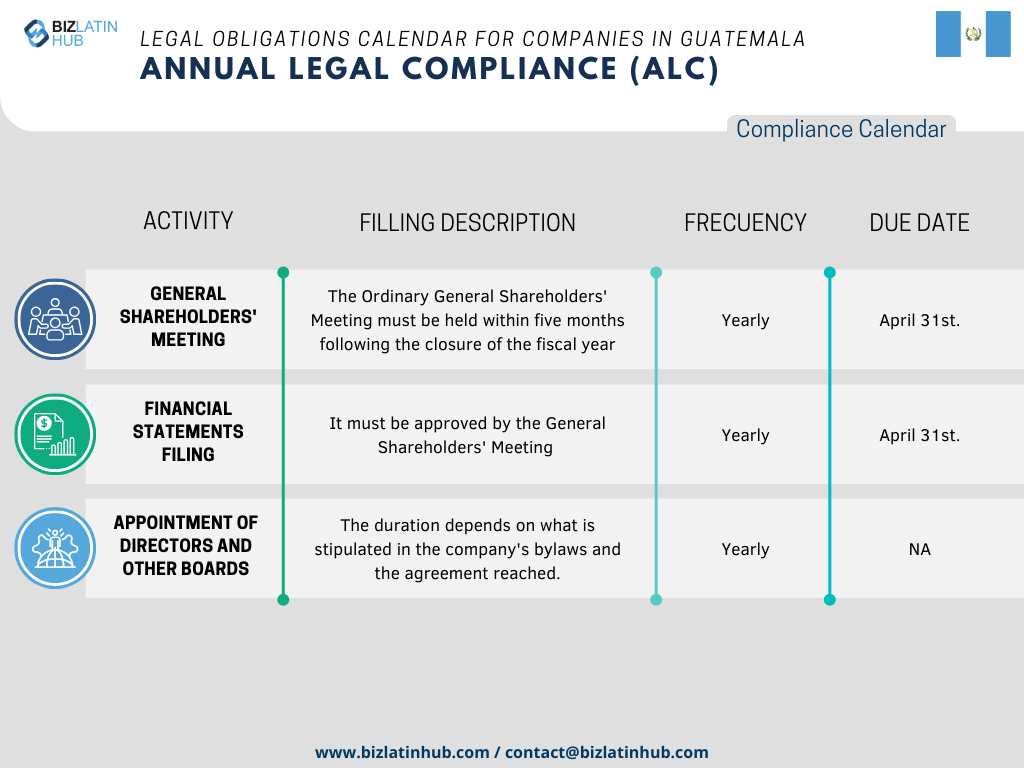

| What Legal Steps Are In Corporate Entity Regulatory Compliance in Guatemala? | Annual Shareholders Meeting Financial Statements Filing Appointment of Directors and Other Boards |

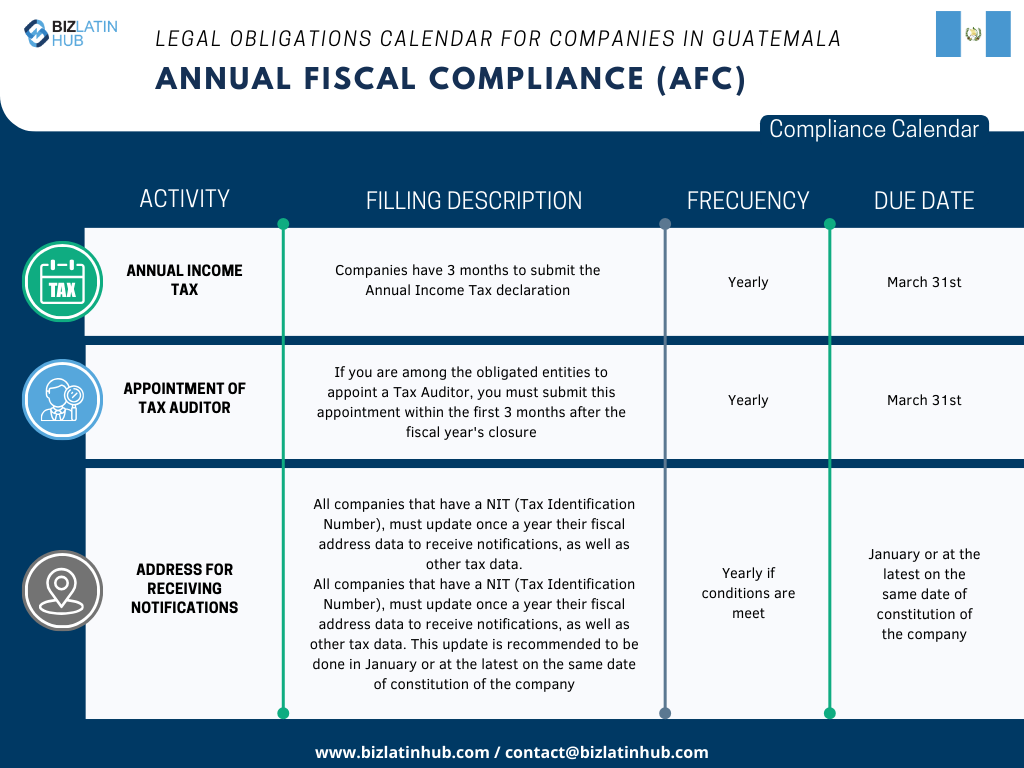

| What Fiscal Steps Are In Corporate Entity Regulatory Compliance in Guatemala? | Annual Income Tax Appointment of Tax Auditor Address for Receiving Correspondence |

| Why Invest in Guatemala? | Guatemala provides rapid market access and strong regional connectivity, with Mexico City and Miami reachable in approximately two hours by air. It also has the region’s second-largest port system after Panama. |

What responsibilities do businesses have in Guatemala?

While financial regulatory compliance in Guatemala can vary based on the type of company you have, the following aspects of corporate compliance are generally applicable to all:

- Holding an Annual General Meeting (AGM) of Shareholders

- Filing and Payment of Value-added Tax (VAT)

- Withholding Tax

- Additional Salary Bonuses

- Statutory Contributions

- Transfer Pricing Studies (TPS)

From our experience, if investory and business decision makers adhere to the below 6 responsibilities, it makes it that much easier to remain compliant and focus on gorwing your business.

Holding an Annual General Meeting (AGM) of Shareholders

The general assembly of shareholders is the highest corporate body of any company and is attended by the shareholders registered in the ‘minutes book of the general shareholders,’ or by their representatives or agents. Its operation and powers are regulated under corporate law in Guatemala, as well as the company’s bylaws. Under the terms of legal regulatory compliance in Guatemala, an AGM must be staged at least once per financial year, and for most companies, it must be held within four months of the close of the financial year on December 31.

Filing and Payment of Value-added Tax (VAT)

VAT must be filed on a monthly basis, by both companies and individuals. The current rate of VAT in Guatemala is 12% on the value of most goods and services, and companies charging VAT must report the total amount of VAT they have charged each month.

Withholding Tax

Withholding tax must be paid on a monthly basis.

Additional Salary Bonuses

Many employees are eligible for two annual bonuses, each equal to one full month of pay. The first one is due in July, while the second must be distributed in two parts. The first half is paid out in the first half of December, while the second half is paid in January. However, many companies pay the second bonus in its entirety in December.

Statutory Contributions

As part of financial regulatory compliance in Guatemala, companies are obliged to pay all health, pension, occupational risk, and unemployment contributions to the relevant government agencies within 20 days of the salary payment to which they correspond.

Transfer Pricing Studies (TPS).

In Guatemala, transfer pricing studies must be conducted in compliance with the country’s tax regulations and international standards. The Guatemalan tax authorities require multinational companies with related-party transactions to follow the arm’s length principle, which means that the prices charged in intercompany transactions should be consistent with what unrelated entities would charge each other for similar transactions.

FAQs on Financial Regulatory Compliance in Guatemala

Based on our extensive experience these are the common questions and doubts of our clients on entity legal compliance in Guatemala:

The following are the most common statutory appointments for Guatemalan legal entities:

– An appointed Legal Representative who will be personally liable, both legally and financially, for the good operation and standing of the company. This should be a local national or a foreigner with a registered and active tax ID (NIT) in the Superintendency of Tax Administration (SAT).

– A Certified Local Accountant (CPA) registered with the authorities on behalf of the company.

Yes, a registered office address or local fiscal address is required for all entities in Guatemala for the receipt of legal correspondence and governmental visits.

All companies that have a NIT (Tax Identification Number) must update once a year their fiscal address data to receive notifications, as well as other tax data. This update is recommended to be done in January or at the latest on the same date of constitution of the company.

If you are among the obligated entities to appoint a tax auditor, you must submit this appointment within the first 3 months after the fiscal year’s closure. The deadline for this in Guatemala is March 31st.

The Ordinary General Shareholders Meeting must be held within five months following the closure of the fiscal year. The deadline for this in Guatemala is April 31st.

Why Choose to Invest in Guatemala?

There has been a recent rise in interest among investors, with foreign direct investment (FDI) almost doubling during the same period to reach $966.8 million in 2019. It is in the context of this rapidly growing and evolving market that investors must navigate financial regulatory compliance in Guatemala.

With Mexico and Belize on its northern border and El Salvador and Honduras to the south, Guatemala has a strategic location as the gateway between North and Central America. Any goods traveling over land between Central and North America have to pass through the country, and Guatemala also has high-volume ports serving both the Pacific Ocean and the Caribbean Sea.

Guatemala is the largest economy in Central America, in terms of GDP. In 2019, GDP reached USD$76.71 billion (all figures in USD). The services sector is the largest contributor, accounting for approximately 63% of that figure. There is also a sizable manufacturing sector, responsible for around 22% of GDP.

Major export products include bananas, coffee, and garments, and Guatemala also has significant hydrocarbon and mineral deposits. The country is also home to a number of sectors that are growing, including the tech sector, pharmaceuticals, medical devices, and electronic devices, which are expected to contribute significantly to post-pandemic economic recovery.

Biz Latin Hub can help with Corporate Entity Regulatory Compliance in Guatemala

At Biz Latin Hub, our local team of corporate legal and accounting experts is able to assist you with financial regulatory compliance in Guatemala, as well as a range of other back office services.

We offer company formation, accounting & taxation, legal services, hiring & PEO, and visa processing among a comprehensive portfolio of corporate solutions, meaning that we can provide a tailored package of integrated back-office services to suit your needs in Guatemala or any of the other 17 markets around Latin America and the Caribbean where we have teams in place.

Contact us now to get more information on financial regulatory compliance in Guatemala.

Or read about our team and expert authors.