If you are doing business in the Costa Rican market, or intending to launch there, you will need to have a grasp of financial regulatory compliance in Costa Rica.

Because failure to comply with financial regulations can cause legal issues or result in financial penalties, potentially diminishing the standing of your company in the eyes of local authorities and impacting your business.

Financial regulatory compliance can also be more broadly referred to as corporate compliance, while many of its features are offered by providers under the name of corporate secretarial services.

If you are considering starting a business in Costa Rica, the following guide should be of considerable use.

If you already have ongoing operations in Costa Rica, or have queries about market entry, contact us today to discuss how we can help you support your business.

Costa Rica popular among foreigners seeking to invest or relocate

Boasting one of the most stable and developed economies in Latin America, Costa Rica is known for being one of the safest and most prosperous nations in the region. It also boasts some of the highest levels of English proficiency.

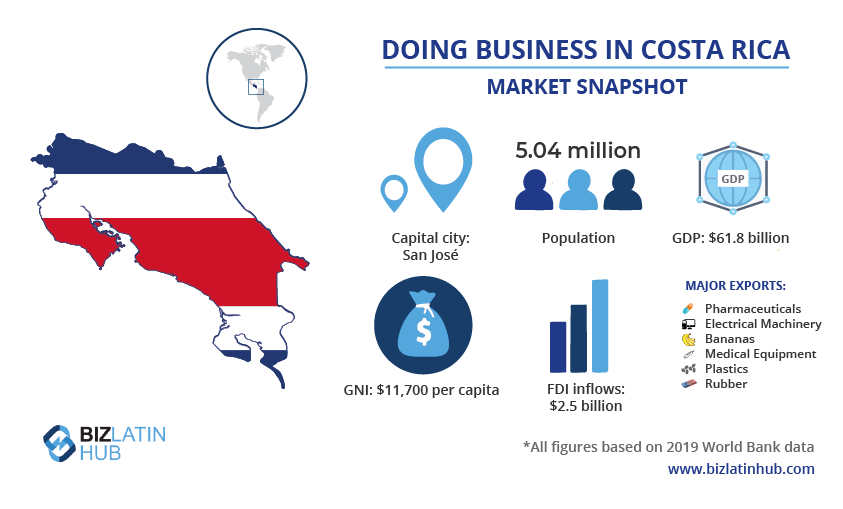

Those factors contribute to Costa Rica’s popularity among foreign investors looking to do business in Latin America, with over $2.5 billion in foreign direct investment (FDI) inflows entering the country in 2019.

It also attracts large numbers of retirees and remote workers relocating to the country from the likes of the United States, Canada, and Europe, as well as being a highly-popular holiday destination.

Prior to the COVID-19 pandemic, foreign investment accounted for 7.8% of gross domestic product, and with that figure falling to 3.5% during the global health crisis, the Costa Rican government has recently taken steps to encourage foreigners to return.

That has included the recent announcement of incentives and reduced investment prerequisites to gain residency, as well as a new scheme to entice digital nomads and remote workers to move to the country.

Financial regulatory compliance in Costa Rica: key responsibilities & dates

While some aspects of financial regulatory compliance in Costa Rica can vary based on the type of company you have, the following aspects of corporate compliance are generally applicable to all.

Holding of an annual shareholders meeting is an essential aspect of compliance for any company registered before Costa Rica’s National Registry of Corporations and requires proper prior notification to all shareholders. This must be done within the first 3 months of the end of the fiscal year, which runs from January 1 to December 31, meaning the shareholders meeting must be held by March 31.

Payment of annual corporation tax must be made to Costa Rica’s General Directorate of Taxation (DGT) every year. Payment is due no later than January 31.

Filing annual income tax returns via Form D-101 must be completed and submitted to the DGT no later than March 15 following the end of the fiscal year for which those returns relate to.

Filing an Annual Statement Summary of Suppliers Clients and Specific Expenses via Form D-151 is another annual obligation which must be completed by February 28 of the year following the fiscal year being filed for. The form is a declaration of large clients and providers that a company trades with, and includes amounts sold or purchased for the past fiscal year.

Ultimate Beneficial Owner Declaration (UBO) must be filed by April 30 each year. The UBO declares who owns or ultimately benefits from a legal entity or legal person involved in transactions and is a critical element of financial regulatory compliance in Costa Rica.

Payment of the annual ‘Education and Culture Stamp’ must be made to the DGT by March 31. The funds generated from this payment go towards higher and further education, particularly among lower-income learners, as well as supporting Costa Rica’s National Museum.

An annual report of operations must be filed to the Costa Rican Trade Promotion Agency (PROCOMER) by any company operating in a free trade zone (FTZ), no later than April 31, four calendar months after the end of the fiscal year.

Financial regulatory compliance in Costa Rica: additional considerations

Any company registered in Costa Rica must have a Costa Rican address registered, where official correspondences can be received.

All companies must also have a legal representative in Costa Rica, who will represent the company in front of authorites, but does not need to hold any particular credentials.

However, if the appointed legal representative is not a Costa Rican citizen or resident, a resident agent must be appointed and they must be a qualified Costa Rican attorney. The resident agent will receive all official correspondences.

Biz Latin Hub can help you with your financial regulatory compliance in Costa Rica

At Biz Latin Hub, our team of multilingual corporate support specialists has the experience and knowledge to help you with financial regulatory compliance in Costa Rica. With our extensive portfolio of back-office solutions, including accounting & taxation, company formation, legal services, hiring & PEO, and visa processing, we can be your single point of contact for entering and doing business in Costa Rica, or any of the other 17 markets around Latin America and the Caribbean where we have teams in place.

Contact us now to discuss how we can support your business.

Or read about our team and expert authors.