If you are active in the Colombian market or intending to launch there, you will have to make sure you adhere to financial regulatory compliance in Colombia in order to avoid inconveniences to your business.

Because non-compliance with such regulations can result in financial penalties or legal issues, ultimately diminishing your standing in the eyes of local authorities.

Financial regulatory compliance is part of corporate compliance, and often forms part of what third-party providers cover when offering corporate secretarial (cosec) services.

If you are looking to incorporate a company in Colombia, this guide to financial regulatory compliance in the South American country should be of particular interest.

If you have any questions regarding compliance, or any other aspect of doing business in Colombia, contact us today to find out more about how we can support you in Latin America’s fourth-largest economy.

Colombian market increasingly popular for investment

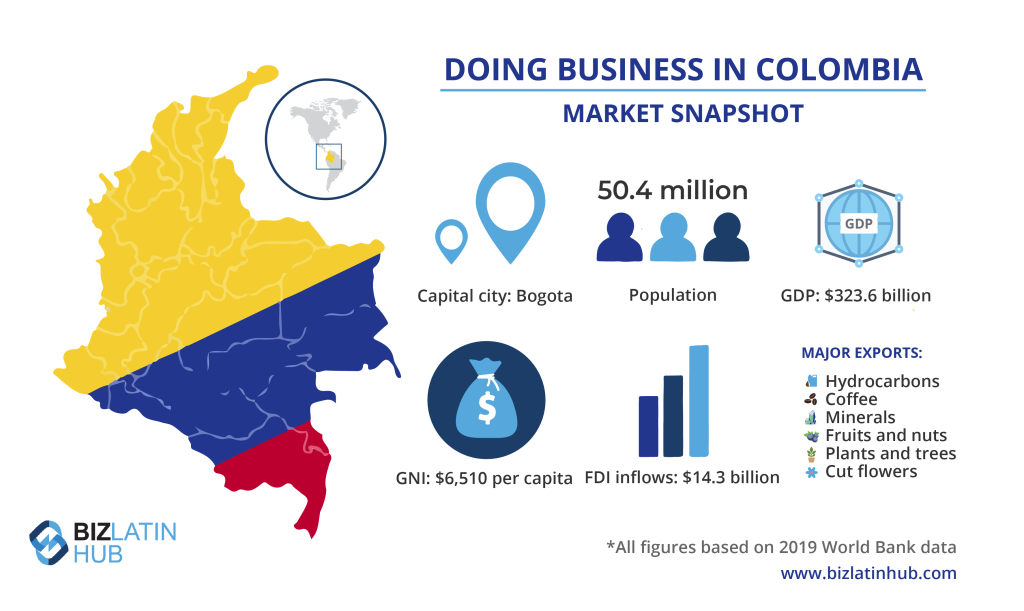

Colombia has witnessed considerable growth over recent years, with gross domestic product (GDP) more than tripling between 2003 and 2019, when it reached $323.6 billion (all figures in USD).

The country saw a corresponding rise in prosperity during that period, with gross national income (GNI) hitting $6,510 per capita in 2019, placing it as an upper-middle income nation by standards established by the World Bank.

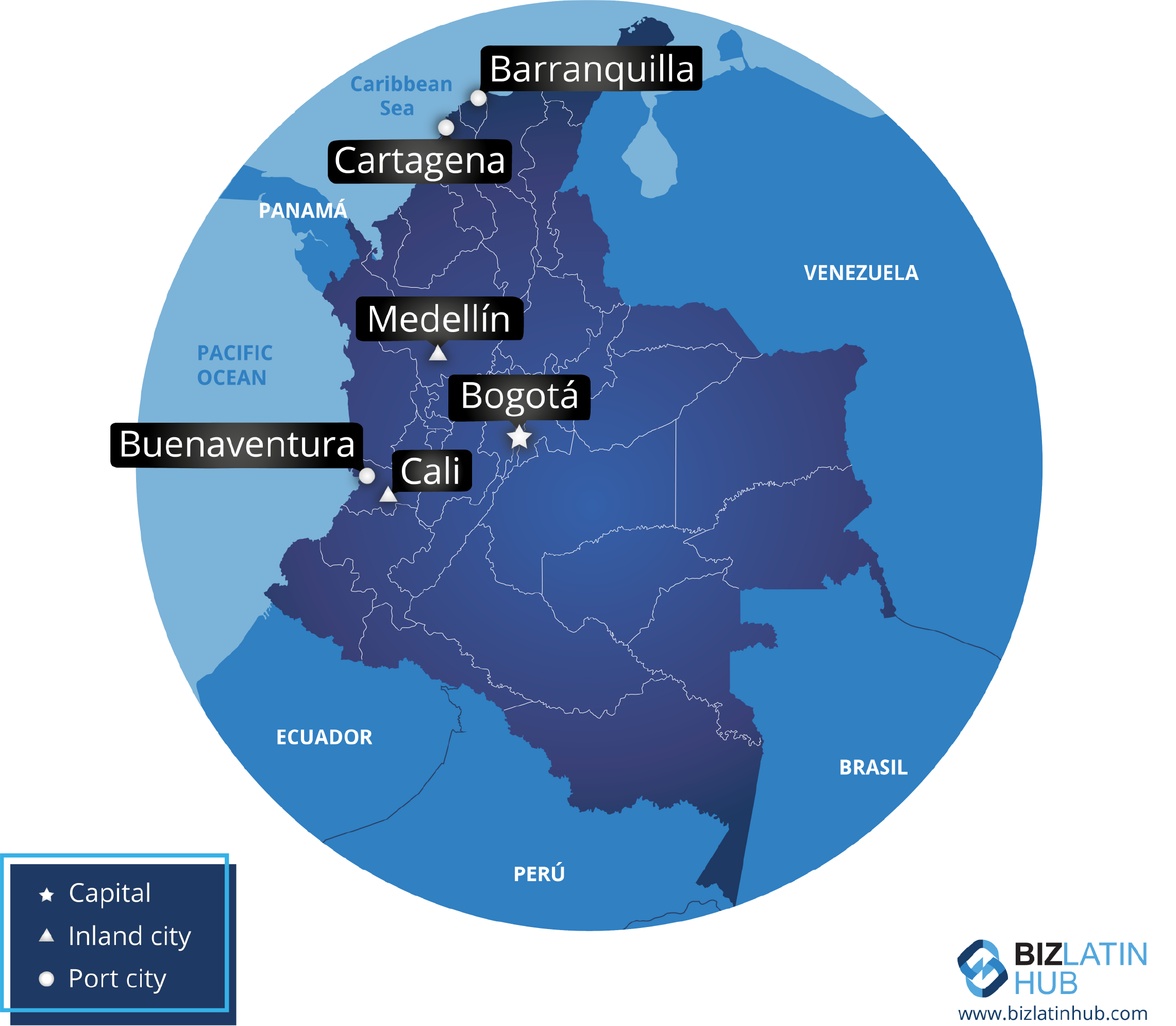

Colombia is a strategically important market, in part due to its geography, with the country located at the meeting point between Central and South America, and also having extensive coasts on both the Pacific and Atlantic oceans with major ports on each.

It is also a key ally of the United States in the region with strong commercial relations with the country, which is a major trading partner. Other important trading partners include Brazil, China, Germany, Mexico, and Panama.

Investors operating in Colombia also benefit from the fact the country has a number of free trade agreements (FTAs) in place, offering resident companies preferential access to major economies in Asia and Europe, as well as the rest of the Americas.

Colombia is also a founding member of the Pacific Alliance — a decade-old economic integration initiative that also includes Chile, Mexico, and Peru, and which recently signed a FTA with Singapore as part of moves to expand its reach beyond Latin America.

All of these factors add up to make Colombia an increasingly popular destination for foreign capital, with net inflows of foreign direct investment (FDI) as a percentage of GDP increasing more than four-fold between 1995 and 2019, when $14.3 billion of FDI entered the country.

However, to take full advantage of the opportunities on offer, it is important to adhere to financial regulatory compliance in Colombia.

Financial regulatory compliance in Colombia: key responsibilities and dates

While financial regulatory compliance in Colombia may vary based on the type of company you have, the following requirements are usually applicable in all cases:

Holding of an annual shareholders meeting (AGM), which requires the timely notification of all shareholders, and demands proper minute taking in order to be in compliance with Colombian regulations

This must be held within the first three months of the financial year, which in Colombia runs from 1 January to 31 December, meaning that this AGM must take place by 31 March.

Proper circulation of those minutes, usually through a board of directors meeting, is then a prerequisite of financial regulatory compliance in Colombia for applicable entities.

Company commercial license renewal before the relevant chamber of commerce, including up-to-date contact information, must be completed. While this process can usually be undertaken online, in some cases the Chamber might require it to be done in person. As in the case of the AGM, this must be completed within the first three months of the financial year.

Renewal of public tender registration before the relevant chamber of commerce is also a requirement if the company is registered to bid for public tenders. This must similarly occur within the first three months of the financial year

Submitting financial information before the Superintendence of Companies (SIC) may be required if the SIC names your company as being required to file its records. In 2021, fail to file this information can come with a fine of up to approximately $118,000.

Updating the corporate books, which include the minutes book from AGMs and the shareholder registry, must be done to adhere to financial regulatory compliance in Colombia.

Biz Latin Hub can assist you with financial regulatory compliance in Colombia

At Biz Latin Hub, our team of multilingual corporate support experts has the experience and know-how to assist you with financial regulatory compliance in Colombia. We have a comprehensive portfolio of back-office services, including company formation, accounting & taxation, legal services, visa processing, and hiring & PEO, meaning that we can provide a tailored package of integrated back office services to suit every need.

We also have teams present in 16 other markets around Latin America and the Caribbean, and specialize in multi-jurisdiction market entry.

Contact us today to discuss how we can assist you in doing business.

Or read about our team and expert authors.