Corporate Entity Regulatory Compliance in Bolivia is essential when establishing a business, ensuring compliance from the start and throughout your growth. Non-compliance with local laws can lead to significant penalties, emphasizing the importance of understanding Bolivia’s legal framework. This guide highlights key compliance requirements and strategies to safeguard your operations after registering a business in Bolivia. With expertise in back office services in Bolivia, Biz Latin Hub can assist in navigating these regulations and ensuring a smooth market entry.

Key Takeaways on Corporate Entity Regulatory Compliance in Bolivia

| Physical Address: | A registered local fiscal address is required for all entities in Bolivia for the receipt of legal correspondence and governmental visits. |

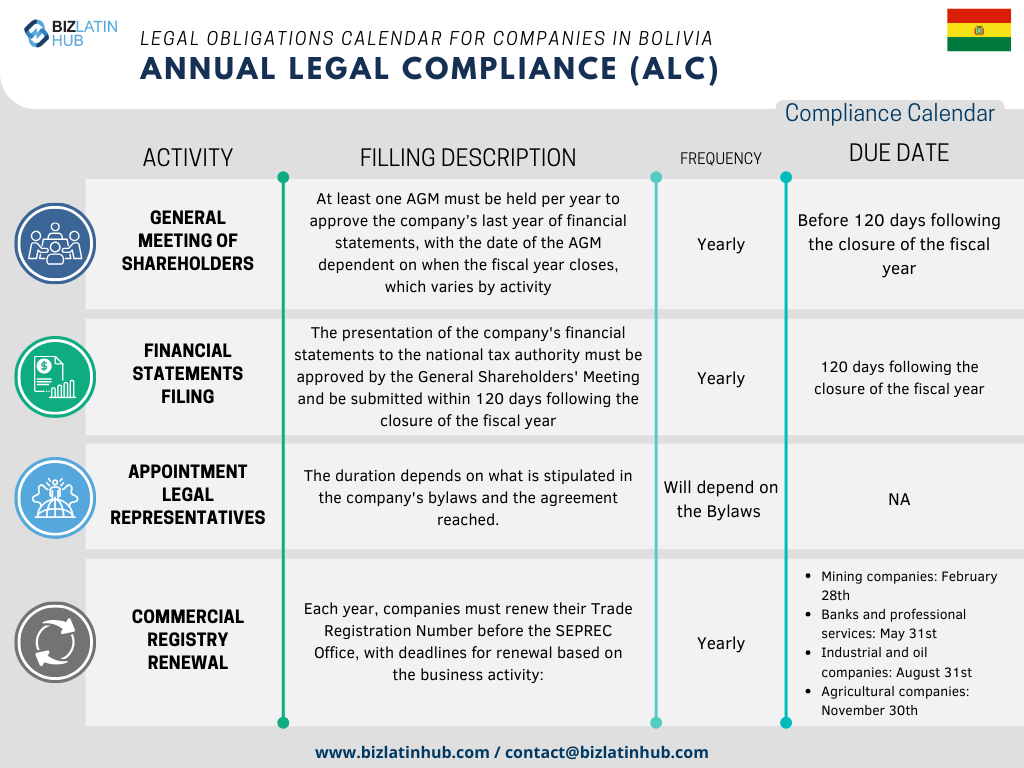

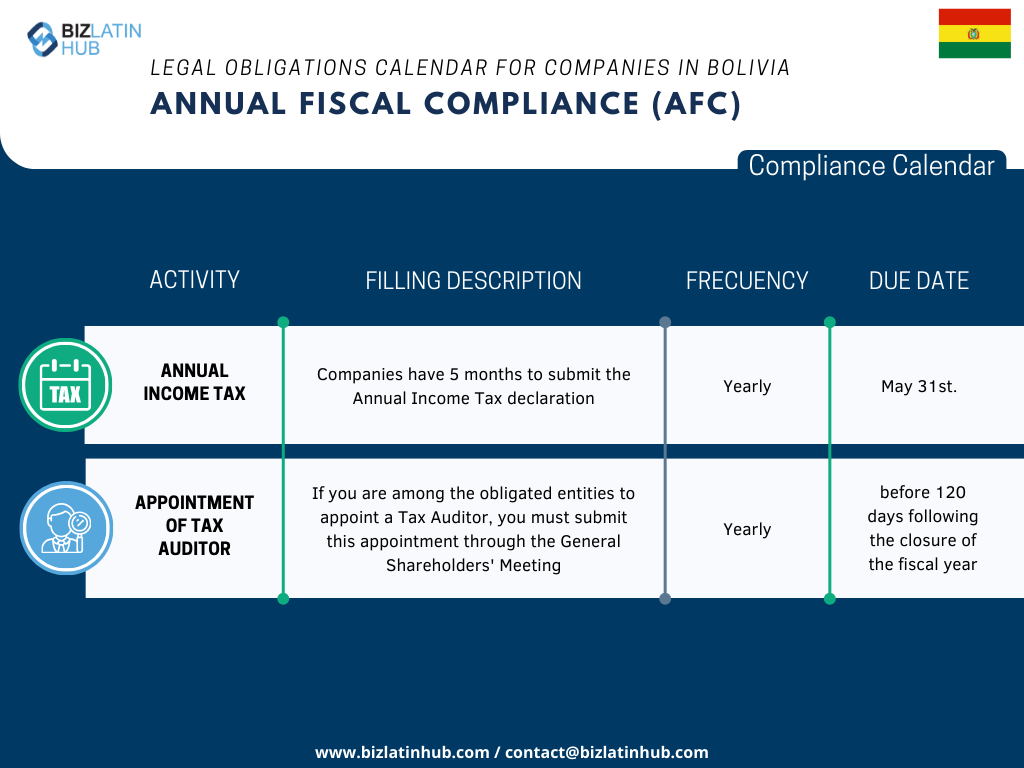

| What are the Annual Entity Fiscal Compliance Requirements? | Annual Income Tax Appointment of Tax Auditer |

| What are the Annual Entity Legal Compliance Requirements? | General Meeting of Shareholders Financial Statements Filing Appointment of Legal Representatives Commerical Registry Renewal |

| Why to Choose to Invest in Bolivia? | Bolivia’s macroeconomic stability, rich natural resources, and central location in South America position it as a promising destination for investment. |

Initial Corporate Compliance Obligations for New Companies

To achieve full financial regulatory compliance in Bolivia, a company must complete a number of initial steps, including the following:

Obtain a Tax Identification Number (NIT): A crucial aspect of Bolivia’s corporate compliance is holding a NIT. It must be assigned before the company can begin doing business, and will be used for identification for all financial matters. The NIT is obtained when the company registers with the national tax service.

Obtain a trade registration number: Any company operating in Bolivia must also have a trade registration number, and renew it annually.

Obtain a company operating license: Companies must obtain an operating license, the details of which vary based on the business activity and location of the company. For example, in Santa Cruz, Bolivia’s industrial heartland, a company must be granted an environmental permit before it can receive an operating license.

Register a legal address: All entities in Bolivia must have a registered legal address, to which official correspondences will be directed.

Appointment of a legal representative: Any company registered in the country must also have a legal representative in Bolivia, who will act on behalf of the legal entity in order to carry out certain procedures and formalities. Legal representatives must meet the following criteria:

- Be of legal age (18 years or older)

- Be a natural person or a foreign national with a Bolivian identity card

- Have legal residence status in Bolivia

- Have the documentation that supports their designation as a legal representative of a legal entity

Obtain a municipal business license and a municipal registration card: In the complex process of establishing a business, the phases that demand the most time and attention are acquiring a municipal business license and a municipal registration card (Padrón Municipal).

Key Responsibilities and Dates For Bolivian Entities

Decisions you make regarding company formation in Boliva and the type of company you choose though limited, might impact some aspects of your financial regulatory compliance requirements. The following obligations are generally applicable:

Annual General Meeting (AGM): At least one AGM must be held annually to approve the company’s financial statements in the past year. The AGM must be held within 120 days of the close of the fiscal year, which varies by industry:

- Industrial and oil companies: March 31

- Agricultural companies: June 30

- Mining companies: September 30

- Banks and professional services: December 31

For example, banks and professional services providers must hold an AGM before the end of April.

Presentation of financial statements: Another requirement for corporate compliance in Bolivia is presenting the company’s financial statements to the national tax authority. This must also be undertaken 20 days before the end of the fiscal year.

Upkeep of company books: An important aspect of financial regulatory compliance in Bolivia, is the proper upkeep of the company books, and the inclusion of information related to shareholders. This will be covered by any audit.

Renewal of trade registration number: Each year, companies must renew their Trade Registration Number before the SEPREC Office. The deadline for renewal depends on the business activity:

- Mining companies: February 28

- Banks and professional services: May 31

- Industrial and oil companies: August 31

- Agricultural companies: November 30

Renewal of company operating license: The company operating license must be renewed on an annual basis, with discounts offered to companies that clear the payment in a timely manner.

Monthly tax declarations: Certain taxes, such as VAT and transaction tax (TT) must be declared on a monthly basis. In Bolivia, VAT is generally set at 13%, while TT is applied to any person with an income and is set at 3%.

Annual tax declaration: All companies must make an annual tax declaration following the close of the financial year, and pay a business profit tax (BPT), set at 25% of net profits.

FAQs on Legal Compliance in Bolivia

Based on our extensive experience these are the common questions and doubts of our clients on regulatory compliance in Bolivia:

1. What are the common statutory appointments for a company in Bolivia?

An appointed legal representative who will be personally liable, both legally and financially, for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country.

2. Is a registered office address needed for a legal entity in Bolivia?

Yes, a registered local fiscal address is required for all entities in Bolivia for the receipt of legal correspondence and governmental visits.

3. When is the commercial registry renewed in Bolivia?

Each year, companies must renew their Trade Registration Number before the SEPREC Office, with deadlines for renewal based on the business activity. For example:

- Agricultural companies: November 30th

- Mining companies: February 28th

- Banks and professional services: May 31st

- Industrial and oil companies: August 31st

5. When must a general meeting of shareholders be held in Bolivia?

At least one AGM must be held per year to approve the company’s last year of financial statements, with the date of the AGM dependent on when the fiscal year closes, which varies by activity. The deadline for this is before 120 days following the closure of the fiscal year.

- Mining companies: February 28th

- Banks and professional services: May 31st

- Industrial and oil companies: August 31st

- Agricultural companies: November 30th

5. When must a general meeting of shareholders be held in Bolivia?

At least one AGM must be held per year to approve the company’s last year of financial statements, with the date of the AGM dependent on when the fiscal year closes, which varies by activity. The deadline for this is before 120 days following the closure of the fiscal year.

Why Invest in Bolivia?

Bolivia is not generally the first name that springs to mind when thinking of investing in Latin America. But the country is full of untapped opportunities and has had strong economic growth since the turn of the century.

Historically, Bolivia’s hydrocarbon deposits have been a major draw for investment. The country sits on 10.7 trillion cubic feet of natural gas reserves, and more than 240 million barrels of proven crude oil reserves. It also has significant deposits of lithium, ores, and precious metals.

Bolivia possesses abundant non-renewable natural resources, including raw mining materials, natural gas, and hydrocarbons, making them key contributors to the country’s economy. The current major exports include zinc, silver, lead, and tin, with significant untapped lithium deposits offering further potential for growth.

Also of interest to many investors is the fact that Bolivia is a founding member of the Comunidad Andina (Andean Community) – a regional association that also includes Colombia, Ecuador, and Peru, and has been implementing a series of measures that deepen economic integration and are beneficial for business.

Biz Latin Hub can Help With Corporate Entity Regulatory Compliance in Bolivia

Biz Latin Hub is a professional services company providing integrated market entry and back office services throughout Latin America and the Caribbean, with offices in 16 major cities around the region.

As such, we specialize in multi-jurisdiction market entries and operational support, including the likes of cross border tax planning.

Our portfolio of services includes accounting & taxation, company formation, corporate legal services, and hiring & PEO, among others, meaning we have the expertise and personnel to effectively assist you with financial regulatory compliance in Bolivia.

Contact us today to find out more about how we can help you.

Or read about our team and expert authors.