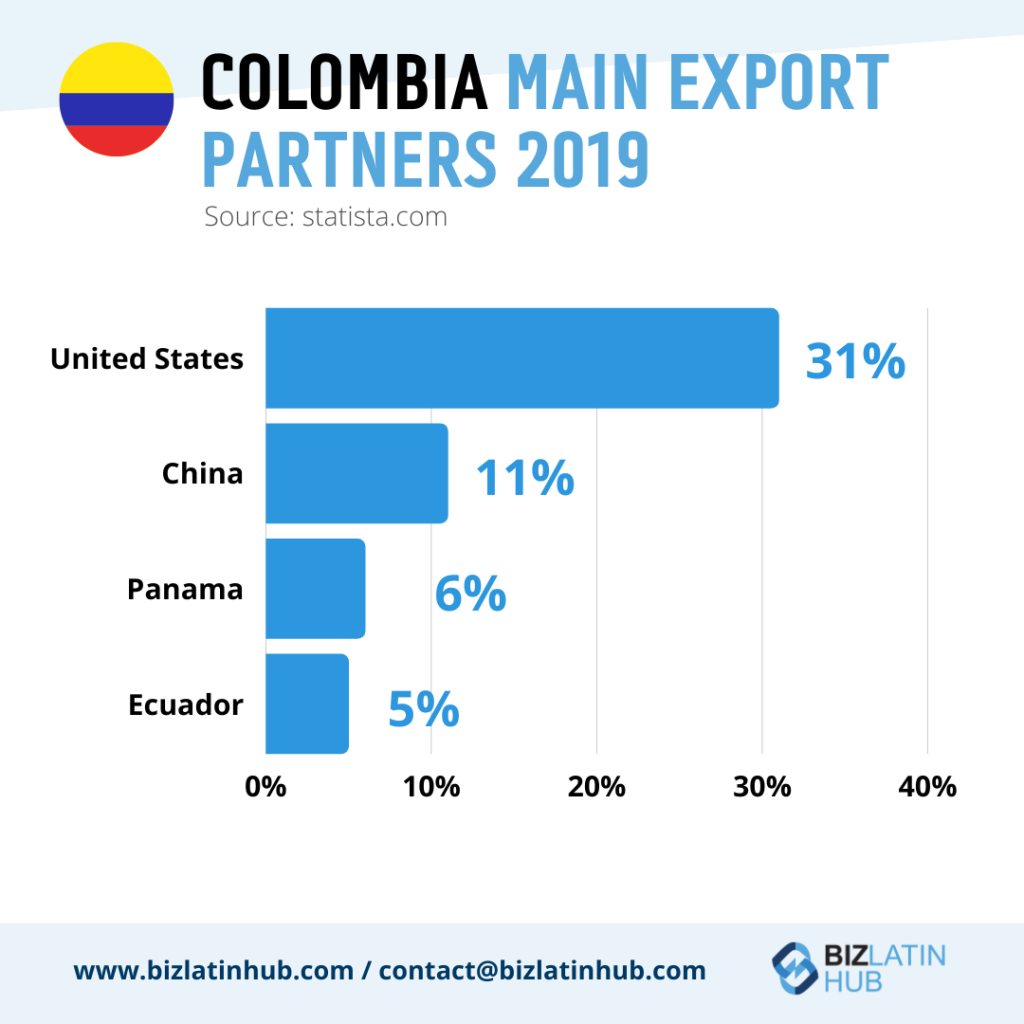

Colombia’s strategic geographical location on the Northern tip of South-America, bordering both the Caribbean Sea and the Pacific Ocean provides foreign companies looking to trade with an excellent hub to access Latin American markets and other continents. To trade, you will need to understand Import Export Taxes in Colombia.

Together with the new investment in infrastructure and new-found political stability, Colombia has attracted ever more Foreign Direct Investment, with the biggest portion invested in the oil and mining industry. Keep reading to learn what are the import export taxes in Colombia.

Companies looking at company formation in Colombia in order to trade should be aware of all the tax regulations regarding imports and exports in order to capitalize on the many attractive tax benefits that Colombia has to offer. To make it easier, we put together an overview of the Import Export Taxes in Colombia.

Import / Export Taxes in Colombia – Overview of Taxes

Colombia presents many incredible offers where tax is partially or completely omitted from the export and import transaction. However, before we dive into that, let’s review the standard tax.

Import

Standard custom duties for import consist of 19% VAT (however, certain services and goods are taxed only 5% and 0%) and tariffs consist of three levels: 0% to 5% on capital goods, industrial goods, and raw materials not produced in Colombia, 10% on manufactured goods, and 15% to 20% on consumer and sensitive goods.

Customs duties, mainly consisting of VAT and tariffs, ranging from 0% to 20%, but can even be higher depending on the HMS code. The goods are evaluated using methods established by the General Agreement of Tariffs and Trade (GATT). Declarations of import have a standing term of 3 years.

However, there are many exceptions and regulations for different kinds of products. For example, temporary importation and re-importation of goods in the same condition can be imported without tax payments given that the product was not altered while abroad. These goods are differentiated into two classes: 1) short term (a maximum of 9-12 months), and 2) long term (maximum of 5 years).

Exports

Exports do not cause any custom duties due to many financial beneficial regulations such as special programs and trade agreements.

Special trade regulations for import export taxes in Colombia

Free Trade Zones

Businesses engaging in industrial activities for goods, services, or commercial activities can make use of Colombia’s Free Trade Zones. The Free Trade Zones are geographical zones located within Colombia and established in 1985 by Act 109, defined as “national public establishments created to promote foreign trade, generate jobs and foreign exchange flows, and promote regional development”, and provide companies with many competitive fiscal advantages as well as other benefits. There are two main types of Free Trade Zones, which both provide the same benefits but house different types of companies but have different requirements:

- Multicompany Free Trade Zones (or ‘special permanent free trade zones’)

- Single Company Free Trade Zones

Companies are required to conduct their business inside of these Free Trade Zones in order to make use of the following benefits:

- 20% unified income tax rate.

- Exemption of customs duties such as VAT and tariffs on raw materials, parts, supplies, and finished goods entering the Free Trade Zones, as long as they are part of the corporate purpose.

- No tax or VAT on imports made in the Free Trade Zone.

- Exports from Free Trade Zone to both third countries and the national market are subject to the regulations according to the 18 Free Trade Agreements, often exempting goods from tax.

- Any goods of foreign origin may reside indefinitely inside the Free Trade Zones.

- The possibility of partial processing outside the Free Trade Zone for up to 9 months, given that production of these goods and services, do not exceed 40% of the companies’ total production of goods or services.

Plan Vallejo

Not only does Colombia house many strategically placed free-trade zones, they recently called in a new resolution regarding special import and export programs called ‘Plan Vallejo’, aimed at modernizing and promoting foreign trade, ultimately leading to economic development.

Plan Vallejo for raw materials

Plan Vallejo provides companies who want to temporarily import goods, such as raw materials and parts, partial exemption of import duties or deferred payment of VAT. The imported good or goods should add value, and have the ultimate goal of being exported. That is, companies are obliged to import the same amount of value of the raw materials imported at a minimum.

Plan Vallejo for exportation of services

Companies whose main activities are the export of services, such as lodging services and aviation companies, can temporarily import capital goods under the regulations of Plan Vallejo.

Requirements

In order for importers and exporters to benefit from Plan Vallejo, they have to apply and submit several documents: namely an application and its amendments, compliance demonstration, program extension requests, and supporting documents through an online platform called MinCIT. MinCIT will then have a maximum of 30 days to either approve or deny the application.

Import of Machinery

In order to promote industrialization in Colombia, The Colombian Foreign Trade Regime provides multiple alternatives for people or entities looking to import machinery and equipment. Industrial machinery is a piece of machinery that transforms raw material into finished products. There are three circumstances in which these products are exempt from VAT:

Ordinary import of industrial machinery – Ordinary import of Industrial Machinery that is not produced within the country by a legal entity recognized by the Colombian National Taxes and Customs Authority as a Highly Exporter User (ALTEX). ALTEX are legal entities with the total value of total exports representing at least 30% of their sales in the year prior before filing the requests.

Temporary imports of heavy machinery for basic industries – Basic industries, such as the mining, iron and steel and hydrocarbon sectors. If at the end of the specified temporary period the heavy machinery remains in Colombia, VAT will be taxed at that point in time.

Imports of equipment and elements for the protection of the environment – Equipment that is used for environmental monitoring, recycling, and processing of waste, programs aimed at improving the environmental conditions, and projects aimed at decreasing emissions of greenhouse gases.

Biz Latin Hub can help you manage your import export taxes in Colombia

Colombia’s has an exceptionally attractive business environment to use as a hub to import and export goods and services, as well as produce goods and services inside the Free Trade Zones.

With the many different rules and regulations, it is advised to trust in a local partner that can help you to navigate the import and export tax system in Colombia.

Reach out to a member of our team today via email here for personalized advice.

Or learn more about our team of expert authors.