So you find yourself living as an EXPAT? You have money to invest and are looking at investment options? You want to plan for the future and don’t know where to start with investing as an EXPAT? This is a challenge and desire facing many EXPATs and in this article we will explore some of the key concepts of Wealth Management as an EXPAT and what you can expect investing as an EXPAT.

Expatriate: What is Wealth Management?

Wealth management is a broad term that relates to a professional service that encompasses, investment advisory and the management of ones finances. Often this is done though the appointment of an individual advisor or an investment company that will help you to plan and manage your finances to achieve determined objectives. It is important that when selecting an advisor that you do your background research to ensure that are professional, responsive and have experience with EXPAT wealth management.

See Also: Offshore Investments for EXPATs

Wealth Management: What do Wealth Managers do for you as an EXPAT?

A wealth managers role is to understand a clients needs, review options and to present suitable investment plans based on agreed financial goals and objectives. Typically the financial offerings will consist of a portfolio of investment products including portfolio management, realestate, retirement planning, and tax services.

What type of Wealth Management Products are available to EXPATs?

There are a range of investment options, but typically they will be the following:

- High Yielding Cash Investment Accounts

- Managed Portfolio Investments

- Real Estate Investments

- Single Asset Class Investment Funds

- Multiple Asset Class Investment Funds

With that said, prior to investing it is important that you consider and know your financial needs, financial objectives and investment timeline. Investing as an EXPAT to create wealth is an exciting time, but likewise you should ensure that you engage expert wealth management advisor before making investment decisions.

What is unique about EXPAT Wealth Management?

As an EXPAT you will be a long way from home and probably no longer a tax resident in your home country, this may bring about some unique investment opportunities, including both onshore and offshore investments. As such it is important that when considering wealth management you are exploring all of your available options that suit your financial needs and lifestyle.

You will need to ensure that your plan is developed for your specific objectives, and that your investment portfolio is crafted to meet those objectives whilst also minimising negative currency exposure risk’s and of course meeting any personal tax compliance requirements.

As an EXPAT your wealth management needs are unique and you need to ensure that your wealth manager takes this into account.

Four reasons why EXPAT Wealth Management is unique?

- Must consider tax residency implications

- Must take into account currency risks

- Must consider future relocations and potential residency locations

- Must take into account foreign jurisdiction and ultimate beneficiary owner requirements

Some common mistakes with Wealth Management Investments as an EXPAT?

- Understanding the impacts of Foreign Account Tax Compliance Act (FATCA)

- Reporting of foreign investment income (when required)

- Filing Tax Treaty Claims (when required)

How can the Biz Latin Hub help with Wealth Management?

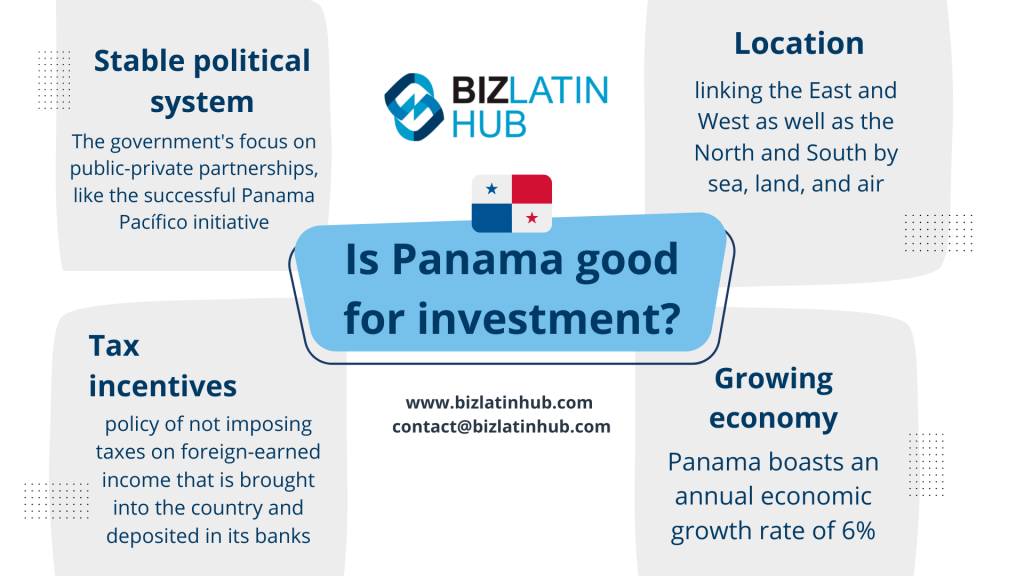

As the largest legal, accounting and recruitment firm within the Latin American and Caribbean Region we have a significant presence within the region and wide exposure to contacts and investment opportunities. Please contact us today and learn about how we can best support you wealth management objectives as an EXPAT.

Learn more about our team and expert authors.