Hiring staff via an employer of record (EOR) in Puerto Rico is a popular option among investors who only need a small number of local executives, or who are looking to hire a team on a short-term basis. An EOR in Puerto Rico will hire staff on your behalf. Even if you are interested in long term company formation in Puerto Rico, read on to find out more about the benefits of using an EOR to get set up in the country.

Key takeaways on using an EOR in Puerto Rico

| Hiring support | Full support |

| Legality of using an EOR in Puerto Rico | Fully legal |

| Presence in the country | Limited – company formation will be necessary for full presence |

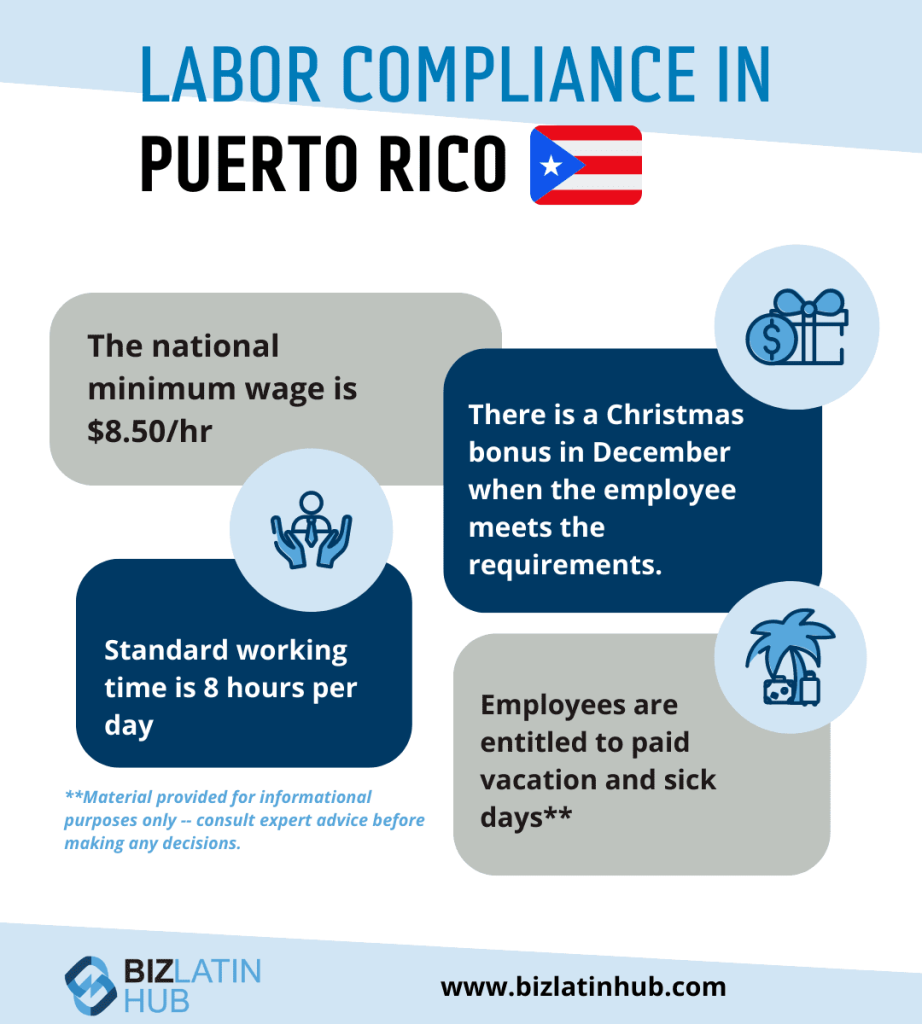

| Working hours | 48 hours weekly |

| Minimum monthly wage covered by an EOR in Puerto Rico | The minimum salary in Puerto Rico is USD$10.50/hr. Workers in Puerto Rico are entitled to be paid the higher state minimum wage. |

What is an employer of record in Puerto Rico?

An employer of record in Puerto Rico is an outsourcing provider that hires local staff on behalf of its clients via its locally incorporated entity.

In practice, that means that while those staff are officially employed by your EOR in Puerto Rico, the client has full control over their schedules, responsibilities, and workloads, and manages them directly.

Where needed, an EOR – which can also be known as a professional employer organization (PEO) – is able to assist the client with recruiting and hiring those staff, handling their onboarding and subsequent offboarding when their period of employment comes to an end.

That is particularly attractive, given that the employer of record will have a firm understanding of the local market, being aware of the best educational institutions and local companies during the processing of resumes, as well as having a well-established recruitment network for finding top talent.

Your EOR in Puerto Rico will also manage the payroll of any staff hired on your behalf, calculating statutory deductions and paying salaries in accordance with local regulations, meaning that you can rest assured your operations will be in complete compliance with local laws.

What are the benefits of hiring staff through an EOR in Puerto Rico?

Among the benefits associated with hiring staff through an employer of record in Puerto Rico are the following:

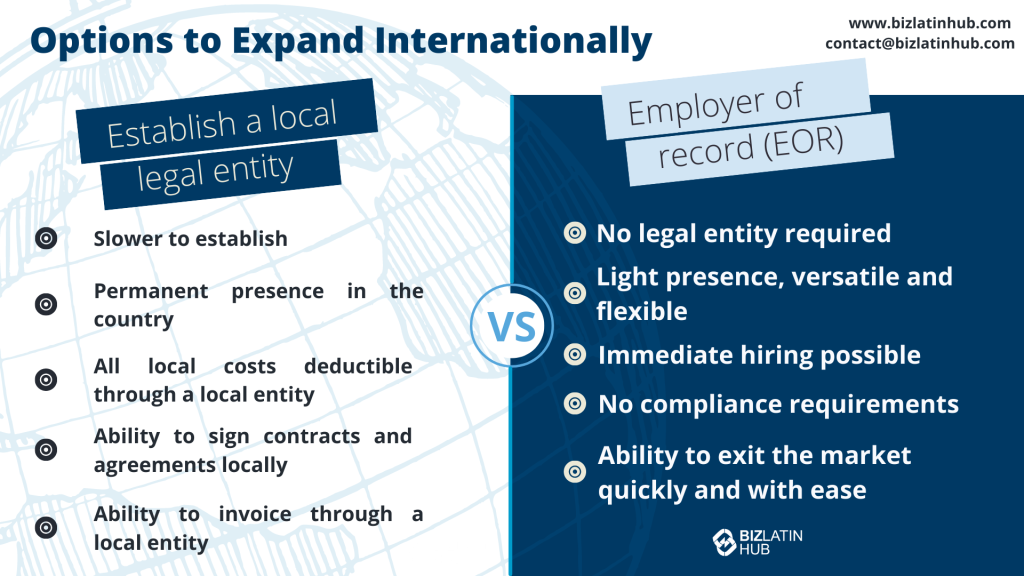

Reduced commitment: When you hire via an EOR in Puerto Rico, you avoid the need to incorporate a company, meaning that you can withdraw from the market in only the time it takes to offboard your local outsourced staff.

Compliance certainty: Your employer of record in Puerto Rico will provide you with the guarantee that all local regulations and norms will be complied with, meaning that your company will not face legal inconveniences or reputational damage due to non-compliance.

Valuable connections: Your EOR in Puerto Rico will be established in the local business community, and will have connections that may be useful to your business, while also assisting with efforts to recruit the staff you are looking for, should that be part of the services agreement you sign.

Cost efficiency: While working with an employer of record will come with a fee – usually on a per-employee basis – that will often be comparable or less than the costs associated with company formation and managing payroll in-house.

Local knowledge: Your EOR in Puerto Rico will be able to help you bridge the cultural gap in a new and unfamiliar market, as well as offering advice on key decisions related to doing business, such as choosing providers to work with.

Legal requirements an employer of record will take care of

The guaranteed compliance that your EOR in Puerto Rico offers can include, but is not limited to, the following:

- Implementing statutory working hours

- Facilitating holiday allowances and honoring public holidays

- Providing sick leave and other personal entitlements according to the law

- Preparing legal documentation, such as contracts

- Timely payment of salaries and benefits

- Managing any other aspect of the payroll system

- Overseeing the onboarding and offboarding of staff hired on your behalf

FAQs on using an EOR in Puerto Rico

Based on our extensive experience, these are the common questions and doubts of our clients on hiring through an EOR (or PEO) in Puerto Rico:

You can hire someone in Puerto Rico by either setting up your own legal entity in the country and using it for recruitment, or by utilizing the services of an employer of record (EOR) or PEO in Puerto Rico. These are third-party entities that allow you to employ individuals in the country while they act as the official employer before the law. When using an EOR or PEO in Puerto Rico, you do not need a local entity to hire employees.

A standard employment contract in Puerto Rico should be written in Spanish (and can also be in English) and outline the terms and conditions of employment to establish a clear understanding between the employer and the employee. Some elements that are typically included in a standard employment contract in Puerto Rico are:

– Parties to the contract.

– Position and responsibilities.

– Employment status.

– Work schedule.

– Compensation.

– Benefits.

– Probationary period.

– Termination clause.

– Confidentiality and non-compete clauses.

– Intellectual property.

– Code of conduct and policies.

– Governing law and Jurisdiction.

The mandatory employment benefits in Puerto Rico are the following:

-Paid Time Off (PTO)

-Meal and Rest Breaks

-Workers’ Compensation

-Unemployment Benefits

-Disability Benefits

-Parental and Maternity Leave

The total cost for an employer to hire an employee in Puerto Rico varies depending on the salary. However, as an indication, the employer cost for mandatory employment benefits is approximately 12.2% on top of the employee’s salary.

Please use our Payroll Calculator to calculate employment costs.

When working with an employer of record (EOR), the contractual handling of the employment relationship is crucial. The EOR serves as the legal employer and needs a contract with the worker, which may or may not include your company. The agreement must be compliant with the law and aligned with your company’s practices across all locations the EOR supports.

Contracts vary across territories. Some have detailed tripartite agreements, clearly defining responsibilities, with the EOR handling payments, taxes, and local matters, while you retain policy control. Benefits and statutory requirements should be discussed. When choosing an EOR, examine their template agreements for consistency and consider how they ensure uniformity while complying with local practices.

You do need to ensure that the EOR can provide its services in Puerto Rico. It is also worth checking which other countries they operate in. Not all providers have global advisory services. Hiring one with such services eliminates the need for multiple consultants to manage compliance in all your countries of operation.

Biz Latin Hub can be your EOR in Puerto Rico

At Biz Latin Hub, we provide tailored packages of back-office services to support investors and corporations entering and doing business in Latin America and the Caribbean, with local teams based in 16 markets around the region.

As well as high-quality hiring & EOR services, our portfolio includes accounting & taxation, company formation, due diligence, legal services, and visa processing, among others. So whether you are looking for an EOR in Puerto Rico or wish to make an investment that goes beyond working with an employer of record, we can help you.

Our unrivaled regional reach also means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

Contact us now to find out more about how we can support you.

Or read about our team and expert authors.