Establishing a business in Puerto Rico offers a variety of choices, but each comes with distinct tax implications. Understanding these choices and how they affect your tax situation is crucial for any entrepreneur. The right business structure can influence both your financial stability and compliance duties.

Business structures in Puerto Rico range from Limited Liability Companies (LLCs) to corporations and partnerships, each providing unique benefits and drawbacks. Knowing these differences helps business owners make informed decisions that align with their goals. Tax considerations play a significant role in each entity’s formation and operation, impacting overall profitability.

This article outlines the types of business entities available in Puerto Rico and their associated tax implications. We will examine LLCs, corporations, partnerships, sole proprietorships, and trusts. Additionally, we will discuss specific regulations regarding disregarded entities and Pass-Through Entities (PTEs) introduced under recent legislation. Understanding these factors is essential for effective business planning in Puerto Rico.

What are the Business Structures in Puerto Rico?

In Puerto Rico, the common business structures include Limited Liability Companies (LLCs) and corporations. Both provide limited liability protection for owners, shielding personal assets from the entity’s debts.

Key Features of Business Structures:

- Limited Liability Companies (LLCs):

- Default to corporate taxation.

- Subject to taxes at business and member levels.

- Can opt for pass-through status to avoid double taxation.

- No minimum capital requirement.

- Corporations:

- Face corporate tax on net income.

- Pay taxes on dividends received by shareholders.

- May elect pass-through entity status.

- Also, no minimum capital requirement.

All legal entities, including LLCs and corporations, must register with the Department of State. Entities created on or after June 2, 2022, must be listed in the Registry of Legal Entities.

Puerto Rico Limited Liability Companies (LLCs)

Puerto Rico LLCs allow for flexible ownership and management. They can have an unlimited number of members and do not require personal liability for these members. An LLC can choose its tax classification as a corporation or partnership under local laws. Under U.S. tax laws, it defaults to being a foreign corporation unless otherwise elected. To form an LLC, entrepreneurs need a certificate of formation and an operating agreement. These documents outline the business’s management and operations. No minimum paid-up share capital is required, making setup accessible. An LLC must have at least one director and one shareholder. The shareholder can be a person or an entity, with no residency requirement in Puerto Rico.

Benefits of LLCs

Puerto Rico LLCs offer limited liability protection to owners, similar to corporations. This protects personal assets from business debts. LLCs offer management flexibility, allowing structures like a partnership, corporation, or hybrid through an operating agreement. They must maintain a principal office and registered agent within Puerto Rico for compliance and transparency. Single-member LLCs owned by residents can be Disregarded Entities for Puerto Rico income tax, simplifying reporting. To start an LLC, you file articles of organization with the Puerto Rico State Department, open to individuals and legal entities.

Tax Implications for LLCs

By default, LLCs in Puerto Rico face corporate tax rates. To be treated as a pass-through entity, they must file an election with the Puerto Rico Treasury and IRS. As a pass-through, profits become self-employment income. Act 52-2022 addresses Disregarded Entity status for income tax purposes. US tax laws prevent foreign LLCs from being taxed as a corporation if treated as pass-throughs. LLCs can choose Disregarded Entity treatment if single-member starting 2023. They must file an entity classification form electronically with their income tax return for their chosen tax treatment.

Compliance Requirements for LLCs

Puerto Rico LLCs must have a principal office and registered agent within Puerto Rico. No minimum share capital is needed, offering flexibility for startups. If choosing pass-through tax treatment, LLCs must file a Classification Election with Puerto Rico’s Department of the Treasury and a Federal Election with the IRS. After registration, LLCs need an employer identification number and must register with the Department of the Treasury. They must submit an annual statement fee and any reports to the Department of State, though annual financial statements are not required.

Corporations in Puerto Rico

A Puerto Rico corporation pays taxes on its worldwide income. The standard corporate income tax rate is 18.5%. However, this rate can rise to 37% depending on the income bracket. Corporations must file annual tax returns with the Puerto Rico Treasury Department. Additional tax declarations or reports might also be necessary.

To form a corporation, at least one shareholder and one director are required. These roles can be held by the same person, even a foreign individual. The Puerto Rico General Corporations Act of 2009 governs these entities. Corporations can amend their certificate of incorporation to increase their authorized share capital at any time.

Types of Corporations

Puerto Rican corporations classify into domestic and foreign categories. Domestic corporations are formed under Puerto Rico’s General Corporation Law. They need to register with the Registry of Legal Entities maintained by the Department of State. Foreign corporations operate under laws from elsewhere and require authorization from the Puerto Rico Department of State.

Corporations can also be for-profit or not-for-profit. For-profit entities focus on earning profits, while not-for-profits have operational or social purposes. Some activities, like buying and selling real estate, are prohibited for corporations. Agricultural firms can own up to 500 acres only. Professional service corporations must meet specific registration needs to ensure licensed professionals provide services.

Tax Benefits and Obligations

Nonresident companies in Puerto Rico can leverage Act 20, the Export Services Act, for a low 4% corporate tax rate. Disregarded entities enjoy simplified tax compliance. They report all income and expenses on the owner’s personal tax return. This reduces compliance costs.

The total sales tax in Puerto Rico is 11.5%. It includes 10.5% for the commonwealth and 1% for municipalities. Corporations and limited liability companies (LLCs) must also pay municipal tax. This varies, with a maximum of 0.5% of gross receipts, or 1.5% for financial businesses.

To gain specific tax incentives, businesses must be located in Puerto Rico. They need to employ at least five full-time Puerto Rican residents. Only some industries qualify for these benefits.

Corporate Compliance for Puerto Rican Corporations

Corporations in Puerto Rico can have unlimited shareholders. These shareholders generally have no personal liability for corporate debts. Both domestic and foreign entities must register with the Registry of Legal Entities.

Entities must file typical charter documents. This includes articles of incorporation, bylaws, and stock certificates. They also need stock ledgers and organizational board resolutions. Corporations face taxes on both corporate earnings and shareholder dividends.

Ongoing compliance involves maintaining a principal office. A registered agent for service of process in Puerto Rico is also required.

Partnerships

In Puerto Rico, partnerships offer a way to share business income among partners. Generally, a partnership itself does not pay taxes. Instead, the income or loss goes through to the partners. Each partner reports their share on their tax return. Foreign entities without a presence in Puerto Rico selling a partnership must pay a 15% tax. If a partnership chooses to be a pass-through entity, partners file their income tax returns with Puerto Rico’s Treasury Department. Non-resident partners are seen as trading in Puerto Rico, requiring them to file a tax return there. Partners in special partnerships or corporations of individuals might lose the choice to treat distributive shares as ordinary income.

General Partnerships vs. Limited Partnerships

General partnerships in Puerto Rico have no minimum capital requirement. All partners have unlimited liability for debts and obligations. In limited partnerships, there is at least one general partner with unlimited liability and one or more limited partners. Limited partners are only liable up to their capital contribution. A limited partnership’s name must show the legal form of the general partner, like a GmbH or AG. A general partner’s liability details choose how the partnership is structured. If the general partner is a company from outside Puerto Rico, the name must reflect its structure, such as LLC or PLC, and “Co.” in its partnership name.

Tax Considerations for Partnerships

In Puerto Rico, partnerships are either Registered or Unregistered Firms for tax purposes. Registered Firms pay the Super Tax and distribute after-tax income to partners. Unregistered Firms let partners receive profit shares without personal tax obligations. Profits and losses in a partnership are shared based on the partnership agreement. Transfers of partner interests require consent from the other partners. Typically, the partnership itself is not taxed, with income or loss being passed to partners for individual tax reporting. If a foreign entity sells a partnership in Puerto Rico without business presence, it owes a 15% income tax.

Sole Proprietorships

Sole proprietorships in Puerto Rico are a basic business structure. Owners do not need formal registration to start a sole proprietorship. This type of business allows owners to stay in control. They make all major decisions alone. However, there is no legal separation between the owner and the business. Thus, the owner is responsible for all business debts and obligations. Income from a sole proprietorship appears on the owner’s personal income tax return. Depending on business activities, sole proprietors may need to file sales and use tax returns.

Advantages of Sole Proprietorships

- Ease of Start-Up: You only need one person to own and manage the business. No complex registration process is necessary.

- Flexibility: There are no governing laws specific to sole proprietorships. This makes management more flexible.

- Control Over Decisions: One person makes all decisions. This means quicker responses to business needs.

- Simple Administration: You do not need an Employer Identification Number unless certain criteria are met. Sole proprietorships also avoid complex annual filings.

Tax Obligations for Sole Proprietors

Sole proprietors must meet both local and federal tax obligations. Puerto Rico has unique tax laws compared to other U.S. areas. While tax incentives exist, federal tax regulations still apply. Sole proprietors using a single-member LLC can opt to be treated as disregarded entities for income tax purposes. This eases tax reporting. However, the owner must be a Puerto Rico resident. They must also comply with registration and EIN requirements.

Trusts in Puerto Rico

Trusts in Puerto Rico operate under the same legal framework as other business entities. This is outlined in the Puerto Rico General Corporations Law. Establishing a trust involves complying with local laws. This includes providing necessary documents such as a certificate of registration. Trusts must have a principal office and a registered agent in Puerto Rico. Trusts can serve various lawful purposes, such as asset protection and estate planning. The tax implications for trusts depend on their structure. Local tax laws define potential tax exemptions for certain types of income.

Types of Trusts

Trusts in Puerto Rico fall under the regulations of the Civil Code, specifically Act No. 55-2020. To create a trust, registration with the Registry of Legal Entities is required. This ensures compliance with regulations for all legal entities. Trusts offer strong liability protection similar to LLCs and corporations. Forming a trust requires legal documentation following statutory requirements by the Department of State. Trusts registered in Puerto Rico are noted entities. They undergo the same registration process as corporations, regardless of their creation date.

Understanding Tax Treatment for Trusts

Trusts in Puerto Rico face different tax treatments based on their structure. The type of income can affect tax obligations for both the trust and its beneficiaries. Unlike corporations, trusts may avoid double taxation if they pass income directly to beneficiaries. These beneficiaries then report it on their tax returns. Some trusts are taxed like partnerships, with income attributed to beneficiaries. Trusts might benefit from specific tax exemptions or deductions under Puerto Rican law. Real estate held by trusts can lead to 100% tax deductions, affecting tax liability. Understanding these elements is crucial for trustees in managing overall tax burdens.

Pass-Through Entity (PTE) under Act 52-2022

Act 52-2022 brought noteworthy changes to Puerto Rico’s tax landscape by recognizing disregarded entities (DREs) for the first time. This recognition simplifies tax compliance, mainly benefiting the local workforce. Entities converting to a Pass-Through Entity (PTE) enjoy a tax-exempt conversion process. This means they can receive assets and liabilities while maintaining their tax basis and attributes without triggering tax obligations. Prior conversion costs, such as taxes on implicit gains or distributions, remain with the entity post-conversion. Converting a corporation to a PTE is treated as a complete liquidation for tax purposes from the prior taxable year. Act 52-2022 aligns Puerto Rico’s tax system for DREs with the US federal tax code. This alignment enhances Puerto Rico’s appeal as a business destination.

Definition and Benefits of PTE

A Pass-Through Entity (PTE) is an entity whose income is attributed directly to its owners, partners, or members for tax purposes. This setup allows tax liabilities to pass directly to the individual, bypassing the entity level. Post Act 52-2022, Corporations, Partnerships, and Limited Liability Companies (LLCs) in Puerto Rico can choose to be treated as PTEs under similar rules to those applied to partnerships. Single-member LLCs can elect to be Disregarded Entities. This election enables the business income to be reported on the owner’s personal tax return, avoiding double taxation. Generally, PTEs in Puerto Rico face tax treatment similar to US partnerships, offering potential tax advantages for business owners. For LLCs organized in Puerto Rico, electing PTE treatment allows them to shift from default corporate taxation to a pass-through profit distribution model. This provides more flexibility in tax planning.

Tax Implications of PTE Classification

Pass-through entities (PTEs) in Puerto Rico must generally align their taxable year with that of their partners. A different year can only be used if justified by a commercial purpose approved by the Secretary of the PR Treasury. Special Partnerships and Corporations of Individuals automatically convert to PTEs. This conversion streamlines the taxation regime by applying relevant Code dispositions. Taxpayers classified as Special Partnerships or Corporations of Individuals before conversion are automatically considered to meet the “commercial purpose” requirement for their taxable year. PTEs are subject to similar taxation rules as partnerships in the US. Here, income or losses are passed through to the partners for tax purposes. The annual statement fee for PTE-classified entities in Puerto Rico is US$150. An auditing requirement kicks in if annual turnover exceeds US$3 million.

Disregarded Entities

Disregarded entities (DREs) are business structures with a single owner, not recognized separately for income tax purposes. In DREs, the owner reports all income and expenses on their personal tax return. This structure includes single-member LLCs, qualified sub-chapter S subsidiaries, and qualified real estate investment trust subsidiaries. In Puerto Rico, the legal recognition of DREs aligns with US federal tax purposes.

What are Disregarded Entities?

Disregarded entities are legal entities alone for legal matters but ignored for tax purposes. An SMLLC is the most common type of DRE. Before Act 52-2022, DREs had different tax treatments in Puerto Rico. The law now simplifies compliance by aligning with federal practices. In Puerto Rico, these entities’ incomes and expenses get reported on the owner’s tax return. This consolidation helps provide owners with limited liability protection.

Tax Considerations for Disregarded Entities

Act 52-2022 changed how DREs get taxed in Puerto Rico. These changes moved the treatment closer to their US federal status. Owners must still obtain an employer identification number for the entity. Despite being ignored for income tax, various taxes and obligations can still apply. The sole owner files a classification election with the Puerto Rico Department of the Treasury to confirm DRE status. This classification prevents the DRE from being taxed like a corporation or partnership.

Significant tax changes can occur if an entity changes its classification. Such changes affect the owner’s and entity’s tax responsibilities. Starting from 2022, entities must use Form SC 6045 for electing DRE status. This form is required for new tax periods, streamlining the once-complicated process of filing taxes for entities as partnerships.

Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a unique taxpayer ID. The IRS issues this number to identify entities conducting business in Puerto Rico for tax filings, including federal corporate income tax returns. Corporations in Puerto Rico must obtain an EIN for federal tax filings and business registration with the Puerto Rico Department of Treasury. Businesses need an EIN for opening bank accounts, securing loans, and applying for permits or licenses. Puerto Rico does not issue a separate identification number; the EIN serves as the sole identifier for business entities.

Importance of Obtaining an EIN

An EIN is essential for businesses, similar to a social security number. Corporations in Puerto Rico require an EIN for federal tax filings. The Puerto Rico Department of Treasury mandates an EIN for registering businesses, reinforcing its necessity for legal operations. Obtaining an EIN is free. Businesses can apply through the IRS, using online services or Form SS-4 by mail. An EIN is also needed when opening a business bank account, securing loans, and applying for local permits and licenses. Corporations, whether C or S corporations, must obtain an EIN to file associated tax documents with the IRS.

Application Process for EIN

Applying for an EIN can be done online via the IRS website or by submitting a paper application (Form SS-4) through mail or fax. The EIN application is free, suitable for both new and existing businesses. Most businesses receive their EIN instantly online. However, those without a social security number might need to file a paper application and could face delays. An EIN is crucial for federal tax filings. The Puerto Rico Department of Treasury requires it for business registration and compliance. The EIN is the sole identification number for businesses, as Puerto Rico does not issue a separate number.

Compliance Obligations for Business Entities

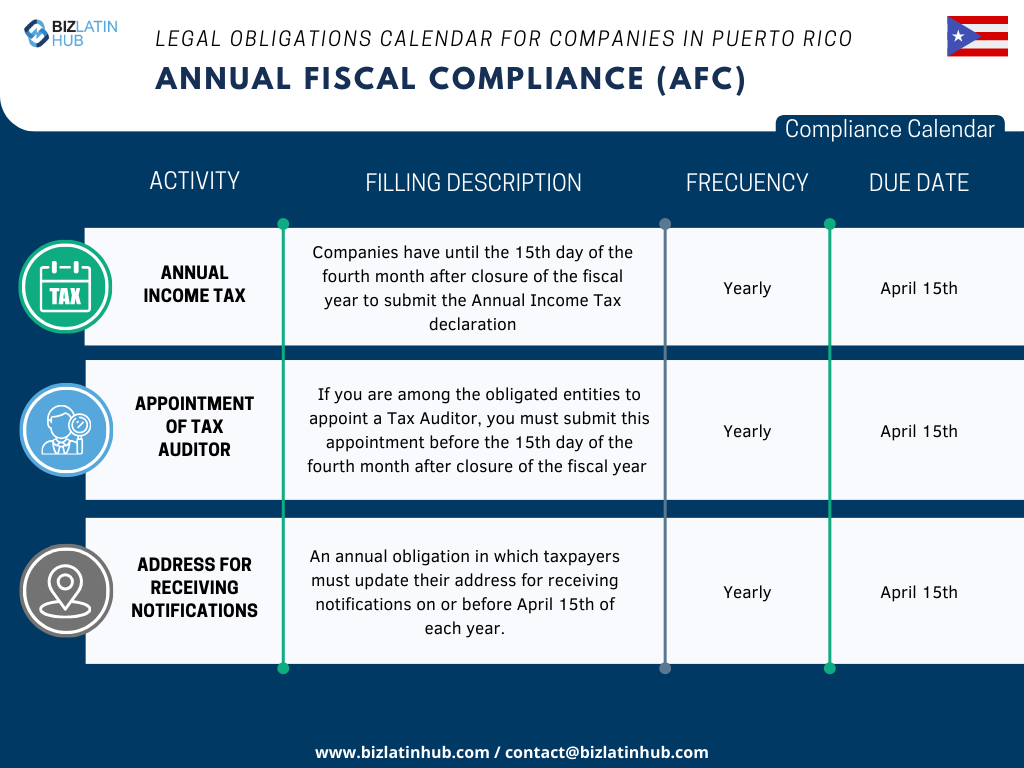

Business entities in Puerto Rico must meet specific compliance obligations. Here are the key requirements:

- Physical Office and Resident Agent

Every corporation must maintain a physical office in Puerto Rico. A resident agent, who is either a local resident or an authorized legal entity, must be appointed. - Annual Filings

- Corporations: Must file an Annual Report by April 15. This report includes financial statements and officer details.

- LLCs: Pay an annual fee of $150 by April 15, instead of filing a report.

- Penalties for Non-Compliance

Failure to file reports or pay fees can lead to penalties and possible cancellation of the business’s legal status. - Registration and Identification

New entities must register with the Department of the Treasury. They need an Employer Identification Number and compliance with local rules.

Meeting these requirements is crucial to maintain good standing in Puerto Rico.

How Biz Latin Hub Can Support Your Business in Puerto Rico

Starting or expanding a business in Puerto Rico can be a complex process, especially when dealing with legal structures, tax obligations, and compliance requirements. Biz Latin Hub specializes in providing end-to-end market entry and back-office solutions, ensuring that entrepreneurs and corporations can focus on growth while we handle the intricacies of compliance.

Tailored Support for Your Business Needs

- Company Formation Services: We streamline the process of registering entities such as LLCs, corporations, or partnerships, ensuring compliance with local regulations.

- Tax Planning and Compliance: Our team of tax experts helps you optimize tax structures, taking full advantage of Puerto Rico’s incentives like Act 20 and Act 22.

- Ongoing Legal Compliance: We ensure your business remains compliant by managing annual filings, tax submissions, and municipal tax obligations.

- Payroll and Accounting: From managing payroll to bookkeeping, we offer seamless financial services tailored to local requirements.

- Legal Advisory: Our seasoned legal professionals guide you through the regulatory environment, ensuring your business operates smoothly.

With a presence in Puerto Rico and throughout Latin America, Biz Latin Hub is uniquely positioned to help businesses expand into the region. Whether you’re considering forming an LLC, seeking assistance with tax compliance, or navigating the intricacies of Pass-Through Entities, our team is here to provide the expertise and support you need. Click here to reach out.