An entity health check in Uruguay is an audit conducted by a third party to verify a company’s compliance with local corporate laws and regulations. As such, if you are doing business here, examining entity compliance thorugh an entity health check can guarantee the longevity of your enterprise and maintain your good standing in the eyes of local authorities. If you are thinking about setting up a business in Uruguay or have already established your company in the country, read on to understand the importance of an entity health check in Uruguay.

Key takeaways on an entity health check in Uruguay

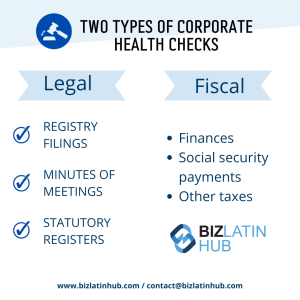

| Types of entity health check in Uruguay | There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company. |

| Why carry out an entity health check in Uruguay? | To enable executives to know how the business is being managed To reduce risks of penalties and negative reputation To reduce transaction risks |

| Are entity health checks in Uruguay a legal necessity? | It is not a legal necessity in of itself, but it will help you make sure you are staying compliant. |

| Who conducts an entity health check in Uruguay? | It should be done by a fully independent auditor to ensure total neutrality. The auditor should also be well aware of Uruguayan company law. |

What is an entity health check?

Corporate compliance is fundamental to the success of any business in any country in Latin America and the Caribbean. An entity health check in Uruguay involves an evaluation of a company’s legal, fiscal, and corporate status, to ensure full compliance with local norms.

Such a check covers multiple aspects of a company’s legal, financial, and operational status, including proper registrations with any relevant government bodies, accountancy and tax compliance, and adherence to best practices in the likes of human resources management.

To this end, an entity health check will inspect whether a company carrying out commercial operations in Uruguay is properly filing tax declarations, monthly reports, and accounting records, while adhereing to all relevant legislation.

Generally, it includes:

- Evaluation of finances, social security payments, and other fiscal obligations

- Examination and review of contracts signed with third parties

- Review of corporate and accounting books

- Review of monthly tax returns and tax statements

- Review of upcoming renewals of certificates and policies

- Preparation of financial statements

- Review of balance sheets submitted at the closure of the fiscal period

3 steps to carrying out an entity health check in Uruguay

Carrying out a successful entity health check in Uruguay involves the following 3 key steps:

1. Information collection

When carrying out an entity health check, a large amount of information will have to be gathered. This will include collecting data from your company’s operations, legal, accounting, and administrative departments.

Note that a best practice many Uruguayan companies are adopting is the creation of a compliance or audit department, in charge of centralizing important company information, which eases this first step.

2. Information validation

Once gathered, the information goes through a validation process. In this step, an entity health check agent will review all the data and documents obtained, cross-reference it against primary sources where necessary, and otherwise seek to prove the veracity of all records being audited.

3. Record Keeping

Records of all the documents and evaluations made during your entity health check in Uruguay will not only be valuable for presenting to tax authorities in case of an inspection, but also during future entity health checks. In some cases, keeping such records is a legal obligation, due to laws desiged to prevent money laundering.

Why you should get an entity health check in Uruguay

The main advantages of conducting an entity health check include:

Enables executives to know how the business is being managed: Through an entity health check, business executives will obtain the necessary information to evaluate how they are doing in terms of their legal compliance and the fulfillment of their objectives. As such, opportunities for improvement and greater efficiency could arise.

Reduce risks of penalties and negative reputation: Uruguayan authorities regularly carry out inspections in order to verify if companies comply with local legislation. Not complying with regulations can bring severe financial penalties, and affect the reputation of your company, as well as that of third parties, whether they are clients or suppliers.

Reduces transaction risks: An entity health check is a valuable tool to verify the status and sound financial standing of an organization before buying it or merging with it. It is similarly a good way to prove to potential clients that your organization complies with corporate laws in Uruguay.

Entity health check types

There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company.

Legal health checks

The legal health check focuses on reviews of commercial contracts, employment contracts, industry-specific regulations, and intellectual property protection. The industry your business operates within is also an important element for auditors to consider when conducting a legal entity health check in Uruguay.

Particular industries carry additional and strict regulations that businesses must comply with; it’s important to know that your business is adhering to any additional industry-specific regulations.

Fiscal health checks

A fiscal entity health check will ensure that your accounts, social security payments, and taxes are consistent with regulations and give you information that will be valuable for your future choices and strategies.

FAQs on an entity health check in Uruguay

1. Why should you get an entity health check?

The main advantages of conducting an entity health check include:

To enable executives to know how the business is being managed

To reduce risks of penalties and negative reputation

To reduce transaction risks

2. What steps are there to an entity health check?

Carrying out a successful entity health check involves the following 3 key steps:

1. Information collection

When carrying out an entity health check, a large amount of information will have to be gathered. This will include collecting data from your company’s operations, legal, accounting, and administrative departments.

Note that a best practice many companies are adopting is the creation of a compliance or audit department, in charge of centralizing important company information, which eases this first step.

2. Information validation

Once gathered, the information goes through a validation process. In this step, an entity health check agent will review all the data and documents obtained, cross-reference it against primary sources where necessary, and otherwise seek to prove the veracity of all records being audited.

3. Record Keeping

Records of all the documents and evaluations made during your entity health check will not only be valuable for presenting to tax authorities in case of an inspection, but also during future entity health checks. In some cases, keeping such records is a legal obligation, due to laws desiged to prevent money laundering.

3. What happens in an entity health check?

Generally, an entity health check includes:

Evaluation of finances, social security payments, and other fiscal obligations

Examination and review of contracts signed with third parties

Review of corporate and accounting books

Review of monthly tax returns and tax statements

Review of upcoming renewals of certificates and policies

Preparation of financial statements

Review of balance sheets submitted at the closure of the fiscal period

4. Who can perform an entity health check in Uruguay?

It should be done by a fully independent auditor to ensure total neutrality and make sure everything is in accordance with the authorities.

Contact Biz Latin Hub about conducting an entity health check in Uruguay

At Biz Latin Hub, our team of multilingual professionals has broad experience in undertaking entity health checks with companies in different countries across Latin America and the Caribbean. With our full suite of market entry and back-office services, we can support you with the provision of tailored due diligence services, as well as company formation, legal representation, and accounting services.

Reach out to us now to receive personalized assistance.

Learn more about our team and expert authors.