If you are looking at company formation in the Dominican Republic, you should have an entity health check done. An entity health check in the Dominican Republic will involve a full examination of that company’s compliance with local regulations. You may also opt for an entity health check in the Dominican Republic if you already run a business there and simply wish to audit your existing operations to identify potential options to improve your bottom line. This guide explains the importance of a proactive compliance audit and details the primary areas of review needed to ensure a company operates in accordance with Dominican law.

Key takeaways: Entity health check in the Dominican Republic

| What is a corporate entity health check? | An entity health check is an in-depth analysis carried out by legal and financial auditors to discover if any non-compliance issues or major inefficiencies can be identified in a company’s operations. |

| What are the key areas reviewed for a Dominican company? | Key regulations include DGII tax filings, IDSS social security contributions, compliance with Dominican labor laws, anti-money laundering laws such as Law 155-17, and free zone operational rules under CNZFE. |

| What does a tax health check look at? | It verifies compliance with the tax authority (DGII) and the Mercantile Registry. |

| What common problems can a health check bypass? | A health check ensures that the company’s registry information is up-to-date. |

| Why is a health check important for risk management? | It is a critical part of due diligence for takeovers and acquisitions as well as a way to avoid non-compliance issues such as fines. |

The Purpose of a Corporate Health Check

A corporate health check is a detailed examination of a company’s statutory records and obligations. It is designed to identify compliance gaps, such as unrenewed registrations or missed tax filings, and provide a clear plan to resolve them, thereby preventing government penalties and legal complications.

Main Areas of a Dominican Entity Health Check

Expert Tip: The Biennial Mercantile Registry Renewal

From our experience conducting health checks in the Dominican Republic, the most common compliance failure we encounter is an expired Mercantile Registry registration. Unlike in many countries where this is a one-time filing, in the Dominican Republic, the registration (Registro Mercantil) must be renewed every two years with the local Chamber of Commerce.

If this renewal is missed, the company loses its good standing and cannot obtain essential certificates or conduct many legal acts. Verifying that the Mercantile Registry is current is the first and most critical step of any health check.

1. Review of Corporate and Legal Records

This audit verifies that the company’s Mercantile Registry is renewed and up-to-date, that shareholder meeting minutes are properly recorded, and that all corporate information is accurate.

2. Assessment of Tax Compliance

This involves a review of all monthly and annual tax filings with the DGII, including income tax and VAT (ITBIS), to confirm they were submitted correctly and on time.

3. Verification of Labor and Social Security Compliance

This review checks that the company is correctly registered with the Ministry of Labor and the TSS, and that all monthly social security payments for employees have been made.

4. Financial and Accounting Records Review

This check ensures that the company is maintaining proper accounting records that accurately support its financial statements and tax filings, in compliance with local regulations.

What is an entity health check?

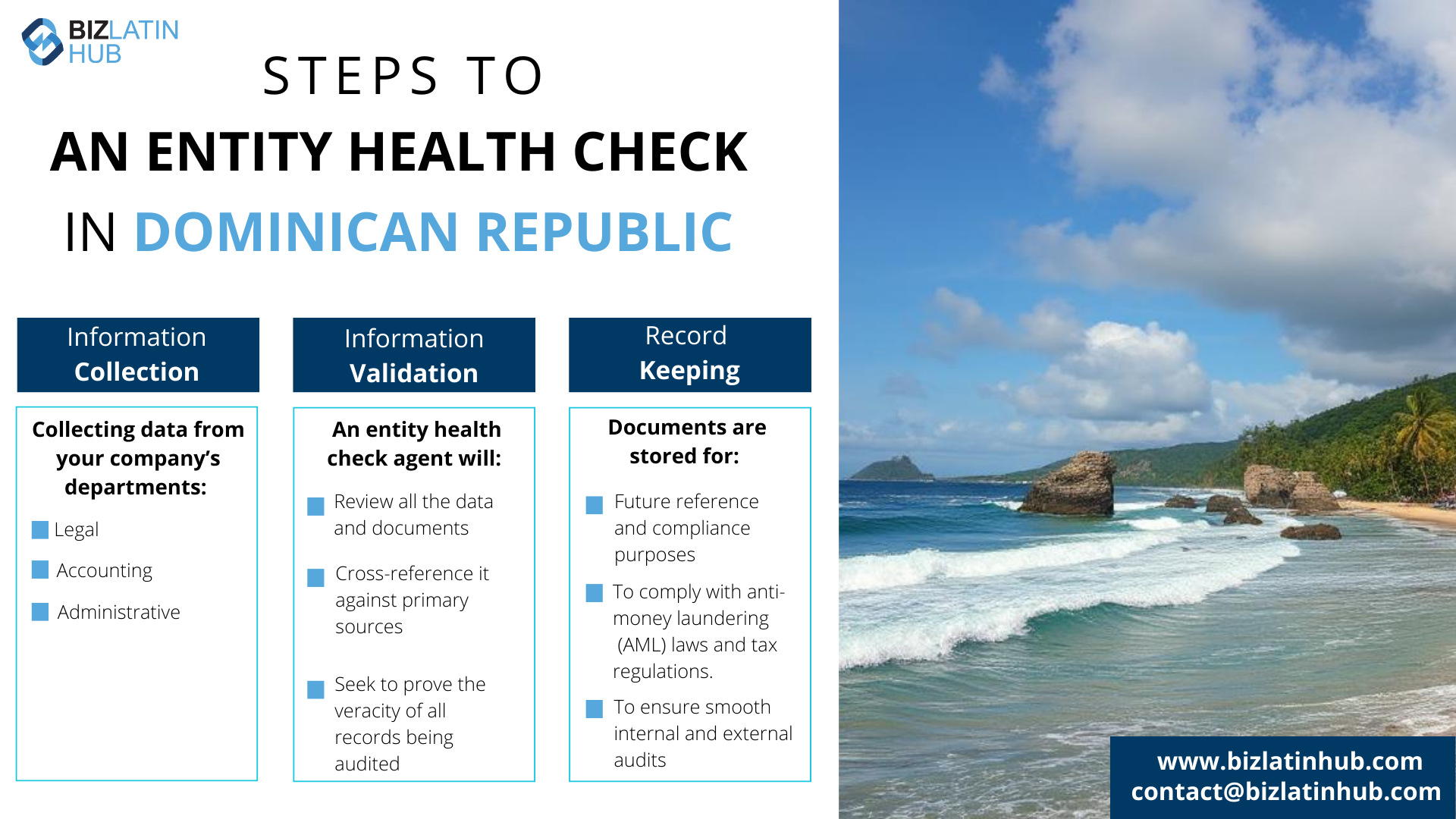

An entity health check is an in-depth analysis carried out by legal and financial auditors to discover if any non-compliance issues or major inefficiencies can be identified in a company’s operations. When this is carried out on a company you are planning to purchase or partner up with, it forms a crucial aspect of the due diligence you must undertake to ensure the money you are investing is going to be safe.

Hiring an external provider to carry out an entity health check is the best way to guarantee that it is undertaken comprehensively and impartially, and that the conclusions drawn are reliable. The external provider will have to be authorized by the owner of the business you are doing business with to access current and historic financial, accounting, and legal records.

In the event a company you are doing business with or planning to do business with shows reluctance to submit to such a process, or proves resistant in offering up its records, that should act as a red flag that something is likely not right and offer you good cause to reconsider your venture.

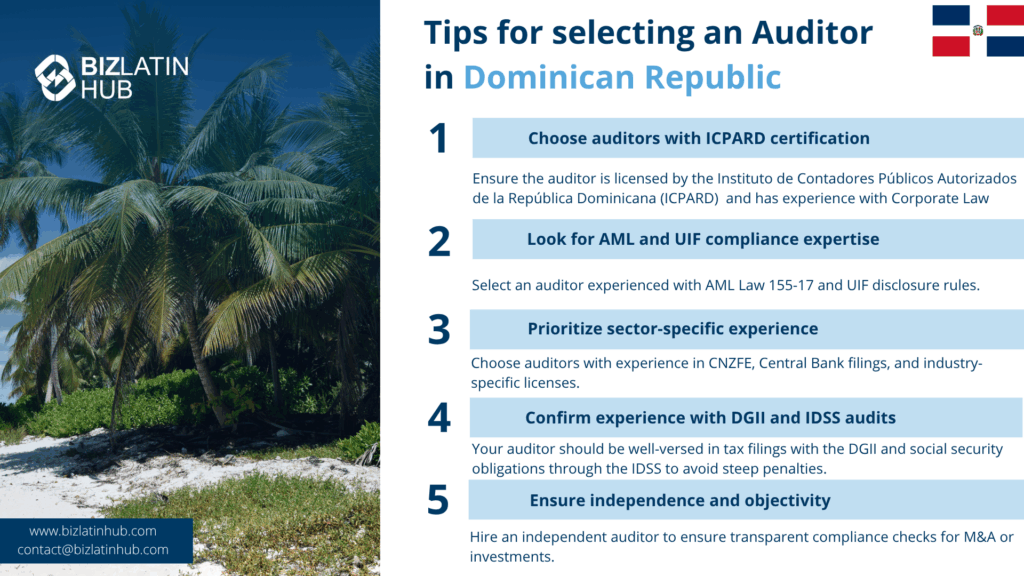

Due Diligence Dominican Republic: Corporate Verification Process

Legal due diligence Dominican Republic examines your entity’s compliance with local corporate governance requirements. This process verifies commercial registry filings with the Chamber of Commerce, validates employment contracts under Dominican Labor Code 16-92, and confirms industry-specific licensing requirements.

Corporate due diligence Dominican Republic processes follow the country’s Corporate Law 479-08 and recent amendments affecting foreign investment structures. This approach ensures compliance with beneficial ownership disclosure requirements mandated by the Financial Intelligence Unit (UIF) and anti-money laundering regulations under Law 155-17.

A Dominican Republic compliance check verifies:

- DGII (tax authority) filing status and payment history

- IDSS (social security) contribution compliance

- Ministry of Labor regulatory adherence

- Central Bank foreign investment registration (if applicable)

- Free zone compliance through CNZFE (if operating in designated zones)

Dominican Republic entity verification services validate legal standing, corporate structure integrity, and ongoing regulatory compliance across all operational jurisdictions within the country.

Entity health check types

There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company.

Legal health checks

The legal health check focuses on reviews of commercial contracts, employment contracts, industry-specific regulations, and intellectual property protection. The industry your business operates within is also an important element for auditors to consider when conducting a legal entity health check in the Dominican Republic.

Particular industries carry additional and strict regulations that businesses must comply with; it’s important to know that your business is adhering to any additional industry-specific regulations.

Fiscal health checks

A fiscal entity health check will ensure that your accounts, social security payments, and taxes are consistent with regulations and give you information that will be valuable for your future choices and strategies.

When to Conduct Dominican Republic Entity Health Checks

Mandatory Scenarios

- M&A transactions: Required for all merger and acquisition due diligence

- Foreign investment entry: Central Bank registration compliance verification

- Free zone operations: Annual CNZFE compliance audits

- High-risk industry operations: Quarterly checks for financial services, mining, telecommunications

Recommended Self-Audits

- Annual compliance reviews: Identify potential issues before tax authority inspections

- Declining profitability: Uncover hidden inefficiencies or compliance costs

- Regulatory changes: Ensure adaptation to new Dominican laws and regulations

- Pre-transaction preparation: Maintain investment-ready status

Timing Considerations

Best practice: Schedule entity health checks during Q1 or Q3 to avoid DGII tax season delays and ensure faster processing of verification requests.

FAQs on an entity health check in the Dominican Republic

Why should you get an entity health check in the Dominican Republic?

Conducting an entity health check helps businesses understand their compliance status, reduce risks of tax penalties and reputational harm, prepare for mergers or acquisitions, and ensure they meet evolving Dominican regulations.

What is the DGII?

The DGII (Dirección General de Impuestos Internos) is the General Directorate of Internal Taxes, the main tax authority in the Dominican Republic. A health check ensures all filings and payments to the DGII are current.

What corporate documents are reviewed?

The review covers the company’s bylaws, the list of shareholders, records of shareholder meetings (asambleas), and the current status of its registration with the Mercantile Registry.

What is the TSS?

The TSS (Tesorería de la Seguridad Social) is the Social Security Treasury. A health check verifies that the company is correctly registered and has made all monthly social security contributions for its employees to the TSS.

How can a health check help a business owner?

For a business owner or manager, a health check provides peace of mind. It offers a clear and independent assessment of the company’s compliance health, confirming that all legal obligations are being met and protecting the company from unexpected fines or legal challenges.

What are the penalties for non-compliance discovered during entity health checks?

Penalties may include significant tax fines (10–200% of unpaid amounts), social security penalties, labor law fines, business license suspension, or loss of investment incentives for foreign-owned companies.

How often should Dominican Republic compliance checks be conducted?

Annual self-audits are recommended for all entities, with quarterly reviews for high-risk industries and additional checks during major transactions or regulatory changes.

Biz Latin Hub can help you do an entity health check in the Dominican Republic

At Biz Latin Hub, our team of due diligence experts has deep knowledge of the regulatory framework in the Dominican Republic and is experienced in carrying out entity health checks in support of foreign investment into the country.

With our comprehensive portfolio of back-office services, including legal, accounting, and recruitment, we can be your single point of contact to support your market entry and ongoing operations in the Dominican Republic, or any of the other 15 countries around Latin America and the Caribbean where we have a local team in place.

Reach out to us today for a quote or free consultation.

Or learn more about our team of expert authors.