Conducting an entity health check in Costa Rica when performing commercial operations — especially the likes of purchasing or merging with a local organization — is important for protecting your business from potential risks. If you are considering starting a business in Costa Rica or have already established a commercial presence in the country, read on to understand the importance of an entity health check in the Central American country.

Key takeaways on an entity health check in Costa Rica

| Types of entity health check in Costa Rica | There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company. |

| Why have an entity health check in Costa Rica? | To enable executives to know how the business is being managed To reduce risks of penalties and negative reputation To reduce transaction risks |

| Are entity health checks in Costa Rica necessary? | It is not a legal necessity in of itself, but it will help you make sure you are staying compliant. |

| Who conducts an entity health check in Costa Rica? | It should be done by a fully independent auditor to ensure total neutrality. The auditor should also be well aware of Costa Rican company law. |

What is an entity health check in Costa Rica?

An entity health check in Costa Rica includes an exhaustive legal and accounting review to determine if a company complies with all local norms and regulations, and verify that accounting records are accurate. An entity health check can include the examination of different corporate documents such as tax returns, corporate filings, or operating licenses.

By conducting an entity health check in Costa Rica when buying or doing business with a local organization, you will be able to identify — and ideally rectify — any inconsistencies to protect your business operations and avoid possible penalties imposed by local authorities.

In addition to undertaking such due diligence ahead of doing a deal in Costa Rica, you can also conduct a self-check. Such a measure is particularly useful if your company has witnessed a decrease in productivity or profits, but can simply be undertaken to verify that everything is running smoothly and identify and eliminate potential future risks that may come to affect your business operations.

Note that you can also carry out an entity health check on a subsidiary or branch operating in Costa Rica, to know if there is any type of non-compliance or bad business practice that could have repercussions for your headquarters or broader operations.

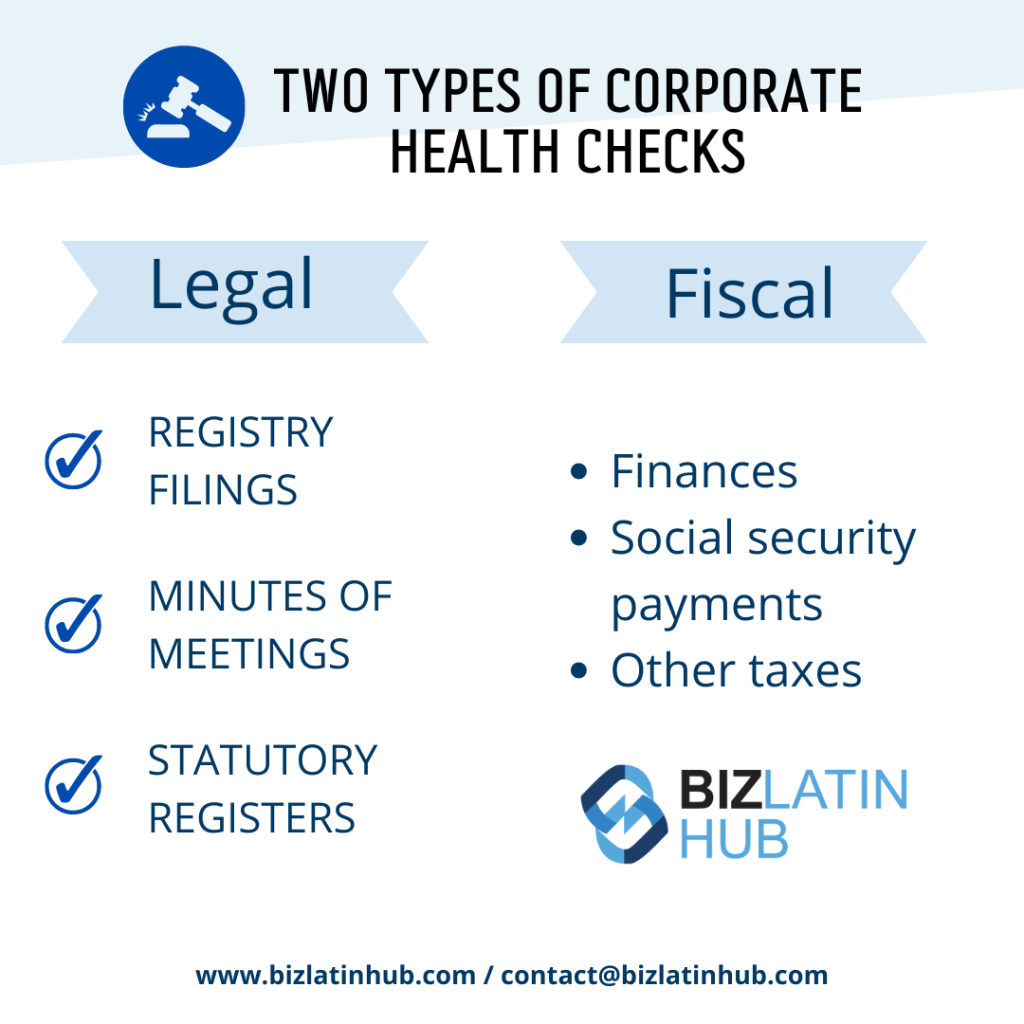

Types of corporate health check

The following types of corporate health check may be particularly useful, depending on your goals:

High-level corporate health check: This type of entity health check closely examines a company’s registration submissions, legal records, and meeting minutes to identify issues that may turn into potential violations of the law.

In-depth gap analysis: This type of entity health check analyzes the finances, accounting practices, and financial statements of a company, to identify gaps in the management of accounting records that may cause future legal sanctions.

What does an entity health check involve?

An entity health check can be comprised of several elements, and an individual process may involve all or just some of them, depending on your aims and needs. A common breakdown of reviewing is to have either a legal or fiscal entity health check. Areas covered in any type often include:

Corporate compliance: An entity health check process verifies that all corporate practices comply with local regulations. This includes a review of the minutes of annual meetings to verify if such meetings have been held and logged according to rules established in the Costa Rican commercial code.

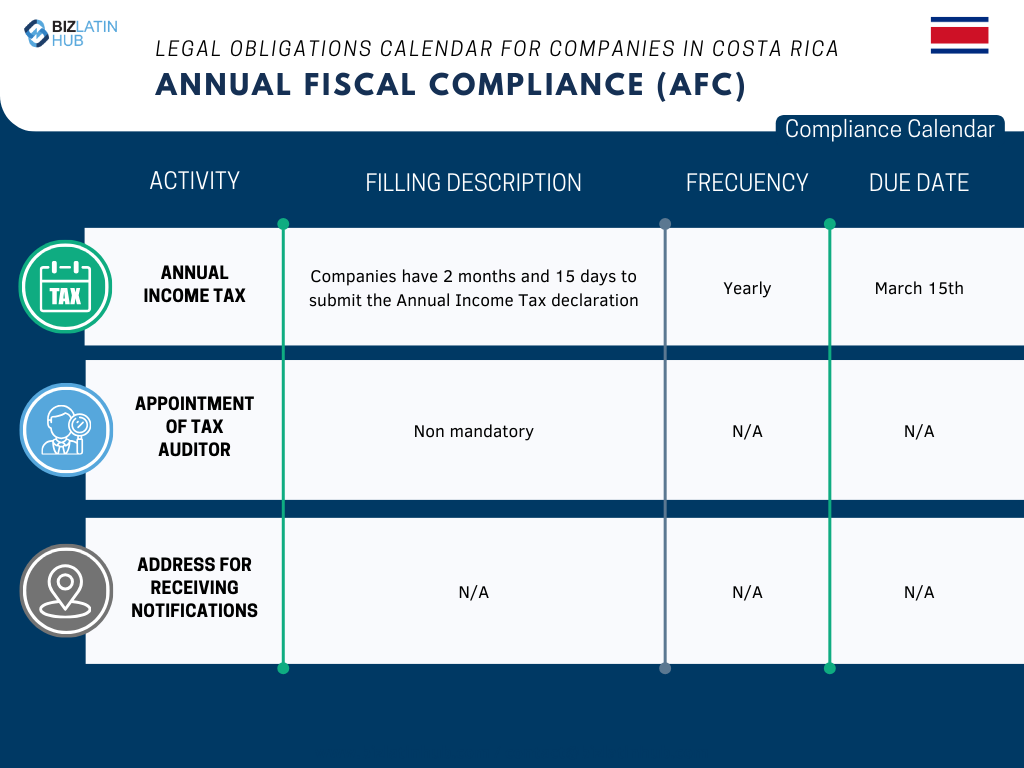

Tax compliance: An entity health check in Costa Rica can involve the study and verification of tax returns made before the General Directorate of Taxation of Costa Rica, as well as the municipality where the entity is based. Such a process will verify compliance with the likes of valued added tax (VAT) and income tax regulations, among any other business- or sector-specific levies.

Labor compliance: Where an entity health check looks at labor compliance, a study will be done of the likes of social security payments made to the Costa Rican Social Security Fund, as well as a review of workers’ compensation insurance policies held with the National Insurance Institute.

In addition, employee hiring and firing processes and relevant legal documentation related to the workforce will also be evaluated. Note that failing to comply with labor regulations in Costa Rica can lead to serious penalties, or even result in the closure of your business.

FAQs on an entity health check in Costa Rica

1. Why should you get an entity health check?

The main advantages of conducting an entity health check include:

To enable executives to know how the business is being managed

To reduce risks of penalties and negative reputation

To reduce transaction risks

2. What steps are there to an entity health check?

Carrying out a successful entity health check involves the following 3 key steps:

1. Information collection

When carrying out an entity health check, a large amount of information will have to be gathered. This will include collecting data from your company’s operations, legal, accounting, and administrative departments.

Note that a best practice many companies are adopting is the creation of a compliance or audit department, in charge of centralizing important company information, which eases this first step.

2. Information validation

Once gathered, the information goes through a validation process. In this step, an entity health check agent will review all the data and documents obtained, cross-reference it against primary sources where necessary, and otherwise seek to prove the veracity of all records being audited.

3. Record Keeping

Records of all the documents and evaluations made during your entity health check will not only be valuable for presenting to tax authorities in case of an inspection, but also during future entity health checks. In some cases, keeping such records is a legal obligation, due to laws desiged to prevent money laundering.

3. What happens in an entity health check?

Generally, an entity health check includes:

Evaluation of finances, social security payments, and other fiscal obligations

Examination and review of contracts signed with third parties

Review of corporate and accounting books

Review of monthly tax returns and tax statements

Review of upcoming renewals of certificates and policies

Preparation of financial statements

Review of balance sheets submitted at the closure of the fiscal period

4. Who can perform an entity health check in Costa Rica?

It should be done by a fully independent auditor to ensure total neutrality and make sure everything is in accordance with the authorities.

Biz Latin Hub can conduct an entity health check in Costa Rica

At Biz Latin Hub, our team of multilingual legal services specialists has deep knowledge of Costa Rica’s regulatory framework and broad experience conducting entity health checks for companies and executives doing business in the country. With our extensive portfolio of accounting, commercial representation, and back-office services, we are equipped to deliver service with excellence and can be your single point of contact to support your commercial operations in Costa Rica or in any other of the 15 countries in Latin America and the Caribbean where we are present.

Reach out to us now for personalized assistance or a free quote.

Learn more about our team and expert authors.