As a general rule, Latin America has a highly regulated business environment, with frequent headaches for business owners. Compliance is often one of the largest tasks a business faces when starting up, and unfortunately can be the undoing of a company, particularly for those with foreign backgrounds. An entity health check in Latin America can help you avoid some of the biggest problems in company formation and compliance no matter where you are, from Mexico City to Buenos Aires and anywhere in between.

Key Takeaways

| Types of entity health check in Latin America | There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company. |

| Reasons for an entity health check in Latin America | To enable executives to know how the business is being managed To reduce risks of penalties and negative reputation To reduce transaction risks |

| Necessity of entity health checks in Latin America | It is not a legal necessity in most countries, but it will help you make sure you are staying compliant. |

| Who conducts an entity health check in Latin America | It should be done by a fully independent auditor to ensure total neutrality. The auditor should also be well aware of company law both in country and regionally. |

What exactly is an entity health check in Latin America?

Entity health checks involve opening the company up to investigate possible compliance issues.

An Entity health check (also known as corporate health check) is an audit conducted by independent contractors who are employed to inspect accounting and legal compliance. Services of this kind consist of opening the company up to investigate possible compliance issues. These checks assess the business’ current status with all relevant government institutions.

By examining tax filings, social security payments, up to date licensing and general corporate housekeeping, a company can know if their actions and activities are clean. In a minefield of legal and accountancy regulations, it is very easy for companies to overlook or simply ignore compliance regulation.

Entity health check types

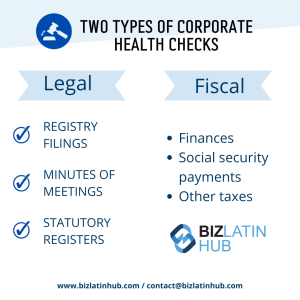

There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company.

Legal health checks

The legal health check focuses on reviews of commercial contracts, employment contracts, industry-specific regulations, and intellectual property protection. The industry your business operates within is also an important element for auditors to consider when conducting a legal entity health check in Latin America.

Particular industries carry additional and strict regulations that businesses must comply with; it’s important to know that your business is adhering to any additional industry-specific regulations.

Fiscal health checks

A fiscal entity health check will ensure that your accounts, social security payments, and taxes are consistent with regulations and give you information that will be valuable for your future choices and strategies.

Why is an entity health check in Latin America important?

To avoid being penalized by financial or legal authorities, independent reviews and health checks are advised. This is particularly the case for newer or foreign companies who are not yet familiar with local corporate law. Health checks are also advised if a major legislation reform has been recently put in place.

Changes to corporate law can easily slip under the radar of business owners so to avoid penalties and fines, it is always advised to get a check. Entity health checks have applications for all companies – large or small. However, generally, users of health checks follow three categories:

1. Startups

Startups are often faced with a number of challenges – employing a workforce, bringing in capital, conforming to compliance, as well as a range of other administrative tasks associated with opening a new business. Further added complications occur with foreign business startups. During this juggling act of tasks, it is very easy for compliance to be overlooked.

This is where an entity health check provider could be useful pointing out gaps, whether it be fiscal or to do with licensing. Once the company is up and running, fewer of these checks will be required. An entity health check in Latin America can uncover all the financial details underneath the surface of a company.

2. Mergers and Acquisitions

Company buyouts are a warren for compliance traps. On the surface of a company, all can seem profitable, compliant and equitable; underneath, however, can be a string of debt and fines. Such issues are highly relevant when valuing a business, and without knowledge of these problems, a merger or acquisition could spell disaster for the buyer.

An entity health check in Latin America is common practice for mergers and acquisitions. By fully investigating a company’s financial books and legal background, both parties can come to a fair and reasoned agreement. Particularly in the case of countries with many compliance regulations, a thorough investigation has to take place from a group of legal and accounting specialists.

3. Branch offices of large corporations

Branch offices in foreign countries can be difficult to manage. Foreign branch offices often can easily fall into inattention. Issues such as time zones, foreign work cultures, as well as simply not having the time to constantly review your branchs’ performance, can mean the branch is unregulated.

To ensure performance as well as compliance, independent entity health checkers can be employed to keep a watchful eye on the branch, acting as an overseer of operations. Though not always the fault of the company as a whole, due to responsibility always falling at the highest authority, large companies and their reputations can be damaged by small issues. By looking after the specifics, companies can protect the bigger picture.

Other benefits for your business

There is no doubt that the primary role of an entity health check in Latin America is to ensure corporate compliance. However, health checks also have other benefits such as a demonstration of good governance and also risk mitigation.

Good governance

In medium-large companies, it can be difficult for management to keep an eye on everything going on. Particularly in the process of expanding a company, where the focus is placed elsewhere and business owners are looking to the future rather than the past, it is common for compliance to slip.

The same can be said for companies with branch offices that have been neglected by management. By getting an entity health check in Latin America, the management team can ensure all is compliant as well as showing employees that their performance and actions are under review

Risk mitigation

Corporate compliance penalties can come in a variety of forms. Some issues, if not serious, authorities penalize on a tiered warning system; others come as fines; whilst the most serious, if suspected criminal, can end in jail time. Whatever the gravity of the situation, the consequences of penalties are never only direct; they invariably stretch out and impact the business as a whole.

A fine may only be a speed bump in the growth of the company but it can contribute to a bad quarter or even a bad reputation. More importantly, however, penalties take time and effort to address, particularly in the cases involving courts. An entity health check in Latin America can prevent your company from wasting time and money on indirect consequences of a penalty and instead focus on achieving its objectives.

FAQs on an entity health check in Latin America

1. Why should you get an entity health check?

The main advantages of conducting an entity health check include:

To enable executives to know how the business is being managed

To reduce risks of penalties and negative reputation

To reduce transaction risks

2. What steps are there to an entity health check?

Carrying out a successful entity health check involves the following 3 key steps:

1. Information collection

When carrying out an entity health check, a large amount of information will have to be gathered. This will include collecting data from your company’s operations, legal, accounting, and administrative departments.

Note that a best practice many companies are adopting is the creation of a compliance or audit department, in charge of centralizing important company information, which eases this first step.

2. Information validation

Once gathered, the information goes through a validation process. In this step, an entity health check agent will review all the data and documents obtained, cross-reference it against primary sources where necessary, and otherwise seek to prove the veracity of all records being audited.

3. Record Keeping

Records of all the documents and evaluations made during your entity health check will not only be valuable for presenting to tax authorities in case of an inspection, but also during future entity health checks. In some cases, keeping such records is a legal obligation, due to laws desiged to prevent money laundering.

3. What happens in an entity health check?

Generally, an entity health check includes:

Evaluation of finances, social security payments, and other fiscal obligations

Examination and review of contracts signed with third parties

Review of corporate and accounting books

Review of monthly tax returns and tax statements

Review of upcoming renewals of certificates and policies

Preparation of financial statements

Review of balance sheets submitted at the closure of the fiscal period

4. Who can perform an entity health check in Latin America?

It should be done by a fully independent auditor to ensure total neutrality and make sure everything is in accordance with the authorities in the country or countries where you are operating.

Biz Latin Hub can help you with an entity health check in Latin America

You should seek experts to do your entity health check in Latin America. Generally speaking, Latin America has a rigorous corporate compliance system. According to reports, Brazil and Argentina fall into the bracket of the top 10 most complex countries for corporate compliance. Though both countries have developed and thriving economies, corporate compliance regulations are comprehensive and, if mishandled, penalties are rigorous.

Some of the largest multinational companies in the world go through health checks every financial quarter to avoid the burden of compliance issues. Though small-medium sized businesses may not be able to afford this luxury, entity health checks are advised, at the least on a yearly basis.

Biz Latin Hub specializes in business services, particularly for foreign companies. Our legal and accounting experts all across Latin America are trained in auditing and corporate health checking services. By partnering with one of our offices, we can ensure your company is compliant with local law.

Contact us today to discuss how we can support you.

Learn more about our team and expert authors.