For anyone interested in company formation or who is already doing business in the region, understanding and studiously adhering to employment law in Latin America will give you a greater guarantee of success while maintaining the good standing of your company in the eyes of authorities.

Employment law in Latin America is an important part of the business climate, and while many aspects of Mexican employment regulations are similar to those seen in other countries in Latin America, some particularities must be understood, such as the PTU profit sharing system.

A basic guide to employment law in Latin America is provided below. If you would like to find out more about how we can assist you in doing business, contact us today. We are experts in the region and have offices all over Latin America and the Caribbean. Our array of back-office services can help you at all stages of your business life cycle.

3 Common contracts under employment law in Latin America

There are three main types of contract allowed under employment law in Latin America that investors tend to use;

- Indefinite-period contracts are the most widely-used contracts and only end based on mutual agreement between the employer and employee, or when one of the parties has the right to act unilaterally. That right includes an employee’s resignation from their role or an instance of employee misconduct that warrants dismissal by the employer.

- Definite-period contracts can only be used either when the nature of the task warrants it, such as for a particular project, or when replacing another worker temporarily, such as for maternity leave or to cover another type of extended absence.

- Seasonal contracts may only be provided for fixed work of a limited nature that only occurs during a specific period of the year, such as a tourist season or harvest.

What are the working hours in Latin America?

Under employment law in Latin America, a standard working week is usually between 40 and 48 hours long, with 44 being normal. A number of countries are in the process of revising their standard work weeks downwards towards the forty hour mark. The week is made up of six working days (including Saturday) and one rest day.

If an employee works for more than the standard in a week, they are entitled to additional and proportionate pay for the extra hours worked. Employees are also entitled to a premium rate for working holidays and/or Sundays.

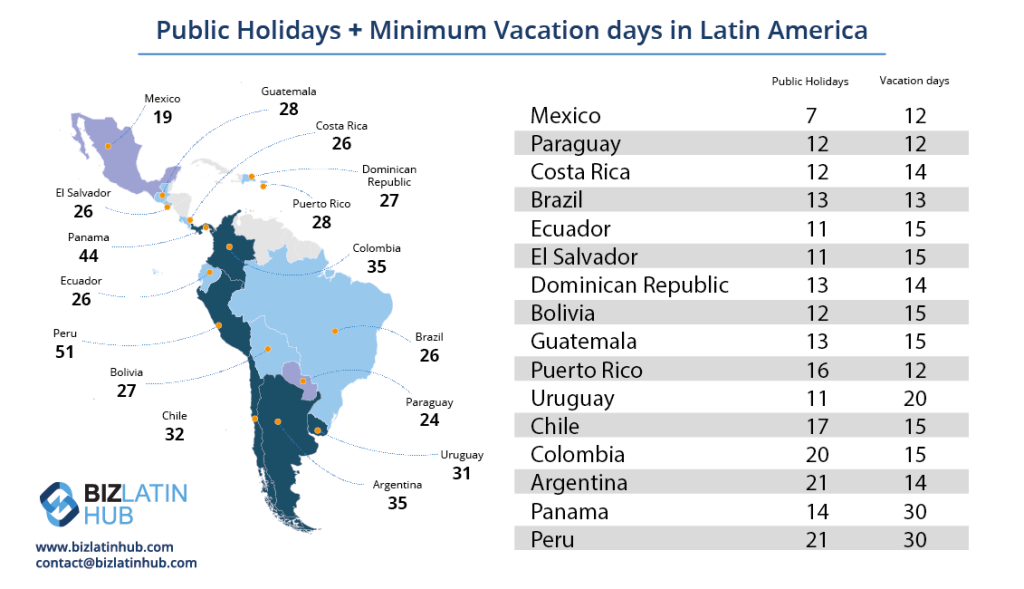

Note that in Latin America, there are generally a high number of national holidays that fall on weekdays each calendar year, as well as some regional holidays. This varies by country, but most have around 14-19 national holidays, often taken on Mondays. Some of these are lost when they fall on a Sunday, others are not, so check carefully with the country you wish to work in.

The working day is the time during which the worker is at the disposal of the employer to perform his or her work. Many countries make a distinction according to when the hours are worked. This typically sees the formation of the following types of working hours:

- Daytime: Between 6:00 to 20:00

- Nightly: Between 20:00 to 6:00

- Mixed: When the shift is arranged with daytime and nightly working hours. There is normally a limit on how much of this time may be in the nighttime period.

Legal benefits established by employment law in Latin America

Under employment law in Latin America, there are statutory benefits that are mandatory for employees to receive. This will vary widely according to the country and/or region, but typically seen across the geographical area are the following:

- Christmas bonus: Usually paid at or before a set date in December, between a fortnight and a month of basic salary. Often called an Aguinaldo or 13th Month.

- Sunday/holiday bonus: If the employee works on Sundays/holidays, they shall receive a set percentage on top of the day’s salary.

- Seniority bonus: After serving for a certain number of years at a company, workers usually accumulate extra days of vacation and potentially bonuses as well.

- Vacation time: Most countries in Latin America have a minimum number of days’ vacation that workers are entitled to, ranging from a week to a month depending on the country.

In general, no employee can renounce these legal benefits and it is the employer’s obligation to provide them on time.

Termination and severance in Latin America

Under employment law in Latin America, there is usually no minimum notice period that employees must provide when they resign, meaning that an employee can resign with immediate effect without penalty. However, it is common for a notice period to be written into the employment contract.

When an employee leaves voluntarily, they are entitled to receive a proportional part of their legally acquired benefits pro rata on number of days worked.

If an employer decides to dismiss an employee without just cause, the employee is entitled to compensation that typically includes:

- Payment for all hours worked to date

- A payment equal to a certain number of days’ salary

- Seniority subsidy where applicable

- Payment for outstanding vacations

- A proportion of their annual bonus accumulated pro rata

In the event of dismissal with just cause, such as a crime being committed against the company or persistent absence, the employer must generally provide the employee with written notice in which a clear referral is made to the conduct warranting the dismissal, as well as the date or dates upon which it occurred.

What does employment law in Latin America say about absences?

Employment law in Latin America lays out that employees are entitled to an annual vacation period. This varies from as little as a week to as much as a month. There is typically a bonus number of days according to time spent with the company, meaning that more established workers will often have a significantly longer annual leave allowance.

- Maternity and paternity leave: Maternity leave in the region is incredibly generous. New mothers are granted a total of 8-16 weeks of paid leave, usually divided into a period prior to a due date documented by a medical professional and a period following birth.

In some countries, a new mother is granted six weeks of maternity leave from the day of the adoption. For new fathers, there is usually a week of leave, but sometimes less. - Sick leave: In case of non-occupational illness or injury, an injured employee is usually entitled to all necessary medical care from the onset of the illness, as well as financial compensation when their illness or injury prevents them from working.

This compensation is generally paid by the social security fund at a set rate (between 50-100%) of their normal salary, starting from a certain point (around a week) of their absence, and extended for up to 52 weeks. This is promised by Latin America’s labor laws. - Bereavement leave: Under most employment law in Latin America, there is no statutory right to leave in the case of bereavement, although companies are often compassionate. Some countries give short leave periods (2-5 days) for losses of close family members.

Employment law in Latin America: Statutory contributions

- Employee deductions: Income tax is usually deducted directly from payslips, in a progressive manner. There will usually be a set amount between 5-15% set aside for social security contributions, depending on the local framework of such systems.

- Employer contributions: According to employment law in Latin America, employers must contribute to the social security fund on behalf of their employees. This is usually a fairly serious figure, and usually supports the social security system directly, as well as local causes such as national housing funds or healthcare systems.

- Profit sharing: Some countries have mandatory profit sharing, whereby a certain percentage of annual profits must be divided between the workers. The exact share for each employee depends on factors such as position, time with the company and so on.

FAQs about employment law in Latin America

In our experience, these are the most common questions our clients ask.

In Latin America, the standard workweek typically consists of 40-48 hours, and employment contracts may be either fixed-term or indefinite. Most countries have a national minimum wage, and employees are entitled to annual paid leave. Generous paid maternity leave is granted and paternity leave is limited. Social security contributions encompass unemployment, health and retirement benefits in most countries. Most countries recognize collective bargaining rights and the right to strike.

receive. This will vary widely according to the country and/or region, but typically seen across the geographical area are the following:

Christmas bonus: Usually paid at or before a set date in December, between a fortnight and a month of basic salary. Often called an Aguinaldo or 13th Month.

Sunday/holiday bonus: If the employee works on Sundays/holidays, they shall receive a set percentage on top of the day’s salary.

Seniority bonus: After serving for a certain number of years at a company, workers usually accumulate extra days of vacation and potentially bonuses as well.

Vacation time: Most countries in Latin America have a minimum number of days’ vacation that workers are entitled to, ranging from a week to a month depending on the country.

In general, no employee can renounce these legal benefits and it is the employer’s obligation to provide them on time.

This is usually around eight hours per day, adding up to somewhere between 40 and 48 hours weekly.

This varies widely, and may even be different for different parts of a single country. This is most common in the larger countries such as Mexico and Brazil.

This depends on the country, but there is usually a legally mandated standard depending on the occasion. This is most commonly found for Sunday and holiday work and will be a set percentage of the basic salary.

Employers in Latin America are not generally obligated to provide advance notice of termination, but they are required to pay severance regardless of the reason for termination.

Additionally, the employer needs to provide a severance package for employees on indefinite contracts. The severance package can be substantial and includes:

20 days of daily wage for each worked year.

90 days of daily wage as constitutional indemnification.

12 days of daily wage as a seniority bonus for each year of service that the employee has worked.

To terminate an employee with just cause in Latin America, the employer must usually follow certain requirements which may include some or all of the following:

Confirm that there are grounds for termination.

Establish records and documentation of employee behavior.

File a notice of termination.

Notify the worker in writing.

Provide the employee notice in writing within 30 days of knowing about the misconduct.

Explain the grounds for dismissal.

Present evidence if the employee seeks to challenge the termination.

Consider collective dismissal if applicable.

Consider individual dismissal if applicable.

When an employee decides to quit their job in Latin America, they are considered to have voluntarily resigned. In this situation, the employee is entitled to receive the proportional part of their statutory benefits depending on the number of days worked.

This means that the employer is responsible for providing all accumulated benefits pro rata, which include Christmas bonuses, vacations, Sunday bonuses, extra hours, and seniority bonuses if applicable.

Biz Latin Hub can assist you with employment law in Latin America

At Biz Latin Hub, we provide integrated packages of back-office services that are tailored to every need.

Our portfolio includes accounting & taxation, company formation, due diligence, legal services, and hiring & PEO, and we are active in 16 markets around Latin America and the Caribbean, making us ideal partners for supporting multi-jurisdiction market entry and cross-border operations.

Our experience and understanding of the markets where we operate means that working with us comes with the guarantee of compliance with all local regulations, be that employment law in Latin America or any other legal code related to investment.

Contact us today to find out more about how we can support you doing business in Latin America.

Or learn more about our team and expert authors.